The reassessment notice issued for failure to follow the procedure prescribed under Section 148A of the Income Tax Act, 1961, has been quashed by the Delhi High Court.”

Chandra Prakash Srivastava, the applicant, has filed a petition challenging an order dated July 28, 2022, which was issued under Section 148A(d) of the Income Tax Act, 1961. This petition also contests a notice dated the same day, issued under Section 148 of the Act, along with additional proceedings concerning the assessment year 2015-16.

The applicant’s company submitted an income return for the AY 2015-16 on 30.09.2015, declaring a loss of ₹7,28,478. Under Section 148 of the Act, the Assessing Officer [AO] issued a notice on 28.06.2021 asking to reopen the Assessment for the AY 2015-16.

But after 31.03.2021, the said notice was issued, the quoted procedure u/s 148A of the Act was not complied with, since the notice was premised on the provision of the reassessment as was in force before 31.03.2021.

On May 25, 2022, the Assessing Officer (AO) cited the Supreme Court’s decision in Union of India & Ors. v. Ashish Agarwal (2022) to support the claim that the petitioner’s income may have escaped assessment.

Based on this, the AO treated the earlier notice issued on June 28, 2021, under Section 148 of the Income Tax Act as a deemed notice under Section 148A(b). The petitioner submitted a response to this notice on June 6, 2022.

An order was passed by the AO on 28.07.2022 u/s 148A(d) of the Act, stating that it was a suitable matter for the issuance of a notice u/s 148 of the Act concerning AY 2015-16. With a notice, the said order was forwarded to the applicant on 28.07.2022, issued u/s 148 of the Act.

The applicant claimed that the proceedings as per the impugned notice on 28.07.2022 need to be set aside as per the concession incurred via the revenue before the Apex court in Union of India and Ors. v. Rajeev Bansal: 2024.

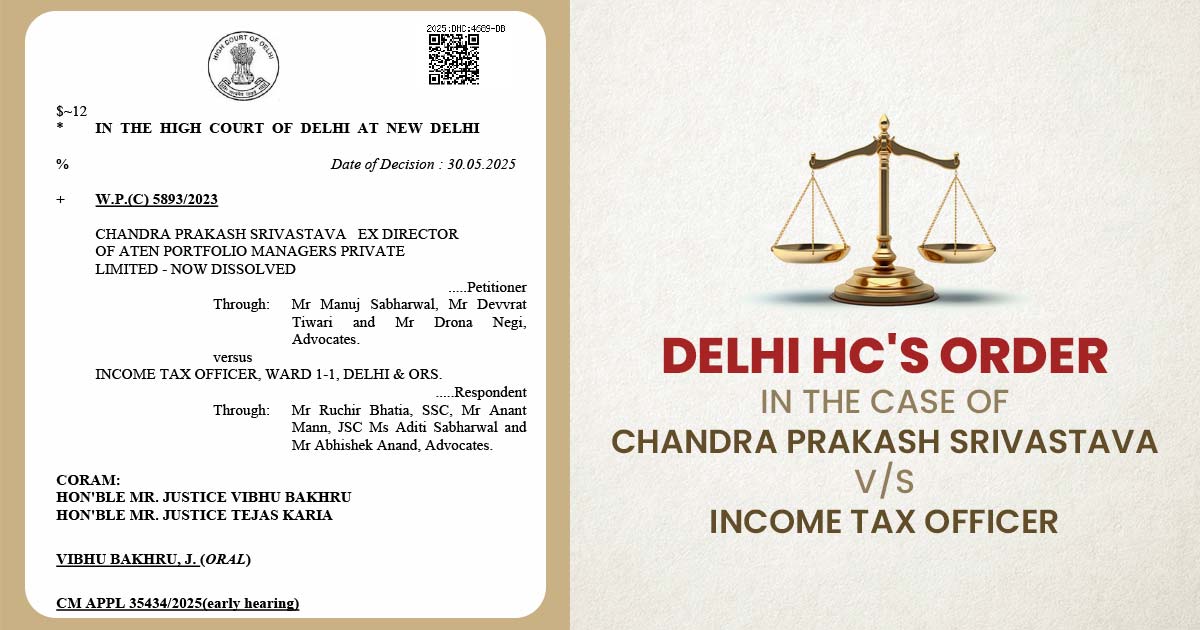

The impugned notice and the proceedings have been set aside by the division bench of Justice Vibhu Bakhru and Justice Tejas Karia.

Since the revenue incurred a concession in the decision that specified above is towards the AY 2015-2016, all notices issued on or after 1st April, 2021 shall need to be dropped as they shall not fall for the completion in the stated duration under taxation and other statutes (Relaxation and Amendment of certain Provisions Act, 2020).

In this case, nothing needs to be adjudicated as the notices, so far as the present litigation is concerned, are on 25.6.2021.

U/s 148 of the Act, the impugned notice issued has been quashed and set aside by the court on 28.07.2022.

| Case Title | Chandra Prakash Srivastava vs. Income Tax Officer |

| Case No. | W.P.(C) 5893/2023 |

| Counsel For Appellant | Mr Manuj Sabharwal, Mr Devvrat Tiwari and Mr Drona Negi |

| Counsel For Respondent | Mr Ruchir Bhatia, Mr Anant Mann, Ms Aditi Sabharwal and Mr Abhishek Anand |

| Delhi High Court | Read Order |