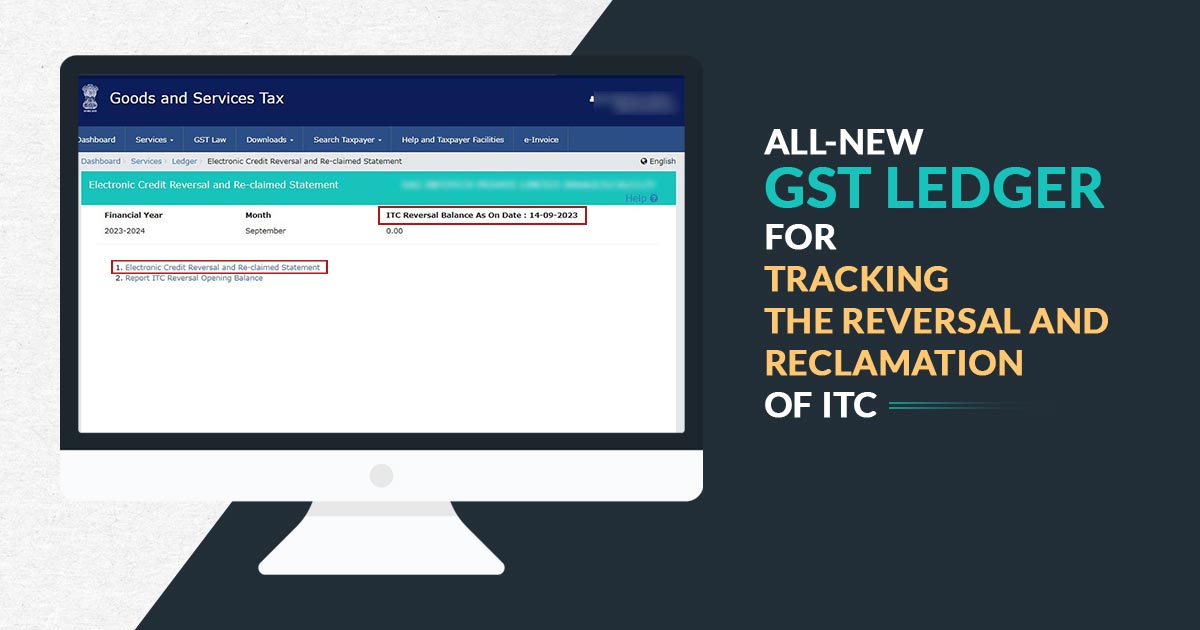

To simplify and improve transparency in India’s taxation system, the Goods and Services Tax Network (GSTN) has introduced a new ledger called the Electronic Credit Reversal and Reclaimed Statement (ECRRS). This ledger allows taxpayers to easily track the reversal and reclamation of Input Tax Credit (ITC) on a specific date.

This change is in response to the government’s recent amendment to the GSTR-3B return form, which now provides detailed information about ITC eligibility, reversals, and reclaims starting from the August 2022 return period.

What is the ECRRS Ledger on the GST Portal?

