A judgment has been furnished by the Income Tax Appellate Tribunal (ITAT) Delhi on 17th May 2024, in the matter of Saroj Sangwan Vs Income Tax Officer (ITO), addressing critical issues surrounding Section 148 of the Income Tax Act.

The same case, related to the AY 2011-12, examines the procedural virtue and jurisdictional control of the reassessment proceedings of the Income Tax Department. The appellant, Saroj Sangwan, contested the reassessment notices validity and orders issued by non-jurisdictional officers, raising noteworthy questions concerning the principles of natural justice and legal compliance.

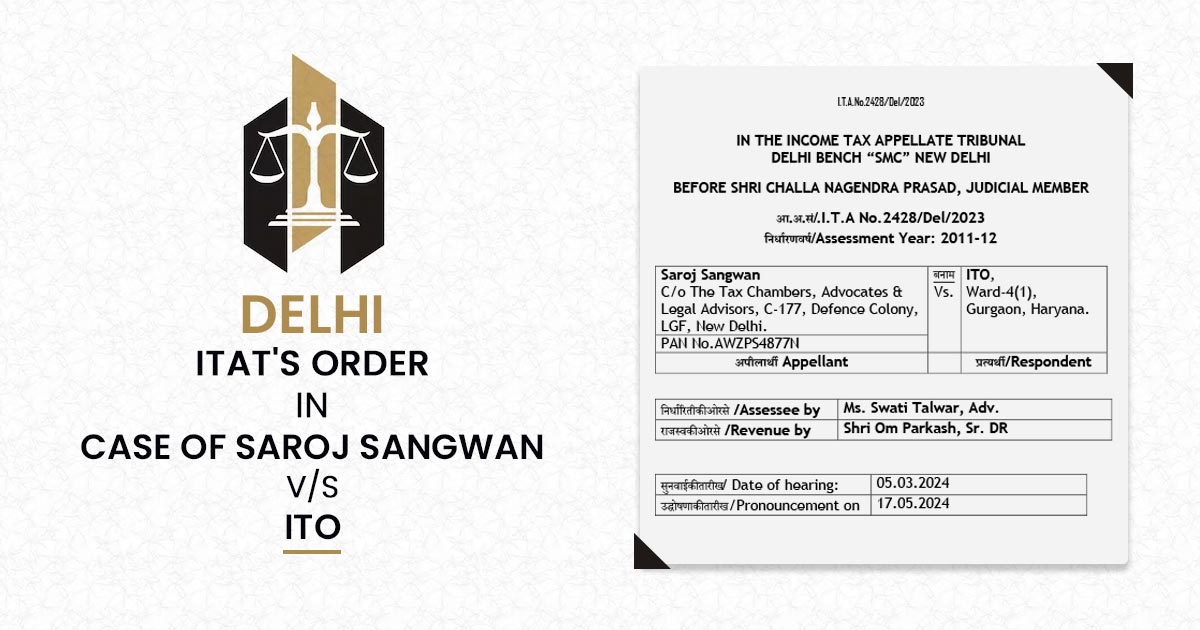

Details Analysis in Case of Saroj Sangwan Vs ITO

The petition for a distinct basis, particularly concentrating on the jurisdictional legality of the reassessment notice under section 148 issued by the Income Tax Officer, Ward 69(1), New Delhi. Key opinions and legal precedents were shown to contest the procedural validity of the reassessment process:

- Errors in Jurisdiction and Invalid Procedures: It was argued by the appellant that under Section 148 the reassessment notice was issued by an officer who does not have jurisdiction over her case. The following transfer of the file to the jurisdictional officer, ITO Ward 4(1), Gurgaon, was asserted to be procedurally flawed, rendering the reassessment order invalid. Through referencing the other identical cases like Nishi Kapoor Vs ITO and Hynoup Food & Oil Industries Ltd. Vs ACIT, where reassessments were quashed because of jurisdictional differences, the same contention was assisted.

- Violating Natural Justice: The proceedings of reassessment were asserted to be arbitrary and not in compliance with the principles of natural justice. As per the appellant, the initial notice and the measures were opted with no adequate proof or valid jurisdiction, subsequently breaching her right to a fair assessment procedure.

- Mechanical Sanction Without Application of Mind: The recorded satisfaction by the higher authorities like the Additional Commissioner of Income Tax (ACIT) and the Principal Commissioner of Income Tax (PCIT), was claimed to be mechanical and without any thoughtful acknowledgement. The whole reassessment procedure was asserted to be vitiated by this mechanical sanction.

- Precedents and Legal Interpretations: For substantiating the claims of the appellant various case statutes were quoted along with the ITAT Delhi Bench and the Hon’ble Gujarat High Court decision. Such precedents supported the assertion that reassessment proceedings prompted by officers with no jurisdiction and finished via different officers without recording fresh reasons are legally unsustainable.

Conclusion: The decision of ITAT Delhi in Saroj Sangwan Vs ITO arrived as a substantial ruling in tax jurisprudence, highlighting the significance of jurisdictional precision and procedural integrity in reassessment proceedings u/s 148 of the Income Tax Act.

The reassessment has been quashed by the tribunal underlining that the notice furnished via a non-jurisdictional officer was not valid and on a wrong notice the next reassessment via the jurisdictional officer was established.

The same matter is supported by the need for the tax council to comply with the legal obligations and keep the principles of the natural justices to ensure a fair and statutory tax administration.

The judgment furnished the relief before the appellant and indeed designated a crucial precedent for the subsequent reassessment matters, emphasizing the judicial investigation obligated to carry the virtue of the procedure of the tax assessment.

| Case Title | Saroj Sangwan Vs ITO |

| Case Number: | I.T.A No.2428/Del/2023 |

| Date: | 17.05.2024 |

| Counsel For Assessee By | Ms. Swati Talwar, Adv. |

| Counsel For Respondent By | Shri Om Parkash, Sr. DR |

| Delhi ITAT’s | Read Order |