Form 10B is to be filed via a trust or institution that holds the enrollment u/s 12A or that submits an application for enrollment via furnishing of the Form 10A. Form 10B poses an audit report that is furnished by a CA on the assessee’s nomination.

Income tax form 10B would be accessed and submitted online, and it is to be furnished on or before the prescribed date given in Section 44AB, which is the month before the last date to file the income return under sub-section (1) of Section 139.

Latest Update in Income Tax Form 10B

- The income tax department has recently extended the deadline of Forms 10B and 10BB to 31st October 2025. Read press release

- Offline filing of Form 10B is available for AY 2023-24. The Offline Utility can be downloaded via the “Downloads” menu option. Please click on Form 10B and then click on “Form Utility” (Form AY 23-24 onward). Click to Download

Provisions to Claim this Service

- Taxpayers and CA are registered users of the new income tax e-Filing web 2.0 portal

- The status of the PAN card of the taxpayer and CA is Active

- The Indian taxpayer has added CA for Form 10B via the My CA service

- Valid, registered, and active Digital Signature Certificate (DSC) of the CA

- The assessee should apply for enrollment or already obtained enrollment as a charitable or religious trust or institution under section 12A via furnishing Form 10A, and as per that Form 10B is available beneath the taxpayer login.

Summary of Form 10B Under Income Tax

Here we have listed some important points to be kept while understanding Form 10B under the income tax head. It has the purposes and the assessees required to file Form 10B

Purpose of This Form

The audit report u/s 12A(1)(b) needs to be furnished under section 12A or which has submitted the application for enrollment via furnishing Form 10A. The Audit Report is mandatorily required to be filed if the total income of the entity for the relevant previous year exceeds the maximum amount that is not chargeable to tax.

The accounts for these trusts or institutions should be audited by the accountant as mentioned under section 288(2) of the same act. Currently, this report of audit needs to be filed before the mentioned date, rendered under section 44AB of the IT Act, which is the month before the last date for filing the income return under sub-section (1) of Section 139. Form 10B would get accessed and submitted via the enrolled CA on the nomination with the help of the assessee.

Who Would Utilise Form 10B?

The assessee who adds the CA and allotted mentioned form beneath the My CA service would access and submit Form 10B.

Submit Query for Filing Form 10B Software

Overview of Filing Form 10B

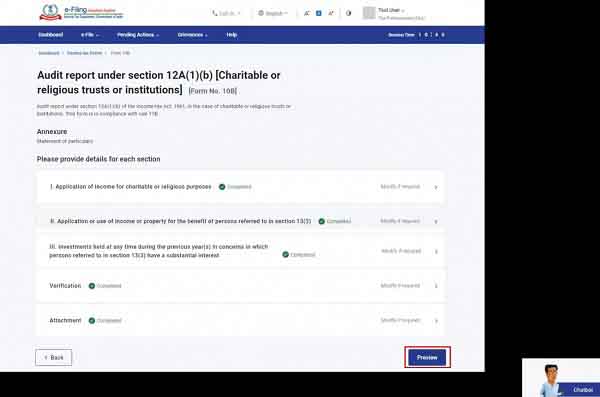

Form 10B poses 5 sections that the CA is required to furnish before submitting the form. These comprise:

- Annexure I

- Annexure-II

- Annexure III

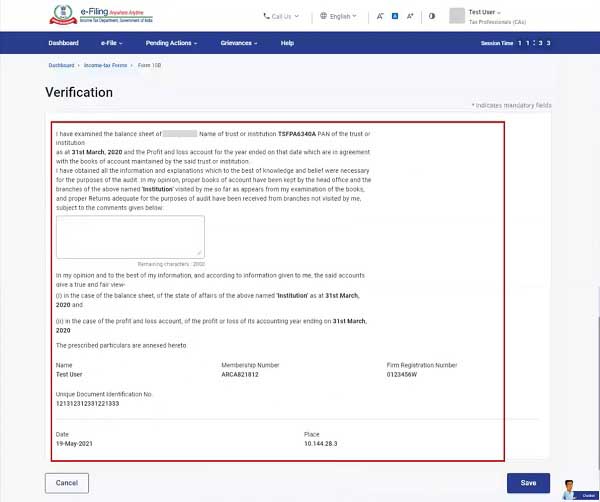

- Verification

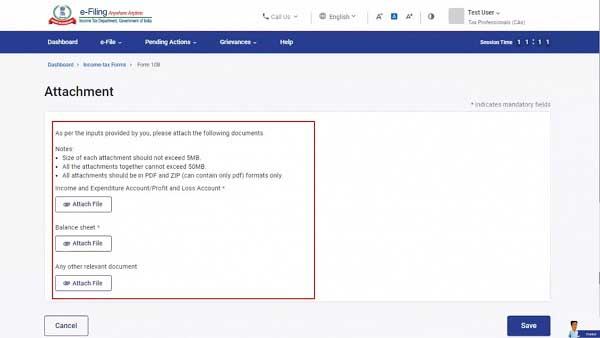

- Attachment

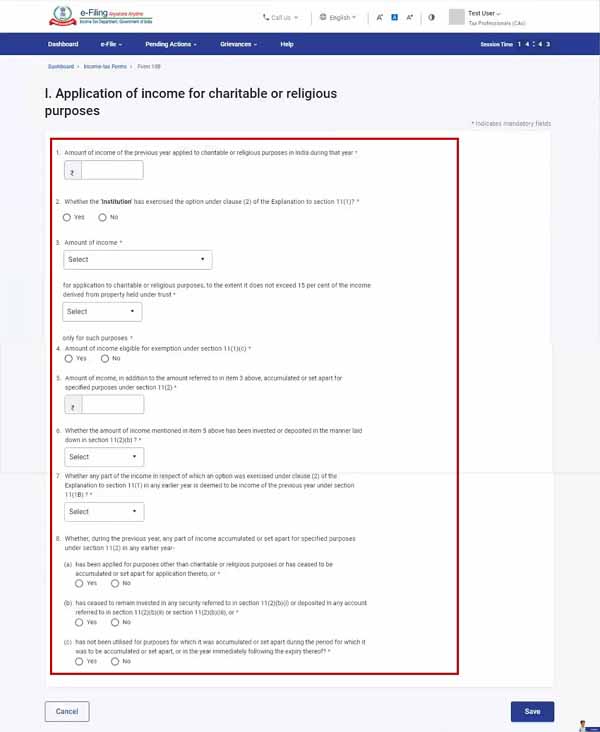

Annexure I: The Annexure I section is where the information on the income for charitable or religious intentions is prescribed.

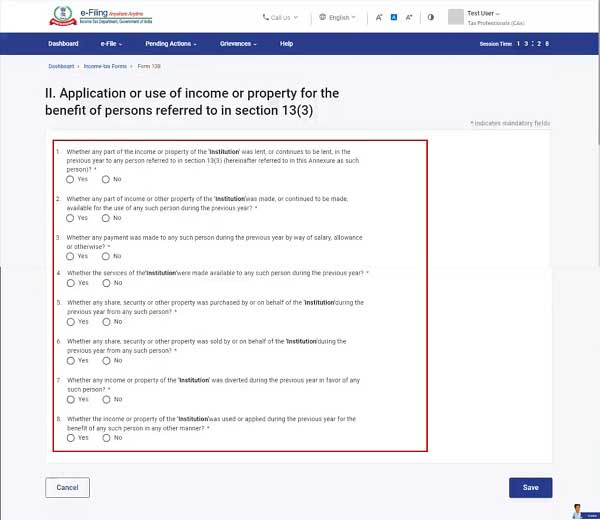

Annexure-II: Inside the Annexure-II section, the information about the income or the property for the advantage of the individual pointed towards section 13(3) is being furnished.

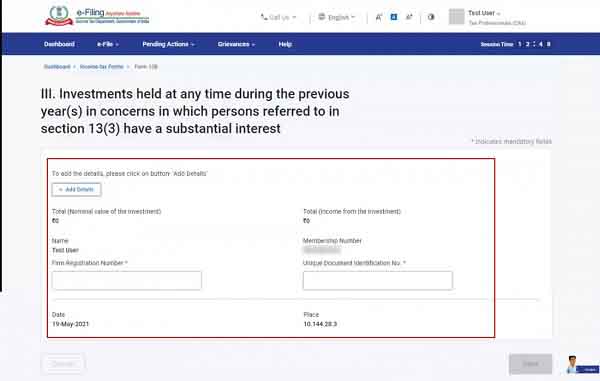

Annexure III: The Annexure III section comprises information on the former investments where the people referred to in section 13(3) secure the interest.

Verification of Information: The verification page is where the CA furnishes the assurance of the information given in the form.

Documents Attachment: The attachments page permits attaching documents and furnishes them under the inputs given by the CA.

