The ITC 01 is a significant filing form for all the taxpayers concerned with the input tax credit availed. There are multiple features and reasonable points which are important to be noticed. The ITC 01 form has to be filed by every fresh registration for GST by the taxpayer to avail the input tax credit.

Here we have covered some of the latest and major issues to be learned while filing the GST ITC 01 in multiple parts and divided as per the chronology. The points will be covering the acknowledgment and steps to be taken while filling the form. Check out all the cases as per the government regulations through which one has to go while filing the form and certain conditions applicable:

Cases While GST ITC-01 Form Need to be Filed

The declaration form in ITC – 01 is expected to be furnished in the subsequent cases:

- When the application of GST enrollment is furnished in 30 days of becoming payable to file GST. [Section 18(1)(a)]

- When the individual selects for voluntary registration. [Section 18(1)(b)]

- If the individual chooses to the composition policy but carries to enrol as the regular assessee. [Section 18(1)(c)]

- When tax is levied on the exempted supply of goods and services. [Section 18(1)(d)]

Input Tax Credit Types & Its Acknowledgement

- Input tax credit regarding the input contained in stock on the halt date.

- Input tax credit concerning the inputs put in the semi-finished goods on the cut-off date.

- Input tax credit

- Input tax credit with context to the capital goods on the cut-off date.

Steps to Learn During Filing of ITC 01

- Note that input tax credit should be claimed. For example, in the context of services, the ITC cannot be claimed under Form ITC 01. In case the composition dealer chooses the composition policy then ITC in context to the capital goods can be claimed and privileged supply becomes taxed.

- The invoice wise data for ITC on the buying as on the cutoff date must be present.

- In 30 days within the date of enrollment or migration to the regular policy, Form ITC 01 needs to be filed.

- For up to 1 year the invoices shall be claimed on inputs and 5 years for the capital goods.

- There is a need to upload the Chartered Accountant certificate or Cost Accountant certificate if the ITC claim exceeds INR 2 lakh.

What is the procedure to declare and file a claim of ITC prior to registration/ on withdrawal from the composition scheme/ on the exempt supply of goods/ services becoming taxable on the GST Portal?

The process to declare and file a claim of ITC prior to registration/ on withdrawal from composition scheme

Steps to File ITC 01 on GST Portal

Login and Navigate to the ITC-01 page

- Open a browser and head-up to www.gst.gov.in. Frontpage or homepage will appear.

- Use the login credential and login to the GST portal.

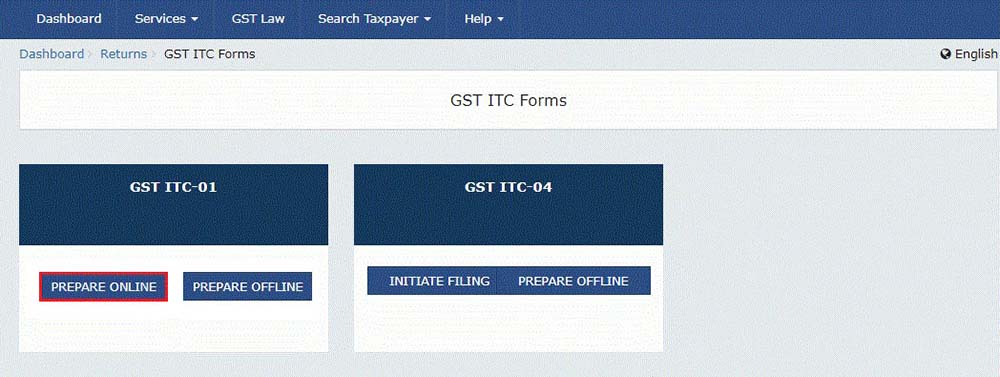

- Click on Services and then navigate to Return>ITC Forms command.

