The Central Board of Direct Taxes (CBDT) ceased via Excel and Java Versions of ITR Utilities, mentioning JSON Utility for ITR-1 to ITR-4 for Assessment Year 2025-26.

By using the offline utilities, opt for the assessment year and download the Excel or Java or JSON utility. Inside the system, the utility by default will be downloaded in the name of the ‘download’ folder in a compressed mode (ZIP file), extract (uncompress) the ZIP file from the utilities. The folder needs to be extracted to the same location where the compressed utility was downloaded. Open the utility and initiate the filing.

Latest Update

- Taxpayers can download the updated version (1.2.9) of the Common Offline Utility for Windows (ITR-1, ITR-2, ITR-3 and ITR-4). Download Now

- The first version (1.2.5) of the MAC utility for the common offline filing of ITR-1 to ITR-4 is now available on the official portal.

ITR 1 to ITR 4 e-Filing Software, Get Demo!

Procedure to Download & Install the JSON Offline Utility

Step 1:

Once you access the e-filing portal. Then you can download the utility beneath:

- Downloads -> Common Offline Utility (ITR 1 to ITR 4) -> Utilities, click here

Note: – System Wants

- OS – Windows 7 or later are supported (ia64, x64 systems binaries will run on ia32)

- Processor – Intel Pentium 4 processor or later, that’s SSE2 capable, or AMD K10 or higher core architecture

- RAM – 2 GB of RAM or more

- HDD – 700 MB or more of free space

Step 2:

Once you tap on the link for the utility shown with respect to Income Tax Return 1 or ITR-4, a ZIP file will start downloading on your system. Open the utility from the extracted folder.

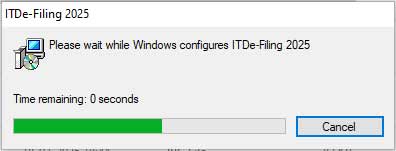

Step 3:

Post-extracting the downloaded utility as a ZIP file opens the utility via an extracted folder. In the case you receive this message tap the “Run Anyway” option in the dialogue box.

Step 4:

On tapping the “Run Anyway”, your utility will start installing, after which you can move on to furnishing the ITR.

Step 5:

After installing the utility, you will land on the homepage. Tap on ‘Continue’ to proceed with version V1.2.6.

Major Points to Know Before Using the Utility

- Only for ITR 1, ITR 2, ITR 3 and ITR 4, this offline utility is enabled. The other will be subjected to summing inside the utility in the consequent freedoms

- The Utility is based on the grounds of the latest technology, JSON

- Through e-filing of the portal, it allows for to import and pre-filling of the information. You can furnish the balance information. You can indeed edit the profile information, excluding the PAN information. But it is to be given that to edit this in your profile at the e-filing website and regenerate the pre-fill information

- The facility to upload ITR in the e-filing portal is not allowed. You can furnish and save it in the utility or export the output JSON file to your system

- After the filing is permitted, you can upload this to the e-filing portal

Under add-ons will be approved in Subsequent Releases

- Pre-fill data related to tax payments

- Upload of ITR

- Questionnaire on the grounds of functionality, which assists in finding which ITR is subject to you

