The new filing system is starting up on April 1, 2020, the demonstration session about the same shall be first conducted by the Goods & Services Tax (GST) department adhering to the orders of Finance Minister Nirmala Sitharaman.

FM has given orders to the GST dept to organise demo & consultation sessions for new return mechanism to get feedback so that the loopholes can be removed before the final launch of the new return system.

In India, there are more than 1.20 crore assessees whom all are mandatorily required to file GST returns

“Select assessees along with their accountants will be invited in each of the circle (of Central Board of Indirect Taxes & Custom) on December 7,” Revenue Secretary Ajay B Pandey said.

In a meeting between the Finance Minister and tax assessees, FM discussed the ways to simplify the current process of filing returns and make it more convenient for users, with the tax assessees who were classified in five groups. FM along with Senior GST and GSTN officials gave thoughtfulness to the different issues w.r.t return filing kept forth by five bodies/individuals. The five sums up Rajasthan Tax Consultants’ Association, Laghu Udyog Bharti, ICAI, CAIT, and a high profile tax professional.

According to Revenue Secretary, issues are not prevailing w.r.t basic filing of returns. However, problems are associated with some entries where amendments have been done such as issuance of credit note or debit note, reconcilement of input tax credit (ITC) for purchaser who is filing monthly return and seller who is filing quarterly return and tax official’s demand to present physical invoice even when details are available in GST Return Form 2A.

He underlined that many measures have been suggested and taken to improve the ease and user-friendliness in return filing process and linking up different forms while considering other issues encountered by assessees. Taxpayers are free to file monthly or quarterly returns. Further improvements will be helpful for businessmen to claim ITC easily.

Pandey also notified the availability of new GST return forms for trial on the portal as part of a pilot scheme. Approx 85000 new forms have been furnished till yet on a pilot basis. Such filers are also filing the current forms as mandatory by the law.

