Many websites are providing links to free download income tax return filing software for people looking for a free trial. However, after clicking these links, users often receive a software purchase form instead of access to the demo.

Here we are going to describe the free income tax e-filing software procedure for FY 2025-26. If you are looking for a demo of IT return software for online registration and tax refund, SAG Infotech provides a free trial of Gen Income Tax software for ITR filing. The trial version also works as a free income tax filing software. The search for free income tax e-filing software in India ends here for customers.

Fill a Form for a Demo of Income Tax Filing Software

Customers can also easily download the ITR (Income Tax Return) Forms for AY 2026-27 through the trial software. They can also get an income tax return acknowledgement and learn how to get income tax return copies online. Gen IT software also explains the procedure of how to file income tax returns online for a salaried employee.

Today itself, download a free demo of GEN IT. Also, the taxpayers can get the benefits of up to a 20% discount on the paid version of the software.

Note:

- Advance Tax Due Dates – 15th June (15%) | 15th Sept. (45%) | 15th Dec. (75%) | 15th March (100%)

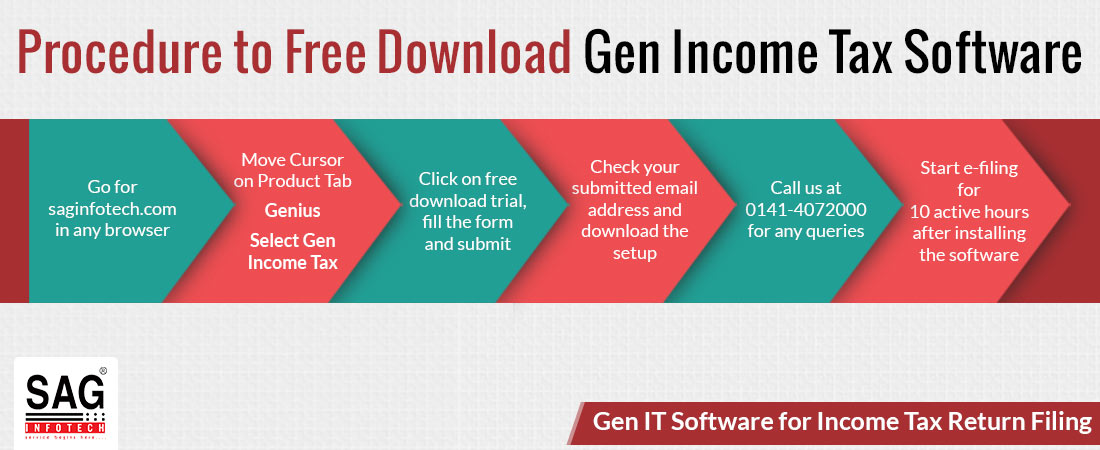

Procedure to Free Download Gen Income Tax Software

- Open a browser and type https://saginfotech.com/

- Go to the Move Cursor on Our Product Tab ⏩ Genius ⏩ Select Gen Income Tax software in the tab

- Click on the free download trial option, and fill in the information in the form as required. After furnishing all the details, submit the form

- Evaluate your given email address, and afterwards, download the setup

- For clarification over any doubts, contact us at 0141 – 4072000

- You can start e-filing after installing the software and completing 10 active hours of installation

Procedure to Download Common Offline Utility

Visit the new 2.0 e‑Filing portal at incometax.gov.in → under the “Downloads” section → look for “Common Offline Utility (ITR-1 to ITR-4)” for the relevant Assessment Year (e.g., AY 2025‑26, FY 2024‑25).