- Payment of taxes through this utility

- Facility to check and upload ITR through the utility itself

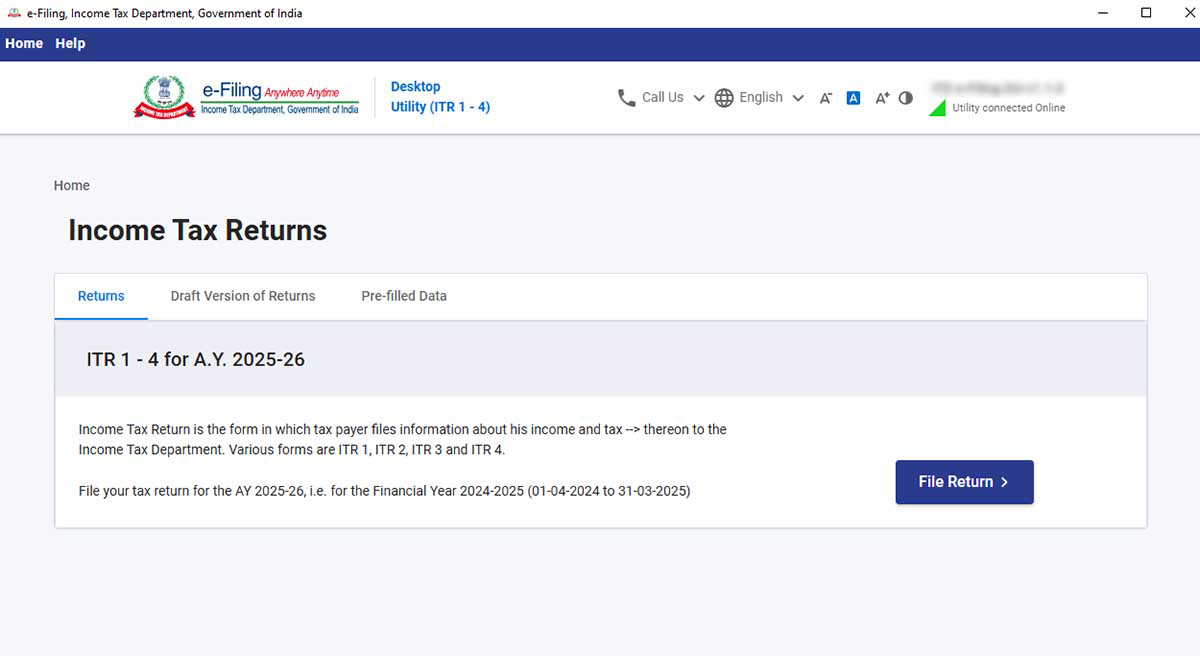

Step 6:

You will find 3 tabs: –

- Returns: if filing done by you is for the 1st time, then tap on “File returns” in this tab.

- The draft version of returns: if the returns furnished by you have already been executed, then you can see the draft version of your returns in the tab and tap on “edit”.

- Pre-filled Data: This will make you see all the pre-filled ITR information that you had before importing it into the utility.

