The ITR-3 Form can be filed by those Individuals and Hindu Undivided Families who earn income from a Proprietary business or by practising his/her profession. However, when an individual/HUF earns income as a partner of a partnership firm that is carrying out business/profession, he can file an ITR-3.

Latest Update

- Taxpayers can now download the ITR-3 Excel-based utility (V1.9) from the official e-filing portal. Download Now

File ITR 3 Via Gen IT Software, Get Demo!

ITR 3 Filing Start Date for Tax Professionals

The online filing of ITR-3 started on 30th July 2025 for taxpayers through the Income Tax portal.

Who is Not Eligible to File the ITR-3 Form?

Individuals and HUF who don’t have income from business and profession.

When Should ITR 3 be Filed?

- ITR-3 form is filed when the assessee earns income which falls into the below-mentioned category:

- Income earned from Proprietary Business

- Income gained by conducting a profession

- Income from House property

- ITR-3 is also needed to be filed by a person whose income is chargeable to tax under “profits and gains of business or profession” like, interest, salary, bonus, commission or remuneration.

What is the Due Date for Filing ITR 3 Form?

The due date for filing an income tax return is as follows for individuals and businesses:

| Annual Year | For Non-audit Cases | For Audit Cases |

|---|---|---|

| AY 2025-26 | 31st July 2025( Revised till 16th September 2025, Read Press Release) | 10th December 2025 (Revised) Read PR |

| AY 2024-25 | 31st July 2024 | 31st October 2024 (Revised till 15th November 2024, Read Circular) |

| AY 2023-24 | 31st July 2023 | 31st October 2023 |

What are the Different Methods of Filing ITR-3 Form?

There are the following three methods for filing the Income Tax Return ITR-3 Form:

- By filing a return electronically under a digital signature. (Assesses who need to obtain a tax audit must use this method)

- By conveying the data in ITR-3 form electronically under an electronic verification code.

- By transmitting the data in ITR-3 form electronically, followed by the submission of the return verification in

- Return Form ITR-V to the Income Tax Office via mail. (Taxpayer filing ITR-3 form using this method must complete the acknowledgement in ITR-V.)

Read Also: Complete Process of Filing ITR 1 Online

How an Acknowledgement in ITR-V is Filed Out?

After furnishing all the necessary details, the assessee should print out two copies of Form ITR-V (verification). One copy of ITR-V, properly signed by the assessee, has to be posted to Post Bag No. 1, Electronic City Office, Bengaluru–560100 (Karnataka). The other copy can be held back by the assessee for his record.

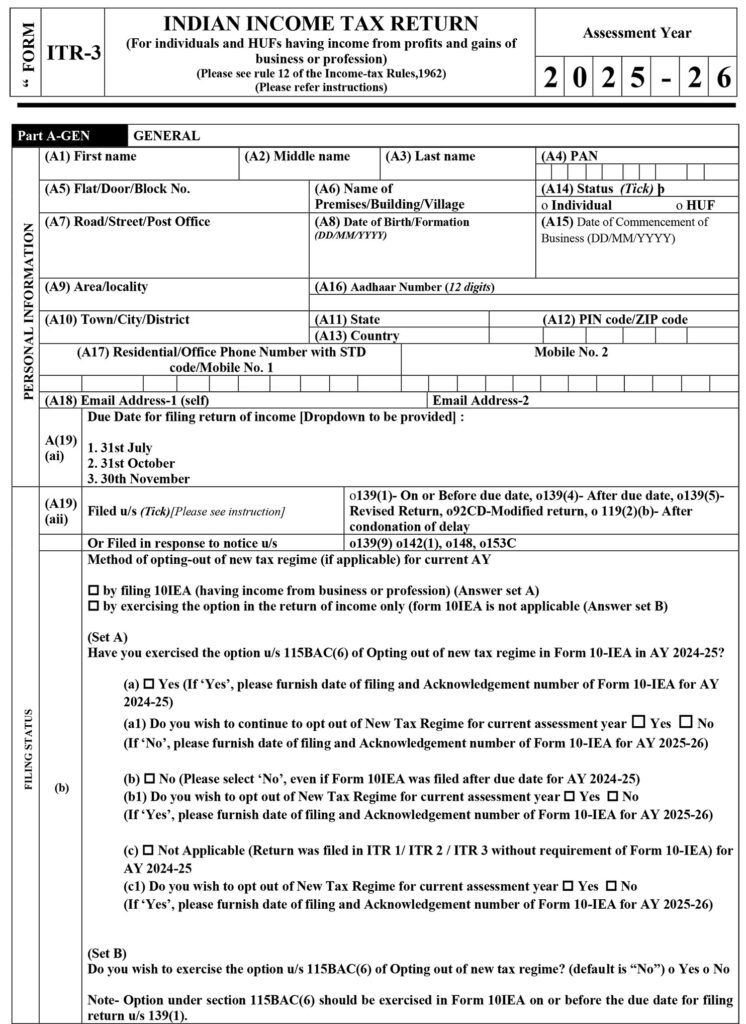

Step by Step Process to File ITR 3 Online for AY 2025-26

Part A – GEN General

A. Personal Information

- First name

- Middle name

- Last name

- PAN

- Flat/Door/Block No. Name Of Premises/Building/Village

- Date of Birth/Formation (DD/MM/YYYY)

- Date of Commencement of Business (DD/MM/YYYY)

- Status (Tick)

- Individual

- HUF

- Road/Street/Post Office

- Area/locality

- Aadhaar Number (12 digits)/Aadhaar Enrolment Id (28 digits) (if eligible for Aadhaar)

- Town/City/District, State Pin code/Zip code

- Country

- Residential/Office Phone Number with STD code/Mobile No.

- Email Address-1(Self)

- Email Address-2

- Due Date for filing return of income [Dropdown to be provided]

- 31st July

- 31st October

- 30th November

B. Filing Status

- (a.1) Filed u/s

- 139(1)- On or Before the due date

- 139(4)- After due date

- 139(5)- Revised Return

- 92CD-Modified return

- 119(2)(b)- after Condonation of delay

- (a.2) Or Filed in response to notice u/s

- 139(9)

- 142(1)

- 148

- 153C

- (b) Method of opting out of the new tax regime (if applicable) for the current AY:

- By filing 10IEA (having income from business or profession) (Answer set A)

- By exercising the option in the return of income only (Form 10iea is not applicable (Answer set B)

- Set (A)

- Have you exercised the option u/s 115BAC(6) of Opting out of the new tax regime in Form 10-IEA in AY 2024-25?

- (a) Yes (If ‘Yes’, please furnish date of filing and Acknowledgement number of Form 10-IEA for AY 2024-25)

- (a1) Do you wish to continue to opt out of the New Tax Regime for the current assessment year? Yes or No

- (If ‘No’, please furnish date of filing and Acknowledgement number of Form 10-IEA for AY 2025-26)

- (a1) Do you wish to continue to opt out of the New Tax Regime for the current assessment year? Yes or No

- (b) No (Please select ‘No’, even if Form 10IEA was filed after the due date for AY 2024-25)

- (b1) Do you wish to opt out of the New Tax Regime for the current assessment year? Yes or No

- (If ‘Yes’, please furnish date of filing and Acknowledgement number of Form 10-IEA for AY 2025-26)

- (b1) Do you wish to opt out of the New Tax Regime for the current assessment year? Yes or No

- (c) Not Applicable (Return was filed in ITR 1/ ITR 2 / ITR 3 without requirement of Form 10-IEA) for AY 2024-25

- (c1) Do you wish to opt out of the New Tax Regime for the current assessment year? Yes or No

- (If ‘Yes’, please furnish date of filing and Acknowledgement number of Form 10-IEA for AY 2025-26)

- (c1) Do you wish to opt out of the New Tax Regime for the current assessment year? Yes or No

- Set (B)

- Do you wish to exercise the option u/s 115BAC(6) of Opting out of new tax regime? (default is “No”) Yes or No

- Note-Option under section 115BAC(6) should be exercised in Form 10IEA on or before the due date for filing return u/s 139(1)

- Do you wish to exercise the option u/s 115BAC(6) of Opting out of new tax regime? (default is “No”) Yes or No

- (c) Are you filing a return of income under the seventh proviso to Section 139(1) but otherwise not required to furnish a return of income? (Tick) Yes or No (If yes, please furnish the following information)

- [Note: To be filled only if a person is not required to furnish a return of income under section 139(1) but filing return of income due to fulfilling one or more conditions mentioned in the seventh proviso to section 139(1)]

- c (i) Have you deposited amount or aggregate of amounts exceeding Rs. 1 Crore in one or more current account during the previous year? (Yes/No)

- c (ii) Have you incurred expenditure of an amount or aggregate of amounts exceeding Rs. 2 lakhs for travel to a foreign country for yourself or for any other person? (Yes/No)

- c (iii) Have you incurred expenditure of an amount or an aggregate of amounts exceeding Rs. 1 lakh on the consumption of electricity during the previous year? (Yes/No)

- c (iv) Are you required to file a return as per other conditions prescribed under clause (iv) of seventh proviso to section 139(1) (If yes, please select the relevant condition from the drop-down menu)

- [Note: To be filled only if a person is not required to furnish a return of income under section 139(1) but filing return of income due to fulfilling one or more conditions mentioned in the seventh proviso to section 139(1)]

- (d) If revised/Defective/Modified, then enter the Receipt No. and Date of filing original return (DD/MM/YYYY)

- (e) If filed, in response to a notice u/s 139(9)/142(1)/148 or order u/s 119(2)(b), enter Unique Number/Document Identification Number and date of such notice/order, or if filed u/s 92CD enter date of advance pricing agreement

- (f) Residential Status in India (for individuals)

- A. Resident

- B. Resident but not Ordinarily Resident

- C. Non-resident

- Residential Status in India (for HUF)

- A. Resident

- B. Resident but not Ordinarily Resident

- C. Non-resident

- (g) Do you want to claim the benefit under section 115H? (applicable in case of resident)

- (h) Are you governed by Portuguese Civil Code as per section 5A? Tick) Yes or No (If “YES” please fill Schedule 5A)

- (i) Whether this return is being filed by a representative assessee? (Tick) Yes or No If yes, furnish following information-

- Name of the representative assessee

- Capacity of the Representative (drop down to be provided)

- Address of the representative assessee

- Permanent Account Number (PAN)/Aadhaar No. of the representative assessee

- (j) Whether you were Director in a company at any time during the previous year?

