The addition of ₹5,01,500 made by the Assessing Officer (AO) under Section 69A of the Income Tax Act, 1961, has been overturned by the Cuttack Bench of the ITAT, which held that the cash deposits made during the demonetisation period were substantiated as business receipts.

Tekchand Harilal, a firm that operates as a distributor of fast-moving consumer goods (FMCG) for brands like Nestle, Amul, and PDS kerosene, submitted its income tax return for the Assessment Year (AY) 2017-18, reporting a total income of Rs. 83,940. The income tax department selected this case for scrutiny primarily due to a significant increase in cash deposits made during the demonetization period.

The Assessing Officer (AO) rejected Rs. 5,01,500 from the total cash deposits of Rs. 13,68,500 by applying Section 69A of the Income Tax Act. Additionally, the AO made an adhoc disallowance of Rs. 19,360, which was calculated as 10% of the carriage outward expenses.

The taxpayer, dissatisfied with the AO’s order, appealed to the Commissioner of Income Tax (Appeals) [CIT(A)], who upheld the findings of the AO. The unsatisfied taxpayer from the order of CIT(A) filed a plea to the ITAT.

The counsel for the assessee presented an argument highlighting that the assessee regularly collected cash from retailers as an integral part of its business operations. These cash amounts were subsequently deposited into the assessee’s bank account.

Furthermore, the counsel emphasised that these cash deposits, which included Specified Bank Notes (SBNs) during the demonetization period, were duly recorded in the books of account, reflecting legitimate business receipts.

The counsel relied on a decision of the Visakhapatnam Bench of ITAT in the matter of Polepalli Srinivasulu Gupta vs. DCIT, which ruled that sale proceeds invariably deposited in the bank are legally valid and not subject to addition.

The single-member bench, comprising Duvvuru RL Reddy (Vice President), stated that the taxpayer was engaged in two businesses: the sale of FMCG products and the distribution of subsidised PDS kerosene.

Read Also: ITAT Removes INR 14 Lakhs Addition U/S 69A Due to Incorrect Transaction Details Recorded by AO

The taxpayer had submitted bank statements, purchase and sale registers, cash books, and month-wise cash deposit details for the AY 2017-18, as well as for the preceding and succeeding years, which demonstrated uniform business operations, the bench noted.

The bench mentioned that CIT(A) had considered the type of business of the taxpayer in its order, and no discrepancies were discovered in the cash deposits in the years.

The taxpayer has elaborated the cash deposits source as business receipts, and the Assessing Officer (AO) was unjustified in deeming them as unexplained money u/s 69A. It asked AO to remove the addition of Rs 5,01,500. The taxpayer’s appeal was permitted.

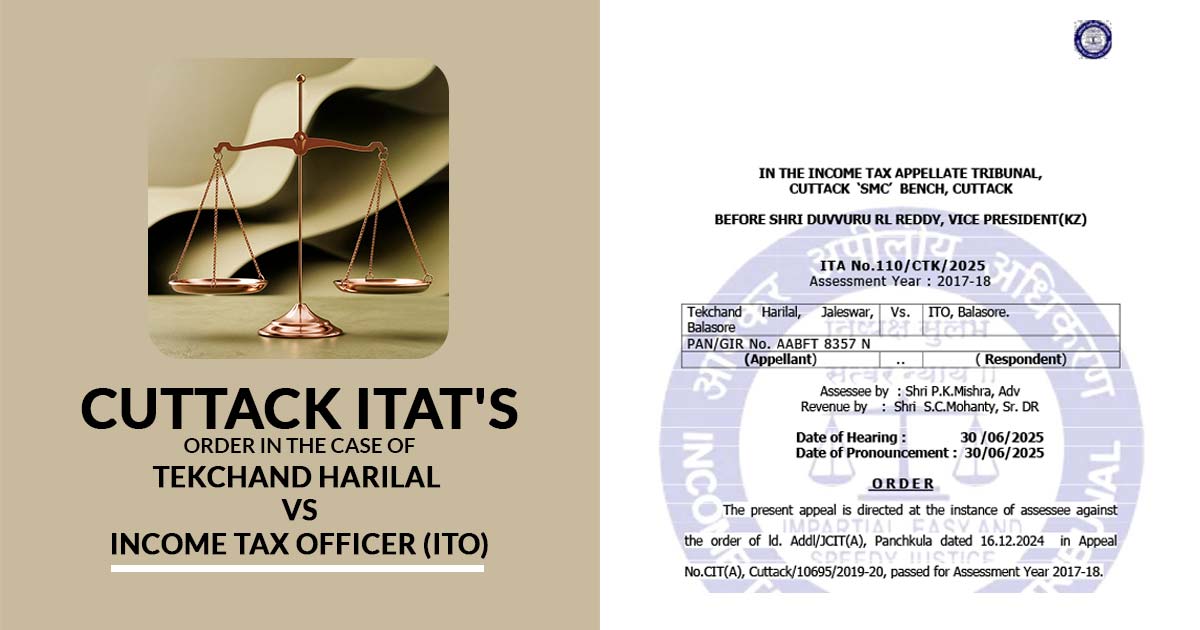

| Case Title | Tekchand Harilal vs. Income Tax Officer (ITO) |

| Case No. | ITA No.110/CTK/2025 |

| Assessee by | Shri P.K.Mishra |

| Revenue by | Shri S.C.Mohanty |

| Cuttack ITAT | Read Order |