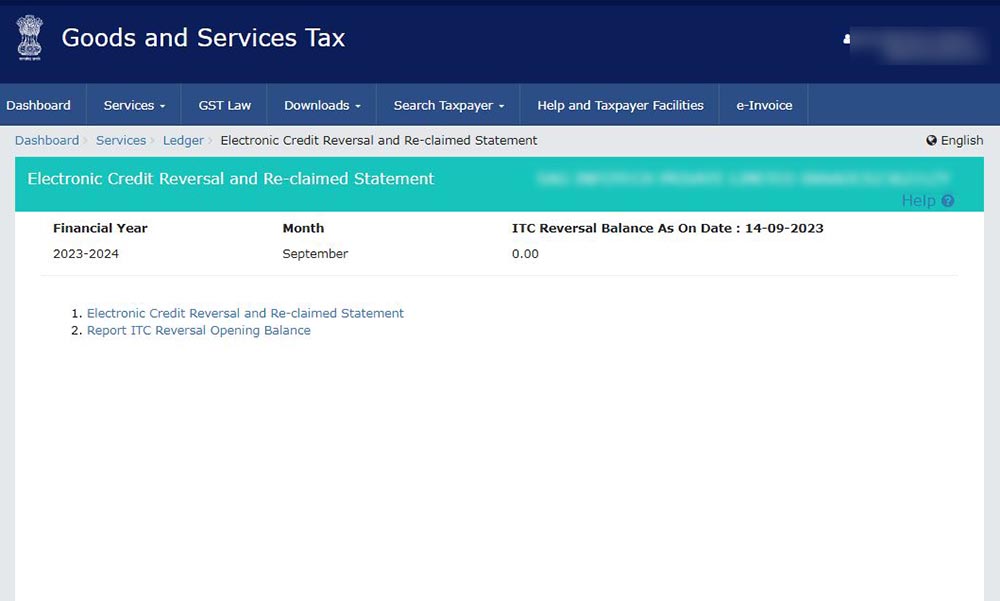

The Electronic Credit Reversal and Reclaimed Statement (ECRRS), a ledger similar to electronic cash or credit ledgers, is now available on the GST portal. This declaration gives taxpayers access to their remaining input tax credit balances, especially the sums that have been reversed and subsequently claimed on particular dates.

Before delving into how this ledger works, it’s important to understand the situations that might require a GST ITC reversal and later reclamation.

These situations include those outlined in CGST Rule 37, CGST Section 16(2)(b), CGST Section 16(2)(c), and cases involving auto-populated credit notes. In such instances, ITC must initially be reversed but can later be reclaimed when certain conditions are met. The introduction of the Electronic Credit Reversal and Reclaimed Statement aims to simplify the tracking of this complex process.

How ECRRS Streamlines ITC Reversal and Reclaim Monitoring:

In the past, taxpayers used to manually handle the reporting of ITC reversals and reclaims in Table 4 of the GSTR-3B return. This process relied heavily on self-declarations and lacked an effective means for tax authorities to confirm whether a claimed ITC was genuinely linked to a previously reversed ITC.

ECRRS statement fills this gap. Simpler tracking of ITC reversals and reclaims via assessees has been facilitated by the Electronic Credit and Reclaimed Statement. Additionally, it gives tax authorities early access to information about the remaining ITC reversals and the highest amount that may be claimed on any particular day.

Additionally, the GSTR-3B form now includes a validation check.

The system will issue a warning message if a taxpayer attempts to claim more ITC than is allowed in Table 4D(1) when compared to the total of ITC reversal balances from earlier periods. By using this approach, taxpayers can claim ITCs while staying within the boundaries set forth by the law.

Taxpayer Availability and Next Steps

Starting from the return period of August 2023, monthly filers will gain access to the ECRRS facility. Conversely, quarterly filers will be able to access it starting with the return period of July-September 2023.