Simple Process to Access and File Form 10B

The online method of income tax filing form 10B through the new e-filing portal. Follow the procedure to fill and submit the Income Tax Form 10B via online mode.

Full Process to Online Filing Form 10B by the New Portal for CA

Before the login and access to the form is performed by the CA, the form needs to be allotted to the CA via the assessee. The procedure for allotting the forms to CA can be viewed in the My CA user manual.

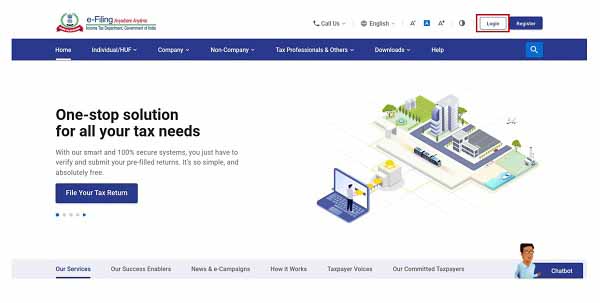

Step 1: Open the official site and log in to the new ITR e-filing portal with valid CA credentials.

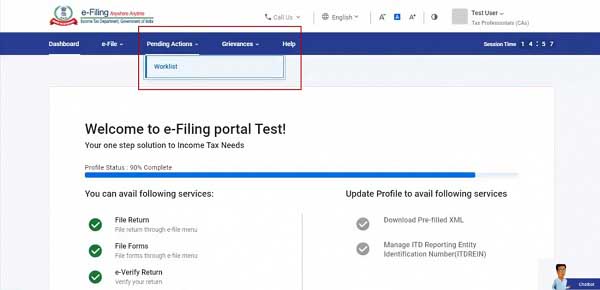

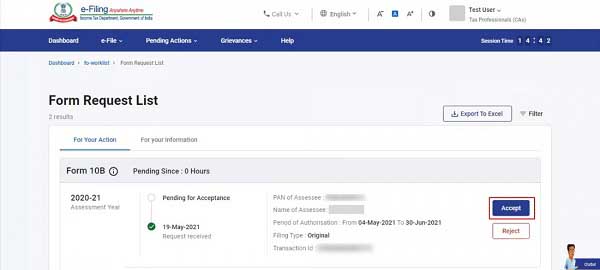

Step 2: Click Pending Actions > Worklist to view all the income tax forms assigned to you by taxpayers.

Step 3: One would accept or reject via furnishing a cause that would be sent to the assessee the forms allotted to you. Accept Form 10B from the list with respect to the concerned assessee.

A message would be prompted mentioning that the form has been accepted successfully.

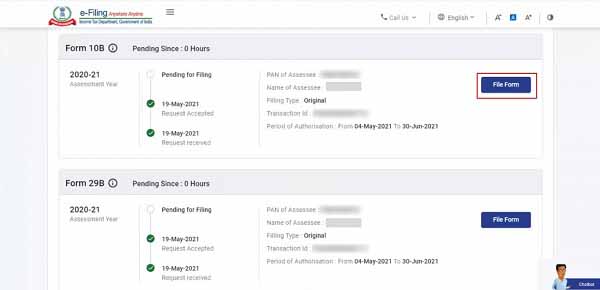

Step 4: In the Worklist, tap on the file form with respect to the income tax form 10B.

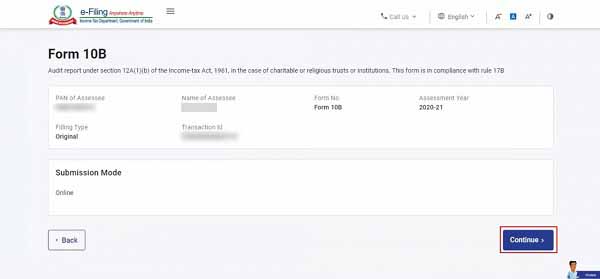

Step 5: Verify your information and tap continue.

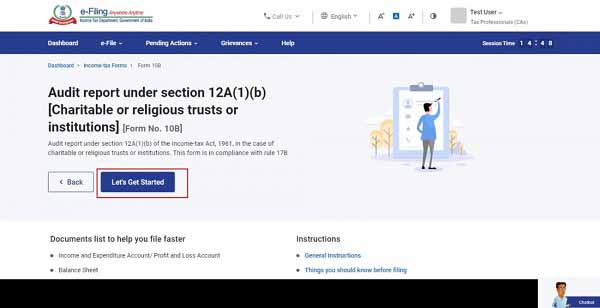

Step 6: On the Instructions page, tap on Let’s Get Started.