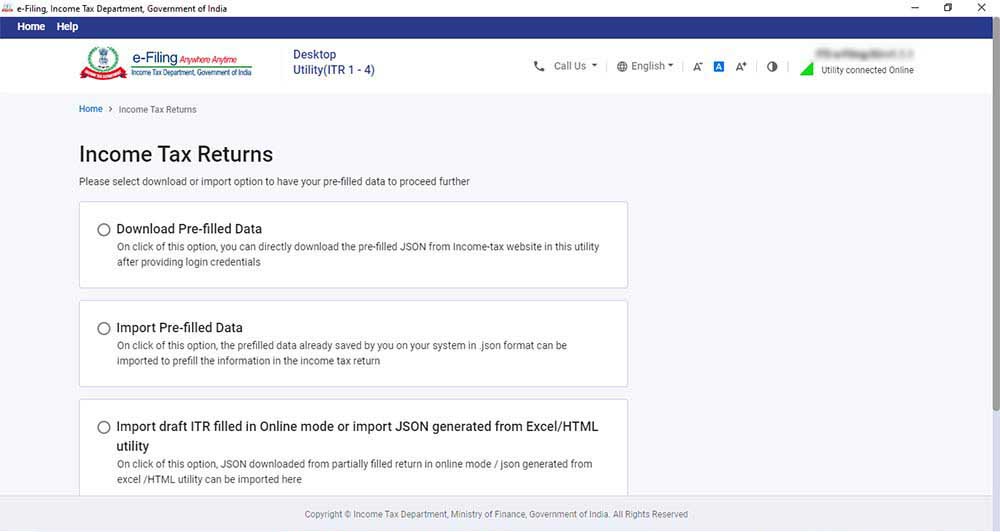

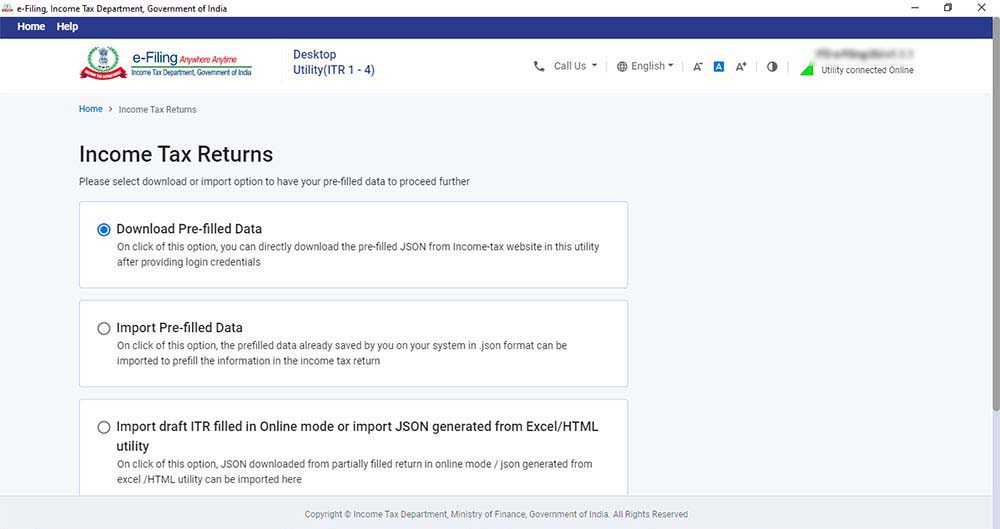

Step 7:

After clicking on “File returns”, select the radio button to “Import pre-filled data”. On tapping the option, the pre-filled information, which was previously saved by you in the system in .json format, will be imported to prefill the data in the income tax return.

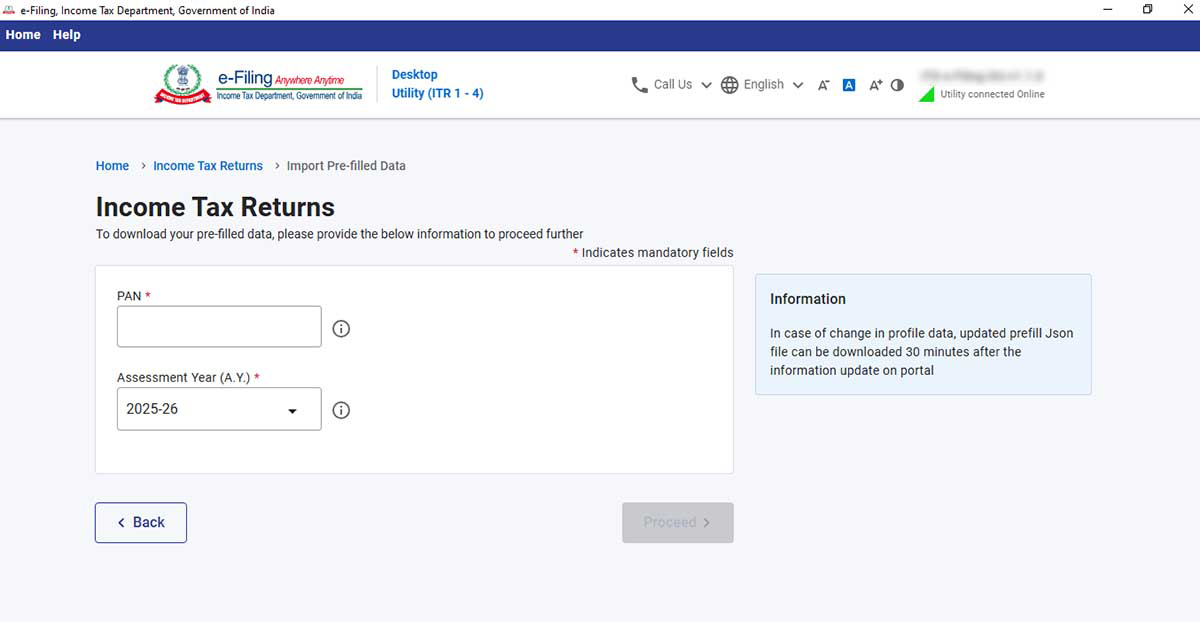

Step 8:

Insert PAN for whom you need to furnish the return and choose the “Assessment year”, and tap on “Proceed”. The assessment year 2025-26 can be chosen.

