What is the ITR 4 Sugam Form?

ITR stands for Income Tax Return and ITR 4 Sugam Form is for the taxpayers who are filing return under the presumptive income scheme in Section 44AD, Section 44ADA and Section 44AE of the Income Tax (IT) Act. If the turnover of the aforementioned business becomes more than Rs 2 crores, then the taxpayer can’t file ITR-4.

Provided Section 44AD and Section 44ADA limit increased to 3 crore and 75 lakh, respectively amounts received during the previous year, in cash, does not exceed 5% of the total gross receipts of such previous year.

Latest Update in ITR 4 Form

- The IT Department has released the latest version of the Excel-based utility (V1.3) and the JSON Schema of ITR-4. Download now

- CBDT has released a new schema for e-filing of ITR 4 form for residents, HUFs, and firms (other than LLPs) with a total income of up to Rs 50 lakh, as well as income from business and professions under sections 44ADA, 44AD, and 44AE, and agricultural income up to Rs. 5 thousand.

Who can File the ITR 4 Sugam Form?

ITR 4 Sugam form can be filed by the individuals / HUFs / partnership firm (other than LLP) being a residents if:-

- Total income does not exceed Rs. 50 lakh.

- Assessee having business and profession income under section 44AD,44AE or ADA or having interest income, family pension, etc.

- Having agricultural income up to Rs 5,000/-

- Have a single House property.

- Long Term Capital Gain u/s 112A provided the LTCG 112A does not exceed Rs.1.25 Lakhs and there is no loss to be carried forward or set off under the capital gains head.

It must be noted that the freelancers involved in the above-mentioned profession can also choose this scheme only if their gross receipts are not more than Rs 50 lakhs.

File ITR 4 Via Gen IT Software, Get Demo!

Who Can’t File the ITR 4 Form for AY 2025-26?

A person whose income from salary or house property or other sources is more than Rs 50 lakh cannot file ITR 4 Form for AY 2025-26. A person who is a director in a company or has invested in the unlisted equity shares or has any brought forward/ carry forward loss under house property income cannot file the ITR 4 for AY 2025-26.

Read Also: Section-Based Income Tax-Saving Tips For Salaried Person

Due Date for Filing ITR 4 Sugam Form for FY 2024-25 & AY 2025-26

- FY 2024-25 (AY 2025-26) – 31st July 2025 | 16th September 2025 (Revised)

- FY 2023-24 (AY 2024-25) – 31st July 2024

- FY 2022-23 (AY 2023-24) – 31st July 2023

- FY 2021-22 (AY 2022-23) – 31st July 2022

Guide to File Income Tax Return (ITR) 4 Sugam Online:

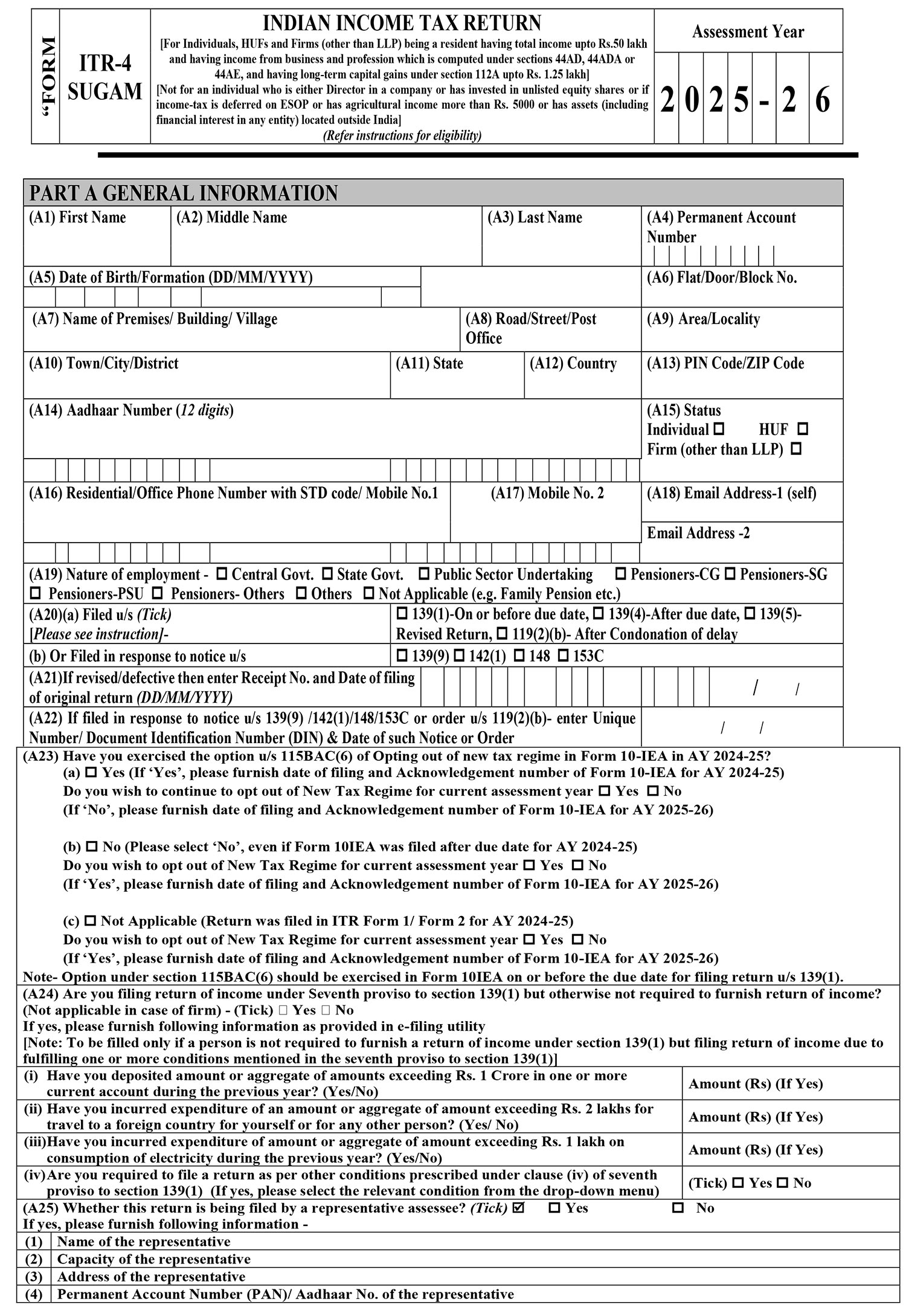

PART A: General Information

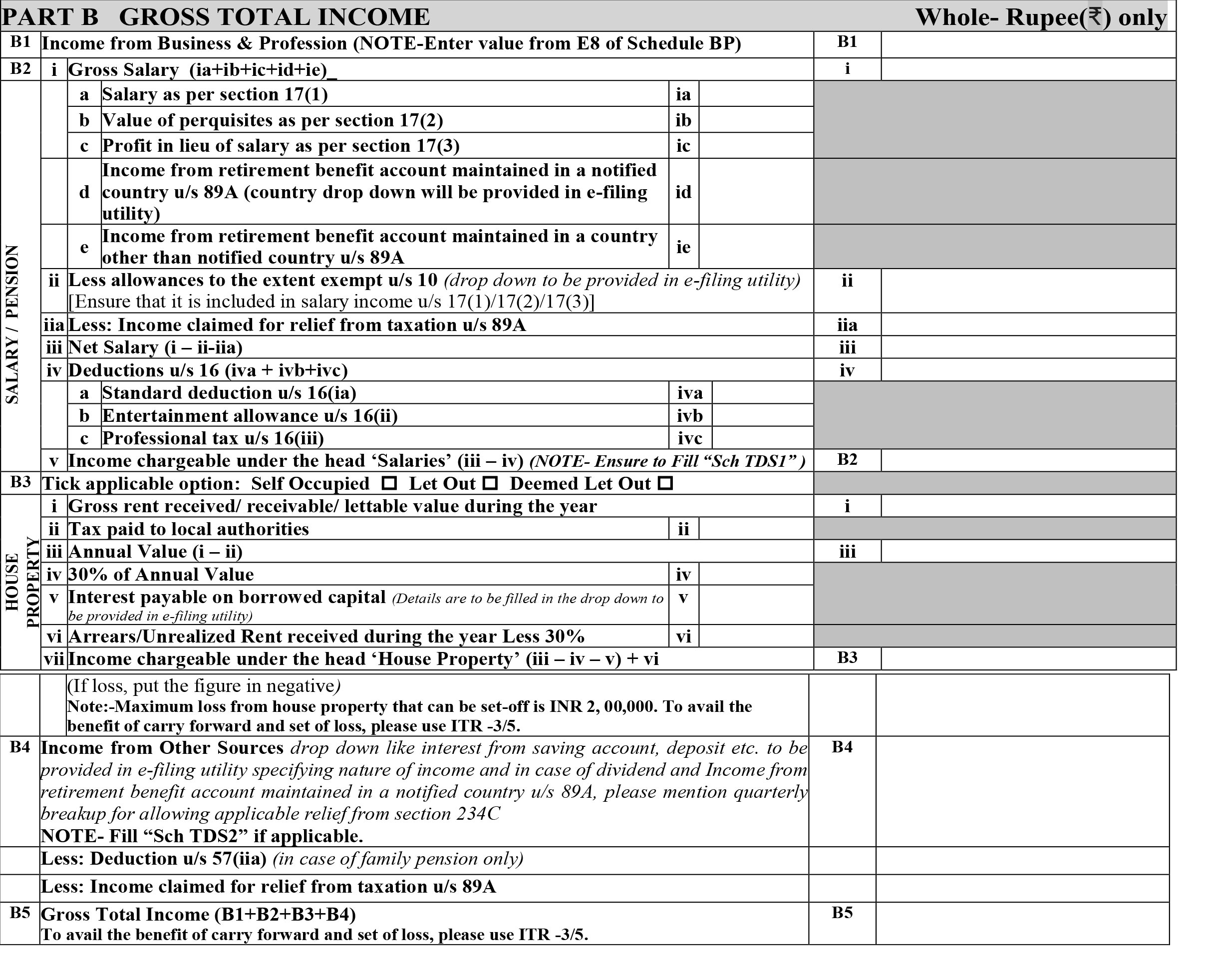