Step 7: Fill in all the needed information and tap on the Preview.

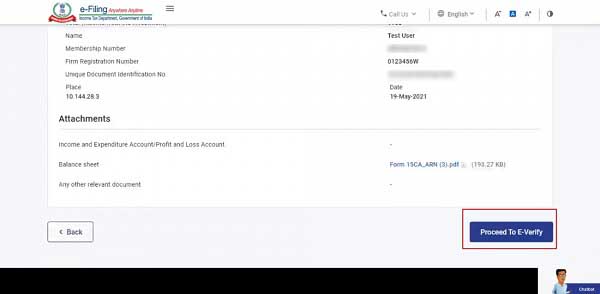

Step 8: On the Preview page, tap on Proceed to e-Verify.

Step 9: On tapping yes, you will be brought to the e-Verify page. Validate the form through DSC.

Note: Refer to the method in the e-Verify user manual to know more.

On the successful validation, email and SMS communication are to be given to the assessee who would accept or reject the Form 10B.

Note: Refer to the dashboard and the worklist user manual for more details on the method to accept or reject Form 10B as an assessee.

Why Choose Gen Income Tax 10B Filing Software?

Gen IT software secures the first solution in the market to furnish income tax form 10B features under the regulations of the government. Indeed, the Gen Income tax form 10B filing software would provide a brief overview of the grounds of the first basis to the client. The Gen IT software is indeed durable software to obtain effective filing features like income tax return filing, master data, document storage, etc.

Major FAQs on Filing Form 10B Under Income Tax

Q.1 – What Do You Mean by Form 10B?

Form 10B allows the assessee to furnish the audit report when the assessee applied for or is already enrolled as a charitable or religious trust or institution by filing Form 10A. Form 10B can be accessed by CA added by the assessee beneath the My CA service and has allotted the related form.

Q.2 – What is the Method to Use Form 10B?

The CA who have enrolled users on e-filing the portal would get access to Form 10B. Moreover, the CAs should be allotted the form by the assessee so as to access, edit, review, and submit that.

Q.3 – When is Form 10B Needed to Be Furnished?

When the total income of the trust or institution gets calculated without influencing sections 11 and 12 and surpasses the maximum amount not levied to the income tax in any provided fiscal year the accounts for that year need to get audited via CA. The same needs the individual to files the receipt of the mentioned income engaging with the income return the report of these audits in Form 10B duly signed and validated by CA.

Q.4 – Is it Essential to Furnish Form 10B Online?

Yes, it is started into compliance from AY 2020-21 it is needed that Form 10B is important to furnished in the online mode.

Q.5 – What Will be a Procedure to Furnish Form 10B?

Form 10B is allocated to CA via Assessee. The CA would upload and e-verify the form with the help of an enrolled, active, and valid DSC. the assessee then needs to accept the request and e-verify that through DSC or EVC to complete the submission procedure.

Q.6 – Regarding which Assessment Year the re-notified Form 10B becomes effective?

Form 10B, as officially notified through Notification No. 7/2023 dated 21st February 2023, comes into effect starting from the Assessment Year 2023-24 onward. For example, the upcoming Assessment Year 2023-24.

Q.7 – Is the earlier version of Form 10B, used before the issuance of Notification No. 7/2023, still accessible via the e-filing portal?

Certainly, the previous version of Form 10B remains accessible on the portal and applies exclusively to the Assessment Year 2022-23. For filings up to and including Assessment Years 2022-23, Form 10B can be located on the e-Filing portal using the following procedure:

e-File > Income Tax Forms —-> File Income Tax Forms —> Persons not reliant on any Source of Income > Form 10B” for assignment to Chartered Accountants.

orAlternatively, you can assign the form using the “My CA” option as well.

Q.8 – When is it mandatory for an auditee to submit Form 10B, as outlined in Notification No. 7/2023?

From the Assessment Year 2023-24, the re-notified Form 10B becomes applicable under specific circumstances, including:

- When the auditee’s total income, excluding specified clauses/sections, such as-

- Sub-clauses (iv), (v), (vi), and (via) of clause 23C of section 10

- Sections 11 and 12 of the Act, exceed five crores rupees during the previous year

- If the auditee has received foreign contributions during the previous year

- When the auditee has utilized any portion of its income outside India in the previous year. For more comprehensive details, you can refer to Rule 16CC and Rule 17B of the Income Tax Rules, 1962.