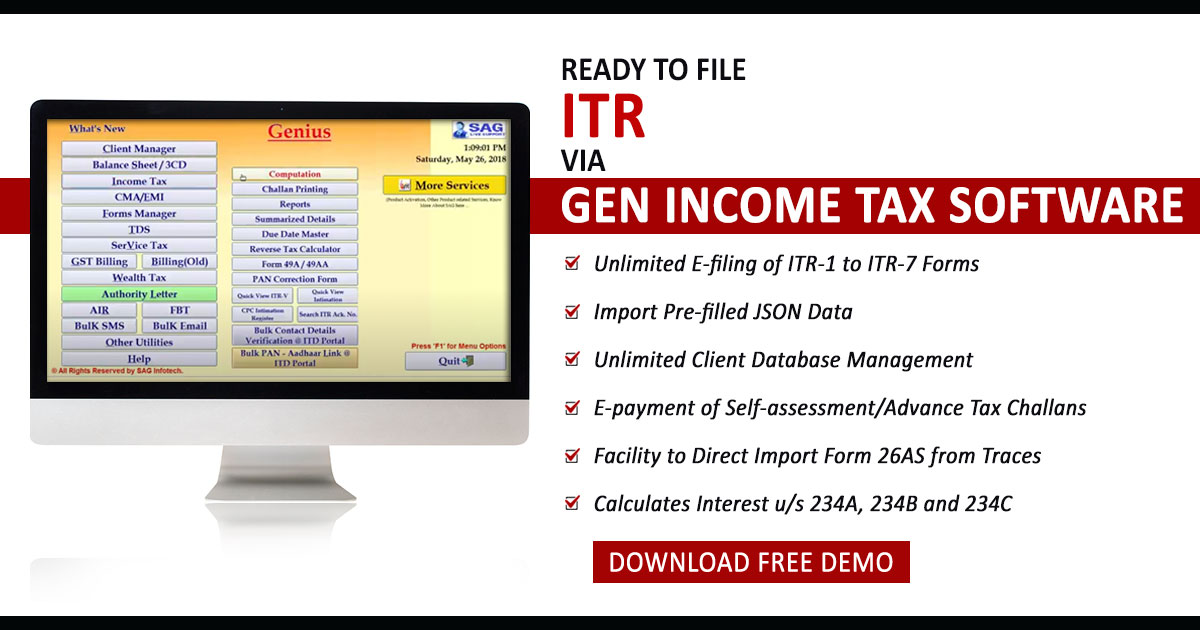

Features of the Trial Version of Gen IT Software

- Easy-to-understand & fastest IT e-filing software

- Income Tax Return (ITR) Form Download facility

- Free income tax return filing facility

- Check the income tax return due date

- Easy income tax online registration

- Check income tax refund status

- Complete a 10-hour free trial version, where you can e-file income tax returns

- You get an ERI facility for bulk e-filing

- You also calculate the income tax from the assessment year 2000-01 to 2020-21 by using the trial version of Gen IT

- It automatically prepares the return forms, viz, ITR 1 to ITR 7 forms

- Calculation of Advance Tax

- Now you can send any document or PDF file via WhatsApp or email from the Print Preview of Reporter

- Return Forms, 26AS, Acknowledgement, Computation, AIS, and TIS files can be imported/sent through the mail

- You can download and import an XML/ JSON File from the ITD Portal

- Filing of Online Form such as 10CCBBA, 10B, 29B, 10CCBC, 10CCBD, 29C, 10CCC, 56FF

How Can a Free Income Tax Software E-File Your Taxes Like a Pro?

Undergo the ease and expertise of free income tax software, which allows you to file your income tax returns electronically with the confidence and ability of a seasoned professional. The software has the most effective features that control you through each step of the tax filing procedure, ensuring accuracy and compliance with the existing tax norms.

With clear explanations and intuitive prompts, these platforms simplify complex tax concepts, making them accessible to individuals with varying levels of tax knowledge.

Such software solutions compute deductions, credits, and refunds, automatically maximising the taxpayer’s potential return. With the means of secure encryption protocols, they ensure the confidentiality of sensitive financial information while electronically filing tax returns, delivering convenience and peace of mind.

By utilising free income tax software, individuals can confidently navigate the complexities of tax preparation, allowing them to efficiently and effectively file their taxes, similar to a seasoned tax professional.

