As we all know, TDS is deducted to deposit a certain amount of your salary to the government in the form of tax. Apart from depositing tax, you are required to file a TDS Return as well. TDS Return needs to be filed with NSDL or the ITD portal by the deductor at regular intervals. But, what if you notice a mistake or missed any information in your already submitted return form? To correct your existing return, you can file a Revised TDS Return.

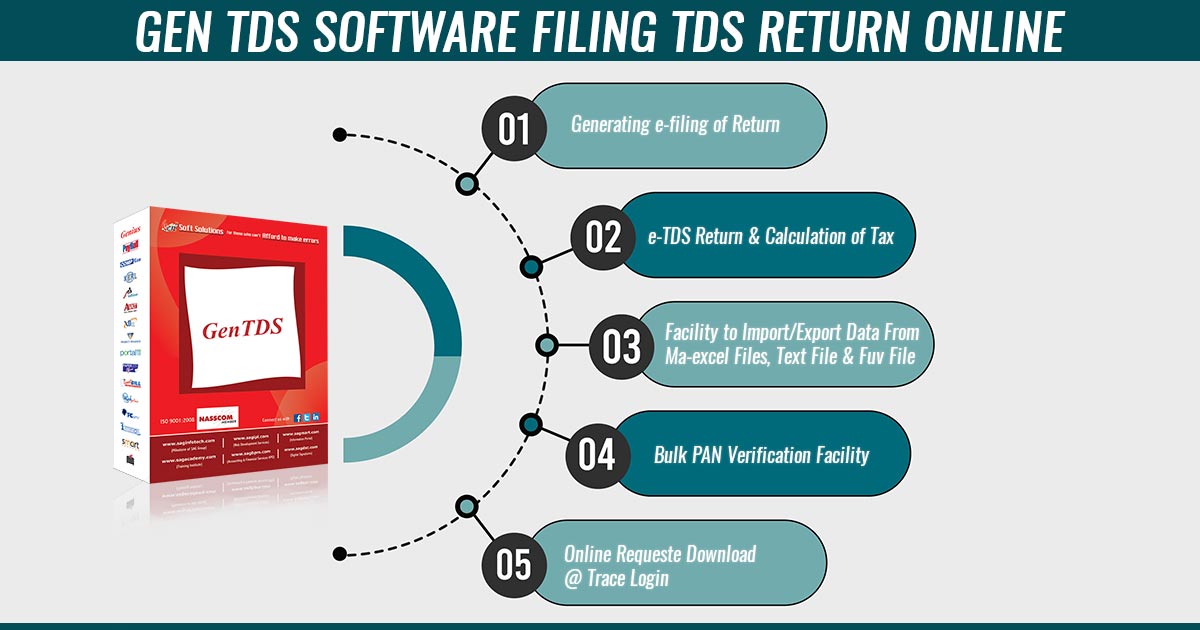

File Revised TDS Return Via Gen TDS Software, Get Demo!

Procedure for Filing Revised TDS Return

If you find any mistake in filling out the eTDS or want to make any modifications like changing the name, address, challan serial no., BSR code, challan tender date, etc., you can correct your form in simple steps. However, before going through the steps, there is something you should know:

- Update the deductor details, such as the Name and address of the Deductor. This type of correction is known as C1

- Update challan details such as challan serial no., BSR code, challan tender date, challan amounts, etc. This type of correction is known as C2.

- Update/delete /add deductee details. This type of correction is known as C3.

- Add/delete salary detail records. This type of correction is known as C4.

- Update the PAN of the deductee or employee in the deductee/salary details. This type of correction is known as C5.

Add a new challan and underlying deductees. This type of correction is known as C9. - Cancel accepted statement. This type of correction is known as Y. Cancellation of Regular TDS/TCS can be done only if the TAN of the deductor is being revised. When you cancel the regular statement with an incorrect TAN, it is necessary to file a new regular TDS/TCS statement with the correct TAN.

Recommended: Due Dates for E-Filing of TDS and TCS Return

Steps to File TDS Revised Return

Facing the issues in amending the TDS return, below is the mentioned process to furnish the TDS revised return.

Step 1: Request for Conso File from Traces Portal

- Log in to Traces

- Post to logging, you can see several tabs on the home screen.

- Go to the statements or payment tab, go to the urge for conso file.

- You then opt for the FY, quarter, and Form to which the return shall be amended.

