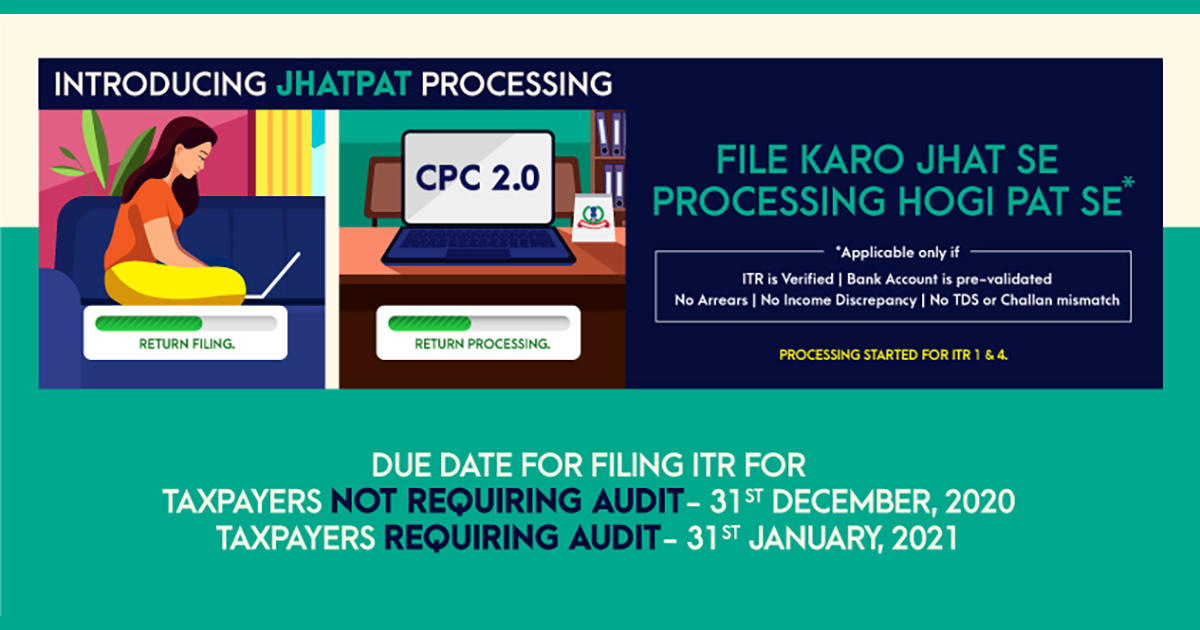

As per a tweet from IT department’s official twitter handler “File Karo Jhat Se, Processing Hogi Pat Se”, the department is ready to introduce a new technologically upgraded platform CPC 2.0 for faster processing of ITRs. And the filing of Income Tax Return for financial year 2019-20 (AY 2020-21) will be processed on CPC 2.0.

However, the due date of Income Tax Return

Taxpayers can get benefits of the new technologically upgraded platform CPC 2.0 only if their ITR is verified, Bank Account is pre-validated, there are no assears, having no income discrepancy and not having any TDS for challan mismatch.

For now, with this platform Processing started for ITR 1 and ITR 4. ITR-1 is also known as Sahaj Form and it is for people having income up to ₹ 50 Lakhs. The ITR 1 Sahaj form

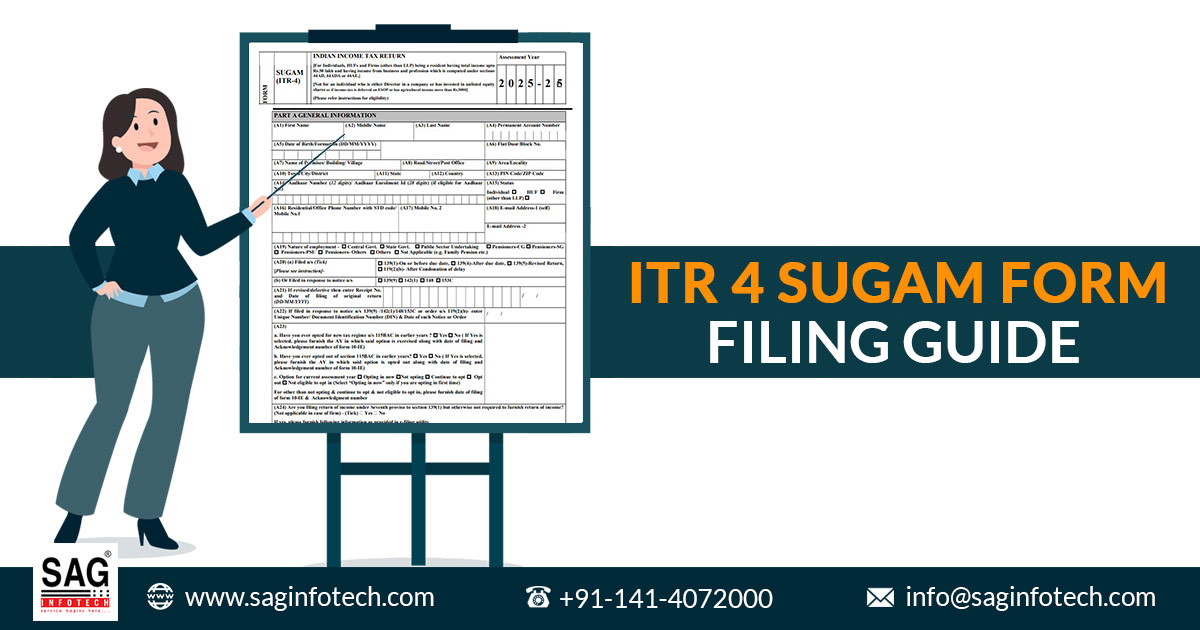

Whereas, The ITR 4 Sugam form

The central processing centre 2.0 (CPC 2.0) platform which is now confirmed by the Income Tax department is being introduced to provide improved taxpayer services and to speed up the processing speed of the Income Tax Return filing process

With this new upgraded platform, the tax department is expanding capacity and upgrading techniques to provide better services to taxpayers through predefined forms and to reduce time for refunds.