When a tax officer issues form GST DRC-01 to a taxpayer due to non-payment, underpayment of taxes, improper utilization of input tax credit, or issuance of an erroneous refund, and the taxpayer fails to settle the outstanding amount, they are labelled as defaulters. In accordance with clause (a) of sub-section (1) of section 79 of the CGST Act, the concerned tax officer can then proceed to issue form GST DRC-09 to recover the owed amount from the taxpayer on behalf of the department.

Latest Update

- The new ‘Personal Hearing’ option for reporting GST DRC-01 notice is now enabled on the GST portal. View more

Fill Form for GST Compliance Software

What Does DRC-01 Mean in GST?

DRC-01, short for “Demand and Recovery Certificate-01,” is a form utilized by GST officers to provide a concise overview of a show cause notice to a taxpayer. This form includes specific details concerning the notice, outlining the allegations made against the taxpayer. Its primary aim is to communicate the reasons behind requesting payment, encompassing taxes, interest, penalties, and additional outstanding amounts.

The details given in Form DRC-01:

- GSTIN of the person to whom the SCN is provided.

- Address and additional pertinent data.

- Data related to certain tax duration and financial year for which the notice is issued.

- Section reference under the GST law that is applicable.

- Unique reference numbers for the SCN.

- A summary outlining the events that prompted the issuance of the show cause notice. This could encompass information regarding purportedly unpaid or underpaid taxes, incorrect refunds, or improper use of input tax credits.

What is the Method to Answer to Notice DRC-01?

Step 1: Access the GST Portal: Log in to the GST portal by the use of your credentials.

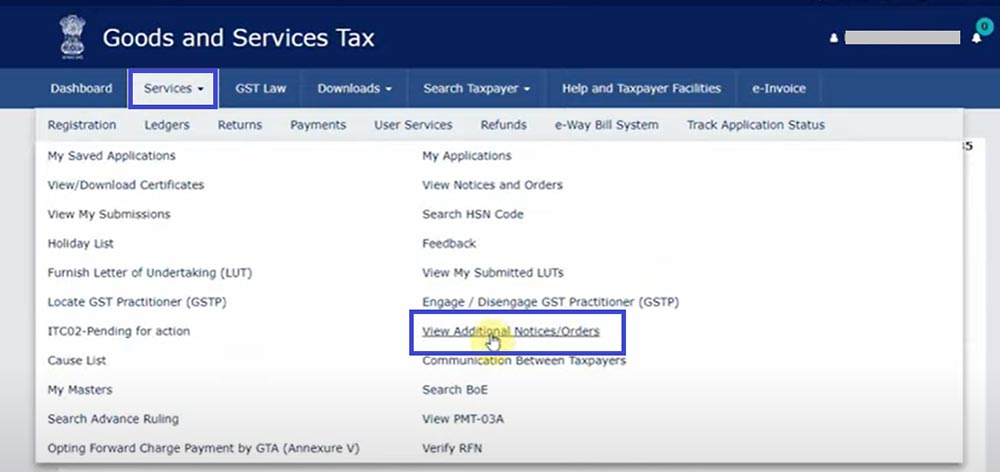

Step 2: Navigate to Services: Tap on the “Services” tab on the GST portal.