- Tap on Go which shall proceed to the subsequent page where you fill in the original return token number, challan details & deductee details of the challan details which you have mentioned.

- Your request for the conso file is submitted.

- To find out, go to the download tab and opt for the requested download. Lastly, you were enabled to see their submission of your conso file & the status will show furnished. Post to the day, the status of your conso File will show as available.

Step 2: Download the Conso File and Open it in the Utility

- Post to the day when you log in, the traces the states if your conso file shall show available.

- Tap on the HTTP download given below.

- When you extract the zip file, you can enter a password. The password to extract the zip file is the TAN number (capital letters) _Request Number. (The request number will show in your request download)

- The extract file is the .tds file. Open the same file through the software or RPU utility that is available at tinnsdl.com in the download section.

- Open the RPU utility, opt for the form to which the conso request was furnished and then import the conso file and then you will see that it will succeed.

Step 3: Renew the Correction in the Utility

- After the successful import of the conso file, the desktop screen would show 4 tabs in sequence. Form/Challan/Annexure-I (deductee details)/Other services for TIN. (Chiefly for correction, the first three tabs are important)

- TAB-1 Form that reveals the ordinary information, and where there is no revision is needed.

- TAB-2 Challan: You shall see that the challan previously uploaded in the original return shall display you. This tab consists of 23 columns.

- For instance, if you are urged to build the correction for any of the challans uploaded that can be consumed, go to column No. 2 and opt for the renewed choice.

- Column No. 23 will confer on you the amount of balance which you can utilise.

- TAB-3 Annexure-I (deductee details).

- To consume the non-consumed amount in the challan, you can add the deductee.

- At the bottom down you can see the choice of adding a row, and it will prompt you how many rows are to be added. Add the rows as per the deductee you urged to add.

- Column No. 2 shows challan serial No., pick the challan where you ought to make an update (which I have given as an example as challan no. 2), choose the section & update the essential information.

- Post to finish at the bottom, you can see the button to make the file, which shall show a menu.

- The pop-up will reveal or ask you to upload the three files with the path that is mentioned below:

- CSI file, which is downloaded from the challan status.

- Error/upload & Statistics reported file- Choose the directory where .fuv & form 27A are to be saved.

- Conso file path: Select the conso file from traces(which have previously been downloaded).

Tap on generate the file. In that section, your FUV file will be created without any errors. If error forms go to the error-generated file & resolve the error.

Step-4: Upload to the “E-filing” portal

- Log in through TAN in the E-filing portal.

- Go to the last tab of TDS, opt for upload TDS and complete the required information and then tap on the proceed button.

- The subsequent step shall tell you to enter the original return furnished for the token number and then proceed.

- It opts for the FUV file, and if your DSC is not enrolled, you can upload it through the Aadhar OTP.

- The Form 27A form can be furnished at the TIN-FC centre for those who are not enrolled at the e-filing portal.

Read Also: What is Form 15G and 15H, How it Saves TDS on Interest Income?

Procedure to Download FUV from the NSDL website

- Open the website. www.tin.nsdl.com

- Choose the Option TAN Registration

- Type your login details.

- Select TDS/TCS and then / View the Consolidated file

- Type all the important Details

- Fill the questionnaire

- After filling in the required details, you will be able to download the FVU File.

Steps To Track the Revised TDS Return Request

- Step 1: Log in to the official website of the TRACES > click on the ‘Defaults’ tab > select the option of ‘Track Correction Request’, present on the webpage.

- Step 2: Enter the Request number (mandatory) and the period for which the request has been made, and select the option of ‘View Request’ to access the request or ‘View All’ to view all the requests.

- Step 3: View and check the status of the Revised TDS Return Request filed by you.

Note: If the user is an admin, then he can access the request filed by his sub-user following the same procedure.

Steps to Complete the Correction or Rectification

- Step 1: Visit the official website of TRACES website and view the rectification status. Proceed for the correction if it displays as ‘Available’.

- Step 2: Ensure that the token number entered is correct and is the same as he received with the statements related to the Return.

- Step 3: Alter the challan details and PAN, once the details entered is authenticated by the Income Tax department.

Points to Ponder While Filing a Revised TDS Return

- Online changes can be done only in the PAN and challan, add/modify /delete Deductee and add/modify challan. For any other revision in the return, one needs to make changes through TIN-FC.

- Only those TDS returns can be revised, the statements for which are issued after the fiscal year 2007-08.

