Form GSTR-4A is said to be the auto-drafted and read-only form towards the composition assessee, auto-generated as per the information which is saved or furnished Form GSTR-1 and 5 and furnished Form GSTR-7 of the deductors in which the composition assessee is the recipient. The composition assessee had not taken any action for Form GSTR-4A. This form is for the view.

You must know that:

Form GSTR-4A might be practised as a reference to insert the information in Form GSTR-4.

Differentiate Term Debit/Credit Notes Prior & Post to Delinking of Form GSTR-4A

| S.no. | “Before Delinking of Debit/ Credit Note” | “After Delinking of Debit/ Credit Note” |

|---|---|---|

| 1 | “Original invoice number and original invoice date were auto-drafted” | “Original invoice number and original invoice date fields are not visible” |

| 2 | “POS field was not available” | “POS field is auto-populated as a mandatory field” |

View the Return Form GSTR-4A with Easy Steps

Step 1: Open www.gst.gov.in URL.

Step 2: From the GST Home page login to the Portal with valid details.

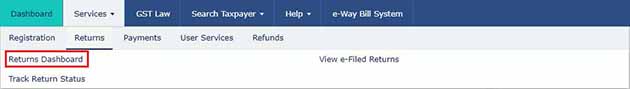

Step 3: Navigate to Services > Returns > Returns Dashboard command.

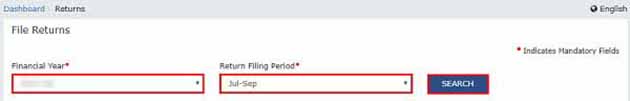

Step 4: The file returns page will appear. Here, select the relevant Financial Year & Return Filing Period from the drop-down list.

Step 5: Now, click the SEARCH tile.

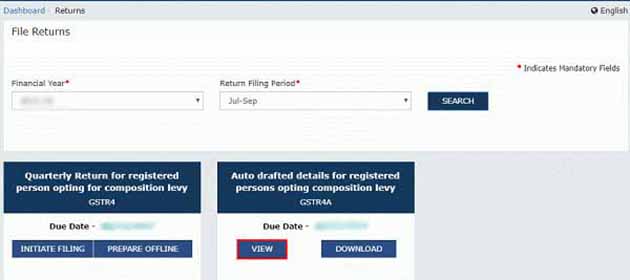

Step 6: From the File Returns page check the GSTR4A tile, find and click on the view tile.

Note: If the number of invoices is over 500, you will have to download the invoice to view it in your Form GSTR-4A. To generate the file, click on the Download button and on the Generate File tile in the GSTR-4A tile.

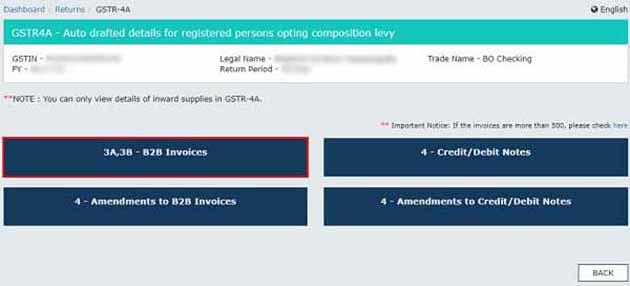

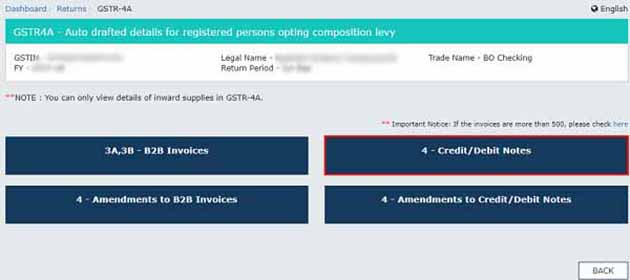

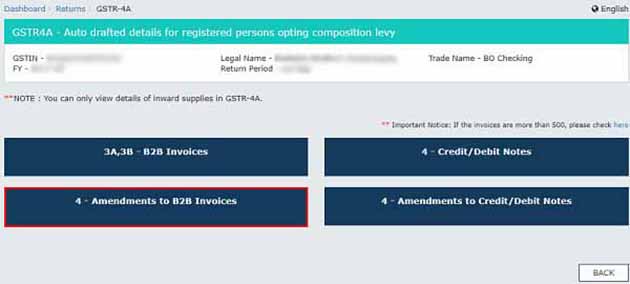

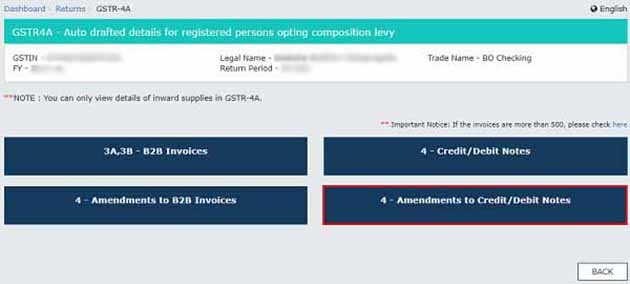

GSTR4A – The auto-draft details will be displayed for the registered persons opting for the Composition Levy page.