- (k) Whether you are Partner in a firm?

- (l) Whether you have held unlisted equity shares at any time during the previous year? (If yes, please furnish following information in respect of equity shares)

- (m) In case of a non-resident, is there a permanent establishment (PE) in India?

- (n) In the case of a non-resident, is there a Significant Economic Presence (SEP) in India (Tick)(Yes/No), please provide details of

- (a) Aggregate of payments arising from the transaction or transactions during the previous year as referred to in Explanation 2A(a) to Section 9(1)(i)

- (b) Number of users in India as referred in Explanation 2A(b) to Section 9(1)(i)

- (o) Whether assessee is located in an International Financial Services Centre and derives income solely in convertible foreign exchange?

- (p) Whether you are an FII / FPI? Yes/No If yes, please provide SEBI Regn. No

- (q) Legal Entity Identifier (LEI) details (mandatory if refund is 50 Crores or more)

- LEI Number

- Valid upto date

C. Audit Information

- (a1) Are you liable to maintain accounts as per section 44AA?

- (a2) Whether assessee is declaring income only under section 44AE/44B/44BB/44AD/44ADA/44BBA/44BBC. Yes or No

- a2i: If No, whether during the year Total sales/turnover/gross receipts of the business is between Rs. 1 crore and Rs. 10 crore?

- Yes

- No turnover does not exceed 1 crore

- No, turnover exceeds 10 crores

- a2ii: If Yes is selected at a2i, whether aggregate of all amounts received, including amount received for sales, turnover or gross receipts or on capital account like capital contributions, loans etc. during the previous year, in cash & non-a/c payee cheque/DD, does not exceed five per cent of said amount? (Yes/No)

- a2iii: If Yes is selected at a2i, whether the aggregate of all payments made, including the amount incurred for expenditure or on capital account, such as asset acquisition, repayment of loans etc., in cash & non-a/c payee cheque/DD during the previous year does not exceed five per cent of the said payment? (Yes/No)

- a2i: If No, whether during the year Total sales/turnover/gross receipts of the business is between Rs. 1 crore and Rs. 10 crore?

- (b) Are you liable for audit under section 44AB?

- If Yes is selected at (b), mention by virtue of which of the following conditions:

- (bi) Sales, turnover, or gross receipts exceed the limits specified under section 44AB

- (bii) Assessee falling u/s 44AD/44ADA/44AE/44BB but not offering income on presumptive basis (Tick applicable section) 44AD, 44ADA, 44AE, 44BB

- (biii) Others (Tick)

- If Yes is selected at (b), mention by virtue of which of the following conditions:

- (c) If (b) is Yes, whether the accounts have been audited by an accountant? (Tick) Yes No If Yes, furnish the following information below:

- (1) Date of furnishing of the audit report (DD/MM/YYYY)

- (2) Name of the auditor signing the tax audit report

- (3) Membership No. of the auditor

- (4) Name of the auditor (proprietorship/ firm)

- (5) Proprietorship/firm registration number

- (6) Permanent Account Number (PAN) of the proprietorship/ firm

- (7) Date of the report of the audit

- (8) Acknowledgement number of the audit report

- (9) UDIN

- (di) Are you liable for Audit u/s 92E? Yes, No

- (dii) If (di) is Yes, whether the accounts have been audited u/s 92E?

- (diii) If liable to furnish other audit reports, mention whether you have furnished such report. If yes, please provide the details as under:

- Section Code

- Date

- Acknowledgement number

- (e) If liable to audit under any Act other than the Income-tax act, mention the Act, section and date of furnishing the audit report?

- Act and section

- (DD/MM/YY)

- Act and section

- (DD/MM/YY)

Nature of Business: Nature of business or profession, if more than one business or profession, indicate the three main activities/ products (other than those declaring income under sections 44ad, 44ada and 44ae)

- Code

- Trade name of the proprietorship, if any

- Description

Part A-BS: Balance sheet as on the 31st day of March 2025 of the proprietory business or profession

A. Sources of Funds

- Proprietor’s fund

- Proprietor’s capital

- Reserves and Surplus

- Revaluation Reserve

- Capital Reserve

- Statutory Reserve

- Any other Reserve

- Total (bi + bii + biii + biv)

- Total proprietor’s fund (a + bv)

- Loan funds

- Secured loans

- Foreign Currency Loans

- Rupee Loans

- From Banks

- From others

- Total ( iiA + iiB)

- Total (ai + iiC)

- Unsecured loans (including deposits)

- From Banks

- From Others

- Total (bi + bii)

- Total Loan Funds (aiii + biii)

- Secured loans

- Deferred tax liability

- Advances

- From persons specified in section 40A(2)(b) of the I. T. Act

- From others

- Total Advances (i + ii)

- Sources of funds (1c + 2c +3)

B. Application of Funds

- 1 Fixed assets

- 2 Investments

- 3 Current assets, loans and advances

- 4

- a Miscellaneous expenditure not written off or adjusted

- b Deferred tax asset

- c Profit and loss account/ Accumulated balance

- d Total (4a + 4b + 4c)

- Total, application of funds (1e + 2c + 3e +4d)

C. No Account Case: In a case where regular books of account of business or profession are not maintained –

- Amount of total sundry debtors

- Amount of total sundry creditors

- Amount of total stock-in-trade

- Amount of the cash balance

Part A Manufacturing Account: Manufacturing Account for the financial year 2024-25:

- 1. Debits to manufacturing account

- 2. Closing Stock

- 3. Cost of Goods Produced – transferred to Trading Account (1F – 2)

Part A Trading Account: Trading Account for the financial year 2024-25:

Credits to Trading Account:

- 4 Revenue from operations

- 5 Closing Stock of Finished Goods

- 6 Total of credits to Trading Account (4D + 5 )

Debits to Trading Account:

- 7 Opening Stock of Finished Goods

- 8 Purchases (net of refunds and duty or tax, if any)

- 9 Direct Expenses (9i + 9ii + 9iii)

- 10 Duties and taxes, paid or payable, in respect of goods and services purchased.

- Custom duty

- Counter veiling duty

- Special additional duty

- Union excise duty

- Service tax

- VAT/ Sales tax

- Central Goods & Service Tax (CGST)

- State Goods & Services Tax (SGST)

- Integrated Goods & Services Tax (IGST)

- Union Territory Goods & Services Tax (UTGST)

- Any other tax, paid or payable

- Total (10i + 10ii + 10iii + 10iv + 10v + 10vi + 10vii + 10viii + 10ix + 10x + 10xi)

- 11 Cost of goods produced – Transferred from Manufacturing Account

- 12 Gross Profit from Business/Profession – transferred to Profit and Loss account (6-7-8-9-10xii-11)

- 12a Turnover from Intraday Trading

- 12b Income from Intraday Trading – transferred to Profit and Loss account

Part A-P& L: Profit and Loss Account for the financial year 2024-25

Credits to Profit and Loss Account:

- 13 Gross profit transferred from Trading Account

- 14 Other income

- 15 Total of credits to profit and loss account (13+14xii)

Debits to Profit and Loss Account:

- 16 Freight outward

- 17 Consumption of stores and spare parts

- 18 Power and fuel

- 19 Rents

- 20 Repairs to building

- 21 Repairs to machinery

- 22 Compensation to employees

- 23 Insurance

- 24 Workmen and staff welfare expenses

- 25 Entertainment

- 26 Hospitality

- 27 Conference

- 28 Sales promotion including publicity (other than advertisement)

- 29 Advertisement

- 30 Commission

- 31 Royalty

- 32 Professional / Consultancy fees / Fee for technical services

- 33 Hotel, boarding and Lodging

- 34 Traveling expenses other than on foreign traveling

- 35 Foreign travelling expenses

- 36 Conveyance expenses

- 37 Telephone expenses

- 38 Guest House expenses

- 39 Club expenses

- 40 Festival celebration expenses

- 41 Scholarship

- 42 Gift

- 43 Donation

- 44 Rates and taxes, paid or payable to Government or any local body

- 45 Audit fee

- 46 Other expenses

- 47 Bad debts

- 48 Provision for bad and doubtful debts

- 49 Other provisions

- 50 Profit before interest, depreciation and taxes

- 51 Interest

- 52 Depreciation and amortisation

- 53 Net profit before taxes

Provisions Provision for Tax and Appropriations:

- 54 Provision for current tax

- 55 Provision for Deferred Tax and deferred liability

- 56 Profit after tax

- 57 Balance brought forward from previous year

- 58 Amount available for appropriation

- 59 Transferred to reserves and surplus

- 60 Balance carried to balance sheet in proprietor’s account

Presumptive Income Cases:

- 61 Computation of Presumptive Business Income Under Section 44ad

- 62 Computation of Presumptive Income From Professions Under Section 44ada

- 63 Computation of Presumptive Income From Goods Carriages Under Section 44ae

No Account Case

- 64 IF REGULAR BOOKS OF ACCOUNT OF BUSINESS OR PROFESSION ARE NOT MAINTAINED, furnish the following information for previous year 2024-25 in respect of business or profession

- 65 i Turnover from speculative activity

- ii Gross Profit

- iii Expenditure, if any

- iv Net income from speculative activity (65ii-65iii)

Part A- OI Other Information

- 1 Method of accounting employed in the previous year

- 2 Is there any change in method of accounting

- 3a Increase in the profit or decrease in loss because of deviation, if any, as per Income Computation Disclosure Standards notified under section 145(2) [column 11a(iii) of Schedule ICDS]

- 3b Decrease in the profit or increase in loss because of deviation, if any, as per Income Computation Disclosure Standards notified under section 145(2) [column 11b(iii) of Schedule ICDS]

- 4 Method of valuation of closing stock employed in the previous year

- (A) Raw Material (if at cost or market rates, whichever is less, write 1, if at cost write 2, if at market rate write 3)

- (B) Finished goods (if at cost or market rates, whichever is less, write 1, if at cost write 2, if at market rate write 3)

- (C) Is there any change in stock valuation method (Tick) (Yes/No)

- (D) Increase in the profit or decrease in loss because of deviation, if any, from the method of valuation specified under section 145A 4d

- (E) Decrease in the profit or increase in loss because of deviation, if any, from the method of valuation specified under section 145A

- 5 Amounts not credited to the profit and loss account, being

- 6 Amounts debited to the profit and loss account, to the extent disallowable under section 36 due to non-fulfilment of conditions specified in relevant clauses

- 7 Amounts debited to the profit and loss account, to the extent disallowable under section 37

- 8 Part A: Amounts debited to the profit and loss account, to the extent disallowable under section 40

- (a) Amount disallowable under section 40 (a)(i), on account of non-compliance with the provisions of Chapter XVII-B

- (b) Amount disallowable under section 40(a)(ia) on account of non-compliance with the provisions of Chapter XVII-B

- c Amount disallowable under section 40(a)(ib), on account of non-compliance with the provisions of Chapter VIII of the Finance Act, 2016

- d Amount disallowable under section 40(a)(iii) on account of non-compliance with the provisions of Chapter XVII-B

- e Amount of tax or rate levied or assessed on the basis of profits [40(a)(ii)] Ae

- f Amount paid as wealth tax [40(a)(iia)] Af

- g Amount paid by way of royalty, license fee, service fee etc. as per section 40(a)(iib) Ag

- h Amount of interest, salary, bonus, commission or remuneration paid to any partner or member [40(b)] Ah

- i Any other disallowance Ai

- j Total amount disallowable under section 40(total of Aa to Ai) 8Aj

- 8 Part B: Any amount disallowed under section 40 in any preceding previous year but allowable during the previous year

- 9 Amounts debited to the profit and loss account, to the extent disallowable under section 40A

- 10 Any amount disallowed under section 43B in any preceding previous year but allowable during the previous year

- 11 Any amount debited to profit and loss account of the previous year but disallowable under section 43B

- 12 Amount of credit outstanding in the accounts in respect of

- 13 Amounts deemed to be profits and gains under section 33AB or 33ABA

- 14 Any amount of profit chargeable to tax under section 41

- 15 Amount of income or expenditure of prior period credited or debited to the profit and loss account

- 16 Amount of expenditure disallowed u/s 14A

- 17 Whether assessee is exercising option under subsection 2A of section 92CE

Part A – QD Quantitative Details:

- A. In the case of a trading concern

- 1 Opening stock

- 2 Purchase during the previous year

- 3 Sales during the previous year

- 4 Closing stock

- 5 Shortage/ excess, if any

- B. In the case of a manufacturing concern:

- 6 Raw materials:

- a Opening stock

- b Purchases during the previous year

- c Consumption during the previous year

- d Sales during the previous year

- e Closing stock

- f Yield finished products

- g Percentage of yield

- h Shortage/ excess, if any

- 7 Finished products/ By-products

- a opening stock

- b purchase during the previous year

- c quantity manufactured during the previous year

- d sales during the previous year

- e closing stock

- f shortage/ excess, if any

Schedules to the Return Form (Fill as Applicable)

Schedule S: Details of Income from Salary

- Name of Employer

- Nature of employment

- TAN of Employer

- Address of employer

- Town/City

- State

- Pin code/Zip code

Salaries

- 1 Gross Salary (1a + 1b + 1c+1d+1e+1f)

- a Salary as per section 17(1) (drop down to be provided)

- b Value of perquisites as per section 17(2) (drop down to be provided)

- c Profit in lieu of salary as per section 17(3) (drop down to be provided)

- d Income from retirement benefit account maintained in a notified country u/s 89A

- e Income from retirement benefit account maintained in a country ‘other than notified country’ u/s 89A

- f Income taxable during the previous year on which relief u/s 89A was claimed in any earlier previous year

- 2 Total Gross Salary (from all employers)

- 2a Income claimed for relief from taxation u/s 89A

- 3 Less allowances to the extent exempt u/s 10

- 4 Net Salary (2 – 3)

- 5 Deduction u/s 16 (5a + 5b + 5c)

- a Standard deduction u/s 16(ia)

- b Entertainment allowance u/s 16(ii)

- c Professional tax u/s 16(iii)

- 6 Income chargeable under the Head ‘Salaries’ (4 – 5)

Schedule HP: Details of Income from House Property

- 1 Address of the property:

- a Gross rent received or receivable or letable value

- b The amount of rent which cannot be realized

- c Tax paid to local authorities

- d Total (1b + 1c)

- e Annual value (1a – 1d) (nil, if self -occupied etc. as per section 23(2)of the Act)

- f Annual value of the property owned (own percentage share x 1e)

- g 30% of 1f

- h Interest payable on borrowed capital

- i Total (1g+ 1h)

- j Arrears/Unrealised rent received during the year less 30%

- k Income from house property 1 (1f – 1i + 1j)

- 2 Pass through income/Loss if any

- 3 Income under the head “Income from house property” (1k + 2)

Note:

- Please include the income of the specified persons referred to in Schedule SPI and Pass-through income referred to in schedule PTI while computing the income under this head

- Furnishing of PAN/Aadhaar No. of tenant is mandatory, if tax is deducted under section 194-IB.

- Furnishing of TAN of the tenant is mandatory if tax is deducted under section 194-I

Schedule BP: Computation of income from business or profession

(A) From business or profession other than speculative business and specified business:

- 1 Profit before tax as per profit and loss account (item 53, 61(ii), 62(ii), 63(ii), 64(iii) and 65(iv) of P&L )

- 2a Net profit or loss from speculative business included in 1 (enter –ve sign in case of loss) [Sl.no 65iv of Schedule P&L]

- 2b Net profit or Loss from Specified Business u/s 35AD included in 1 (enter –ve sign in case of loss)

- 3 Income/ receipts credited to profit and loss account considered under other heads of income or chargeable u/s 115BBF or chargeable u/s 115BBG or chargeable u/s 115BBH

- a Salaries

- b House property

- c Capital gains

- d Other sources

- d(i) Dividend income

- d(ii) Other than Dividend income

- e u/s 115BBF

- f u/s 115BBG

- u/s 115BBH (net of Cost of Acquisition)

- 4a Profit or loss included in 1, which is referred to in section 44AD/44ADA/44AE/44B/44BB/44BBA/44BBC/44DA (drop down to be provided)

- 4b Profit from activities covered under rule 7, 7A, 7B(1), 7B(1A), and 8 (Dropdown to be provided and capture as individual line item)

- 5 Income credited to Profit and Loss account (included in 1) which is exempt

- Share of income

- Share of income

- Any other exempt income (specify)

- 6 Balance (1– 2a – 2b – 3a – 3b – 3c – 3d – 3e – 3f – 4a-4b– 5d)

- 7 Expenses debited to profit and loss account considered under other heads of income/related to income chargeable u/s 115BBF or u/s 115BBG or u/s 115BBH

- Salaries

- House property

- Capital gains

- Other sources

- u/s 115BBF

- u/s 115BBG

- u/s 115BBH (other than Cost of Acquisition u/s 115BBH)

- 8a Expenses debited to profit and loss account which relate to exempt income

- 8b Expenses debited to profit and loss account which relate to exempt income and disallowed u/s 14A (16 of Part A -OI)

- 9 Total (7a + 7b + 7c + 7d + 7e + 7f + 8a+8b)

- 10 Adjusted profit or loss (6+9)

- 11 Depreciation and amortisation debited to profit and loss account

- 12 Depreciation allowable under the Income-tax Act:

- i. Depreciation allowable under section 32(1)(ii) and 32(1)(iia) (item 6 of Schedule-DEP)

- ii. Depreciation allowable under section 32(1)(i) (Make your own computation refer Appendix-IA of IT Rules)

- iii. Total (12i + 12ii)

