Form 26QB has significant importance in the process of deducting tax at source (TDS) for property sales. However, occasional errors and mistakes may occur during the submission of this form. If you come across any inaccuracies in your Form 26QB, there’s no need to worry, as you can rectify them.

This article has been written to provide a comprehensive guide on how to correct Form 26QB effectively.

Fill Form for ITR & TDS Compliance Software

What is the Process to Correct Form 26QB-TDS Online?

Below is the authentic process to easily correct the 26QB form with important queries for taxpayers.

The 26QB-TDS Form on Property Sale

Form 26QB is an e-form also known as a “challan-cum-statement.” It is used for deducting tax under Section 194-IA of the Income Tax Act, 1961, regarding property transactions.

The deductor, who is the buyer of the property, is required to file Form 26QB electronically on the Income Tax Department’s e-filing website (www.incometax.gov.in) within 30 days from the end of the tax deduction month.

What are the Steps to Correct Issues/Mistakes on Form 26QB?

The deductor, i.e., the buyer of the property, can rectify errors or mistakes in Form 26QB online by logging into the TRACES website. For easy understanding and utilization of the 26QB correction functionality, relevant e-tutorials are available on the home page of the TRACES website.

In Form 26QB, Who is Eligible to Apply for Corrections?

Only deductors (buyers of the property) who are registered on the TRACES website can submit a request for correction in Form 26QB. The option for “26QB” correction can be found under the “Statements/Forms” tab.

Is it Possible to Correct Certain Aspects of Form 26QB?

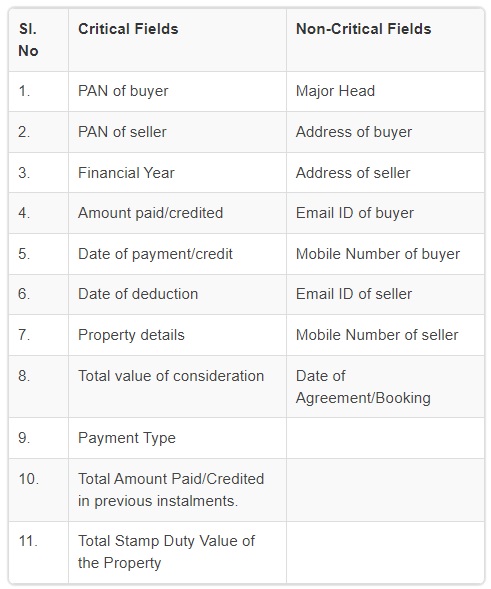

Corrections can be made in both critical fields (allowed for correction only twice) and non-critical fields. The following fields are categorised as critical and non-critical for correction purposes:

How Does Form 26QB-TDS Need to Be Corrected?

The steps for correcting Form 26QB are outlined below:

Step 1: Log in to the TRACES website as a taxpayer using your registered User ID and Password.