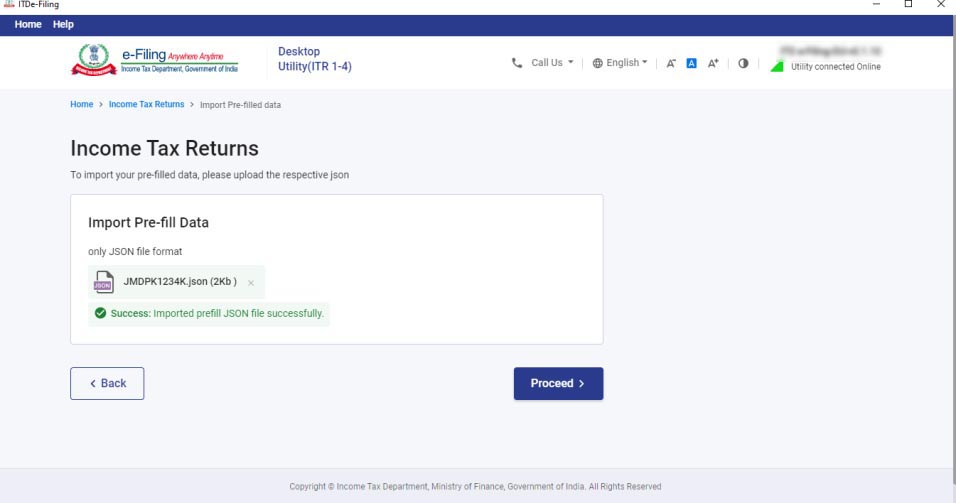

Step 9:

Pre-filled JSON can be downloaded after logging into the e-filing portal through:

‘My Account -> ‘Download Pre-Filled for AY 2025-26’ and is imported to the utility for pre-filling the personal and other opened information.

Next, attach the pre-filled file of JSON via the system and tap on “proceed”.

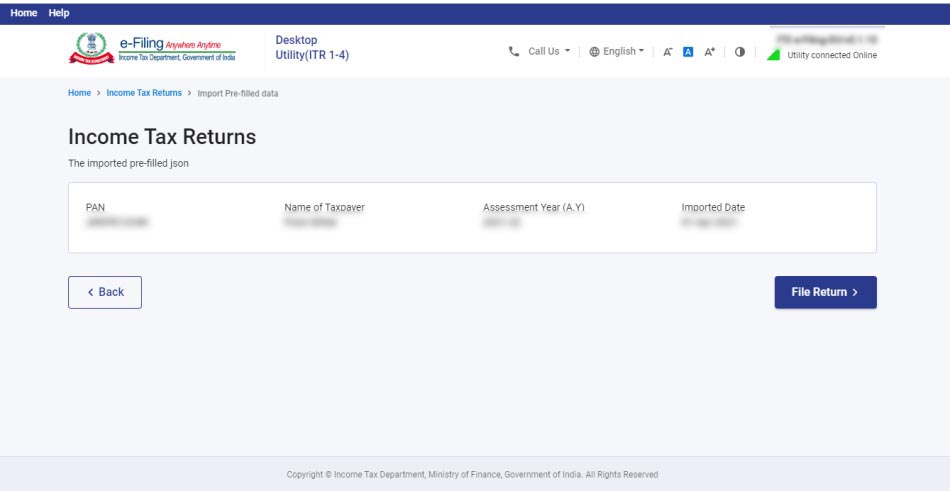

Step 10:

Tapping on proceed in the earlier screen, you will be moved towards the “Income Tax Returns” screen, in which you can view the general pre-filled details via the option as an imported JSON file. Click on “File Return” to continue

