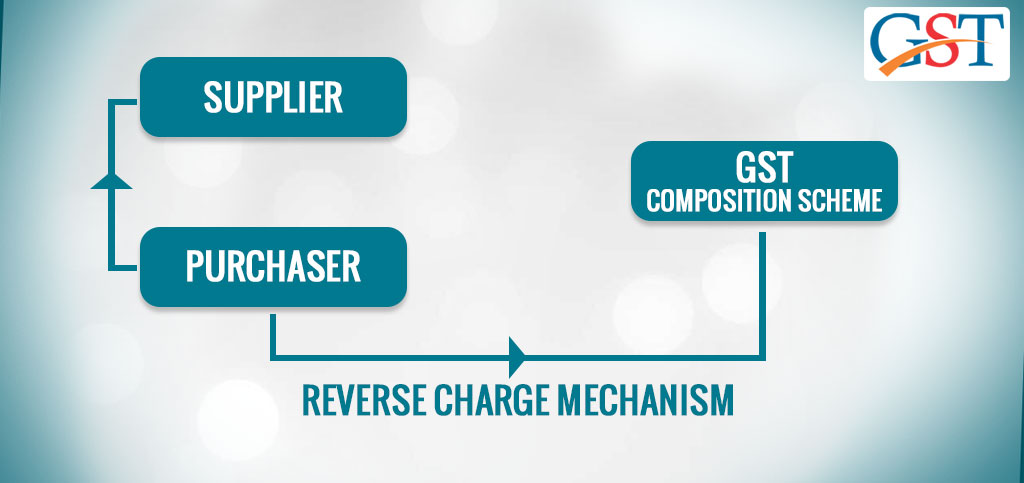

To deal with the increasing tax evasion cases, the Indian government is planning to bring the composition scheme under the reverse charge mechanism. An amendment will be showcased by the government in the budget session to implement the new compliance in the indirect tax regime. Till now, 40 changes have been approved by the GST council to the law.

According to a tax official, “The law will be changed to introduce an enabling provision for you to bring in reverse charge mechanism wherever you want.” He further added, “The thinking is that at least in the case of composition scheme the reverse charge should be done.”

Currently, in the reverse charge mechanism, a person who is receiving goods or services at first collects the GST imposed and then submits taxes to the government. The reverse charge mechanism which is currently postponed by the government for some time-period was made only for the unregistered taxpayers supplying goods or services. In such circumstances, those people who are receiving goods or services would levy the tax and pay the same as a reverse charge and mention that they had paid the tax.

Read Also: Disadvantages of Transaction with Unregistered Dealer in GST

The government feels that there is a need to bring some changes in the reverse charge mechanism compliance otherwise it seems that there might be chances of tax evasion. The tax official said that “It will not be compulsory but where it is needed it will be done”, by adding that it might be introduced with the composition scheme. “This will create a disincentive for remaining in the composition scheme and they will move to the regular scheme.”

Under the composition scheme, taxpayers whose annual turnover is up to Rs 1 crore are liable to pay 1-5 percent in the form of tax and not required to file detailed GST returns. The GST council has raised the composition limit from Rs 1 crore to Rs 1.5 crore. The council has decided 1 percent and 5 percent tax rates for traders and restaurants respectively.

The collections under the composition were very low and it is one of the concerning factors for the GST Council. Large-scale evasions were reckoned by the tax officials on the basis that nearly Rs 300 crore taxes have been paid by more than 1.6 million businesses those have registered for the composition scheme. If the businesses are saying that their turnover is less than Rs 20 lakh, then why they have opted for the composition scheme as they should be exempted from the GST.

According to Pratik Jain, indirect taxes leader of PwC, “The government perhaps believes that in the absence of the reverse charge and with the increase in composition limit, it is being used as a route to evade tax.” He further added, “The tax collected from composition dealers is very low with many of them declaring less than 20 lakh annual turnover. Reverse charge will help the government to monitor the purchases of composition dealers and help plug the leakage.”