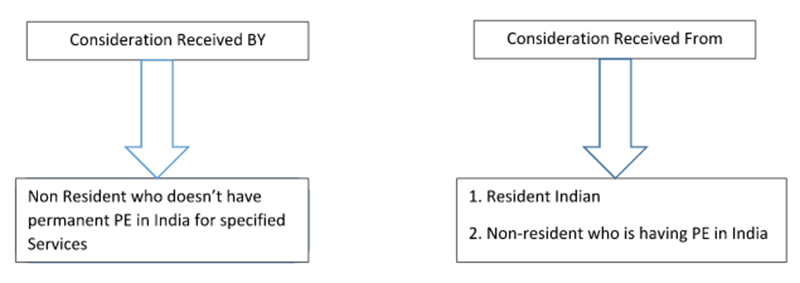

A new chapter viii titled ‘Equalisation levy’ is inserted in the finance bill which will take effect from the 1st of June 2016 to provide for an equalization levy of 6 % of the amount of consideration for specified services received or receivable by a non-resident not having a permanent establishment (‘PE’) in India, from a resident in India who carries out business or profession, or from a non-resident having a permanent establishment in India.

With the introduction of the equalization levy, the Govt has been indirectly able to tax global advertising companies and has set more services that may be added to the list of specified services in the future.

Latest Update

- The government has proposed the abolition of the 6% Equalisation Levy on online advertising in the Finance Bill of 2025.

- The scheme in respect of the processing of the Equalisation Levy Statements has been notified by the Central Board of Direct Taxes (CBDT), i.e. Centralised Processing of Equalisation Levy Statement Scheme, 2023

Important Knowledge About India-US Pact on Equalization Levy

India’s Ministry of Finance provided a statement in which the terms of the October joint statement would indeed apply to India’s 2% equalization levy applicable on e-commerce supply or services and USTR’s trade action concerning the equalization levy. As per the statement, the final terms of the agreement would be finalized dated 1st Feb 2022.

Equalization Levy Withdrawal

India needs to withdraw its 2% equalization levy, which is subject to being applied to e-commerce supply or services until the OECD pillar one provision begins in the country, predicted to be in 2013.

The Furnishing of Credit Excess Equalization of Levy

Surplus paid by the multinational companies determined by pillar one would be available as credit for set-off concerning their corporate tax liability, which is below pillar one.

Credit Availability in a Year

The credit of surplus equalization levy furnished would be subjected to apply in the 1st taxable year where the assessee would be liable for the tax liability post to the interim duration.

Towards the concern of the Pillar, one would not be subjected to apply on the assessee in the execution year on the grounds of the first year the credits have been revealed, where pillar one is applicable for these assessee and would become available at these times.

However, the credit would not be available for the assessee who first applied to pillar one exceeding 4 years post pillar one would be applicable in India.

Credit Carry Forward

The credit that is revealed would be carried forward for set off opposite to pillar one corporate tax liability unless it gets exhausted.

USTR Execution Under Equalization Levy

The US would eliminate USTR action in India for the levied trade tariffs coordination towards the 2% equalization levy till the end of the interim/transitional period.

Currently, this Equalisation Levy is levied only on advertisements.

Equalisation Levy: 6% on the Amount of Consideration

The Salient Features of this Equalisation Levy are as Under

- Equalisation Levy as introduced by Finance Bill 2016 in Union Budget 2016-17, here are some features of the same:

- It is to tax the e-commerce transaction/digital business that is conducted without regard to national boundaries.

- The equalization levy would be 6% of the amount of consideration for specified services received or receivable by a non-resident not having a permanent establishment (‘PE’) in India, from a resident in India who carries out business or profession, or from a non-resident having a permanent establishment in India.

- Specified services mean online advertisement, any provision for digital advertising space or any other facility or service for the purpose of online advertisement and include any other service as may be notified by the Central Government.

- No levy if the aggregate amount of consideration does not exceed Rs.1 lac in any previous year.

Equalisation Levy will not be Charged

- If the service provider is a non-resident having PE in India.

- The service provider is a resident of India.

- The amount of consideration is less than Rs 1 lakh

Applicability and Manner of Deduction of Equalisation Levy

- This levy of equalization would be in the same manner as TDS, like the person making the payment for advertisement will be required to deduct the Equalisation levy @ 6% on the total amount of consideration and deposit the same to the account of the Central Government.

- In case of failure to do so, these expenditures will not be allowed to be claimed for Income Tax purposes.

Reason for the Introduction of Equalisation Levy

- Many companies who are providing services in cyberspace register themselves in a country wherein the Tax rates are low and pay very low taxes on their global income.

- Like in India The revenue of Google in FY 2014-15 was 4,108 Crores, hence the introduction of the Equalisation levy would fetch the Govt a lot of money which till now was not Taxed that’s why many people are calling the Equalisation levy Google Tax. Because a major share of online ads spent goes to Google.

Due Date of Depositing Equalisation Levy

Due Date of depositing Equalisation levy to the account of Central Govt by the 7th day of the Month immediately following the said calendar month.

Due Date of Furnishing Equalisation Levy Statement (Form-1)

The due date of the Furnishing Equalisation levy Statement is on or before 30th September of the Financial Year end. (after the end of the Financial Year, assessee has to submit Form-1 on or before 31st July or within the prescribed time as the case may be.)

Note: “The Equalization Levy Statement in Form No.1 for the Financial Year 2023-24, which was required to be filed on or before 30th June 2024”

Revision or Late Submission of Form-1

If the assessee failed to furnish the statement within time or had furnished it wrong and now wants to revise the same, he can upload a belated return or revise the TDS return at any time before the expiry of two years from the end of the financial year in which specified services were provided.

Interest on Default: If the amount of levy is not deposited within a specified time then the assessee shall have to pay 1% Interest on such levy for every month or part of the month by which such credit of the Tax or any part of Tax is delayed.

Penalty for Failure to Deduct or Pay Equalisation Levy

- Failed to deduct levy–: penalty amount will be equal to the amount of the Equalisation levy that the assessee failed to deduct.

- Levy has been deducted but not deposited: The penalty amount, in this case, will be 1,000 Rs. per Day till the default continues, but the total penalty shall not exceed the amount of the equalization levy.

Penalty for Default in Furnishing Statement

If the assessee fails to furnish the Equalisation levy statement within the prescribed time, he has to pay a penalty of 100 Rs. Per day till the default continues.