Click on the following tile names to get more details:

- 3A,3B – B2B Invoices

- 4 – Credit/Debit Notes

- 4 – Amendments to B2B Invoices

- 4 – Amendments to Credit/Debit Notes

3A and 3B – Business to Business Invoice

It will show all inward supplies got from registered suppliers. The B2B section of Part A of GSTR-4A will be auto-populated when suppliers in their respective returns of GSTR-1 and GSTR-5 upload or save their invoices.

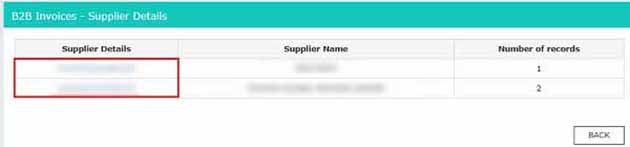

Step 1: Now, click on the tile having text ‘3A,3B – B2B Invoices’. The B2B Invoices – Supplier Details page will appear

Step 2: Click on the GSTIN hyperlink under Supplier details to check all the invoices uploaded by the supplier.

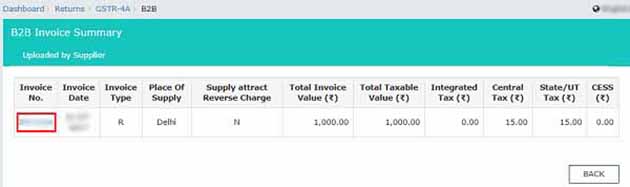

Step 3: Now, click on the hyperlink present under Invoice No. to check the details of the invoice.

Step 4: Details of a particular item will be displayed on the screen.

4 – Credit and Debit Notes

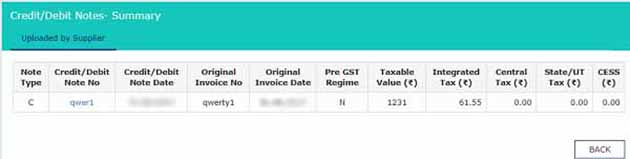

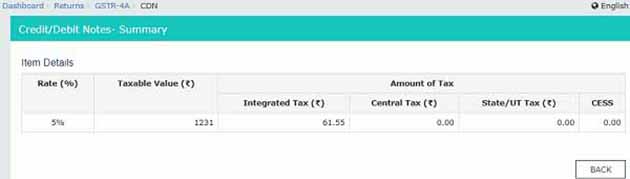

Here, users can see credit/debit notes attached by the supplier in their respective returns (GSTR-1/5).

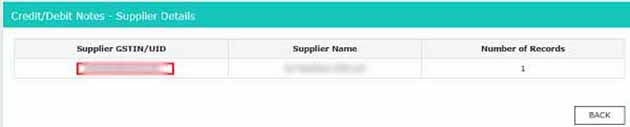

Step 1: Click on the tile having text ‘4 – Credit/Debit Notes’. The Credit/Debit Notes – Supplier Details page will be displayed.

Step 2: Users have to click on the GSTIN hyperlink under supplier details to view all the invoices uploaded by any particular supplier.

Step 3: Under the Credit/ Debit Note No click on the hyperlink to check the details of the attached credit/debit note.

Step 4: Complete details of that particular Credit/ Debit Note will be displayed.

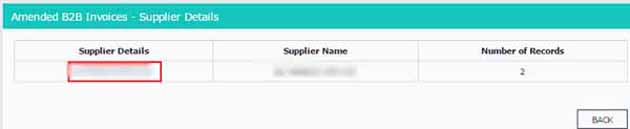

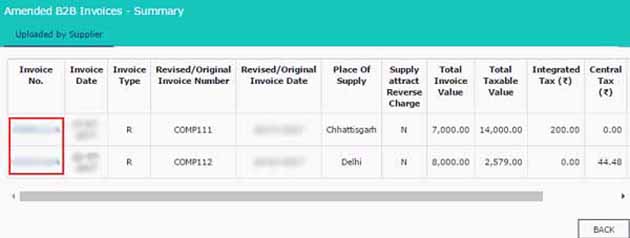

4 – Amendments to Business to Business Invoice

This particular section pertains to all those invoices which have been amended by the supplier in the return of GSTR-1 and GSTR-5, respectively.