- 13 Profit or loss after adjustment for depreciation (10 +11 – 12iii)

- 14 Amounts debited to the profit and loss account, to the extent disallowable under section 36 (6r of PartA-OI)

- 15 Amounts debited to the profit and loss account, to the extent

- disallowable under section 37 (7j of PartA-OI)

- 16 Amounts debited to the profit and loss account, to the extent disallowable under section 40 (8Aj of PartA-OI)

- 17 Amounts debited to the profit and loss account, to the extent disallowable under section 40A (9f of PartA-OI)

- 18 Any amount debited to profit and loss account of the previous year but disallowable under section 43B (11h of PartA-OI)

- 19 Interest disallowable under section 23 of the Micro, Small and Medium Enterprises Development Act,2006

- 20 Deemed income under section 41

- 21 Deemed income under section 32AD/ 33AB/ 33ABA/ 35ABA/35ABB/ 40A(3A)/ 72A/80HHD/ 80-IA

- 22 Deemed income under section 43CA

- 23 Any other item of addition under section 28 to 44DA

- 24 Any other income not included in profit and loss account/any other expense not allowable (including income from salary, commission, bonus and interest from firms in which individual/HUF/prop. concern is a partner)

- 25 Increase in profit or decrease in loss on account of ICDS adjustments and deviation in method of valuation of stock (Column 3a + 4d of Part A – OI)

- 26 Total (14 + 15 + 16 + 17 + 18 + 19 + 20 + 21+22 +23+24+25)

- 27 Deduction allowable under section 32(1)(iii)

- 28 Amount of deduction under section 35 or 35CCC or 35CCD in excess of the amount debited to profit and loss account (item x(4) of Schedule ESR) (if amount deductible under section 35 or 35CCC or 35CCD is lower than amount debited to P&L account, it will go to item 24)

- 29 Any amount disallowed under section 40 in any preceding previous year but allowable during the previous year(8B of PartA-OI)

- 30 Any amount disallowed under section 43B in any preceding previous year but allowable during the previous year(10g of PartA-OI)

- 31 Any other amount allowable as deduction

- 32 Decrease in profit or increase in loss on account of ICDS adjustments and deviation in method of valuation of stock (Column 3b + 4e of Part A- OI)

- 33 Total (27+28+29+30+31+32+33)

- 34 Income (13+26-34)

- 35 Profits and gains of business or profession deemed to be under:

- i. Section 44AD (61(ii) of schedule P&L)

- ii. Section 44ADA (62(ii) of schedule P&L)

- iii. Section 44AE (63(ii) of schedule P&L)

- iv. Section 44B

- v. Section 44BB

- vi. Section 44BBA

- vii. Section 44DA 36vii (item 4 of Form 3CE)

- viii. Total (36i to 36vii)

- 36 Net profit or loss from business or profession other than speculative and specified business (35 + 36viii)

- 37 Net Profit or loss from business or profession other than speculative business and specified business after applying rule 7A, 7B or 8, if applicable

- a Income chargeable under Rule 7

- b Deemed income chargeable under Rule 7A

- c Deemed income chargeable under Rule 7B(1)

- d Deemed income chargeable under Rule 7B(1A)

- e Deemed income chargeable under Rule 8

- f Income other than Rule 7A, 7B & 8 (Item No. 37)

- 38 Balance of income deemed to be from agriculture, after applying Rule 7, 7A, 7B(1), 7B(1A) and Rule 8 for the purpose of aggregation of income as per Finance Act [4b-(38a+38b+38c+38d+38e)]

B Computation of income from speculative business:

- 39 Net profit or loss from speculative business as per profit or loss account (Item No. 2a)

- 40 Additions in accordance with section 28 to 44DA

- 41 Deductions in accordance with section 28 to 44DA

- 42 Income from speculative business (40+ 41 – 42)

C Computation of income from the specified business under section 35AD1

- 43 Net profit or loss from specified business as per profit or loss account

- 44 Additions in accordance with section 28 to 44DA

- 45 Deductions in accordance with section 28 to 44DA

- 46 Profit or loss from specified business (44 + 45 -46)

- 47 Deductions in accordance with section 35AD(1)

- 48 Income from Specified Business (47-48)

- 49 The relevant clause of sub-section (5) of section 35AD which covers the specified business (to be selected from

drop down menu)

D. Income chargeable under the head ‘Profits and gains from business or profession’ (A38 + B43 + C49)

E. Intra headset off of the business loss of the current year

- Type of Business income

- The income of the current year (Fill this column only if the figure is zero or positive)

- The business loss set off

- Business income remaining after set off

Schedule DPM: Depreciation on Plant and Machinery (Other than assets on which full capital expenditure is allowable as a deduction under any other section):

- 1 Block of assets

- 2 Rate (%)

- 15

- 30

- 40

- 45

- 3a Written down the value on the first day of the previous year

- 3b Adjustment as per second proviso to sub-section (3) of section 115BAC (Refer to rule 5)

- 3 Total (3A + 3B)

- 4 Additions for a period of 180 days or more in the previous year

- 5 Consideration or other realization during the previous year out of 3 or 4

- 6 Amount on which depreciation at full rate to be allowed (3 + 4 -5) (enter 0, if the result is negative)

- 7 Additions for a period of less than 180 days in the previous year

- 8 Consideration or other realizations during the year out of 7

- 9 Amount on which depreciation at the half rate to be allowed (7-8) (enter 0, if the result is negative)

- 10 Depreciation on 6 at full rate

- 11 Depreciation on 9 at half rate

- 12 Additional depreciation, if any, on 4

- 13 Additional depreciation, if any, on 7

- 14 Additional depreciation relating to immediately preceding year’ on asset put to use for less than 180 days

- 15 Total depreciation (10+11+12+13+14)

- 16 Depreciation disallowed under section 38(2) of the I.T. Act (out of column 15)

- 17 Net aggregate depreciation (15-16)

- 18 Proportionate aggregate depreciation allowable in the event of succession, amalgamation, demerger, etc. (out of column 17)

- 19 Expenditure incurred in connection with the transfer of asset/ assets

- 20 Capital gains/ loss under section 50 (5 + 8 -3 – 4 -7 -19) (enter negative only if block ceases to exist)

- 21 Written down the value on the last day of the previous year (6+ 9 -15) (enter 0 if the result is negative)

Schedule DOA: Depreciation on other assets (Other than assets on which full capital expenditure is allowable as a deduction)

- 1 Block of assets

- Land Building (not including land)

- Furniture and fittings

- Intangible

- assets

- Ships

- 2 Rate

- Nil

- 5%

- 10%

- 40%

- 10%

- 25%

- 20%

- 3 Written down the value on the first day of the previous year

- 4 Additions for a period of 180 days or more in the previous year

- 5 Consideration or other realization during the previous year out of 3 or 4

- 6 Amount on which depreciation at full rate to be allowed (3 + 4 -5) (enter 0, if the result is negative)

- 7 Additions for a period of less than 180 days in the previous year

- 8 Consideration or other realizations during the year out of 7

- 9 Amount on which depreciation at the half rate to be allowed (7-8) (enter 0, if the result is negative)

- 10 Depreciation on 6 at full rate

- 11 Depreciation on 9 at half rate

- 12 Total depreciation (10+11)

- 13 Depreciation disallowed under section 38(2) of the I.T. Act (out of column 12)

- 14 Net aggregate depreciation (12-13)

- 15 Proportionate aggregate depreciation allowable in the event of succession, amalgamation, demerger etc. (out of column 14)

- 16 Expenditure incurred in connection with the transfer of asset/ assets

- 17 Capital gains/ loss under section 50 (5 + 8 -3-4 -7 -16) (enter negative only if block ceases to exist)

- 18 Written down the value on the last day of the previous year (6+ 9 -12)

Schedule DEP: Summary of depreciation on assets (Other than assets on which full capital expenditure is allowable as a deduction under any other section)

- 1 Plant and machinery

- a Block entitled for depreciation @ 15 percent ( Schedule DPM -17i or 18i as applicable)

- b Block entitled for depreciation @ 30 percent ( Schedule DPM – 17ii or 18ii as applicable)

- c Block entitled for depreciation @ 40 percent ( Schedule DPM – 17iii or 18iii as applicable)

- d Total depreciation on plant and machinery ( 1a + 1b + 1c)

- 2 Building (not including land)

- a Block entitled for depreciation @ 5 percent (Schedule DOA- 14ii or 15ii as applicable)

- b Block entitled for depreciation @ 10 percent (Schedule DOA- 14iii or 15iii as applicable)

- c Block entitled for depreciation @ 40 percent (Schedule DOA- 14iv or 15iv as applicable)

- d Total depreciation on building (total of 2a + 2b + 2c)

- 3 Furniture and fittings(Schedule DOA- 14v or 15v as applicable)

- 4 Intangible assets (Schedule DOA- 14vi or 15vi as applicable)

- 5 Ships (Schedule DOA- 14vii or 15vii as applicable)

- 6 Total depreciation (1d+2d+3+4+5)

Schedule DCG: Deemed Capital Gains on sale of depreciable assets

- 1 Plant and machinery

- a Block entitled for depreciation @ 15 percent (Schedule DPM – 20i)

- b Block entitled for depreciation @ 30 percent (Schedule DPM – 20ii)

- c Block entitled for depreciation @ 40 percent (Schedule DPM – 20iii)

- d Block entitled for depreciation @ 45 per cent (Schedule DPM – 20iv)