Q.9 – Who qualifies as an “auditee,” as referred to in Question No. 3 above?

In the context of Question No. 3, an “auditee” is considered for including any fund, institution, trust, university, educational institution, hospital, medical institution, or any entity specified in sub-clauses (iv), (v), (vi), or (via) of clause (23C) of section 10 of the Act. This term also includes trusts or institutions mentioned in sections 11 or 12 of the Act. All these entities are collectively referred to as the “auditee” in this form.

Q.10 – What is the deadline for submitting Form 10B for the Assessment Year 2023-24 and onwards?

The due date for filing Form 10B aligns with the specified date stipulated in section 44AB, i.e. one month before the deadline for furnishing the income tax return as outlined in sub-section (1) of section 139 of the Income Tax Act, 1961.

Q.11 – How to download the new form 10B for offline uses?

To download the offline utility for the new Form 10B, follow these steps:

- Visit the Home page of the Income Tax Department

- Navigate to the download section

- Select “Income Tax Forms

- Locate “Form 10B (A.Y.2023-24 onwards)” and click on the form utility

Alternatively, Chartered Accountants (CAs) can access this path by clicking the download button under the offline utility option when uploading the form.

Note: Please ensure you always use the latest version of the utility available on the E-filing portal for downloading and uploading the JSON file.

Q.12 – What are the available methods to verify Form 10B on the system?

Verification options for Form 10B (A.Y. 2023-24 onwards) are as follows:

- For Chartered Accountants (CAs), only the Digital Signature Certificate (DSC) option is available for uploading the form

- For taxpayers (auditees) other than companies, both the DSC and Electronic Verification Code (EVC) options are available to accept the form uploaded by the CA

- For Companies, only the DSC option is available to accept the form uploaded by the CA

Q.13 – What does “foreign contribution” mean in reference to Question No. 3 regarding the re-notified Form 10B?

In the context of Rule 16CC and Rule 17B, the term “foreign contribution” holds the same definition as provided in clause (h) of sub-section (1) of section 2 of the Foreign Contribution (Regulation) Act, 2010 (42 of 2010)

Q.14 – How can records be provided for Schedules that offer both the “Add Details” and “Upload CSV” options simultaneously?

For Schedules that provide both “Add Details” and “Upload CSV” options together, please take note of the following:

- If records are below 50: Either the table or CSV option can be utilized. In both cases, the data will be displayed in the table format.

- If records are above 50: Only the CSV option can be used. The data will appear as a CSV attachment only

- When using the upload CSV option, follow these steps

- Download the Excel template

- Add records

- Convert the Excel template into a .csv file

- Upload the .csv file.

Q.15 – Is there any guidance or instruction available for completing the Form?

Yes, Chartered Accountants (CAs) can download the instruction file within the utility of Form 10B (A.Y. 2023-24 onwards) to provide guidance on filling out the form.

Q.16 – Where should the Balance Sheet, Profit and Loss statement, and applicable tax audit report be uploaded in the new Form 10B??

During the form submission process on the e-filing portal under the section for supporting documents, auditors must upload the Balance Sheet, Profit, and Loss account, and audit report under 3CA/3CB in PDF or zip file format.

Additionally, there is an optional attachment option named “Miscellaneous Attachments” where any other related document may be attached.

It should be kept in mind that the required size of the document is 5MB, and the total size of all attachments combined should not exceed 50 MB. Furthermore, all attachments must be in PDF or ZIP format, and all files within the ZIP folder should be in PDF format exclusively.

Q.17 – Is it possible to revise a filed Form 10B (A.Y. 2023-24 onwards)?

Yes, the option for revision is available for a filed Form 10B

Q.18 – The filing of Form 10B is considered complete after which procedure?

The submission of the form is considered finalized only when the taxpayer acknowledges the form submitted by the Chartered Accountant (CA) and completes verification using a valid Digital Signature Certificate (DSC) or Electronic Verification Code (EVC) registered on the e-filing portal.

Q.19 – When will the panels of schedules be made accessible in order to submit form 10B offline?

The panels for schedules will become accessible for filling only after the user has completed other sections within the form

Q.20 – Where can the filed form details be viewed after filing Form 10B (A.Y. 2023-24 onwards)?

Form Users can find the details of the submitted form following the below path

E-File tab—>Income Tax Forms—>View Filed Forms under CA and Taxpayer’s login