- GST ITC Forms

Declaration for claim of input tax credit under sub-section (1) of section 18

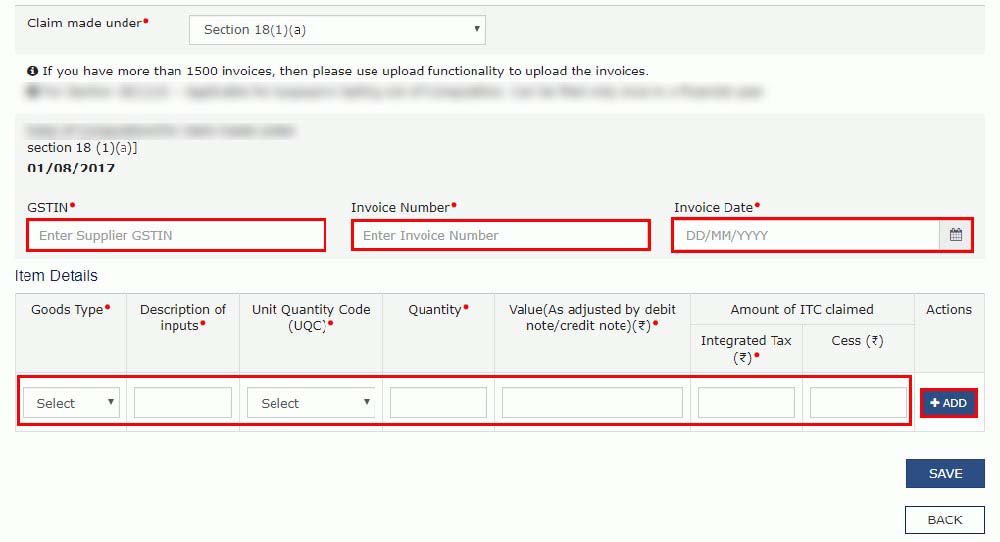

- Now choose the appropriate section from the Claim made under the drop-down list.

- Claim made under Section 18 (1) (a): It is applicable for taxpayers who have applied for registration within 30 days after becoming liable, it can be filed only once.

- Click on the add details button

- Choose Goods Type via the drop-down list

- In the GSTIN field, fill the GSTIN of the supplier of the goods or services

- Put Invoice Number in the Invoice Number field

- Select the appropriate invoice generation date from the calendar in the Invoice date field

- Note: Invoice date needs to be prior to the grant of approval

- In the Description of inputs field, fill details of inputs held in stock, inputs contained in semi-furnished or finished goods held in stock

- Choose the appropriate Unit Quantity Code (UQC) from the drop-down list

- Now in the Quantity field, put the quantity of inputs

- Fill the Invoice Value in the Invoice Value field

- Fill the value of ITC claimed as Central Tax, Integrated Tax, SGST/ UTGST Tax, and Cess as appropriate

- Note: CGST and SGST amount should be the same, and some of both should not exceed the invoice value). If there is an Inter-State purchase then the amount of IGST should not exceed the invoice value.

- Now, tap on Click the add to table button

- Details are updated now click on the Save button

- Note: With the same procedure, up to 20 invoices at a time can be added just make sure to click on save before adding the next invoice

PDF Guide: ITC 01 Claim Made Under Section 18 (1) (a)

- Claim made under Section 18 (1) (d): It is for taxpayers whose supplies have become taxable and can be also filed multiple times.

- Choose the appropriate date on which goods/ services become taxable, using the available calendar

- Now click on the ADD DETAILS button

- Select the Goods Type from the drop-down list

- At the GSTIN field, enter the GSTIN of the supplier of the goods or services

- Now fill the Invoice Number in the Invoice Number field

- The field where Description of inputs has been asked, fill details of inputs held in stock, inputs contained in semi-furnished or finished goods held in stock

- Select the Unit Quantity Code (UQC) using the drop-down list

- Now at the Quantity field, put the up-to-date quantity of inputs

- Now provide the Invoice Value in the Invoice Value field

- Thereafter, provide the amount of ITC claimed as Central Tax, Integrated Tax, SGST/ UTGST Tax, and Cess as appropriate

- After filling in all the above details, Click the ADD TO TABLE button

- Details are successfully added, now click on the Save button

- Note: With the same procedure, up to 20 invoices at a time can be added just make sure to click on save before adding the next invoice.

PDF Guide: ITC 01 Claim Made Under Section 18 (1) (d)

Submit the GST ITC-01 to Freeze Data

- After filling in all the details directly click the submit button to submit GST ITC-01

- Then on the next screen click on the proceed button

- After submitting the data successfully, the filled-in data is frozen and you are not permitted to make any changes

- Only after successful submission of GST ITC 01, Refresh the page, and the status of GST ITC-01 will be changed to Submitted automatically

Update Certifying Chartered Accountant or Cost Accountant Details

If Income Tax Credit claimed is worth above ₹ 2 lakhs, then after submitting and before filing ITC-01 registered taxpayers also have to update the Chartered Accountant (CA) details and along with it they also have to upload the CA certificate on the GST Portal.