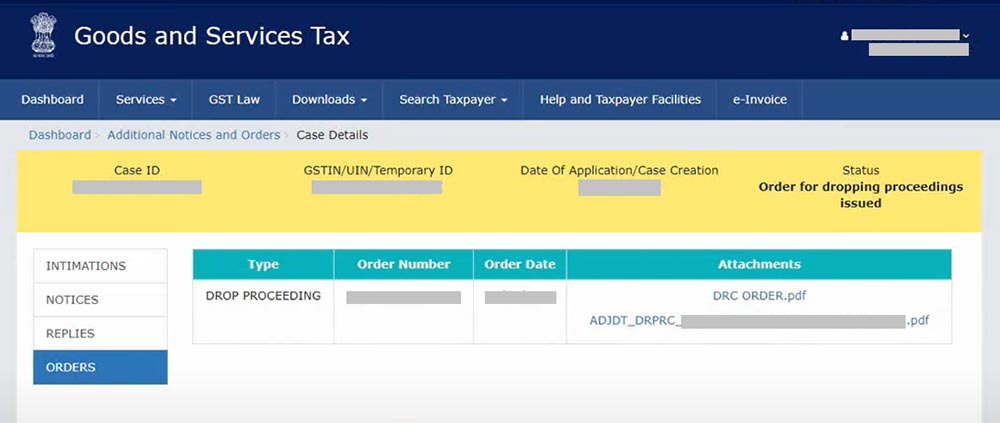

View Additional Notices/Orders: Under the Services tab, choose “View Additional Notices/Orders.”

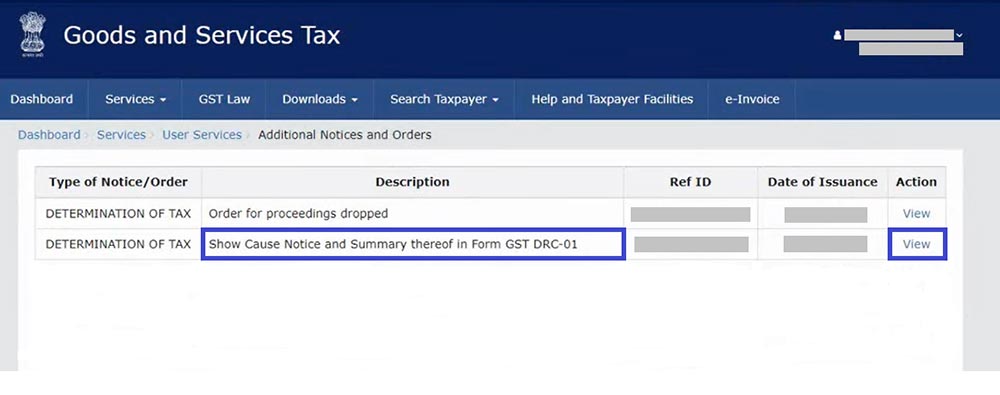

Step 3: Locate the Notice: Discover the precise notice by tapping on “View” next to the pertinent entry.

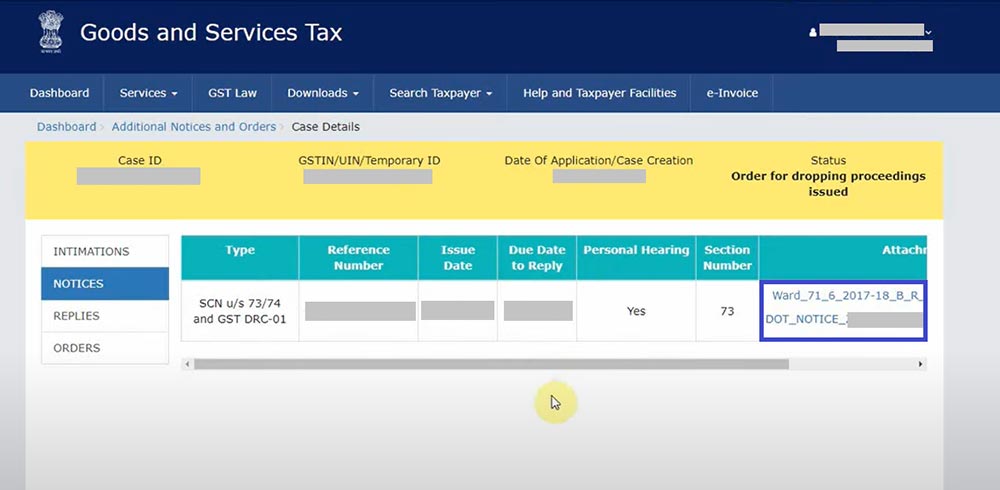

Step 4: Download the Notice: Tap on the attachment to download the notice.

Step 5: Thoroughly Review the Notice: Read the notice, noting details such as type, reference number, issue date, due date for reply, personal hearing details, and section number.