Part B: Gross Total Income

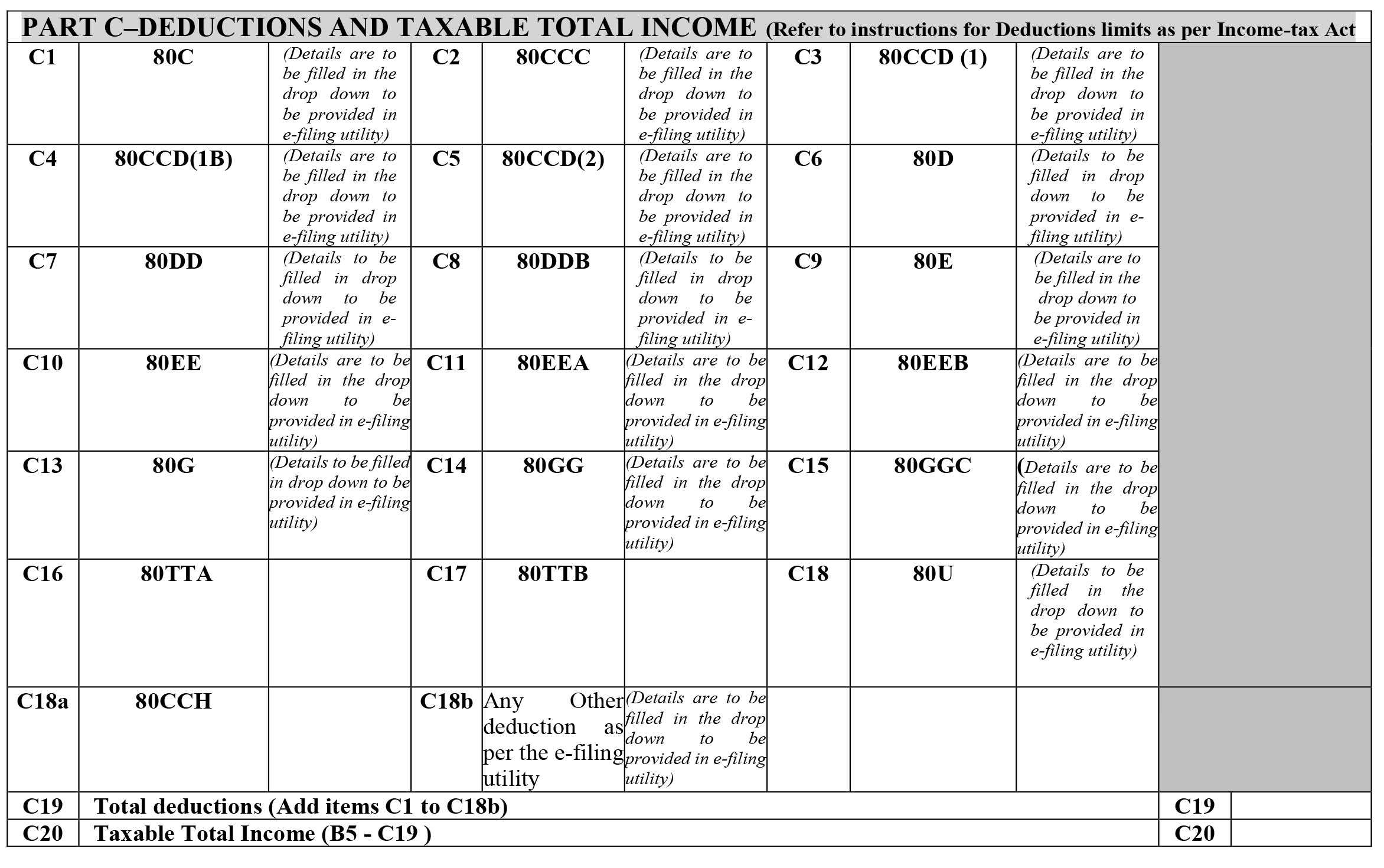

Part C: Deductions and Taxable Total Income