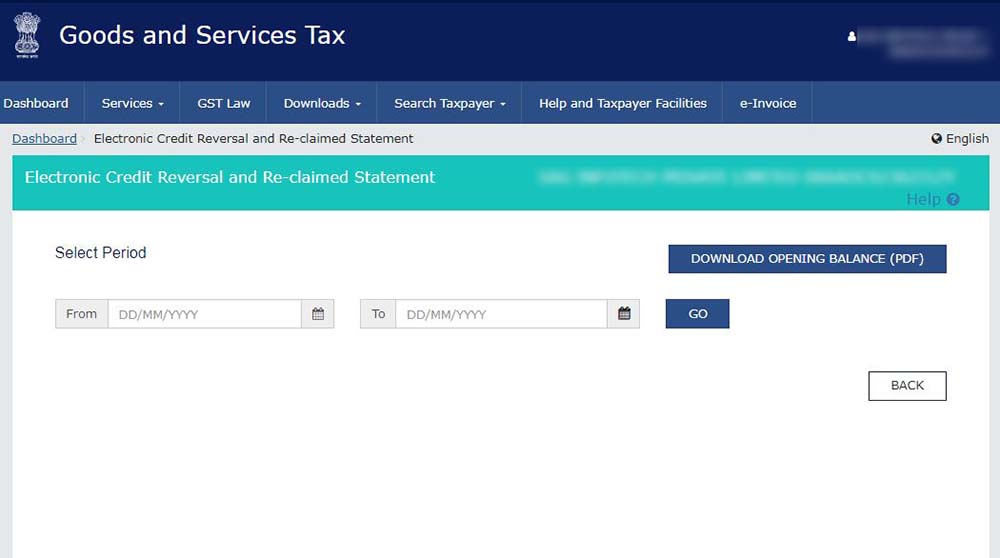

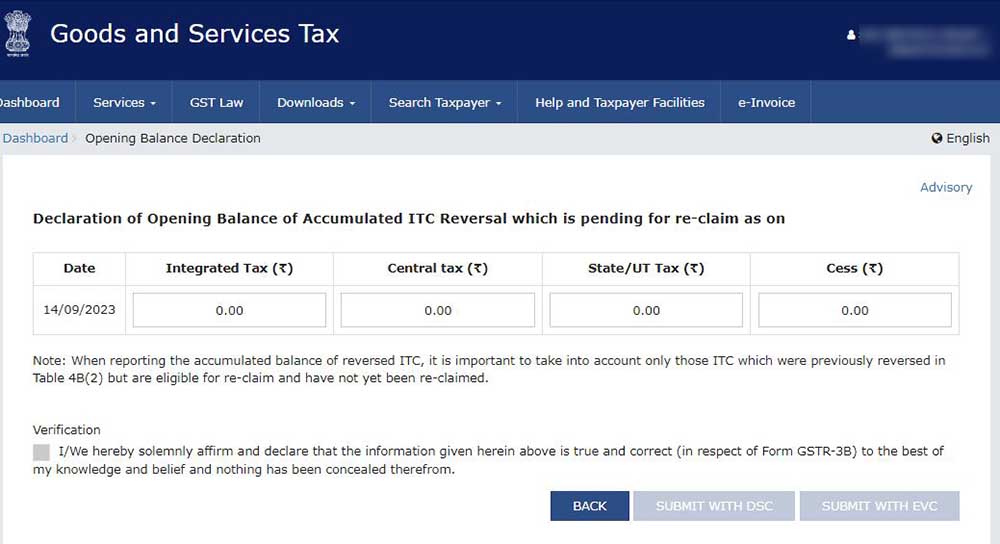

Taxpayers are required to take immediate action by reporting their accumulated ITC reversed balance as a one-time task. This task must be completed no later than November 30, 2023.

Read Also: GSTN New Advisory on e-Credit GST Reversal & Re-Claimed Statements

For monthly filers, the reporting of ITC reversed amounts should cover up to the July 2023 return period, while quarterly filers should report amounts until the return period of April to June 2023.

From November 30 to December 31, 2023, taxpayers have the flexibility to amend their opening balance up to three times. However, please note that this option will be discontinued after December 31, 2023.

Key Measures for Effective Management of ITC

In light of the new ITC reversal and reclaimed ledger, GST taxpayers are motivated to implement the following measures to maintain compliance:

- Commencing from April 2022, perform comprehensive reconciliations to ascertain the ITC claimed, reversed, reclaimed, ineligible ITC, and pending reclaims.

- Establish a separate ledger in their accounting records dedicated to recording all ITC reversals and reclaims going forward.

- Maintain a distinct ledger specifically for temporary ITC reversals, ensuring they are kept separate from permanent reversals or ineligible ITC.

- Maintain proper documentation of all ITC claimed, reversed, and reclaimed, enabling easy tracking of reclaims back to the initial claims.

- Reconcile GSTR-3B with GSTR-2B frequently and the purchase register across different tax periods to avoid issues of double reclaims or missing reclaims.

hi we missed the time limit for add the opening balance for itc reversal now it says time limit exceeds is there any way to add the opening balance for itc reversal and reclaimed ledger on GST site

Uptill Now There is no option to add Opening balance of Accumulated ITC Reversal

God Afternoon sir, what about Import IGST if it is not reflected in GSTR3B.

Do we need set a process of reversal and reclaim of such IGST on imports

Yes