- d Total ( 1a +1b + 1c+1d)

- 2 Building (not including land)

- a Block entitled for depreciation @ 5 percent (Schedule DOA- 17ii)

- b Block entitled for depreciation @ 10 percent (Schedule DOA- 17iii)

- c Block entitled for depreciation @ 40 percent (Schedule DOA- 17iv)

- d Total ( 2a + 2b + 2c) 2d

- 3 Furniture and fittings ( Schedule DOA- 17v)

- 4 Intangible assets (Schedule DOA- 17vi)

- 5 Ships (Schedule DOA- 17vii)

- 6 Total ( 1d+2d+3+4+5)

Schedule ESR: Expenditure on scientific Research etc. (Deduction under section 35 or 35CCC or 35CCD)

- Expenditure of nature referred to in section

- The amount, if any, debited to profit and loss account

- Amount of deduction allowable

- Amount of deduction in excess of the amount debited to profit and loss account (4) = (3) – (2)

Schedule CG: Capital Gains

A. Short-term Capital Gains (STCG): (Sub-items 4 and 5 are not applicable for residents) Short-term Capital Gains

- 1 From the sale of land or building or both (fill up details separately for each property)

- a

- i Full value of the consideration received/receivable

- ii Value of the property as per stamp valuation authority

- iii Full value of consideration adopted as per section 50C for the purpose of Capital Gains () [in case (aii) does not exceed 1.05 times (ai), take this figure as (ai), or else take (aii)]

- b Deductions under section 48

- i Cost of acquisition without indexation

- ii Cost of Improvement without indexation

- iii Expenditure wholly and exclusively in connection with the transfer

- iv Total (bi + bii + biii)

- c Balance (aiii – biv)

- d Deduction under section 54B/54D/ 54G/54GA (Specify details in item D below)

- e Short-term Capital Gains on Immovable property (1c – 1d)

- f In case of transfer of immovable property, please furnish the following details (see note)

- Name of the buyer(s)

- PAN/Aadhaar No. of buyer(s)

- Percentage share

- Amount

- Address of Property

- Pin code

- State

- a

- 2 From a slump sale

- a i Fair market value as per Rule 11UAE(2)

- a ii Fair market value as per Rule 11UAE(3)

- a iii Full value of consideration (higher of ai or aii)

- b. Net worth of the undertaking or division

- c. Short-term capital gains from slump sale (2aiii-2b)

- 3 From the sale of equity shares or units of equity-oriented Mutual Fund (MF) or unit of a business trust on which STT is paid under section 111A or 115AD(1)(ii) proviso (for FII). (Where A4 is not applicable)* Data should be enter considering specific date of 23rd July, 2024.

- a Full value of consideration

- b Deductions under section 48

- i Cost of acquisition without indexation

- ii Cost of Improvement without indexation

- iii Expenditure wholly and exclusively in connection with the transfer

- iv Total (i + ii + iii)

- c Balance (3a – biv)

- d Loss to be disallowed u/s 94(7) or 94(8)- for example, if asset bought/acquired within 3 months prior to record date and dividend/income/bonus units are received, then loss arising out of the sale of such asset to be ignored (Enter positive value only)

- e Short-term capital gain on equity share or equity-oriented MF (STT paid) (3c +3d)

- 4 For NON-RESIDENT, not being an FII- from the sale of shares or debentures of an Indian company (to be computed with foreign exchange adjustment under the first proviso to section 48)

- a STCG on transactions covered u/s 111A (A4ai + A4aii) A4a

- (i) Where the transfer was before 23rd July 2024 A4ai

- (ii) Where the transfer was on or after 23rd July 2024

- b STCG from sale of shares not covered in sl.no. 4a or sale of debenture

- a STCG on transactions covered u/s 111A (A4ai + A4aii) A4a

- 5 For NON-RESIDENTS- from the sale of securities (other than those at A3 above) by an FII as per section 115AD

- a. i In case securities sold include shares of a company other than quoted shares, enter the following details:

- a. Full value of the consideration received/receivable in respect of unquoted shares

- b. Fair market value of unquoted shares determined in the prescribed manner

- c. Full value of consideration in respect of unquoted shares adopted as per section 50CA for the purpose of Capital Gains (higher of a or b)

- ii Full value of consideration in respect of securities other than unquoted shares

- iii Total (ic + ii)

- ii Full value of consideration in respect of assets other than unquoted shares

- iii Total (ic + ii)

- b Deductions under section 48

- c Balance (6aiii – biv)

- d Loss to be disallowed u/s 94(7) or 94(8)- for example if security bought/acquired within 3 months prior to record date and dividend/income/bonus units are received, then loss arising out of sale of such security to be ignored (Enter positive value only)

- e Short-term capital gain on sale of securities (other than those at A3 above) by an FII (5c +5d)

- 6 From sale of assets other than at A1 or A2 or A3 or A4 or A5 above

- 7 Amount deemed to be short-term capital gains

- a Whether any amount of unutilized capital gain on the asset transferred during the previous years shown below was deposited in the Capital Gains Accounts Scheme within the due date for that year?

- b Amount deemed to be short term capital gains u/s 54B/54D/54G/54GA, other than at ‘a’

Total amount deemed to be short-term capital gains (Xi + Xii + b)

- 8 Pass-Through Income in the nature of Short Term Capital Gain, (Fill up schedule PTI) (A8a + A8b + A8c)

- a Pass-Through Income in the nature of Short Term Capital Gain, chargeable @ 15%

- b Pass-Through Income in the nature of Short Term Capital Gain, chargeable @ 30%

- c Pass-Through Income in the nature of Short Term Capital Gain, chargeable at applicable rates

- 9 Amount of STCG included in A1-A8 but not chargeable to tax or chargeable at special rates as per DTAA

- 10 Total Short-term Capital Gain (A1e+ A2c+ A3e+ A4a+ A4b+ A5e+ A6g+A7+A8 – A9a)

B Long-term capital gain (LTCG)

- 1 From the sale of land or building or both (fill up details separately for each property)

- a

- i Full value of the consideration received/receivable

- ii Value of the property as per stamp valuation authority

- iii Full value of consideration adopted as per section 50C for the purpose of Capital Gains [in case (aii) does not exceed 1.10 times (ai), take this figure as (ai), or else take

- b Deductions under section 48 (Data should be enter considering the specific date of 23rd July, 2024)

- i Cost of acquisition

- iia Cost of acquisition with indexation

- iib Total cost of improvement with indexation

- Cost of Improvement

- Year of improvement

- Cost of Improvement with indexation

- iii Expenditure wholly and exclusively in connection with the transfer

- iv Total (bi + bii + biii)

- c Balance (aiii – biv)

- d Deduction under section 54/54B/54D/54EC/54F/54G/54GA/54GB (Specify details in item D below)

- e Long-term Capital Gains on Immovable property (1c – 1d)

- f In case of transfer of immovable property, please furnish the following details (see note)

- Name of the buyer(s)

- PAN of the buyer(s)

- Percentage share

- Amount Address of property

- Pin code

Note: Furnishing of PAN/Aadhaar No. is mandatory if the tax is deducted under section 194-IA or is quoted by the buyer in the documents. In case of more than one buyer, please indicate the respective percentage share and amount.

- 2 From a slump sale

- a. i Fair market value as per Rule 11UAE(2)a.ii Fair market value as per Rule 11UAE(3)a.iii Full value of consideration (higher of ai or aii)

- b. Net worth of the undertaking or division

- c. Balance (2a – 2b)

- d. Deduction u/s 54EC /54F (Specify details in item D below)

- e. Long-term capital gains from slump sale (2c-2d)

- 3 From the sale of bonds or debentures (other than capital indexed bonds issued by the Government)

- a. Full value of consideration

- b. Deductions under section 48

- i Cost of acquisition without indexation

- ii Cost of improvement without indexation

- iii Expenditure wholly and exclusively in connection with the transfer

- iv Total (bi + bii +biii)

- c. Balance (3a – biv)

- d. Deduction under sections /54F (Specify details in item D below)

- e. LTCG on bonds or debenture (3c – 3d)

- 4 From sale of, (i) listed securities (other than a unit) or zero coupon bonds where proviso under section 112(1) is applicable (ii) GDR of an Indian company referred in sec. 115ACA

- a. Full value of consideration

- b. Deductions under section 48

- i Cost of acquisition without indexation

- ii Cost of improvement without indexation

- iii Expenditure wholly and exclusively in connection with the transfer

- iv Total (bi + bii +biii)

- c. Balance (4a – biv)

- d. Deduction under section/54F

- e. LTCG on bonds or debenture (4c – 4d)

- 5 From the sale of equity shares in a company or unit of equity equity-oriented fund or a unit of a business trust on which STT is paid under section 112A

- a. LTCG u/s 112A (column 14 of Schedule 112A

- b. Deduction under sections 54F (Specify details in item D below)

- c. Long-term Capital Gains on sale of capital assets at B5 above (5a – 5b)

- 6 For NON-RESIDENTS- from sale of shares or debentures ofan Indian company (to be computed with foreign exchange adjustment under the first proviso to section 48)

- a LTCG computed without indexation benefit 6a

- b Deduction under sections /54F (Specify details in item D below) 6b

- c LTCG on share or debenture (6a-6b)