Step 1: Click on the tile “4 – Amendments to B2B Invoices“. The Amend B2B Invoices – Supplier Details page will appear.

Step 2: Click the hyperlink present under GSTIN to check the supplier of the amended invoice that has been uploaded on the portal.

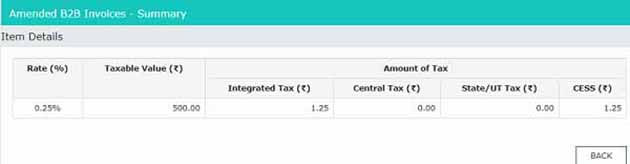

Step 3: Click on the hyperlink presented under Invoice No. to check the details of the invoice.

Step 4: Details of the particular item will appear on the screen.

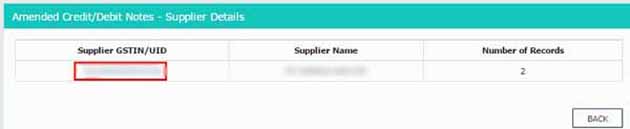

4 – Revisions to Credit and Debit Notes

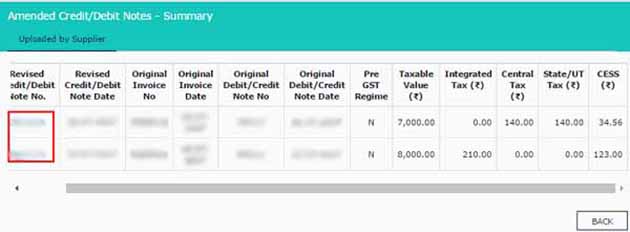

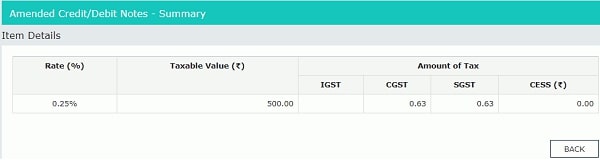

This section features all the revisions of debit/credit notes made by the supplier in their respective returns GSTR1 and GSTR-5.

Step 1: Click on the “4 – Amendments to Credit/Debit Notes” tile. The Amend Credit/Debit Notes – Supplier Details page will appear.

Step 2: Click the hyperlink under the GSTIN column to check the amended credit/debit notes uploaded by the supplier.

Step 3: Now, click the hyperlink under Credit/ Debit Note No to check the details of the invoice.

Step 4: Details of that particular amendment credit/debit note will be displayed.

Major FAQs on Return Form GSTR 4A

Q.1 – What are several sections for Form GSTR-4A and what do they reveal?

Form GSTR-4A mentioned the sections below as:

- 3A,3B – B2B Invoices: The sections mentioned the inward supplies obtained from the enrolled suppliers.

- 4 – Credit/Debit Notes: The sections show the credit or debit noted added through the supplier for the corresponding returns.

- 4 – Amendments to B2B Invoices: The section shows that the invoices are changed through the supplier in their returns.

- 4 – Amendments to Credit/Debit Notes: This shows that the revisions of credit or debit notes performed through the supplier for their corresponding returns.

Q.2 – Can I furnish Form GSTR-4A?

No, you will not need to furnish Form GSTR-4A. It is a read-only document given to you so that you have a record of all the invoices obtained from several suppliers inside the mentioned tax period.

Q.3 – Do I make amendments to or add invoices in my Form GSTR-4A for the case in which there occur any errors or items missing for the information uploaded through the supplier assessee?

No, one shall not makes any revisions towards Form GSTR-4A, as it is a read-only document.

Q.4 – I add some new invoices in Form GSTR-4. Do I am able to view the invoices in Form GSTR-4A?

The new or missing invoices totaled by the composition assessee in Form GSTR-4 are not added to GSTR-4A of either the present or consequent tax period.

Q.5 – What will be executed if the composition assessee furnished his Form GSTR-4 and the supplier is furnishing his Form GSTR-1/5 post that for a respective tax period?

If the composition assessee has furnished his Form GSTR-4 and the supplier is furnishing his Form GSTR-1/5 post that for the respective tax period for the case Form GSTR-1/5 data shall get auto-populated to the subsequent open period Form GSTR-4A.

For instance:

The receiver has furnished Form GSTR-4 for Q1. the supplier filed the Form GSTR-1 for July month. In this case, Form GSTR-1 the invoices will be populated in the subsequent open period that is Q2 of Form GSTR-4A.

Q.6 – When do I require to download the invoices to see them inside my Form GSTR-4A?

If the number of invoices exceeds 500 then you are urged to download the invoices to see them in your Form GSTR-4A.