The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has mentioned that service charge collected by a medical store in the hospital is covered under Health Care Services and are waived from Service Tax.

The Bench of Binu Tamta (Judicial Member) has marked that medical aid to the patients who are admitted to the hospital, most of the time need urgent care and treatment within time and that is the reason for having a medical store within the vicinity of the hospital.

Consequently, the in-house patients are largely dependent on the medicine shop in the hospital. Therefore the allegation raised by the revenue that this amount is the commission which the hospital is levying from the medicine store is not correct

Section 2(j) of the Notification No. 25/2012 defines Clinical Establishment any hospital, nursing home, clinic, sanatorium, or similar institution that furnishes diagnosis, treatment, or care for illness, injury, deformity, abnormality, or pregnancy in recognized Indian medical systems, or a place for diagnostic or investigative services of diseases.

Section 2(j) of the Notification No. 25/2012 explains Clinical Establishment as any hospital, nursing home, clinic, sanatorium, or similar institution that furnishes diagnosis, treatment, or care for illness, injury, deformity, abnormality, or pregnancy in recognized Indian medical systems, or a place for diagnostic or investigative services of diseases.

After the preface of the negative list regime, with effect from 1.7.2012, the health care services are not levied to service tax under Notification No.25/2012-ST. The health care service provided by a clinical establishment is waived from service tax as per Section 2(i) of the Mega Exemption Notification.

Section 194H of the Income Tax Act, of 1961 is for income tax deducted on any income through commission or brokerage by any person liable for paying a resident.

The business of the taxpayer/appellant is to provide the taxable service namely, Health Club & Fitness Services, Renting of Immovable Property Services, and Health Care Services. The Department established that the taxpayer had collected an amount from the in-house medical store u/s 194H of the Income Tax Act, 1961, which relates to commission or brokerage and had not paid any service tax.

A SCN was issued, alleging non-payment of service tax of Rs. 9,23,665 on commission received from the medical store for the period 2015-2016 to June 2017.

The demand for adjudication under the SCN was confirmed. The taxpayer dissatisfied furnished a plea to the Commissioner (Appeals), who denied the appeal and confirmed the demand for service tax under the category of Business Auxiliary Service while rendering health care service. The taxpayer contested the order passed by the Commissioner (Appeals) before the Tribunal.

It was argued by the taxpayer that the taxpayer is operating a hospital and delivering distinct medical services to the patient. The taxpayer services are particularly health care and medical services. Consequently, processing charges received for Mediclaim are the ancillary service and are categorized under the medical service itself and waived from service tax.

It was furnished by the Revenue that the amount retained from in-house medical store covered as services under the heading of “Business Auxiliary Service” and therefore, obligated to Service Tax.

The Tribunal examined the definition of “clinical establishment” under Section 2(j) and “health care service” under Section 2 (t) of Notification No. 25/2012 and kept that the taxpayer who is running the hospital is covered under the definition of “clinical establishment”, which at the outset says the clinical establishment means hospital and is rendering the healthcare services as defined therein.

Consequently, the Tribunal mentioned that Medical aid to the patients who are admitted in the hospital, most of the time needs urgent care and treatment without time and is the reason for having a medical store within the vicinity of the hospital. Accordingly, the in-house patients are largely dependent on the medicine shop in the hospital.

In this case, the hospital which is providing multifarious services under the health care services has the responsibility that the medicines which are the most crucial input in any treatment are available to the patients urgently and simultaneously the payment thereof to the medicine shop is made, for which the hospital is demanded to assimilate the claim in regard of all the services rendered to the patients and forward them to the insurance company.

Therefore the allegation raised by the revenue that this amount is the commission that the hospital is assessing from the medicine store is not correct

The Tribunal for comprehending the concept of the term treatment, it is critical to learn that drug therapy is an important and integral part of treatment. The medicines are utilized to treat or cure illness along with that the intended use of the medicines is in the diagnosis, mitigation, or disease prevention.

The revenues attempt to classify the amount retained via the taxpayer as services under the heading Business Auxiliary Service amounts to restricting the health care service definition to draw under the tax net which is opposite to the intent of the legislature to waive of the health care service, Bench said.

The Tribunal in view of the aforesaid permitted the plea.

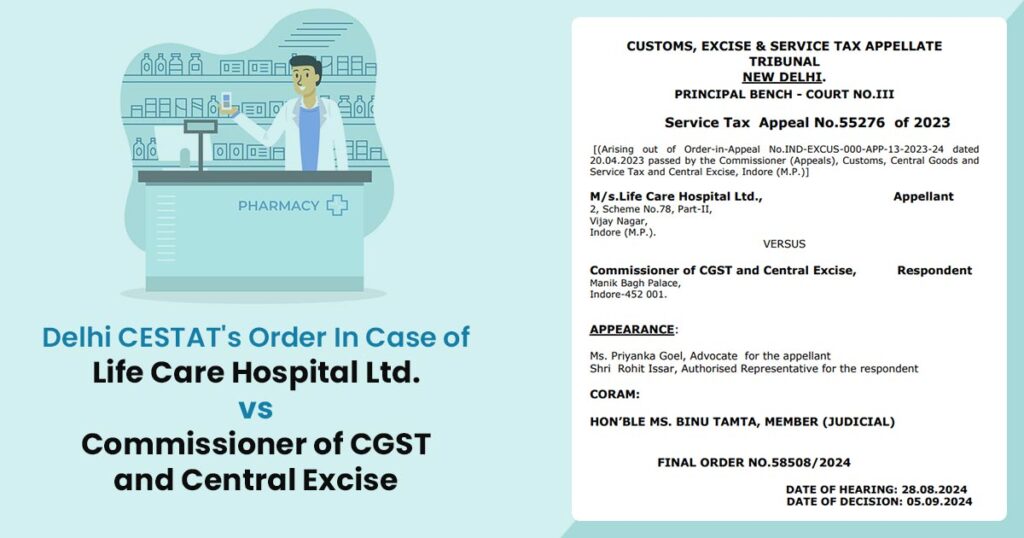

| Case Title | M/s.Life Care Hospital Ltd Vs. Commissioner of CGST and Central Excise |

| Service Tax | Appeal No.55276 of 2023 |

| Date | 05.09.2024 |

| Appellant | Ms. Priyanka Goel, Advocate |

| Respondent | Shri Rohit Issar, Authorised Representative |

| Delhi CESTAT | Read Order |