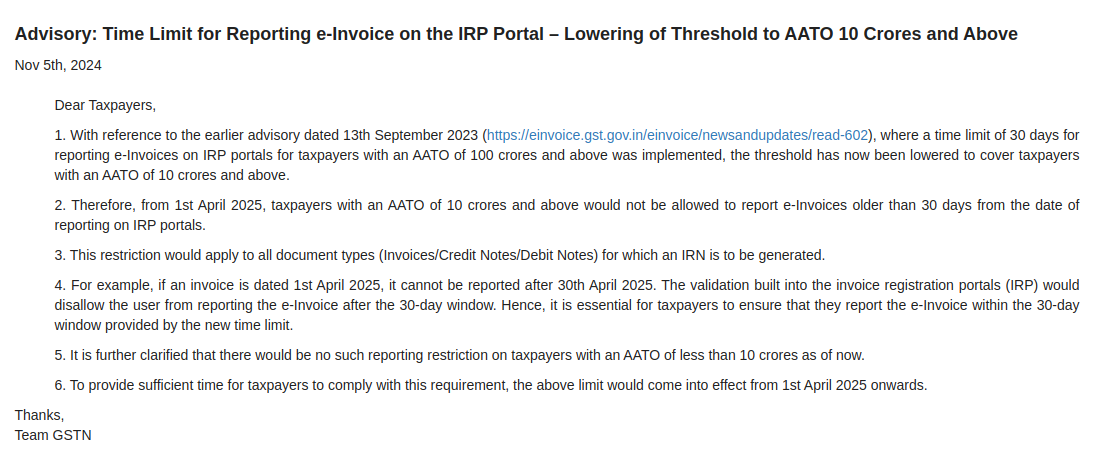

Businesses with Aggregate Annual Turnover (AATO) greater than Rs 10 crore from April 1, 2025, will not be permitted to report e-invoices older than 30 days on the reporting date under the goods and services tax (GST).

The same reform will ensure the GST payment within time and shall govern the delays in the reporting of tax invoices, facilitating the GST ecosystem as a whole.

Previously this time limit restriction was applied to the taxpayers with AATO more than or equal to 100 crores.

The taxpayer from 1st April 2025 with an AATO of 10 crores and more than that shall not be permitted to report the e-invoices older than 30 days from the reporting date on the IRP portals, as per the issued advisory by the GST e-invoice system.

The e-invoice system is for the GST-registered person to upload all the business-to-business (B2B) invoices in the Invoice Registration Portal (IRP).

The IRP generates and returns a unique Invoice Reference Number (IRN), which is a digitally signed e-invoice, and a QR code to the user.

It was mentioned under the advisory that the same limitation shall be applicable before all the document types for which the IRNs are required to get generated along with the credit, and debit notes.

It was said under the advisory that the April 1 due date is been furnished enough time for the assessees to follow with the same pre-requisite.

Read Also: GST E-invoicing Limit for Taxpayer T.O. Exceeding 5 CR

Before that, the government levied a time limit for the business having a turnover of more than Rs 100 crore, w.e.f November 2023.