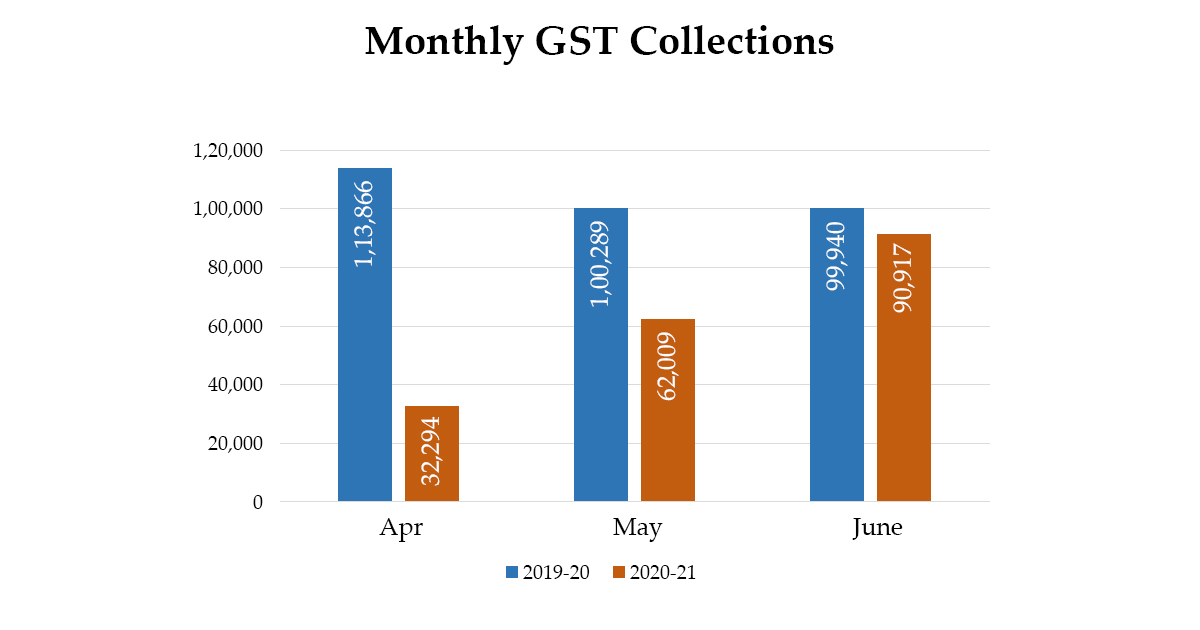

Recovery has been seen in GST collection which has seen a severe decline due to lockdown this year. Therefore since April, it has grown over five times in the past three months, with the rise in 21.92% from June and July this year.

Information collected by the Excise and Taxation department compiled the difference in tax collection as on July 31 the tax collected is Rs 165.91 crore against Rs 136.08 crore in June.

In comparison to 2019, the period between April and July has seen a shortfall which remains at 61.50 %, however the revenue has been collected by 5.22 times increase for three months. April 2020 has recorded the collection at Rs 31.78 crore during the lockdown. The collection was shot up to Rs 165.91 crore at the end of the July this year.

There is a rapid improvement as the collection went up to 132.08 crores from Rs 31.78 crore in April 2020, a straight increase of 100.3 crores. But in June the collection

Due to Covid-19 along with the lock-down, a deep downfall has recorded in the overall economic activity which becomes the major reason for less collection of the revenue. As the financial activity has resumed thus the collection of GST was on the inflation and will cover the losses to an extent said by the Excise and Tax commissioner Ravindra Singh. For the financial year 2019-20, the total revenue collection is RS 3513.72 crore.