Step 6: Draft a Reply: Established on the data in the notice, prepare a comprehensive reply addressing the issues raised.

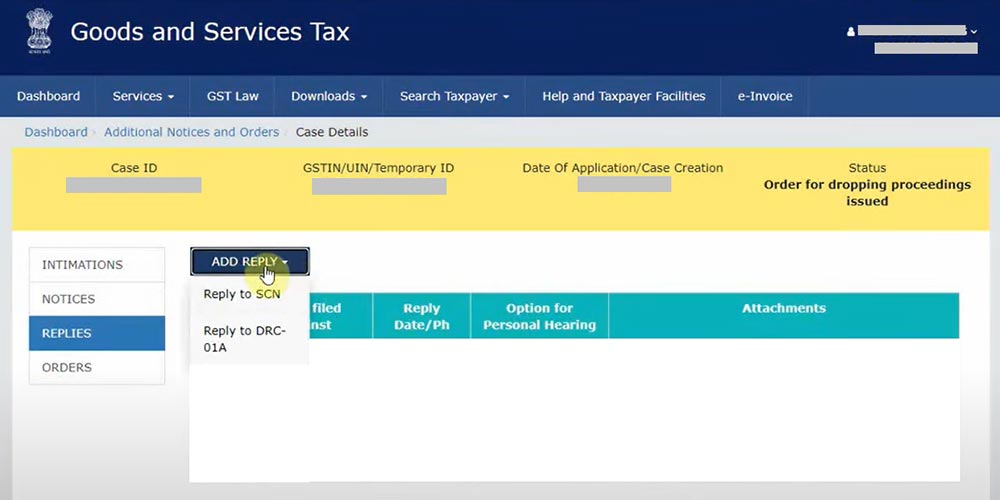

Step 7: Proceed to Replies Section: Return to the GST portal and navigate to the “Replies” section.

Step 8: Add Reply to SCN: Tap on “Add Reply” and choose “Reply to SCN.”

Step 9 Attach Documents: Please include pertinent documents to substantiate your reply. Please note, that there is a limit of four attachments allowed.

Step 10 Physical Hearing: Appear at the arranged in-person meeting where the officer will authenticate the documents you’ve provided.

Step 11 Check Order Section: Post physical hearing track the order section on the portal to see the final decision or order passed via the officer.

How to Reply GST DRC-01 Notice Via Below Example

That the assessee wishes to provide under-

The GST DRC-01 form furnishes do not comprise any proper officer digital signature. Hence the aforesaid notice is not endurable under the law and these SCNs are to be deemed as not valid.

For the case of Marg ERP Ltd vs CGST emerging out of W.P.C. 872/2023, the Hon’ble Delhi High Court directed that “an unsigned notice/order could not be regarded as an order and therefore cannot be sustained.”

The inserted DIN (Document Identification Number) via your good self is not correct and was not validated and authenticated at the GST Portal. Hence when the DIN is incorrect then the aforesaid Show Cause Notice(SCN) is null and void.

The date of the Personal Hearing in the aforesaid notice is too early and the way the same could be performed prior to answering the question of the assessee represents that the absence of the application of the mind via the proper officer at the time of providing the Show Cause Notice(SCN) before the assessee.

Multiple discrepancies seen by your good self comprises of-

Tax Liability Due to Mismatch in GSTR-1 & 3B Forms

As it was the inaugural year of implementing the new GST Law, both the taxpayer and their staff lacked familiarity and proficiency with the newly introduced GST system. Consequently, a number of inadvertent clerical errors resulted in incorrect data entries in the system, leading to discrepancies. Hence, we kindly request you to disregard the following entries in GSTR-1:

Date, Bill No., GSTIN, Invoice Value

Comparison of Forms GSTR 2A and 3B for Excess ITC Claims

The taxpayer did not avail of any excessive Input Tax Credit (ITC) in their returns. They claimed Input Tax Credit (ITC) only for goods they physically possessed, supported by invoices, evidence of bank payments, and proof of actual goods movement. These transactions are entirely legitimate, with the exception of any ineligible ITC.