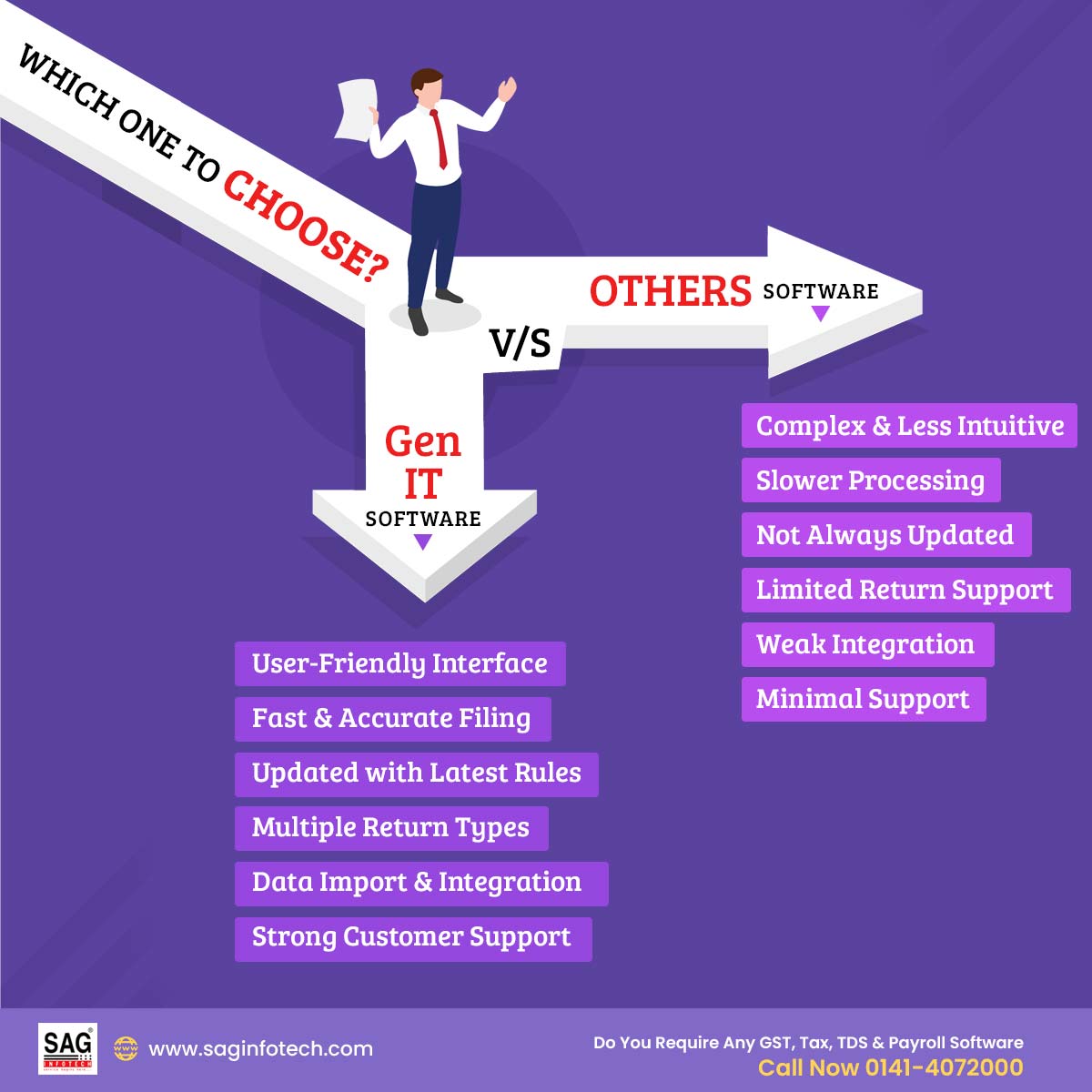

Comparison of Gen Income Tax vs Other Software

What are the Advantages of Downloading Free IT Software?

Free income tax software provides numerous advantages to the assessee. It authorises individuals to easily prepare and file their taxes from the comfort of their homes, saving time and effort. The software frequently contains useful features such as error checks and prompts, which help decrease the chance of mistakes and ensure precise tax filings.

Also, such solutions are frequently updated to show the revisions in the tax statutes, keeping the users updated and compliant with the updated norms. The cost of using the free tax software is lower, which reduces the requirement for expensive tax preparation services or standalone software packages. It authorises individuals to regulate their tax filings, furnishing a convenient, precise, and cost-efficient solution for handling their tax obligations.

There are several benefits to downloading free income tax software:

Precision and Efficiency: Often, complex tax calculations are automated under free software, reducing the risk of errors that can delay your filing or trigger an audit. The same assures a more precise and efficient filing procedure.

Cost Savings: Free software eradicates significant tax filing expenses compared to hiring a professional or purchasing paid software

Convenience: Data entry has been facilitated under free software. Certain programs authorise you to import your data along with the additional tax documents, removing the manual data entry as well as saving time.