- For the online rectification in the TDS return, a taxpayer must be registered on the online portal, i.e. TRACES.

- Only those altered statements are considered valid that have been approved or accepted by the TIN central system.

- The changes made in the TDS return statement should be given many times to reflect the changes in the regular TDS report. However, the TIN Central system accepts a regular statement only once.

- User must ensure that the updated changes or corrections are in harmony with the acceptable alterations in the TDS report.

- The record, disallowed earlier, should be mentioned clearly by the user.

Partly Accepted Statements

When the status of the rectified statements is displayed as “Partially Accepted, the user must do the following:

- Ensure that the rectifications w.r.t the accepted records in the TDS report are duly updated.

- Ensure that the correct PAN is updated in his statement because incorrect PAN details lead to rejection of remuneration.

WHILE FILLING TDS RETURN REVISED 2ND TIME ON GENUIS SOFTWARE, FILE SHOW DELTETION OF CHALLAN AND ENTRIES, PLEASE SUGGEST IT’S DONE OR NOT.

We have forgot the lower TDS certificate details mnetion in vendor whenever we file the original form 26Q but now i can add the lower TDS certificate details.

so please gide. how can i done revised retrun by traces.

I want to revise TDS Return 26Q for the QE-Mar 22 by deleted deductee details. Can I utilize that TDS challan for set off my current month TDS liability & what are the consequences?

Hi sir,

We had filed return (2022-23 Q2 ) on oct-2022, but we forget TDS payment(Challan) & Return of some customer(94C). so we paid remaining TDS Payment Done on Feb-2023. can we Correction the Q2 and Add Remaining Challans and Cust Details, please suggest me here.

First you have to make TDS Payment and then add the challan through online correction. After that request for Conso file and make the Correction statement.

HOW TO GET CONSO FILE OF MANUAL FILED TDS RETURN FOR FY 2007-08 4TH QUARTER.

Sir,

Iam already add challan on Traces online challan correction for the FY 2021-22 every Quarter. Now the status is showing proceed without default. what is the next step if any. please advice me.

Please assist me that while filing Q4 return we forget to mention transaction done U/s 194Q and file the return. now how can i file the transaction done u/s 194Q ?

how to file correction TDS return, becoz, generate error like invalid previous RRR no.

FY 21-22 Q2, Q3 Revised TDS Return is possible

Hi,

Can we change financial year in TDS return after filling it. Actually Problem is, TDS deducted for F.Y 2019-20, Challan for it is also correct but in fiiling of TDS return Mistakenly I put as F.Y 2020-21. Can anybody help me out of this.

Thanks

Hi

As per my understanding, first you need to delete the deductee details from the FY 2020-21 . so that challan can be claimed. Then you need add the challan and deductee details in FY 2019-20. Just check whether its works or not.

tds revised return for the q4 of f.y.2020-21

ACTUALLY, IT WAS NOT CLEAR FOR TDS IN THE CASE OF ONE DEDUCTEE.SO WE HAVE NOT DEPOSITED TDS IN ONE ACCOUNT. BUT I HAVE FILE TDS RETURNS FOR F.Y 2020-21 FOR OTHER DEDUCTEES. FOR ALL QUARTERS. NOE I WANT TO ADD ONE LEFT OUT DEDUCTEE. SO PLEASE GUIDE HOE TO RECTIFY. AND CAN I SUBMIT A REVISED RETURN U.S.194A STATEMENT IS 26Q FOR ALL QUARTERS? PLEASE REVISED MY RETURN. I WIILPAY

dear Sir,

I want to file a return for the assessment year 2009-10 & 2010-11. I need help for this how can I file return

plz advise

I want to amend the TDS sec from 194 oo 94j for legal fees paid, for q3 of fy 2020-21

I have downloaded th JR report file

I have to change the section code of commission paid in the 26Q of quarter 3 of 2020-21. I have already downloaded the console file. what should I do next?

I want to file a revised TDS return for Q1 of 2020-21. I have entered the incorrect deductee name and PAN and want to change it to the correct Name and PAN. Kindly guide me through the process of doing the same and under what head the correction will be done C1 or C3

Hi sir, with respect to the 26Q return which been filed for Q2 of 2020-21, There are purchase transactions for which wrongly TDS deducted and filed. Now we want to delete those deductions. But in Traces Correction Request we found only 3 types of corrections i.e Add challan, Pay interest, Challan correction. How to resolve this. Kindly provide a solution in this regard.