- 7 For NON-RESIDENTS- from sale of, (i) unlisted securities as per sec. 112(1)(c), (ii) bonds or GDR as referred in sec. 115AC, (iii) securities by FII as referred to in sec. 115AD (other than securities referred to in section 112A for which column B8 is to be filled up)

- a

- i In case securities sold include shares of a company other than quoted shares, enter the following details

- a. Full value of consideration received/receivable in respect of unquoted shares

- b. Fair market value of unquoted shares determined in the prescribed manner

- c. Full value of consideration in respect of unquoted shares adopted as per section 50CA for the purpose of Capital Gains (higher of a or b)

- i In case securities sold include shares of a company other than quoted shares, enter the following details

- ii Full value of consideration in respect of securities other than unquoted shares

- iii Total (ic + ii)

- b Deductions under section 48

- c Balance (aiii – biv)

- d Deduction under sections /54F

- e Long-term Capital Gains on assets at 7 above in case of NON-RESIDENT (7c – 7d)

- 8 For NON-RESIDENTS – From sale of equity share in a company or unit of equity oriented fund or unit of a business trust on which STT is paid under section 112A

- a. LTCG u/s 112A [Column 14 of 115AD(1)(b)(iii) proviso]

- b. Deduction under sections 54F (Specify details in item D below)

- c. Long-term Capital Gains on sale of capital assets at B8 above (8a – 8b)

- 9 From sale of foreign exchange asset by NON-RESIDENT INDIAN (If opted under chapter XII-A)

- a LTCG on sale of specified asset (computed without indexation)

- b Less deduction under section 115F (Specify details in item D below)

- c Balance LTCG on sale of specified asset (9a- 9b)

- d LTCG on sale of asset, other than specified asset (computed without indexation)

- e Less deduction under section 115F (Specify details in item D below)

- f Balance LTCG on sale of asset, other than specified asset (9d- 9e)

- 10 From sale of assets where B1 to B9 above are not applicable

- a

- i. In case assets sold include shares of a company other than quoted shares, enter the following details:

- a. Full value of consideration received/receivable in respect of unquoted shares

- b. Fair market value of unquoted shares determined in the prescribed manner

- c Full value of consideration in respect of unquoted shares adopted as per section 50CA for the purpose of Capital Gains (higher of a or b)

- ii Full value of consideration in respect of assets other than unquoted shares

- iii Total (ic + ii)

- i. In case assets sold include shares of a company other than quoted shares, enter the following details:

- b Deductions under section 48

- i Cost of acquisition with indexation

- ii Cost of Improvement with indexation

- iii Expenditure wholly and exclusively in connection with transfer

- iv Total (bi + bii + biii)

- c Balance (10aiii – biv)

- d Deduction under section 54D//54F/54G/54GA

- e Long-term Capital Gains on assets at B10 above (10c- 10d)

- 11 Amount deemed to be long-term capital gains

- a Whether any amount of unutilized capital gain on asset transferred during the previous year shown below was deposited in the Capital Gains Accounts Scheme within due date for that year?

- b Amount deemed to be long-term capital gains, other than at ‘a’

Total amount deemed to be long-term capital gains (Xi + Xii + b)

- 12 Pass-Through Income in the nature of Long Term Capital Gain, (Fill up schedule PTI) (B12a + B12b) B12

- a1 Pass-Pass Through Income/Loss in the nature of Long-Term Capital Gain, chargeable @ 10%

- a2 Pass Through Income/Loss in the nature of Long-Term Capital Gain, chargeable @ 10% – under sections other than u/s. 112A

- b Pass Through Income/Loss in the nature of Long-Term Capital Gain, chargeable @ 20%

- 13 Amount of LTCG included in items B1 to B12 but not chargeable to tax or chargeable at special rates in India as per DTAA

- a Total amount of LTCG not chargeable to tax as per DTAA B13a

- b Total amount of LTCG chargeable to tax at special rates as per DTAA B13b

- 14 Total long term capital gain chargeable under I.T. Act (B1e + B2e + B3e + B4ie + B4iie + B5f + B6c + B7e + B8f + B9c + B10e + B11 + B12 – B13a+B(A))

- C1 Sum of Capital Gain Incomes (9ii + 9iii + 9iv + 9v + 9vi + 9vii + 9viii of table E below)

- C2 Income from transfer of virtual digital assets (Item No. B of Schedule VDA)

- C3 Income chargeable under the head “CAPITAL GAINS” (C1 + C2)

- D Information about deduction claimed against Capital Gains

- E Set-off of current year capital losses with current year capital gains

- F Information about accrual/receipt of capital gain

Schedule 112A: From sale of equity share in a company or unit of equity oriented fund or unit of a business trust on which STT is paid under section 112A

- Si No

- Share/UnitAcquired

- ISIN Code

- Name of the Share/Unit

- No. of Shares/Units

- Sale-price per Share/Unit

- Full value of consideration -If shares are acquired on or before 31.01.2018 (Total Sale Value) (4*5) – If shares are acquired after 31st January 2018 – Please enter Full Value of Consideration

- Cost of acquisition without indexation (higher of 8 or 9)

- Cost of acquisition

- If the long term capital asset was acquired before 01.02.2018, -Lower of 6 & 11

- Fair Market Value per share/unit as on 31st January, 2018

- Total Fair Market Value of capital asset as per section 55(2)(ac)-(4*10)

- Expenditure wholly and exclusively in connection with transfer

- Total deductions (7+12)

- Balance (6-13) -Item 5 (a) of LTCG Schedule of ITR3

Schedule 115AD(1)(b)(iii) proviso: For NON-RESIDENTS – From sale of equity share in a company or unit of equity oriented fund or unit of a business trust on which STT is paid under section 112A

- Si No

- Share/UnitAcquired

- ISIN Code

- Name of the Share/Unit

- No. of Shares/Units

- Sale-price per Share/Unit

- Full value of consideration -If shares are acquired on or before 31.01.2018 (Total Sale Value) (4*5) – If shares are Acquired after 31st January, 2018 – Please enter Full Value of Consideration

- Cost of acquisition without indexation (higher of 8 or 9)

- Cost of acquisition

- If the long term capital asset was acquired before 01.02.2018, -Lower of 6 & 11

- Fair Market Value per share/unit as on 31st January, 2018

- Total Fair Market Value of capital asset as per section 55(2)(ac)-(4*10)

- Expenditure wholly and exclusively in connection with transfer

- Total deductions (7+12)

- Balance (6-13) -Item 5 (a) of LTCG Schedule of ITR3

Schedule VDA: Income from transfer of virtual digital assets

- Sl. No.

- Date of Acquisition

- Date of Transfer

- Head under which income to be taxed (Business/Capital Gain)

- Cost of Acquisition (In case of gift;

- a. Enter the amount on which tax is paid u/s 56(2)(x) if any

- b. In any other case cost to previous owner)

- Consideration Received

- Income from transfer of Virtual Digital Assets (enter nil in case of loss) (Col. 6 – Col. 5)

Schedule OS: Income from other sources

- 1 Gross income chargeable to tax at normal applicable rates (1a+ 1b+ 1c+ 1d + 1e)

- 2 Income chargeable at special rates (2a+ 2b+ 2c+ 2d + 2e 2f related to Sl. No. 1)

- 3 Deductions under section 57

- 4 Amounts not deductible u/s 58

- 5 Profits chargeable to tax u/s 59

- 5a Income claimed for relief from taxation u/s 89A

- 6 Net Income from other sources chargeable at normal applicable rates (1 (after reducing income related to DTAA portion) – 3 + 4 + 5-5a)

- 7 Income from other sources (other than from owning race horses) (2 +6 ) (enter 6 as nil, if negative)

- 8 Income from the activity of owning and maintaining race horses

- Receipts

- Deductions under section 57 in relation to receipts at 8a only

- Amounts not deductible u/s 58

- Profits chargeable to tax u/s 59

- Balance (8a – 8b + 8c + 8d)

- 9 Income under the head “Income from other sources” (7 + 8e) (take 8e as nil, if negative)

- 10 Information about accrual/receipt of income from Other Sources

- Other Source Income

- Upto 15/6

- From 16/6 to 15/12

- From 16/12 to 15/3

- From 16/3 to 31/3

Schedule CYLA: Details of Income after set-off of current year’s losses

- Head/ Source of Income

- Income of current year (Fill this column only if income is zero or positive)

- House property loss of the current year set off

- Business Loss (other than speculation loss or specified business loss) of the current year set off

- Other sources loss (other than loss from owning race horses) of the current year set of

- Current year’s Income remaining after set off

Schedule BFLA: Details of Income after Set off of Brought Forward Losses of earlier years

- Head/ Source of Income

- Income after set off, if any, of current year’s losses as per 5 of Schedule CYLA)

- Brought forward loss set off

- Brought forward depreciation set off

- Brought forward allowance under section 35(4) set off

- Current year’s income remaining after set offz

Schedule CFL: Details of Losses to be carried forward to future years

- Assessment Year

- Date of Filing (DD/MM/ YYYY)

- House property loss

- Loss from business other than loss from speculative business and specified business

- Loss from speculative business

- Loss from specified business

- Short-term capital loss

- Long-term Capital loss

- Loss from owning and maintaining race horses

Schedule UD: Unabsorbed depreciation and allowance under section 35(4)

- Assessment Year

- Depreciation

- Amount of brought forward unabsorbed depreciation

- Amount as adjusted on account of opting for taxation u/s 115BAC

- Amount of depreciation setoff against the current year income

- Balance carried forward to the next year

- Allowance under section 35(4)