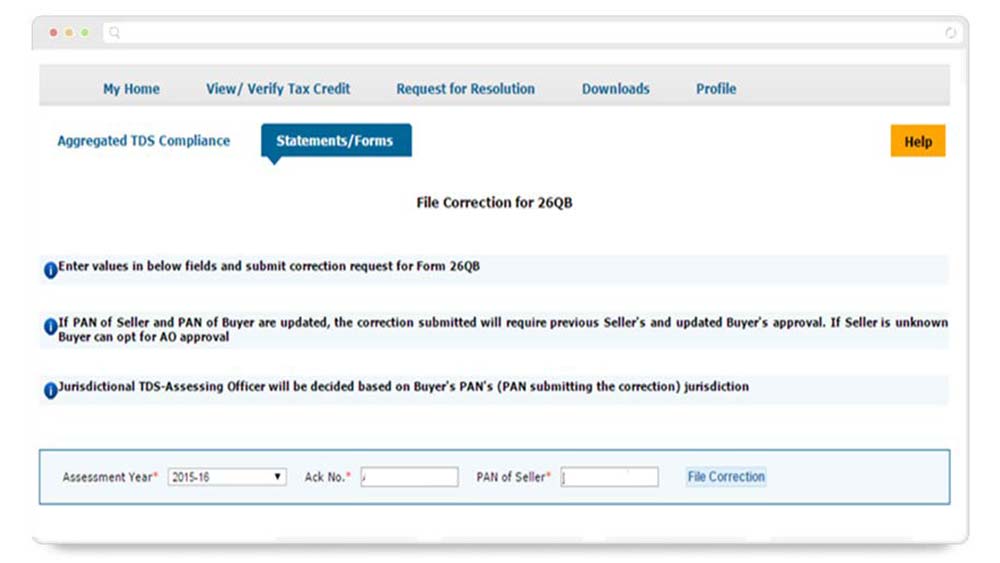

Step 2: Under the “Statements/Forms” tab, select the option “Request for Correction” to start a correction request.

Step 3: Enter the relevant details such as“Assessment Year,”, “Acknowledgement Number,” and “PAN of Seller” based on the filed 26QB form. Click on “File Correction” to submit the correction request. Upon submission, a request number will be generated.

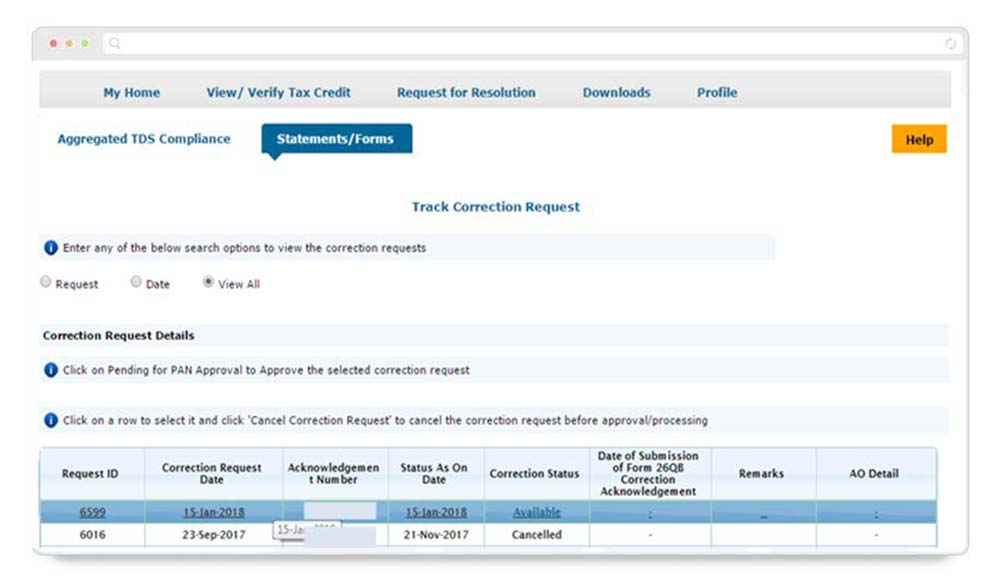

Step 4: Go to the “Track Correction Request” option under the “Statements/Forms” tab and start rectifying after you see the status as “Available”. Click on the “Available” status to proceed.