- At the Name of the Firm issuing certificate field, fill the name of the firm which issued the certificate

- In the field where the Name of the certifying Chartered Accountant/Cost Accountant has been asked, provide the name of the Chartered Accountant or Cost Accountant

- Fill the membership number of the Chartered Accountant or Cost Accountant in the field in front of the Membership number field

- Now use the calendar and choose the date of issuance of the certificate

- Now registered taxpayers also have to upload the certificate of Chartered Accountant or Cost Accountant in JPEG format with a maximum size of 500 KB

File GST ITC-01 with DSC/ EVC

- Select the checkbox for declaration.

- In the Authorised Signatory drop-down list, choose the authorised signatory. It will provide two buttons 1) File ITC with DSC 2) File ITC with EVC. Click on them one by one to complete the filing of GST ITC-01.

- File with DSC:

- A warning will appear on the screen, click on the proceed button.

- Now select the certificate and then click on the sign button.

- File with EVC:

- Authorized Signatory registered at the GST portal will receive OTP on the registered email and mobile number. Enter it into the appropriate field.

- Now Click on the verify button.

- A success message will be displayed on the screen, ARN will be generated and SMS and email will be sent to the taxpayer.

- Refresh the page, the status of GST ITC-01 will be changed to Filed

General Queries for GST ITC 01

Q.1 – What is GST ITC-01?

A declaration in Form-GST ITC-01 is required to be filed by the registered person or more clearly registered taxpayer who is eligible to claim an input tax credit under Section 18 (1). Credit can be availed for inputs held in stock, inputs in semi-finished or finished goods held in stock or capital goods are as follows:

- Filing of Form GST ITC-01 will allow freshly registered taxpayers to get the credit of input tax concerning inputs held in stock and inputs contained in semi-finished or finished goods held in stock on the day immediately preceding the date from which he comes under taxation as per GST provisions.

- Filing Form GST ITC-01 will be also beneficial for taxpayers registered on a voluntary basis, to take credit of input tax in respect of inputs kept in stock and inputs which are semi-finished or finished goods held in stock on the day just before the date of registration.

- Furnishing Form GST ITC-01 will allow the taxpayer who instead of the composition scheme chosen opts to pay tax as a normal taxpayer, to take the input tax credit in respect of inputs held in stock, inputs contained in semi-finished or finished goods held in stock, or on capital goods on the day immediately preceding the date on which he becomes liable to pay tax under Section 9.

- Furnishing the Form GST ITC-01 will entitle registered persons, whose supply of goods and/or services becomes taxable by an exemption, to get the input tax credit in respect of inputs held in stock and inputs contained in semi-finished or finished goods held in stock relatable to such exempt supply and on capital goods exclusively used for such exempted supply on the day immediately preceding the date from which such supply comes under the radar of GST taxation.

Q.2 – Input Tax Credit can be availed on which goods?

- Inputs held in stock

- Inputs contained in semi-finished or finished goods held in stock

- Capital goods (Only in the case where composition taxpayer chooses to pay tax as a normal taxpayer opting out of the composition scheme or where the supply of exempted goods and/or services are considered as taxable supply). Such persons shall ensure that the input tax credit on capital goods shall be claimed by reducing the tax paid on such capital goods by 5 % per quarter of the annum or part from the date of invoice or any concerning documents in which capital goods were received by taxable persons.

Q.3 – When a person can claim Input Tax Credit?

The credit of the input tax in respect of eligible stock of goods can be claimed by the registered taxpayer within 30 days from the date when the person becomes eligible to avail ITC under sub-section (1) of section 18 or within the period may be extended by the Commissioner:

- A claim can be made only once under clause (a) or clause (b) of sub-section (1) of section 18.

- A claim can be made only once in a Financial Year under clause (c) of sub-section (1) of section 18.

- The claim under clause (d) of sub-section (1) of section 18 can be made as and when the exempted supply becomes taxable.

Q.4 – By when do I need to claim Input Tax Credit?

As per the provision, the ITC on invoices can be claimed before one year till the date the grant has been approved or the composition scheme has been opted-out or the taxation on exempt supplies has been levied, all this to be counted on or even after the appointed day. For the capital goods, the same can be calculated before 5 years as per the grant of approval date or the composition scheme opted out or taxes on exempt supplies.

Q.5 – What are the pre-conditions to claim Input Tax Credit?

Only a registered person is allowed to file a claim in Form GST ITC-01 within a period of 30 days from the date when he/she becomes eligible to avail of the credit on input tax in terms of Section 18 of the Act. Now, if the provided details in Form GST ITC-01 must be certified by practicing CA/Cost Accountant.

Q.6 – What will happen once the Form GST ITC-01 is filed?

After successfully filing Form GST ITC-01, the amount of Income Tax Credit claimed will be transferred to your credit ledger; ARN will be generated and the taxpayer will be infrared via SMS or e-mail.