- Amount of brought forward unabsorbed allowance

- Amount of allowance set-off against the current year income

- Balance Carried forward to the next year

Schedule ICDS: Effect of Income Computation Disclosure Standards on profit

- I Accounting Policies

- II Valuation of Inventories (other than the effect of change in method of valuation u/s 145A, if the same is separately reported at col. 4d or 4e of Part A-OI)

- III Construction Contracts

- IV Revenue Recognition

- V Tangible Fixed Assets

- VI Changes in Foreign Exchange Rates

- VII Government Grants

- VIII Securities (other than the effect of change in method of valuation u/s 145A, if the same is

separately reported at col. 4d or 4e of Part A-OI) - IX Borrowing Costs

- X Provisions, Contingent Liabilities and Contingent Assets

- XI Total effect of ICDS adjustments on profit (I+II+III+IV+V+VI+VII+VIII+IX+X)

Schedule 10AA: Deduction under section 10AA

- Sl

- Undertaking

- Undertaking Assessment year in which unit begins to manufacture/produce/provide services

- Sl

- Amount of deduction

Schedule 80G: Details of donations entitled for deduction under section 80G

- A Donations entitled for 100% deduction without qualifying limit

- B Donations entitled for 50% deduction without qualifying limit

- C Donations entitled for 100% deduction subject to qualifying limit

- D Donations entitled for 50% deduction subject to qualifying limit

Schedule 80GGA: (applicable in the case of a partner of firm deriving only profit from the firm)

- Relevant clause under which deduction is claimed

- Name and address of Donee

- PAN of Donee

- Amount of donation

- Eligible Amount of donation

Schedule 80GGC: Details of contributions made to political parties

- Amount of contribution

- Eligible amount of contribution

- Transaction Reference number for UPI transfer or Cheque number/IMPS/NEFT/RTGS

- IFS code of Bank

Schedule 80DD: Details of deduction in respect of maintenance including medical treatment of a dependent who is a person with disability

- Nature of disability

- Type of dependent

- PAN of the dependent

- Aadhaar of the dependent

- Date of filing of Form 10IA

- Ack. No. of Form 10IA

- UDID Number (If available)

Schedule 80U: Details of deduction in case of a person with disabilit

- Nature of disability

- Date of filing of Form 10IA

- Ack. No. of Form 10IA filed

- UDID Number (If available)

Schedule RA: Details of donations to research associations etc. [deduction under sections 35(1)(ii) or 35(1)(iia) or 35(1)(iii) or 35(2AA)]

- Name and address of donee

- PAN of Donee

- Amount of donation

- Donation in cash

- Donation in other mode

- Total Donation

- Eligible Amount of donation

Schedule 80-IA

- a Deduction in respect of profits of an undertaking referred to in section 80- IA(4)(iv)

- b Total deductions under section 80-IA (a1 + a2)

Schedule 80-IB: Deductions under section 80-IB

- a Deduction in the case of undertaking which begins commercial production or refining of mineral oil [Section 80-IB(9)

- b Deduction in the case of an undertaking developing and building housing projects [Section 80-IB(10)]

- c Deduction in the case of an undertaking engaged in processing, preservation and packaging of fruits, vegetables, meat, meat products, poultry, marine or dairy products [Section 80-IB(11A)]

- d Deduction in the case of an undertaking engaged in integrated business of handling, storage and transportation of food grains [Section 80-IB(11A)]

- e Total deduction under section 80-IB (Total of a1 to e2)

Schedule 80-IE: Deductions under section 80-IC or 80-IE

- Deduction in respect of undertaking located in North-East

- aa Assam

- ab Arunachal Pradesh

- ac Manipur

- ad Mizoram

- ae Meghalaya

- af Nagaland

- ag Tripura

- ah Total deduction for undertakings located in North-east (total of aa1 to ag2)

- Total deduction under section 80-IE (ah)

Schedule VI-A: Deductions under Chapter VI-A

- 1 Part B- Deduction in respect of certain payments

- 2 Part C- Deduction in respect of certain incomes

- 3 Part CA and D- Deduction in respect of other incomes/other deduction

- 4 Total deductions under Chapter VI-A (1 + 2 + 3)

Schedule AMT: Computation of Alternate Minimum Tax payable under section 115JC

- 1 Total Income as per item 14 of PART-B-TI 1

- 2 Adjustment as per section 115JC

- a Deduction claimed under any section included in Chapter VIA under the heading “C.—Deductions in respect of certain incomes”

- b Deduction claimed u/s 10AA

- c Deduction claimed u/s 35AD as reduced by the amount of depreciation on assets on which such deduction is claimed

- d Total Adjustment (2a+ 2b+ 2c)

- 3 Adjusted Total Income under section 115JC(1) (1+2d)

- 4 Tax payable under section 115JC [18.5% of (3)] (if 3 is greater than Rs. 20 lakhs)

Schedule AMTC: Computation of tax credit under section 115JD

- 1 Tax under section 115JC in the assessment year 2025-26 (1d of Part-B-TTI)

- 2 Tax under other provisions of the Act in the assessment year 2025-26 (2i of Part-B-TTI)

- 3 Amount of tax against which credit is available [enter (2 – 1) if 2 is greater than 1, otherwise enter 0]

- 4 The utilisation of AMT credit Available (Sum of AMT credit utilized during the current year is subject to a maximum of the amount mentioned in 3 above and cannot exceed the sum of AMT Credit Brought Forward)

- 5 Amount of tax credit under section 115JD utilised during the year [total of item no 4 (C)]

- 6 Amount of AMT liability available for credit in subsequent assessment years [total of 4 (D)]

Schedule SPI: Income of specified persons (spouse, minor child etc.) includable in the income of the assessee as per section 64

- Name of person

- PAN of the person (optional)

- Relationship

- Amount (Rs)

- Head of Income in which included

Schedule SI: Income chargeable to tax at special rates (please see instructions No. 7 for rate of tax)

- 1 111- Accumulated balance of recognised provident for prior years

- 2 111A or Section 115AD(1)(b)(ii)-Proviso (STCG on shares units on

- 3 115AD (STCG for FIIs on securities where STT not paid)

- 4 112 proviso (LTCG on listed securities/ units without indexation)

- 5 112(1)(c)(iii) (LTCG for non-resident on unlisted securities)

- 6 115AC (LTCG for non-resident on bonds/GDR)

- 7a 115AC (Income of non-resident from bonds or GDR purchased in foreign currency)

- 7b 115AC (Income by way of Dividend received by non-resident from GDR purchased in foreign currency

- 8 115ACA (LTCG for an employee of the specified company on GDR)

- 9 115AD (LTCG for FIIs on securities)

- 10 115E (LTCG for non-resident Indian on specified asset)

- 11 112 (LTCG on others)

- 12 112A (LTCG on sale of shares or units on which STT is paid)

- 13 STCG Chargeable at special rates in India as per DTAA

- 14 LTCG Chargeable at special rates in India as per DTAA

- 15 115BB (Winnings from lotteries, puzzles, races, games etc.)

- 16 115BBE (Income under section 68, 69, 69A, 69B, 69C or 69D)

- 17 115BBH (Income from transfer of virtual digital asset)

- Income under head business or profession

- Income under head Capital Gain

- 18 115BBF (Tax on income from patent)

- a. Income under head business or profession

- b. Income under head other sources

- 19 115BBG (Tax on income from transfer of carbon credits)

- a Income under head business or profession

- b Income under head other sources

- 20 115A(1)(b)(A) & 115A(1)(b)(B) (Income of a non-resident from Royalty)

- 21 Income from other sources chargeable at special rates in India as per DTAA

- 22 Pass-Through Income in the nature of Short Term Capital Gain chargeable @ 15%

- 23 Pass-Through Income in the nature of Short Term Capital Gain chargeable @ 30%

- 24 Pass-Through Income in the nature of Long Term Capital Gain chargeable @ 10%

- 25 Pass Through Income in the nature of Long Term Capital Gain chargeable @ 10% u/s. other than section 112A

- 26 Pass-Through Income in the nature of Long Term Capital Gain chargeable @ 20%

- 27 Pass through income in the nature of income from another source chargeable at special rates

- 28 Any other income chargeable at special rat

Schedule IF: Information regarding partnership firms in which you are partner

- Name of the Firm

- PAN of the firm

- Whether the firm is liable for audit? (Yes/No)

- Whether section 92E is applicable to firm? (Yes/ No)

- Percentage Share in the profit of the firm

- Amount of share in the profit

- Capital balance on 31st March in the firm

Schedule EI: Details of Exempt Income (Income not to be included in Total Income or not chargeable to tax)

- 1 Interest income

- 2

- i Gross Agricultural receipts (other than income to be excluded under rule 7A, 7B or 8 of IT Rules)

- ii Expenditure incurred on agriculture

- iii Unabsorbed agricultural loss of previous eight assessment years

- iv Agricultural income portion relating to Rule 7, 7A, 7B(1), 7B(1A) and 8 (from Sl. No. 39 of Sch. BP)

- v Net Agricultural income for the year (i – ii – iii) (enter nil if loss)

- vi In case the net agricultural income for the year exceeds Rs.5 lakh, please furnish the following details (Fill up details separately for each agricultural land)

- a. Name of district along with pin code in which agricultural land is located

- b. Measurement of agricultural land in Acre

- c. Whether the agricultural land is owned or held on lease (drop down to be provided)

- d. Whether the agricultural land is irrigated or rain-fed (drop down to be provided)

- 3 Other exempt income (including exempt income of minor child) (please specify)

- 4 Income not chargeable to tax as per DTAA

- 5 Pass through income not chargeable to tax (Schedule PTI) 6

- 6 Total (1+2+3+4+5+6)

Schedule PTI: Pass Through Income details from business trust or investment fund as per section 115UA, 115UB

- Sl.

