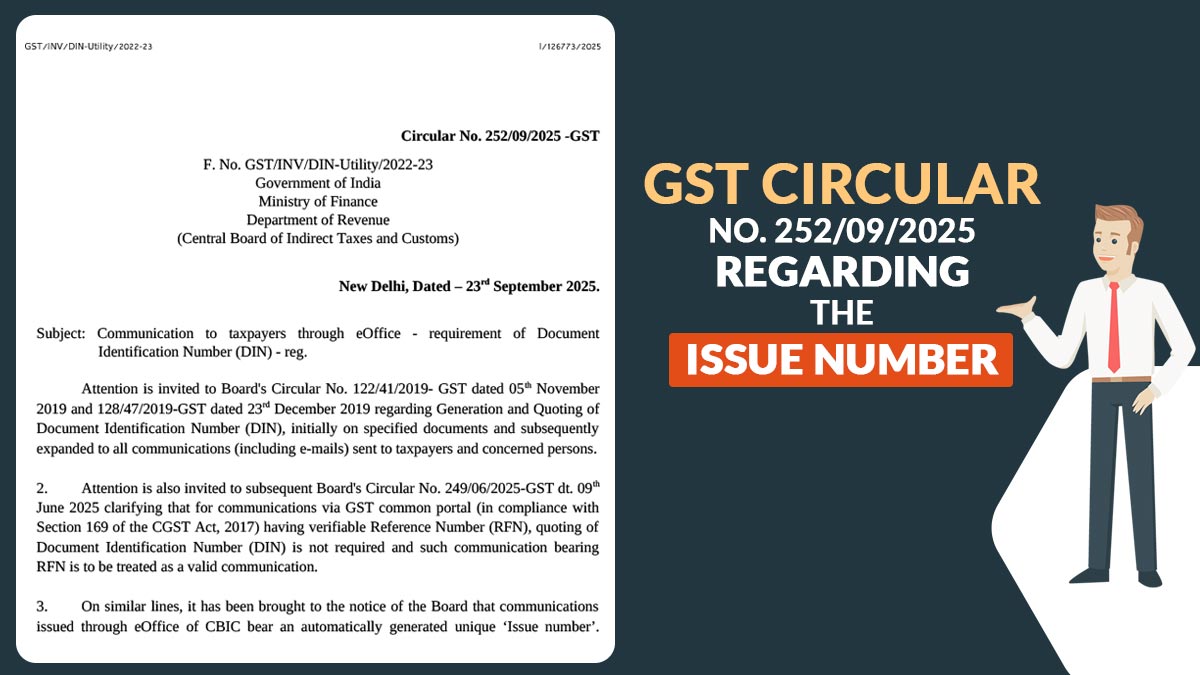

An amendment has been rolled out by the Central Board of Indirect Taxes and Customs (CBIC) through the way official communications are authenticated.

The Board, through Circular No. 252/09/2025-GST, has declared that the ‘Issue Number’ generated in CBIC’s eOffice application will now be considered as the Document Identification Number (DIN) for communications dispatched using the public option.

Things Which Are Changing

CBIC officers were needed to generate and quote a separate DIN on all official communications, even those issued through eOffice. Since both the automatically generated issue number and a DIN will appear on the same document, this would lead to duplication. The eOffice issue number itself shall be regarded as a valid DIN under the revised decision, which removes the need for two identifiers.

Easy Verification

CBIC, for ensuring transparency and authenticity, has launched an online verification utility at https://verifydocument.cbic.gov.in

Taxpayers and stakeholders via this portal can validate communications by entering the eOffice issue number. Information cited below has been validated under the system.

- Type of Communication

- Name of Issuing Office

- File Number

- Date of Issue

- Masked Recipient Details (name, address, and email)

It assures that the taxpayers can validate the legitimacy of any communication obtained via CBIC, which lessens the risk of fake or misleading documents.

DIN Applicability

- Reference Number (RFN), no separate DIN is needed.

- For all other communications, citing a DIN remains mandatory.

- For eOffice communications dispatched via the public option, the Issue Number = DIN.

- For the GST common portal communications that carry a verifiable

Effect on Prior Circulars

This update modifies and replaces pertinent provisions of earlier circulars:

- Circular No. 128/47/2019 (23 December 2019)

- Circular No. 249/06/2025 (09 June 2025)

- Circular No. 122/41/2019 (05 November 2019)

Its Significance

This decision will ease compliance, reduce administrative burden, and enhance trust in CBIC communications. The board, by permitting the eOffice Issue Number to double as DIN (Document Identification Number), has simplified procedures while still ensuring that every communication remains verifiable and secure.

Read Circular No. 252/09/2025-GST