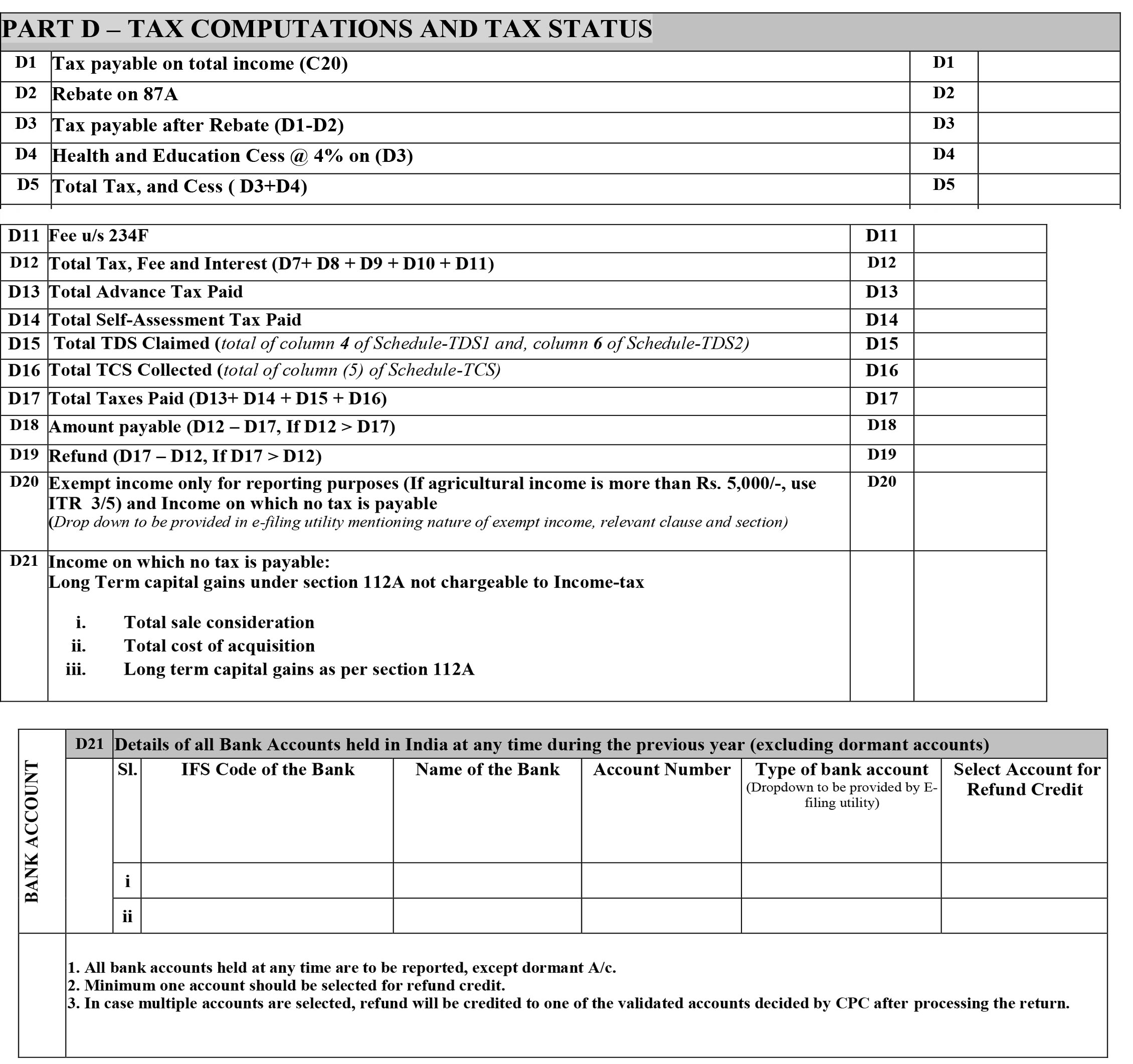

Part D: Tax Computations and Tax Status

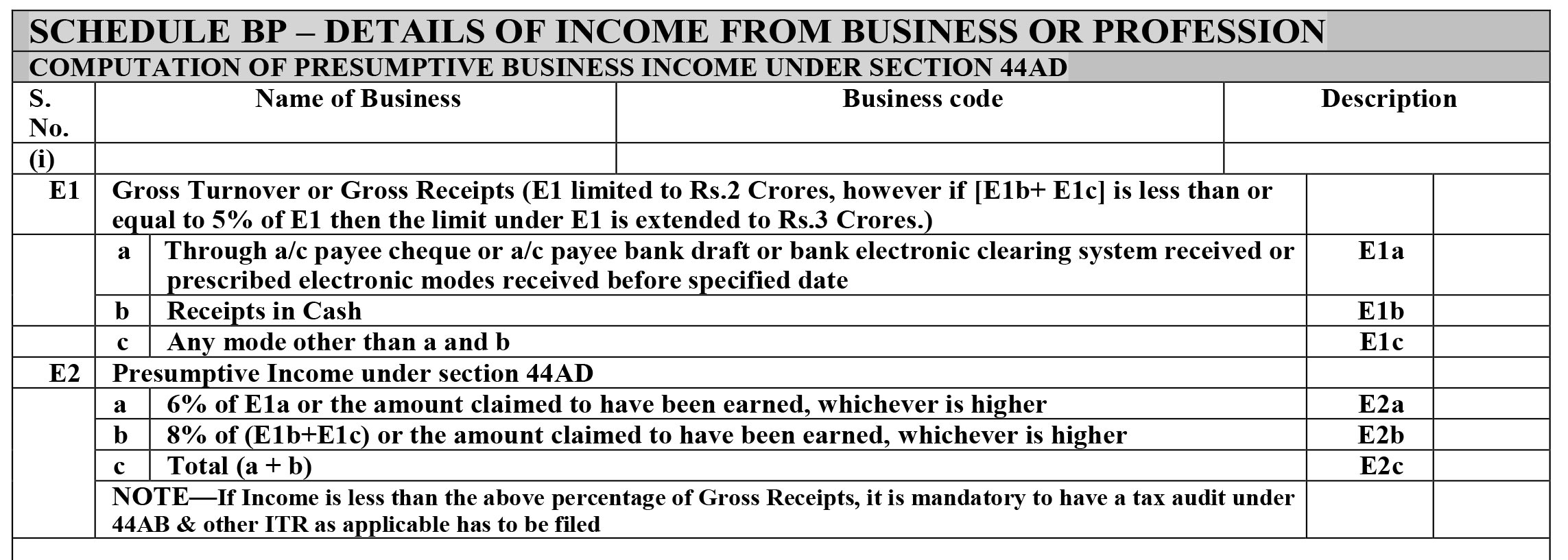