- Investment entity covered by section 115UA/115UB

- Name of business trust/ investment fund

- PAN of the business trust/ investment fund

- Sl.

- Head of income

- Current of income

- Share of current year loss distributed by Investment fund

- Net Income/Loss 9=7-8

- TDS on such amount, if any

Schedule- TPSA: Details of Tax on secondary adjustments as per section 92CE(2A)

- 1 Amount of primary adjustment on which option u/s 92CE(2A) is exercised & such excess money has not been repatriated within the prescribed time

- 2

- a Additional Income tax payable @ 18% on above

- b Surcharge @ 12% on-“a”

- c Health & Education cess on (a+b)

- d Total Additional tax payable (a+b+c)

- 3 Taxes paid

- 4 Net tax payable (2d-3)

- 5 Date(s) of deposit of tax on secondary adjustments as per section 92CE(2A)

- 6 Name of Bank and Branch

- 7 BSR Code

- 8 Serial number of challan

- 9 Amount deposited

Schedule FSI: Details of Income from outside India and tax relief

- Sl.

- Country Code

- Taxpayer Identification Number

- Sl.

- Head of income

- Income from outside India (included in PART B-TI)

- Tax paid outside India

- Tax payable on such income under normal provisions in India

- Tax relief available in India (e)= (c) or (d) whichever is lower

- Relevant article of DTAA if relief claimed u/s 90 or 90A

Schedule TR: Summary of tax relief claimed for taxes paid outside India

- 1 Details of Tax relief claimed

- 2 Total Tax relief available in respect of country where DTAA is applicable (section 90/90A) (Part of total of 1(d))

- 3 Total Tax relief available in respect of country where DTAA is not applicable (section 91) (Part of total of 1(d))

- 4 Whether any tax paid outside India, on which tax relief was allowed in India, has been refunded/credited by the foreign tax authority during the year? If yes, provide the details below:

- a. Amount of tax refunded

- b. Assessment year in which tax relief allowed in India

Schedule FA: Details of Foreign Assets and Income from any source outside India

- A1. Details of Foreign Depository Accounts held (including any beneficial interest) at any time during the calendar year ending as on 31st December 2024

- A2. Details of Foreign Custodial Accounts held (including any beneficial interest) at any time during the calendar year ending as on 31st December 2024

- A3. Details of Foreign Equity and Debt Interest held (including any beneficial interest) in any entity at any time during the calendar year ending as on 31st December 2024

- A4. Details of Foreign Cash Value Insurance Contract or Annuity Contract held (including any beneficial interest) at any time during the calendar year ending as on 31st December 2024

- B.Details of Financial Interest in any Entity held (including any beneficial interest) at any time during the calendar year ending as on 31st December 2024

- C. Details of Immovable Property held (including any beneficial interest) at any time during the calendar year ending as on 31st December 2024

- D. Details of any other Capital Asset held (including any beneficial interest) at any time during the calendar year ending as on 31st December 2024

- E. Details of account(s) in which you have signing authority held (including any beneficial interest) at any time during the calendar year ending as on 31st December 2024 and which has not been included in A to D above.

- F. Details of trusts, created under the laws of a country outside India, in which you are a trustee, beneficiary or settlor

- G. Details of any other income derived from any source outside India which is not included in (i) items A to F above and, (ii) income under the head business or profession

Note: Please refer to instructions for filling out this schedule. In case of an individual, not being an Indian citizen, who is in India on a business, employment or student visa, an asset acquired during any previous year in which he was non-resident is not mandatory to be reported in this schedule if no income is derived from that asset during the current previous year.

Schedule 5A: Information regarding apportionment of income between spouses governed by Portuguese Civil Code

- Name of the spouse

- PAN/Aadhaar No. of the spouse

- Whether books of accounts of spouse is audited u/s 44AB? or Whether your spouse is a partner of a firm whose accounts are required to be audited u/s 44AB under this Act? (Yes/No)

- Whether books of accounts of spouse is audited u/s 92E? or whether your spouse is a partner of a firm whose accounts are required to be audited u/s 92E under this Act? (Yes/No)

- Heads of Income

- Income received under the head

- Amount apportioned in the hands of the spouse

- Amount of TDS deducted on income at (ii)

- TDS apportioned in the hands of spouse

Schedule AL: Assets and Liabilities at the end of the year (other than those included in Part A- BS) (applicable in a case where total income exceeds Rs. 1 crore)

- A. Details of immovable assets

- B. Details of movable assets

- C. Interest held in the assets of a firm or association of persons (AOP) as a partner or member thereof

- D. Liabilities in relation to Assets at (A + B + C)

Schedule GST: INFORMATION REGARDING TURNOVER/GROSS RECEIPT REPORTED FOR GST

- Sl. No.

- GSTIN No(s).

- Annual value of outward supplies as per the GST return(s) filed

Schedule: Tax Deferred on ESOP

- Assessment Year

- Amount of Tax deferred brought forward from earlier AY

- Such specified security or sweat equity shares were sold

- (i)Fully

- (ii)Partly

- (iii)Not

- Ceased to be the employee of the employer who allotted or transferred such specified security or sweat equity share? (Yes/No)

- Forty-eight months have expired from the end of the relevant assessment year in which specified security or sweat equity shares referred to in the said *clause were allotted. If yes, specify date

- Amount of tax payable in the current Assessment Year (to be populated from col. 3 or 4 as the case maybe)

- Balance amount of tax deferred to be carried forward to be next Assessment years Col (3- 7)

Part B – TI Computation of total income

- 1 Salaries

- 2 Income from house property

- 3 Profits and gains from business or profession

- 4 Capital gains

- 5 Income from other sources

- 6 Total of head wise income (1 + 2 + 3v +4e +5d)

- 7 Losses of current year to be set off against 6 (total of 2xvii, 3xvii and 4xvii of Schedule CYLA)

- 8 Balance after set off current year losses (6 – 7) (total of column 5 of Schedule CYLA+5b+3iv)

- 9 Brought forward losses to be set off against 8 (total of 2xvi, 3xvi and 4xvi of Schedule BFLA)

- 10 Gross Total income (8-9) (5xvii of Schedule BFLA+ 5b+ 3iv)

- 11 Income chargeable to tax at special rate under section 111A, 112, 112A etc. included in 10

- 12 Deductions under Chapter VI-A

- a Part-B, CA and D of Chapter VI-A [(1 + 3) of Schedule VI-A and limited upto (10-11)]

- b Part-C of Chapter VI-A [(2 of Schedule VI-A and limited upto (10-11-3iii)]

- c Total (12a + 12b) [limited upto (10-11)]

- 13 Deduction u/s 10AA (c of Sch. 10AA)

- 14 Total income (10 – 12c – 13)

- 15 Income which is included in 14 and chargeable to tax at special rates (total of (i) of schedule SI)

- 16 Net agricultural income/ any other income for rate purpose ( 3 of Schedule EI)

- 17 Aggregate income (14-15+16)[applicable if (14-15) exceeds maximum amount not chargeable to tax]

- 18 Losses of current year to be carried forward (total of row xii of Schedule CFL)

- 19 Deemed income under section 115JC (3 of Schedule AMT)

Part B – TTI Computation of tax liability on total income

- 1 a Tax payable on deemed total income under section 115JC (4 of Schedule AMT)

b Surcharge on (a) (if applicable)

c Health and Education Cess @ 4% on (1a+1b) above

d Total Tax Payable on deemed total income (1a+1b+1c) - 2 Tax payable on total income

- 3 Gross tax payable (higher of 1d and 2i) (3a+3b)

- 3a Tax on income without including income on perquisites referred in section 17(2)(vi) received from employer, being an eligible start-up referred to in section 80-IAC ( Schedule Salary) (3-3b)

- 3b Tax deferred – relatable to income on perquisites referred in section 17(2)(vi) received from employer, being an eligible start-up referred to in section 80-IAC

- 3c Tax deferred from earlier years but payable during current AY (total of col 7 of schedule Tax deferred on ESOP)

- 4 Credit under section 115JD of tax paid in earlier years (applicable if 2i is more than 1d) (5 of Schedule AMTC)

- 5 Tax payable after credit under section 115JD (3a +3c – 4)

- 6 Tax relief

- 7 Net tax liability (5 – 6d) (enter zero if negative)

- 8 Interest and fee payable

- 9 Aggregate liability (7 + 8e)

- 10 Taxes Paid

- 11 Amount payable (Enter if 9 is greater than 10e, else enter 0)

- 12 Refund (If 10e is greater than 9) (Refund, if any, will be directly credited into the bank account)

- 13 Do you have a bank account in India (Non-Residents claiming refund with no bank account in India may select No)

- 14 Do you at any time during the previous year,-

- (i) hold, as beneficial owner, beneficiary or otherwise, any asset (including financial interest in any entity) located outside India; or

- (ii) have signing authority in any account located outside India; or

- (iii) have income from any source outside India?

- 15 If the return has been prepared by a Tax Return Preparer (TRP) give further details below