The provident fund is a major fund collection scheme by the government of India to support and assist the working class in their future needs. The government also provides higher interest rates in return for maintaining the funds in the government treasury and giving individuals a higher sense of security.

Here in this post, we will be looking at some of the processes related to the employees’ PF and ESI registrations.

Registration of Employees’ PF

A company with 20 or more employees is required by law to register in the EPF scheme within one month of attaining the minimum strength of 20 employees. The small companies which do not have minimum strength would register themselves. The employee doesn’t have to become a member of the EPF scheme when the employee takes a salary exceeding Rs 15000 per month.

- Registration of PF

- Registration of ESI

- Advantage of ESIC Registration

- Employee PF Registration Advantages

- ESI Scheme Applicability

- Last 11 Years PF Interest

- Outstanding Gen payroll in the Industry

- Create ESI Challan via Gen Payroll

- Create PF Challan via Gen Payroll

- FAQs on PF and ESI Scheme for Employees

Need Demo of Employee PF and ESI Compliance Software

Registration of ESI

ESI Registration is essentially performed when the employer secures more than 10 employees however, the same is applicable for employees who have lower earnings. According to the act, all employees whose earnings are Rs 15000 or lower per month are required to contribute 0.75% of their pay for ESI and 3.25% by the company for ESI. For effective ESI enrollment, the employer would be required to furnish the advance contribution for 6 months.

Advantages of ESIC Registration

The advantages of enrolling on this scheme are:

- Sickness provides a 70% rate in a salary form if any certified illness exists for a maximum of 91 days in any year.

- Medical benefits to the employee and his family members.

- The maternity advantage for women who are pregnant is in the form of paid leave.

- Employee’s death during his working period, 90% of the salary is provided to his dependents in the form of a monthly payment after the employee’s death.

- Identical to the above for the case of the employee’s disability.

- Funeral expenses.

- Old age medical care expenses.

Advantages of Employee PF Registration

- The PF scheme provides a pre-fixed interest on the deposit secured within EPF India.

- Nearly 8.5% of the employer’s contribution is rendered to the employee pension scheme. The same would assist in creating healthy retirement money for employees.

- The employee can withdraw the amount from the EPF fund during an emergency.

- Earnings made from the EPF are exempt from tax.

Read Also: Generate PF/ESI Challan & TDS Filing Via Gen Payroll Software

The registration for ESIC and EPF would be essential for all the new firms to be availed during the incorporation period, with effect from February 23, 2020, and no individual ESIC and EPF registrations would be provided by the Shramsuvidha portal to any firm.

ESI Scheme Applicability

- (i) Shops

- (ii) Hotels or restaurants not securing any activity related to manufacturing, but only involved in ‘sales’.

- (iii) Cinemas including preview theatres;

- (iv) Road Motor Transport Establishments;

- (v) News paper establishments.(that is not covered as factory under Sec.2(12));

- (vi) Private educational institutions run via people, trustees, societies or other organisations, and Medical Institutions (including Corporate, Joint Sector, trust, charitable, and private ownership hospitals, nursing homes, diagnostic centres, and pathological labs.

Interest Rates of Employee PF in the Last 11 Years

| Financial Year (FY) | Interest Rate p.a. |

|---|---|

| 2023-2024 | 8.25% |

| 2022-2023 | 8.15% |

| 2021-2022 | 8.1% |

| 2020-2021 | 8.50% |

| 2019-2020 | 8.50% |

| 2018-2019 | 8.65% |

| 2017-2018 | 8.55% |

| 2016-2017 | 8.65% |

| 2015-2016 | 8.80% |

| 2013-2015 | 8.75% |

| 2012-2013 | 8.50% |

| 2011-2012 | 8.25% |

| 2010-2011 | 9.50% |

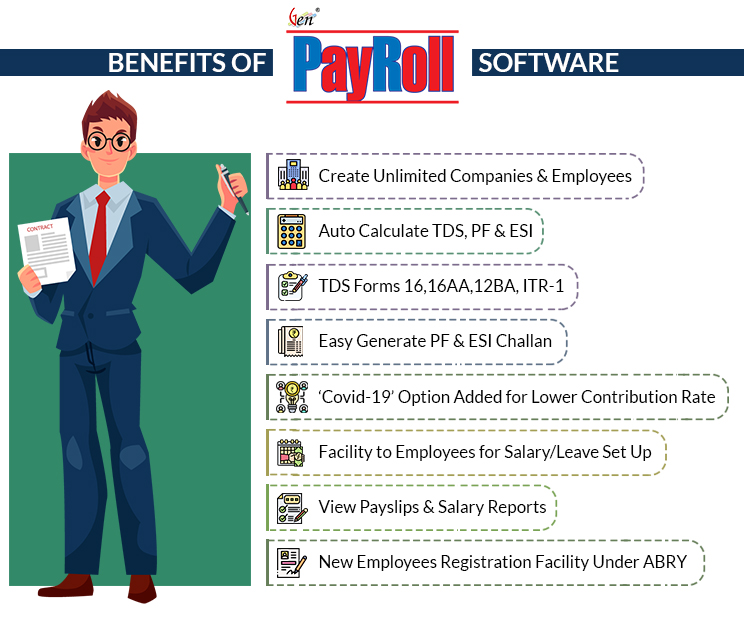

The Outstanding Gen Payroll in the Industry

Gen Cloud, along with the desktop payroll software, is the integration of some effective specifications which make it much more popular in the industry.