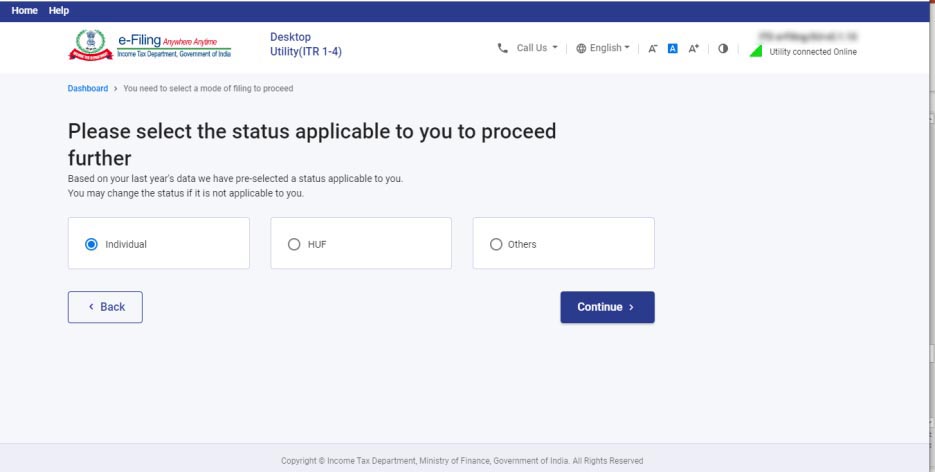

Step 11:

Choose the status that applies to you and tap on “continue”. The status will be prefilled with last year’s information and allowed to be edited.

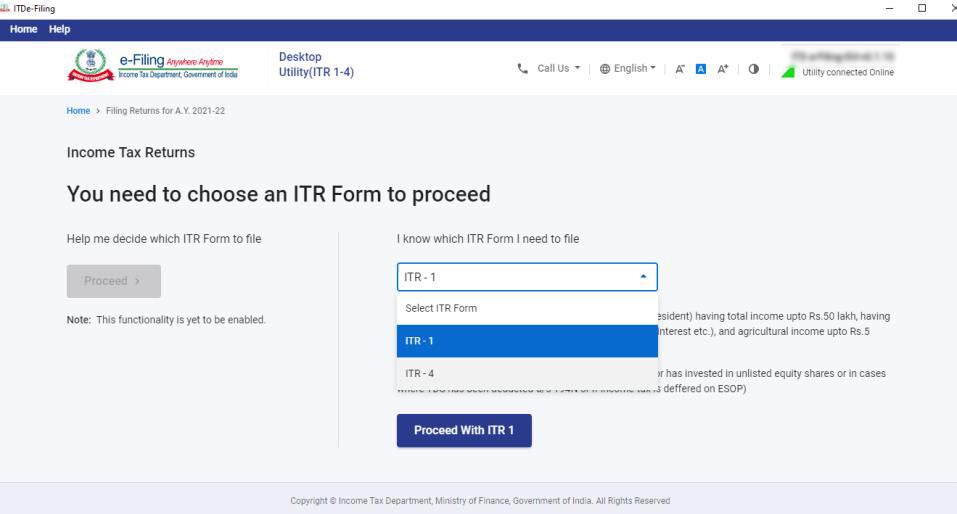

Step 12:

Choose the ITR type where you need to furnish via the dropdown and “Proceed”. The user-friendly questionnaire to determine the Income Tax Return (ITR) subject towards you shall be present in the further release of the offline utility.

