The latest feature has been updated on the GST portal in which the assessee can avail of the ITC despite it is not shown in GSTR-2A or 2B which is a bigger advantage to assessees.

To support the importers of goods along with the recipients of the supplies via SEZ search bill of entry that does not auto-populate in GSTR-2A. On the GST portal, a self-services functionality is open which is practiced to starch the same records in the GST system and bring these missing records through ICEGATE.

Download a Free Trial of ITC Software

It uses 2 days post to the reference date for the BE information to get an update on the GST portal from ICEGATE. The system must be practiced if the information is not present post to the period. Note: The reference date might be out of the charge date, Duty payment date, or the revised date.

For records of type IMPG import of goods, information of period for Form GSTR-2A system-generated statement of inward supplies, reference date, bill of Entry Details like Port Code, BoE Number, BoE Date & Taxable Value; including the amount of Tax will be shown.

Towards the kind of records IMPGSEZ (Import of Goods from SEZ), details of Period for Form GSTR-2A; Reference Date; GSTIN of Supplier; Trade Name of Supplier; Bill of Entry Details like Port Code, BoE Number, BoE Date & Taxable Value, and the amount of tax will be shown.

The assessee is said to authenticate true information either from BE credentials or practising the portal of ICEGATE.

If there is any issue then you must generate the ticket from the GST support or GST self-service portal through engaging several information consisting of the full information about BE records, GSTIN, BE Number, BE Date, Port Code, Reference Number, and Screenshot of ICEGATE portal including BE record. While practising the “Search BoE” functionality on GST Portal they may face any kind of issues.

Easy Procedure of ITC Claiming

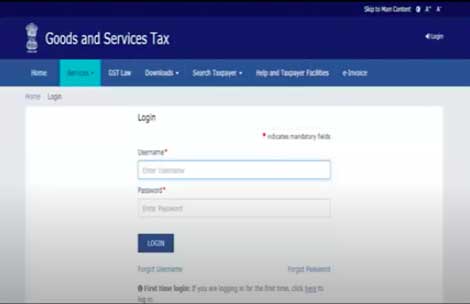

Step 1: The assessee should log in to the GST portal

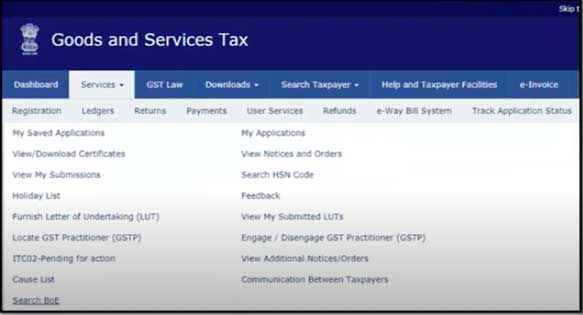

Step 2: Tap on the service tax and opt for Search BoE that is the latest functionality made inside the GST portal.

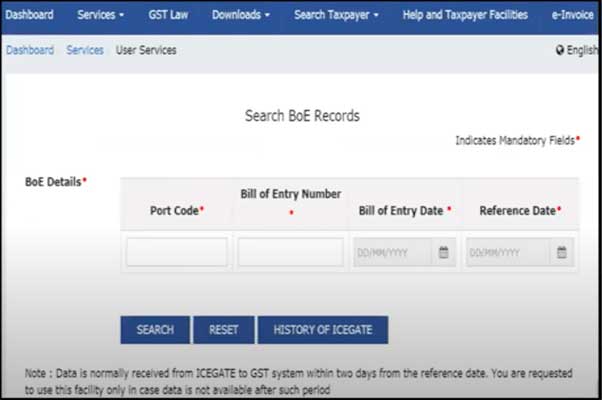

Step 3: On tapping the Search BoE you are required to insert all the information concerned to the Bill of entry port code, Bill of Entry Number, Bill of Entry Date, and Reference Date. Those individuals whose input tax credit has not been seen on GSTR-2A or 2B can enter the information of BoE.

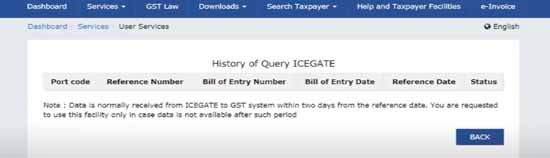

Step 4: The previous information of the fetched BoE taken through ICEGATE including the status of the issues is shown post 30 minutes from the time of hitting out the glitches. The same record will appear on search BoE, GSTR-2A and GSTR-2B if it is found on ICEGATE.

Step 5: Whenever the GST self-service portal fails to display the BOE, the taxpayer can raise a ticket on the GST help desk or GST self-service portal. The taxpayer must include the following details in the ticket such as GSTIN, BoE date, BoE number, Reference date and Port code. A screenshot of the BoE record on ICEGATE. Any other problem or error faced by the taxpayers with the search BoE functionality of the GST portal.