Schedule BP: Details of Income From Business or Profession Computation of Presumptive Business Income Under Section 44ad

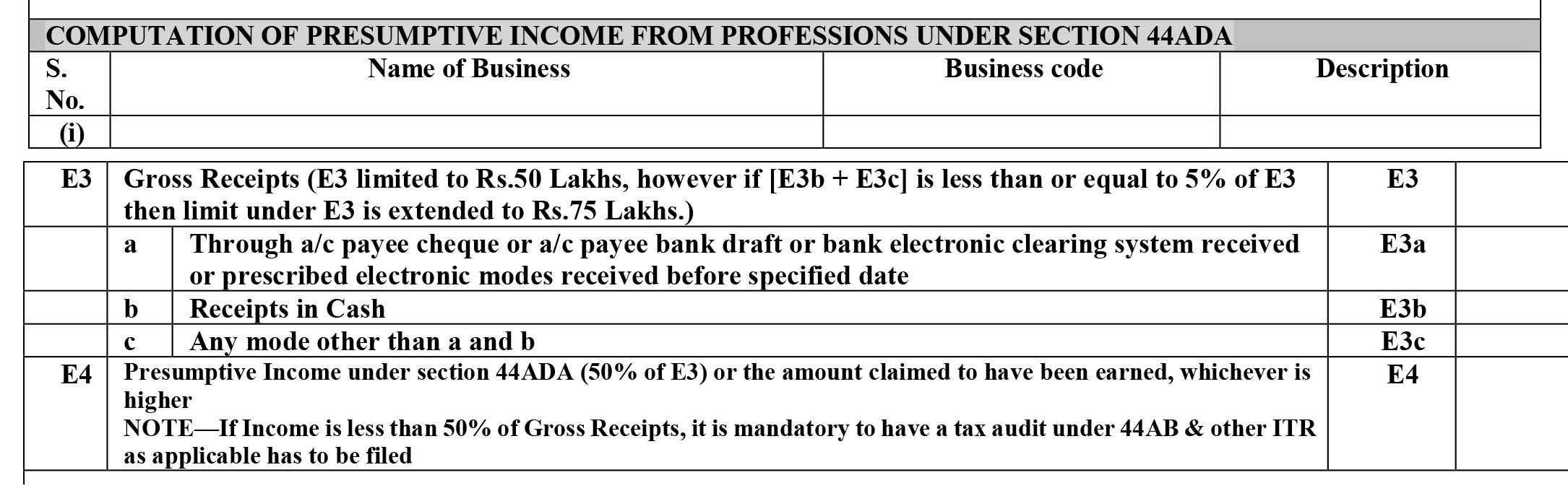

Computation of Presumptive Income From Professions Under Section 44ADA:

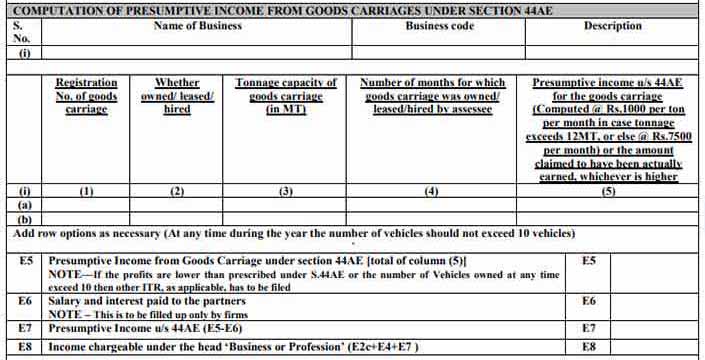

Computation of Presumptive Income From Goods Carriages Under Section 44AE:

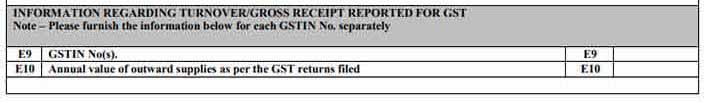

Information Regarding Turnover/gross Receipt Reported for GST

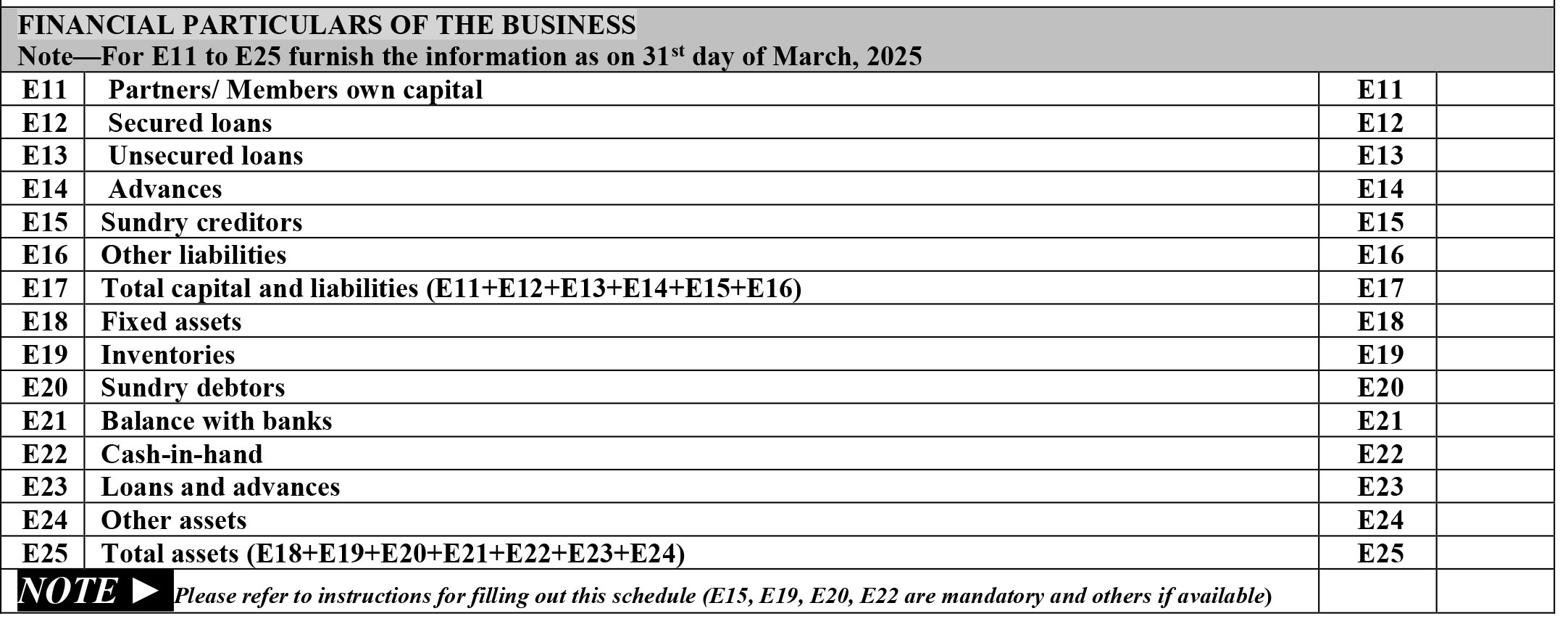

Financial Particulars of The Business

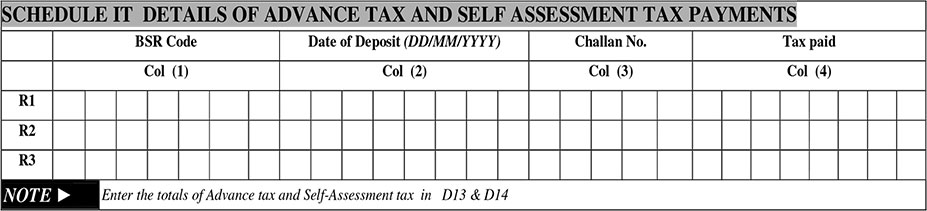

Schedule IT: Details of Advance Tax and Self Assessment Tax Payments

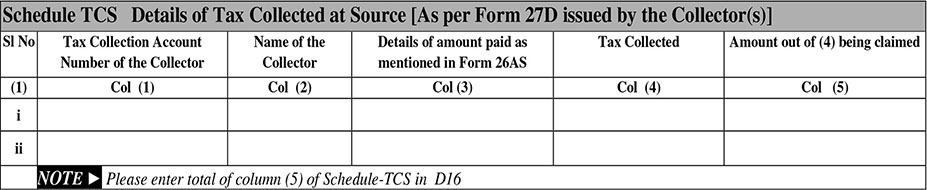