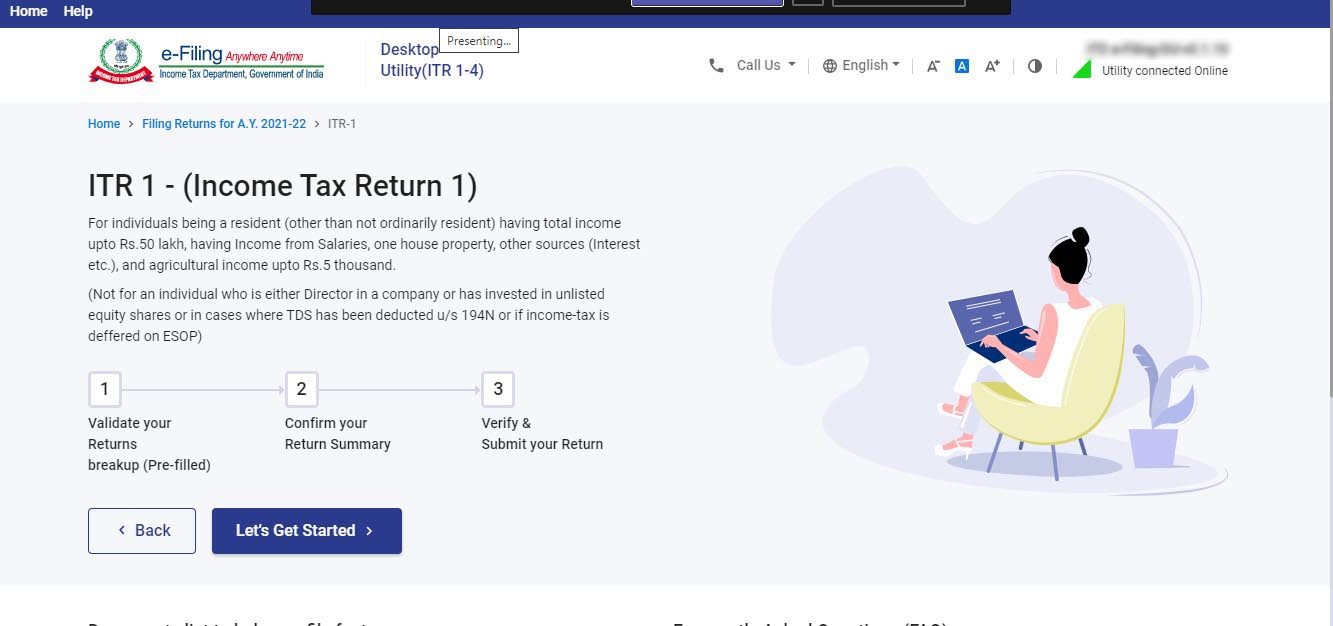

Step 13:

To execute the filing, Tap on “let’s get started”.

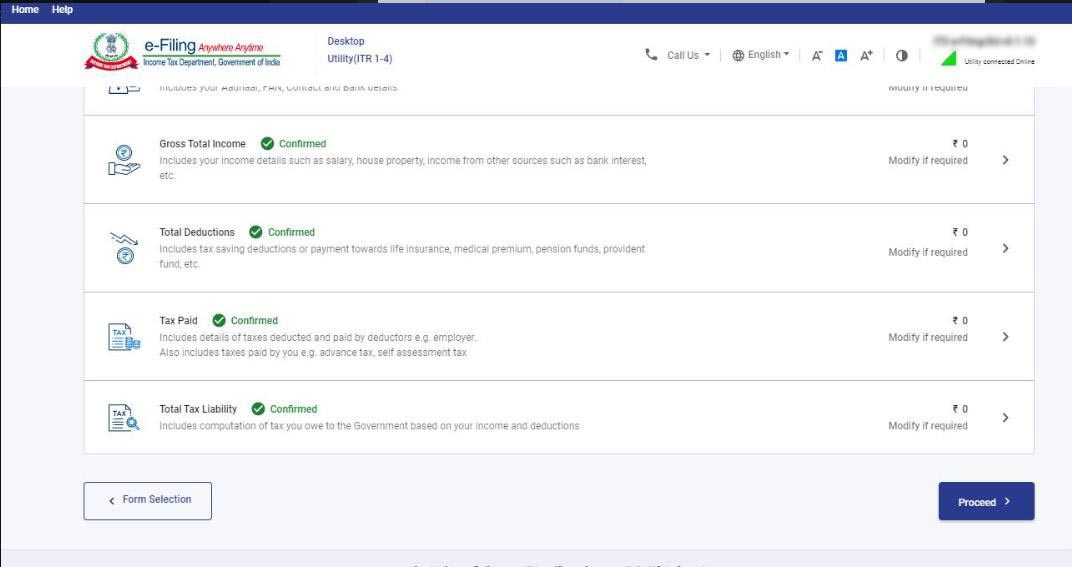

Step 14:

Fill in the subject and important field of the ITR (Income Tax Return) form -> verify all the tabs of the ITR form and the tax that is computed.

