A recent report by the French Tech Firm claims a significant increase of 20 percent in the number of Lakhpatis in India over last year. These are those who are paid in dollars for their services. The report also says that India is the fastest growing market in the world. The findings in the report negate all claims that GST has had a negative impact on the Indian Economy.

According to the French firm’s report, India’s growth has increased in the context of both the High Networth Individual (HNI) and Wealth. The growth rate of India is more than the global average of 11.2% and 12% respectively. China, America, Germany, and Japan are the largest HNI in the world market. India has reached the 11th rank in 2017.

The biggest reason for this increase in India is the increase in market capitalization by 50 percent. At the same time, 4.8% rise in property sector prizes and 6.7% increase in GDP is also a major reason behind this.

Other key takeaways from the Capgemini report include:

- 1 percent of India’s 1.2 billion population owns 73 percent of the wealth. A big disparity!!

- 67 million Indians, including the poor, were found to have only one percent increase in their assets.

According to a report in January this year, Apart from this, according to Oxfam,

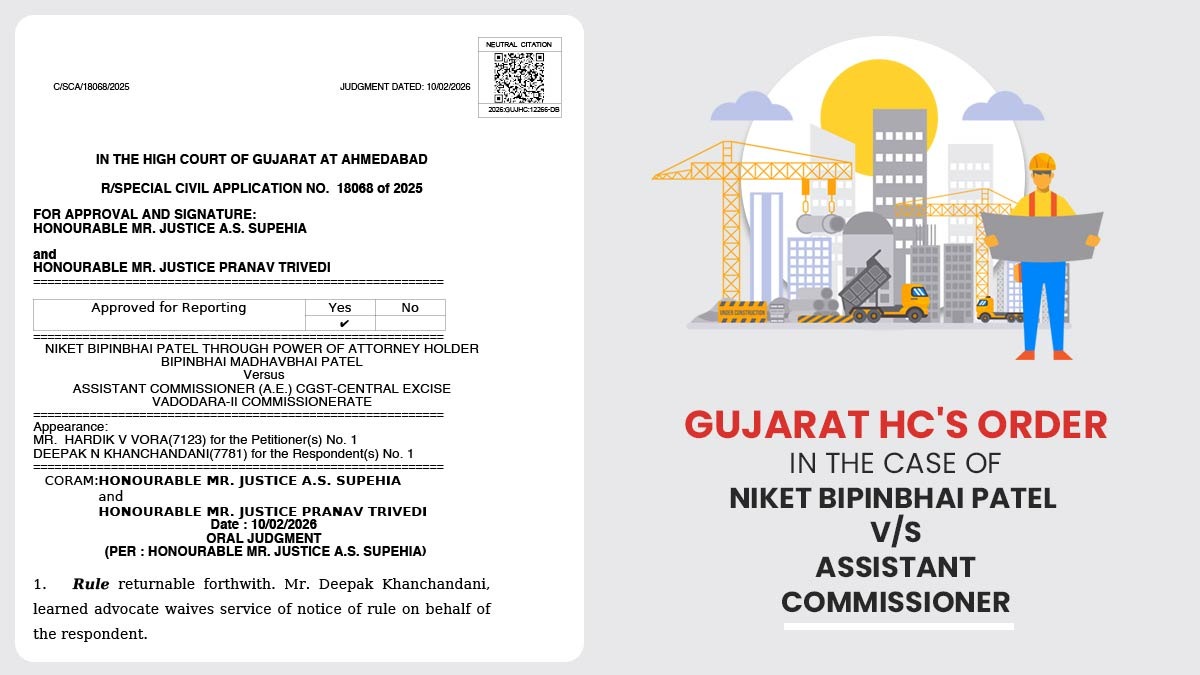

Post GST introduction in July, real estate and the property sector at large went through a lean phase. This was temporary one-off moment though.