Important: Practical GST ITC Claiming Complexness with Suggestions

Additionally, all the suppliers involved in these transactions are operating from their registered business premises and can verify the authenticity of these transactions. Therefore, we kindly request you to consider these transactions and grant the ITC to the taxpayer, as all the conditions stipulated in Section 16 of the CGST/DGST Act, 2017 have been diligently adhered to. It’s worth noting that the same perspective was affirmed by the Hon’ble Supreme Court in the case of Ecom Gill Coffee Trading Pvt Ltd.

That, in the case of Diya Agencies vs State Tax Officers appearing out of W.P.(C). 29769 of 2023, the Hon’ble Kerela High Court carried that “ITC cannot be refused to the recipient only on the basis of the transactions that have not been shown in GSTR-2A.” However, the GSTR-2A form is only a facilitator and cannot be presumed to be correct and complete.

The following is a list of the transactions that led to the mismatch, and all pertinent papers are included for your convenience:

Date, Bill No. GSTIN, Invoice Value, E-way Bill No.

Non-Existing Dealers Making GST ITC Claim

The taxpayer wishes to clarify that purchases were made from the following dealers who were operational at the time of the transaction, and the actual goods were indeed received.

The taxpayer possesses valid GST e-invoices, e-way bills, and evidence of tax payments, including bank records demonstrating the payment to the supplier. Furthermore, all the supplier’s returns have been duly filed on your GST Portal and are verifiable through the GST Portal records. Consequently, the taxpayer has fully complied with Section 16 of the CGST/DGST Act, 2017.

It’s important to emphasize that it is the responsibility of the supplier to remit the taxes collected, following the guidelines set forth by the Central Government of India. Failure to do so could result in double taxation.

However, it’s important to note that the taxpayer cannot independently verify whether the supplier has paid the taxes or adjusted them from their Input Tax Credit (ITC). This responsibility falls on the government administrator, not the bona fide purchaser. The taxpayer can only confirm whether the supplier has filed their GSTR-3B, which, in this case, has been duly filed. It’s also worth highlighting that no contrary legal evidence has been presented, so there is no reason to draw any adverse conclusions.

Date, Bill No., GSTIN, Invoice Value, E-way Bill

Enclosed herewith, for your convenient reference, are copies of the aforementioned invoices, the corresponding e-way bills, and proof of payment.

For the case of Gargo Traders vs Joint Commissioner of Commercial Taxes emerging out of W.P.C. 1009 of 2022, the Hon’ble Calcutta High Court carried that “a recipient of goods/services cannot be refused ITC if the supplier evolves as non-existent or their registration was cancelled retrospectively.”

In the case of LGW Industries Ltd vs Union of India. W.P.C 23512 of 2019, the Hon’ble High Court of Calcutta with the identical opinion.

In the case of CIT Vs. T. Maneklal Mfg. Co. Ltd. (1978) 115 ITR 725, the Bombay High Court emphasized the importance of uniformity in interpreting statutory provisions within the Income-tax Act, given its status as an all-India statute.

The Court held that the considered opinion of any other High Court should generally be adhered to unless there are compelling reasons to adopt a different perspective. Considering that GST is similarly an all-India statute, the principle of uniformity should likewise be upheld.

In light of the aforementioned principles and considering the specific circumstances of this case, the taxpayer is willing to fully cooperate with your office. We kindly request that you dismiss the notice and withdraw the proposed demand in its entirety.

New: According to the terms of the VIL agreement the taxpayer, is needed to supply telecommunication services before the VIL’s consumers, and in order to do so, the taxpayer must get VIL’s acknowledgement.

In conclusion, A tax officer can issue a GST DRC-01 form to a taxpayer in case of non-payment of taxes, input tax credit, or wrongful refund. If the taxpayer fails to pay the outstanding amount, they are categorized as defaulters. A taxpayer can also check all GST notices by using SAG Infotech’s online Gen GST software.