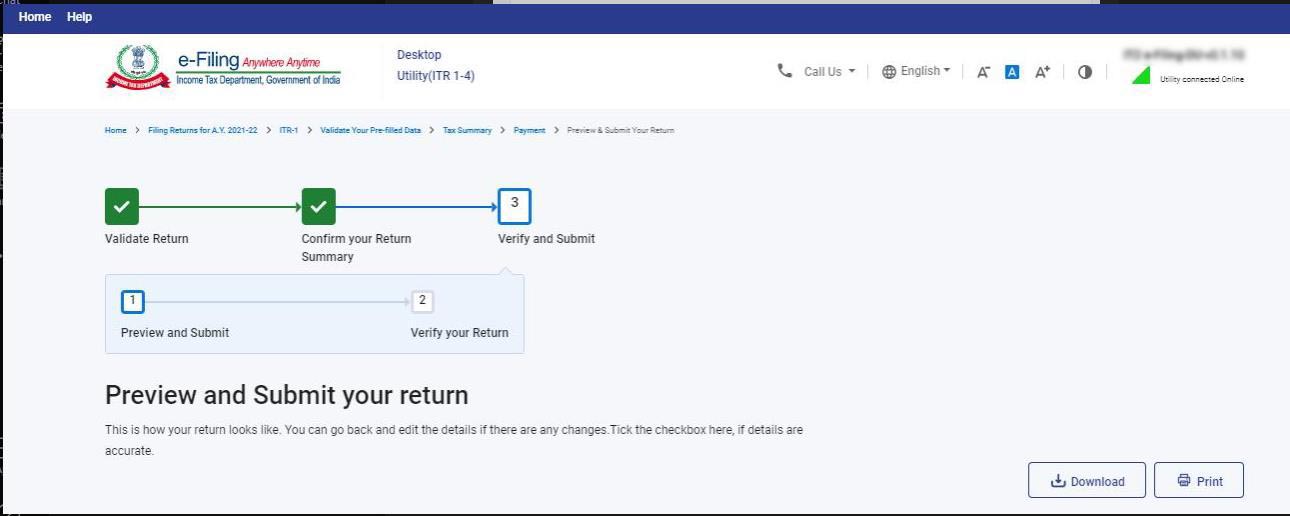

Step 15:

You could download or print the preview by tapping the corresponding buttons. You can download the preview on your system. It will be downloaded in PDF format. Step-by-Step Guide – Fill Income-tax Return

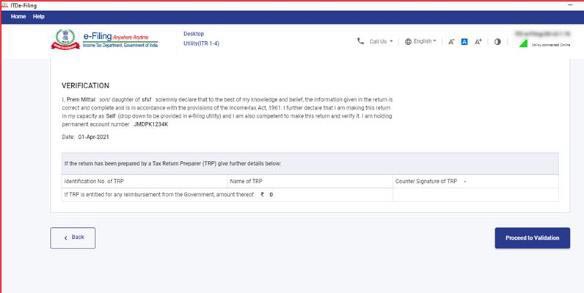

Step 16:

Tap on the “Proceed to validation” to validate the Return

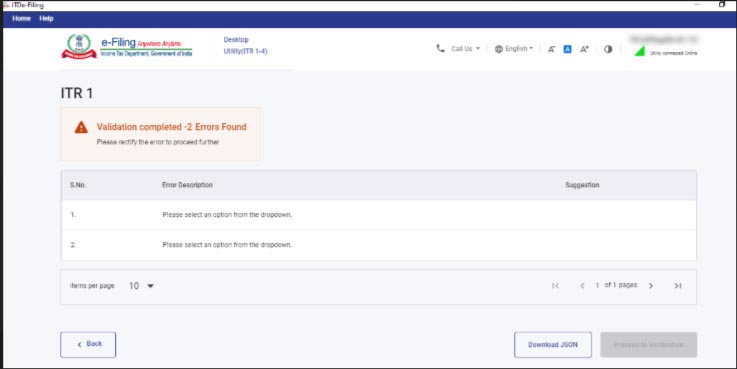

Step 17:

All the errors need to be verified by the user post that he can download JSON. You need to tap on the error you will automatically come to the field that has a relation with the error.

Read Also: Free Download Income Tax Return E-Filing Software