E-Filing Integration: Free software easily integrates with the IT e-filing system. The same permits you to submit your return electronically for quicker processing and quicker access to your refund.

Guided Service: Many free programs provide user-friendly interfaces and guided interviews. They offer clear, step-by-step questions to assist you through the filing process and make sure you take advantage of all the deductions and credits you may be eligible for. This can be especially useful for people who are not familiar with tax filing procedures.

How to Save Money with Gen IT Software

Easy to Use: The majority of the preparation of the software is made to provide complete assistance to the filers with the necessary knowledge to make their tax return files simple. And Gen IT also works on the same principles.

ITR Filing: Tax filing software enables companies or businesses that are busy with their respective work to file returns via a personal computer.

Safe Storage of Files: The tax return preparation software sometimes helps you save the returns on its own so that you can simply access or download the details regarding the taxes when needed.

General Queries on Gen Income Tax Return Filing Software

Q.1 – Can We File an Online Return Using Gen IT Filing Software?

Yes, an online return can be filed using Gen Income Tax software. Moreover, it can be filed accurately because the software displays all the errors of validation which can be rectified by the user then & there.

Q.2 – What are the Basic Functions of Gen ITR Filing Software?

The basic functions of Gen-IT software are as follows:

- It Auto calculates the Interest u/s 234A, 234B and 234C

- It Auto selects the ITR form, based on the source of income.

- It e-files bulk returns through ERI facility.

- It computes Income tax and uploads Income Tax Returns.

- It imports client master data in XML format.

- It imports TDS details from Form 26AS.

- It provides Reverse Tax Calculator facility.

- It facilitates in applying for PAN or correction in PAN.

Q.3 – Why is Gen Income Tax Return Filing Software is the Most Preferred Software?

Gen IT software is the most preferred software because the software is highly advanced yet too convenient for users to use. Also, it guarantees adherence to the legal rules of TRACES and CPC. In addition to TDS and TCS filing, the software is also a one-click solution for the precalculation of the TDS amount, penalties and interests.

Q.4 – How Many Returns Can be Filed Using Gen IT software?

Gen IT Software is for filing unlimited returns i.e. it has the capability to file as many different returns as you want irrespective of number and type.

Q.5 – Which features of Gen Income Tax Return Filing Software Makes It a Unique Software?

Features that make Gen Income Tax Return Filing Software a unique software are as follows:

- Bulk Contact Verification

- Miscellaneous Reports

- XML Generation

- MAT/AMT Calculation

- Arrear Relief Calculation

- MAT/AMT Calculation

- Import Master Data

- Import 26AS facility

Q.6 – What Technical Configuration is Required in the System to Use Gen Tax Filing Software?

Technical Configuration required in the System to use Gen IT Software includes Pentium or Later Processor, Minimum of 32 MB of RAM, Minimum Hard-Disk Space 200 MB.

Q.7 – Do I Need any Particular Operating System for Using Gen IT Software on a Computer?

Requirement for using Gen IT Software on a Computer includes Operating System – Windows 98, XP(Service Pack 1 or Higher), Vista, Windows 7 or 8 families(32- or 64-bit).

Q.8 – How to Download Gen Income Tax Software for Free?

Follow the below-mentioned step by step guide to Download Gen Income Tax Software for free.

- Step 1. Go to https://saginfotech.com

- Step 2. Click on “Our Product Tab” ⏩ Click Genius ⏩ Select Gen IT software in the tab.

- Step 3. Click the free trial download option available on the screen ⏩ Fill in the form with correct details ⏩ click Submit.

- Step 4. Fill in the basic details such as Name, Mobile no., Email address as required in the inquiry form ⏩ Press “Send”.

- Step 5. Download Gen IT software for free through the link sent to the email address you mentioned.

Q.9 – How Many Active Hours are Required for Installing the Gen IT Software Trial Version?

10 active hours are required for installation of the Gen IT Software Trial Version.

Q.10 – Is customer care service available on purchase of Gen IT Software?

Yes, a squad of experts are available to provide quick & reliable customer care service & support to the users of Gen IT software all day long.

- Time to call customer care agents: 10 AM to 8 PM

- Helpline number: 0141-4072000.

- After dialling helpline number, press 5 to connect with Gen IT experts.