The same provides the employee salary payslip towards every request via the candidate while providing them with PF and ESI filing and login on the portal itself. The secures payroll software an HR and employee dashboard for the complete track record of the system, with the employee concerned reports and registers.

Also, the software has a customised salary setup for any miscellaneous time duration, with the data import or export through Excel and the bulk email facility.

Easy Steps to Create ESI Challan via Gen Payroll Software

- Step 1: Open the Gen HR Payroll tool

- Step 2: Then click the home screen and go to–>Statutory Forms

- Step 3: After that, click on the ESI option –> Here you select –> Generating Monthly return file (Excel Format)

- Step 4: Now, here you can make an easy monthly ESI challan in the format of Excel & upload that Excel sheet to the government portal through manual login.

“Note–> Due to some Department Restrictions, you can’t log in directly from Software. (Soon, this issue will be resolved.)”

Easy Guide to Make Employee PF Challan by Gen Payroll Software

- Step 1: Open the Gen Payroll

- Step 2: After that, go to the home screen and click on statutory forms

- Step 3: Then click on Employee PF and select an option –> PF Challan, ECR, Form 12-A, Form 6 (P.S.), Form 4(I.F.)

- On the next screen, you can prepare Monthly PF Challans

- Step 4: The Gen payroll software will automatically calculate the PF Challan as per the workers’ salary details after clicking on the Auto-Fill option

- Step 5: Now, click on the “Electronic Challan Cum Return” Button. You can make an ECR File. You can also log in & Upload that Challan to the government EPFO portal directly from our software

FAQs on PF and ESI Scheme for Employees

Q.1 – What is the method that an ESI scheme assists the employees?

ESI scheme is used to furnish the full medical care towards the employees enrolled with ESIC in the duration of a person’s incapacity and working capacity. It is indeed used to furnish the financial support to compensate for the loss of the wages of the employee in the duration of his or her abstention from work because of sickness, maternity, and employment injury. ESI scheme is used to furnish medical care to the family members of the employee.

Q.2 – Who runs the ESI Scheme?

ESI scheme is run by the government-corporate body known as Employees State Insurance Corporation (ESIC), which consists of the members who represent the employers, Central Government, employees, medical professionals, state government, and the members of Parliament. “The Director-General of the ESIC is the chief executive officer of the ESIC and is also an ex-officio member of the ESIC.”

Q.3 – What is the method of funding the ESI scheme?

ESI scheme is a self-financing scheme. The ESI funds are majorly developed via monthly contributions of the employers and employees. The monthly contributions are built at the rate of the fixed percentage of the furnished wages. “The state governments also bear 1/8th share of the cost of medical benefits.”

Q.4 – ESI covers what types of establishments?

A notice has been circulated by the central government that all factories in which 10 or exceeding individuals are employed come beneath the ESI Scheme. The business that has 10 or exceeding individual are essentially cones beneath the ESI scheme.

- Shops

- Hotels or restaurants do not have any manufacturing activity but are only engaged in sales.

- Cinemas, including preview theatres.

- Road motor transport establishments.

- Newspaper establishments.

- All private educational institutions and medical institutions.

Q.5 – Who determines the contribution rate for the ESI scheme?

The Government of India amended and fixes the rate of contribution for the ESI scheme. The rates are amended with time. In the present times, the government has diminished the rate of contribution from June 2019, effective from 1st June 2019. Currently, the contribution of the employees’ rate (wef 1.07.2019) is 0.75 % of the wages. Also, that of the employers is 3.25% of wages furnished for the employees in every wage duration.

Q.6 – Is ESIC mandatory for all the working employees?

Yes, all the establishments which come beneath the ESI act along with all the factories that employ exceeding 10 employees and furnish less than Rs 21000 per month (Rs 25000 towards the employees with a disability should enroll with the ESIC and contribute to the ESI scheme. All employees who earn exceeding Rs 21000 per month are privileged from the ESI contribution.

Q.7 – How Much Must be Contributed to the EPF Account Statutory Rate?

The statutory rate of contribution is 12% of the basic salary along with the dearness allowance of Rs 15000 per month. If the employee sees to contribute on the higher basic salary, then that would be possible after taking the permission from the provident fund board.

Q.8 – Can the EPF be Withdrawn Without Limits?

The employee who resigns from the service excluding the retirement case could withdraw the PF only after the expiry of two months.

Q.9 – Affected by the Change in Employment, Can the Employee Transfer the PF Account?

Towards the case of the amendment in the employment would transfer the PF account to the new employer through submitting Form 13. The request for transfer would be performed online

Q.10 – What is the Method of EPFO Credit Interest on the EPF Accounts?

The EPFO credits interest on the monthly running balances in the EPF accounts. The rate of interest is reported per year. For FY 2023-24, 8.25% is the reported rate.