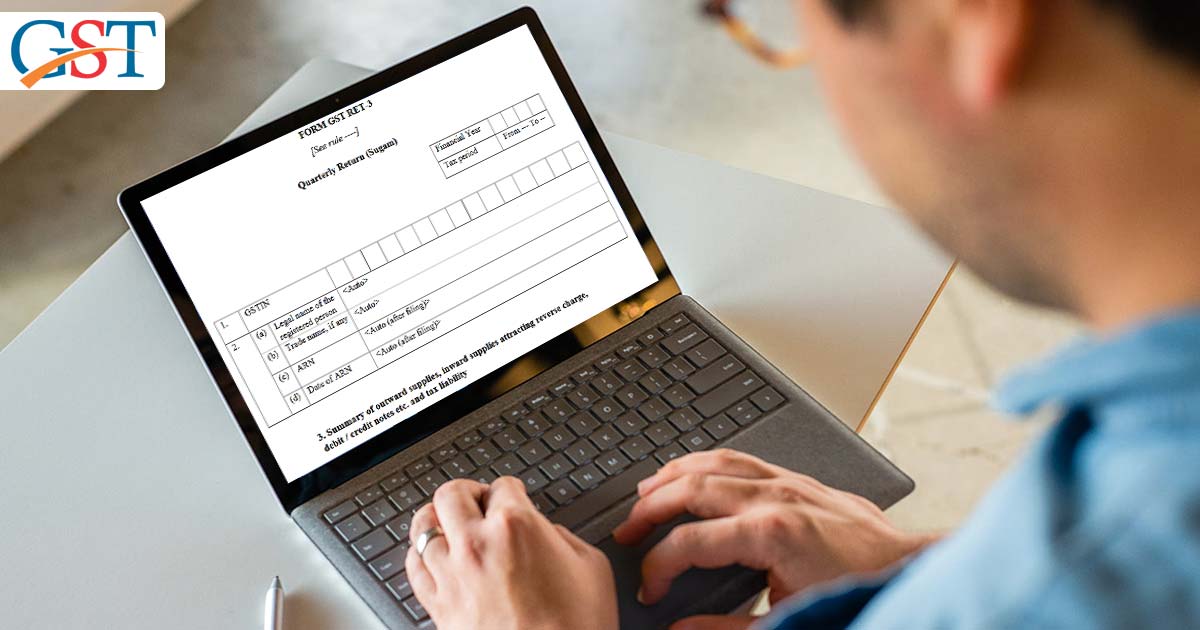

The major population of assessees is having an annual turnover of less than ₹5 crores. 70% assessees with an annual turnover of less than ₹5 crore and engagement in B2B (business to business), B2C (business to consumer) and RCM based supplies can choose to file quarterly return Form- ‘SUGAM’ (RET-3)

Among the 28%, assessees with an annual turnover lower than ₹5 crores and engagement in B2C and reverse charge-based supplies can choose to file – ‘SAHAJ’ form (RET-2)

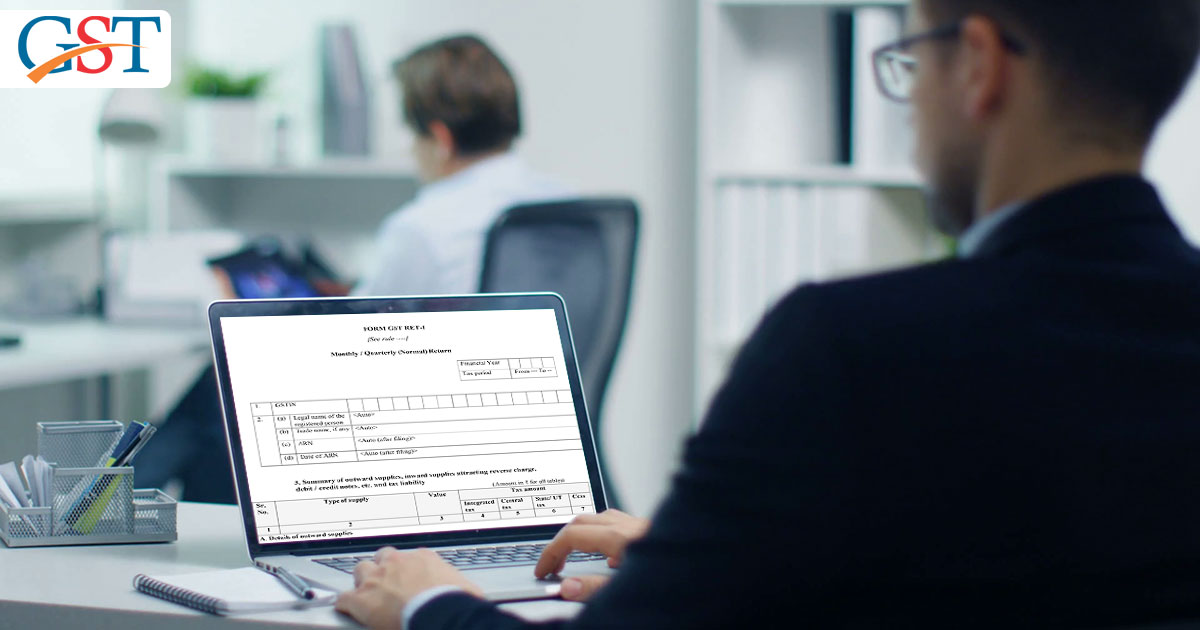

Approx 7% assessees with annual turnover above ₹5 crores, will have to file monthly return in RET-1

Unlike the existing system, the possibility to showcase higher tax liability to claim higher ITC will be nil under the new return filing mechanism because at present two different amount can be furnished as tax liability in GSTR 1 and as tax payment in GSTR 3B as the two forms are not interconnected.

Read Also: Easy Guide to GST ANX-1 & ANX-2 (GST New Return Filing)

However, under the new mechanism, the taxpayer will have to pay the taxes auto-populated from ANX-1 via RET-1/2/3. The auto-populated tax will have to be paid by utilising cash as well as ITC which will be auto-populated via ANX-2. Besides, the details will be allowed to be amended only by the creator of the Form.