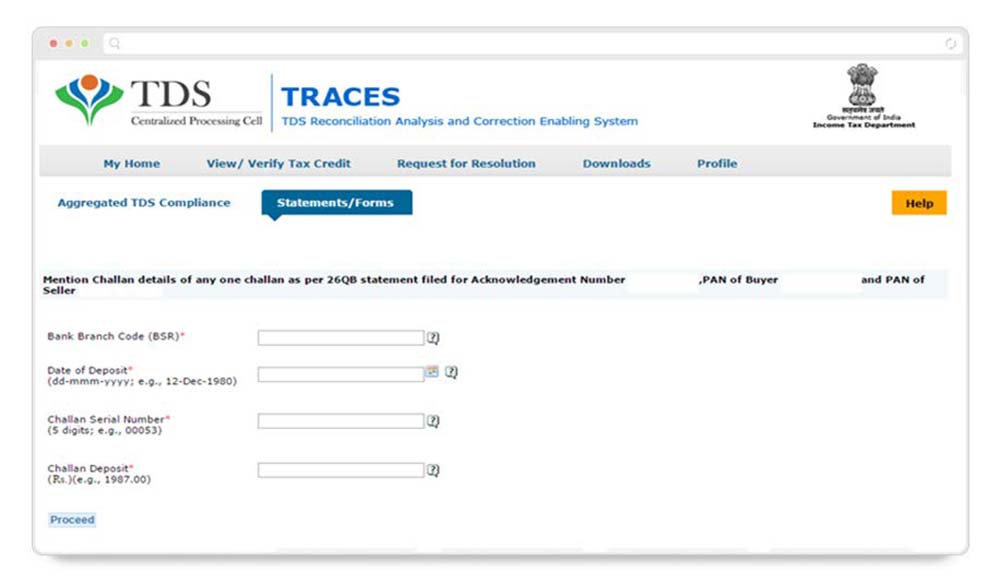

Step 5: Provide the CIN (Challan Identification Number) details as per the filed 26QB statement, then click on “Proceed.”

Step 6:Select the field that needs to be edited in the 26QB form. After clicking on the “Edit” tab, a message will appear on the screen. Click on “Save” to save the updated details, and then click on “Submit Correction Statement.”

Upon submission of the Correction Statement, a “Confirm details” screen will be displayed, highlighting the updated details in yellow.

The profile details will be populated as updated on TRACES. Click on “Submit Request” to finalise the correction request.

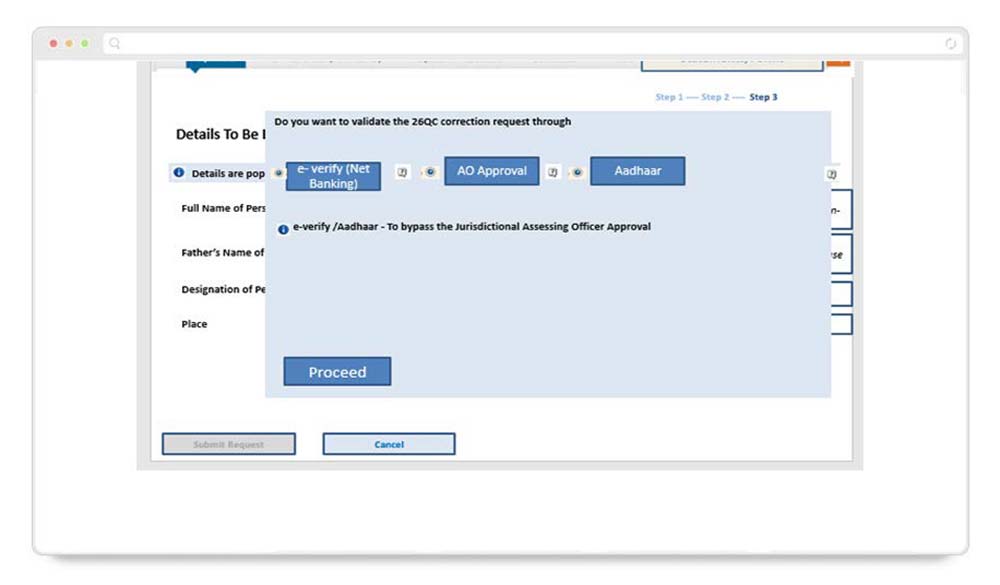

Step 7: After submission, it is necessary to validate the correction request. If your Digital Signature Certificate (DSC) is registered, you can validate the request using the DSC. If your DSC is not registered, you can validate the correction request using options such as e-verification (Net Banking), AO Approval, or Aadhar OTP.

Read Also:- Filing Revised TDS Return Online: Step-by-Step Guide

The profile details will be populated as updated on TRACES. Click on “Submit Request” to finalize the correction request.

Important Points to Remember

- After successfully submitting the correction, the applicant will be issued a Correction ID. This ID can be used to track the status of the correction.

- If your DSC is not registered, you need to provide a hard copy of the acknowledgement of the Form 26QB correction, along with identity proof, PAN Card, documents related to the property transfer, and proofs of payment to the Jurisdictional Assessing Officer (AO) for verification.

- Users can submit 26QB Correction statements without requiring approval from the Assessing Officer by using e-verification (Net banking)/AADHAR/DSC validation.

- Users can submit 26QB Correction statements without requiring approval from the Assessing Officer by using e-verification (Net banking)/AADHAR/DSC validation.

- There is no e-verification option available for NRI taxpayers.