LUT or the Letter Of undertaking is a hot term these days. LUT is paramount for exporters and traders. Export volumes are the real and only parameter that determines the growth rate of a country. It brings in important foreign reserves and also opens up new business opportunities. Hence an easy process for frictionless LUT submission was the need of the year. The GST council has to be lauded for making the process smoother and more transparent than before.

Latest Update In LUT Filing Deferment

- The GSTN department has updated the new functionality to file the Letter of Undertaking (LUT) for FY 2025-26 on the official website. View more

- “The GSTN department has allowed the taxpayers to file LUT for FY 2022-23 and this facility is available on the GST government portal. The application of LUT is needed to be fulfilled by 31st March 2022 or before supply for SEZ and exports.”

Under GST regime, export falls under the IGST umbrella. As per IGST act export can be conducted via two ways. These are:

- File LUT to export without IGST payment

- Pay IGST at time of export and claim later

LUT is an ideal option for exporters. You have to submit the LUT only once in a current financial year. The process involves no additional compliances. Further, the process does not attract any additional costs.

Read Also: How to Save Goods and Services Tax in India Without Any Fraud?

Eligibility For Export Under LUT:

If you want to avail the facility to export under LUT, make sure that you have cross-checked the following eligibility points.

All GST registered traders/persons who have not been prosecuted for any offence under the CGST Act or the Integrated Goods and Services Tax Act,2017 or any of the existing laws.

The amount of tax evaded by individuals who have been booked under the CGST or IGST Act must not exceed two hundred and fifty lakh.

Let’s Start with Procedure to File LUT Online Under GST:

GST Complying Exporters can now fill the ‘LUT (Letter of Undertaking)’ under the GST Process online. This is a great step forward in automation of the GST process and reduces growing grievances of exporters.

Follow the steps below to file your LUT Online.

- Visit the GST Portal and login to your GST account using your credentials

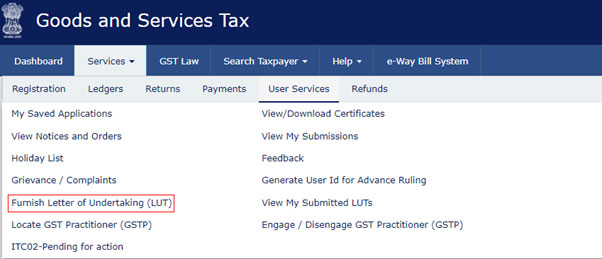

- Now go to the menu bar and select ‘Services’ option

- Now select the ‘User Services’ Option as shown in the above image.

- Finally, click on ‘Furnish Letter of Undertaking’.

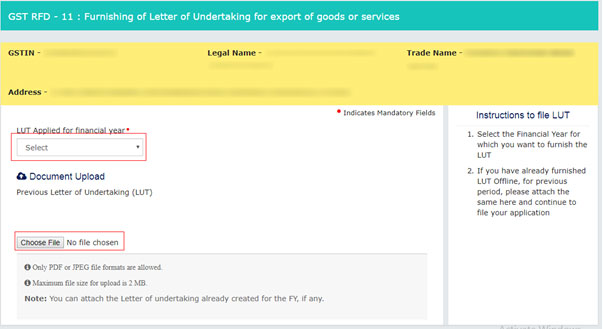

- You will be directed to the following screen:

- Now select the Financial Year for which period you want to submit the LUT

- You can also upload those LUT’s that belong to an earlier period by clicking on the choose file option and uploading the LUT file

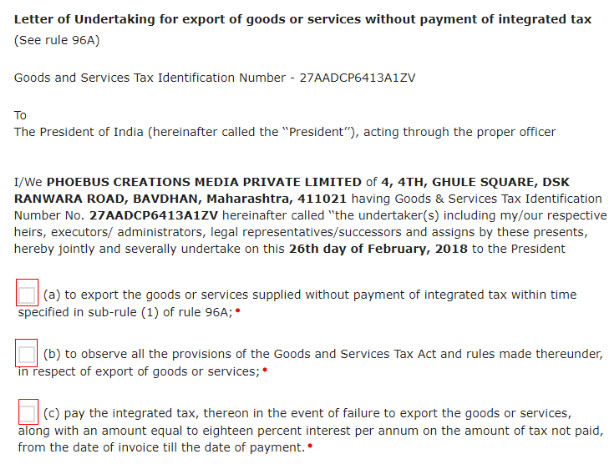

- After this, you have to tick all the three checkboxes as shown in the below screenshot

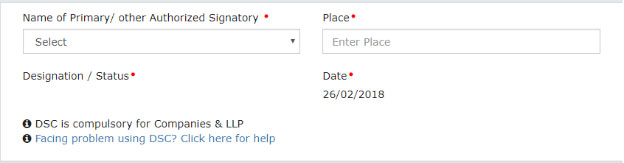

- After selection all the checkbox, fill other compulsory fields on the opened form. Now you need to provide the details of two witnesses

- Next, select name of the primary/ authorized signatory who will sign LUT and fill the place details

- Last but not the least, sign the LUT with your unique DSC/EVC

Remember: Once filed, the LUT form cannot be re-edited. Make sure that you recheck at least once before signing and submitting.

Recommended: How to File GSTR Forms Online in India?