On Thursday the government states that for non-resident e-commerce platforms a 2% levy charge is to be imposed on the earnings originated in India. During depositing and reducing a levy w.e.f April 1 has previously become the responsibility of the resident aspirant of services, the responsibility has now shifted to the non-resident operator, on a quarterly basis the burden is required should fulfil it.

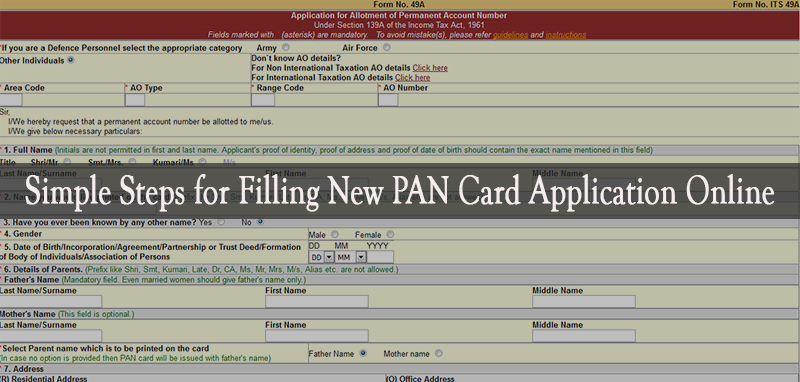

Furthermore, as per the alteration to the yearly statement forms and plea credentials expected to be filed by associated companies, it is necessary for them to get a permanent account number (PAN)

“The challans for payment of e-commerce equalization levy were notified in July 2020 and required furnishing of PAN and Indian bank account for remittance of the levy,” Nangia Andersen LLP partner Sandeep Jhunjhunwala states. He included that a new electronic code to the person which clarifies the yearly statement has also been conducted however it was not of it is used as an alternative to PAN. Moreover, the authority has also held the perspective of limited claim upon the amount of penalty imposed in case of non-payment of the tax however not the quantum for the tax estimation on its own.

Finance Act, 2016, at the rate of 6% has started Referring Google tax to the equalization levy on amounts