Schedule TCS: Details of Tax Collected at Source [As per Form 27D issued by the Collector(s)]

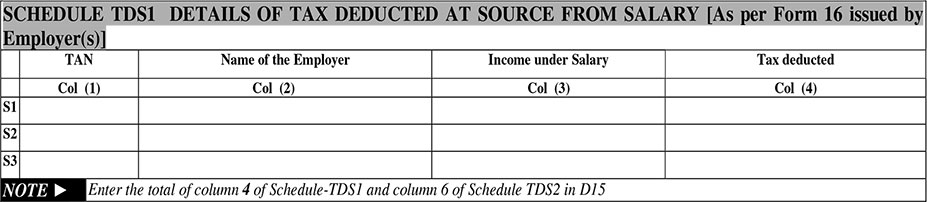

Schedule TDS1: Details of Tax Deducted at Source From Salary [as Per Form 16 Issued by Employer(S)]

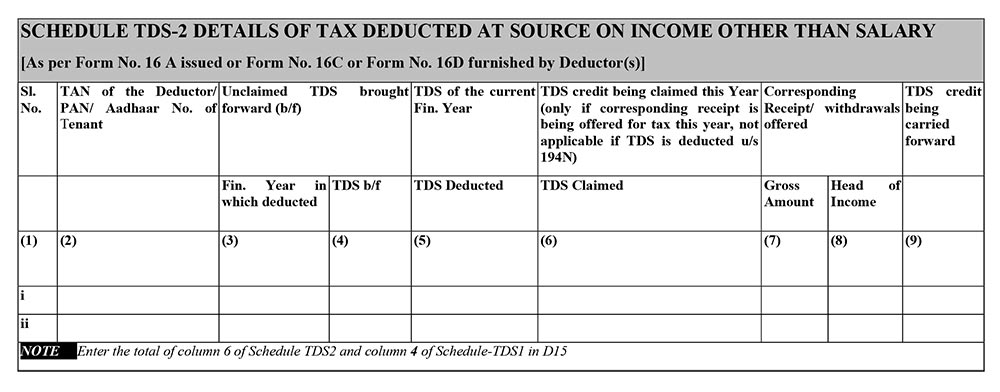

Schedule TDS2: Details of Tax Deducted at Source on Income Other Than Salary [as Per Form 16 an Issued or Form 16c Furnished by Deductor(S)]

Recommended: Penalty Provisions If Not File Income Tax Returns for Current FY

ITR 4 Online User Manual Guide