HRA or House rent allowance is one of the benefits received by salaried employees. The benefit is paid to the employees who are living in a rental property and paying rent to a landlord. If so, then can claim tax exemption on the rent amount.

Now, many income tax filers are not aware that they can claim a number of benefits under ITR laws of India. HRA tax claim is one such benefit.

Latest Update

- The CBDT clarifies that concerns regarding retroactive taxation on case reopenings related to HRA claims are wholly unfounded. View more

Free Demo of Gen IT Software for HRA Calculation

Here’s How an ITR Filer can Claim HRA in their Return.

Unlike before, the tax department has now decided to sync ITR-1 with the Form-16, making it easier for people to claim eligible employee benefits in their IT returns. Form-16 is the official TDS certificate issued by an employer to its employees. It contains the details of the TDS (Tax deducted at source) charged by the employer along with the HRA and other related details.

You can now easily claim HRA by attesting a copy of Form-16 with your ITR-1.

However, if you prefer to do it the other way, you can also submit the rent-related documents such as rent agreement or receipts in order to claim HRA when filing your return. But the process can be troublesome for those people who do not have these documents handy.

In case you do not have the rent documents available, you can still claim HRA benefit by manually submitting the eligible HRA amount which is tax-exempted.

Read Also: Section-Based Income-tax Saving Tips For Salaried Person

However, if you do not submit the HRA documents to your employer, the HRA section in your Form-16 will be considered taxable.

Without further ado, let’s now discuss the step-by-step procedure for claiming HRA tax exemption.

Case 1: You have submitted rent documents to the employer

If you submit your rent documents (receipts, etc.) to your employer on time, your Form-16 will show the HRA section as tax-exempt. Now, depending on your eligibility for claiming HRA exemption, either full or part of your HRA for the particular financial year will be exempted.

For instance, if your total annual rent amount exceeds Rs 1 lakh, then you are also required to submit your landlord’s PAN along with your rent documents to the employer.

If any part of your HRA is taxable, it will be added under the head ‘Gross Salary’ of Form-16, while the tax-exempt part will be displayed under the ‘Allowances’ section of the document.

Furnishing Taxable HRA in ITR-1

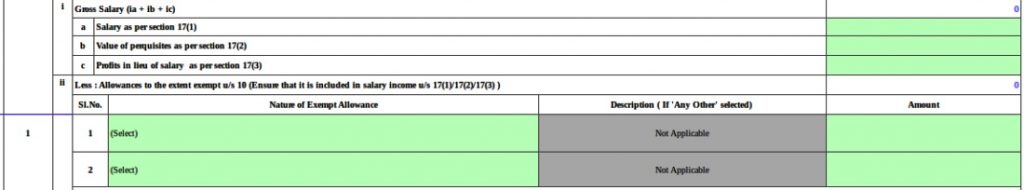

The taxable part of HRA will be mentioned in the part-B of your Form-16 under the head ‘Gross Salary’ according to the provisions in Section 17(1). You can simply copy this information and paste in the ‘Salary as per section 17’ section of your ITR-1 form.

Furnishing Tax-exempt HRA in ITR-1

If you are filing your income tax return on the online website, the chances are that the HRA exempted amount is already pre-filled. If so, you can verify the amount with the information given in your Form-16.

However, if the details are not already filled or if you are filing your return via Excel, you need to file the information manually as follows:

Copy the amount of tax-exempt HRA from part-B of your Form-16 and paste it under the ‘Allowances exempt u/s 10′ head in the ITR 1. Select ’10(13) – Allowance to meet expenditure incurred on house rent’ from the dropdown menu.

Case 2: Not submitted rent documents to the employer

In case if you do not have the required rent documents or have forgotten to submit the same with your employer, then you need to manually calculate the HRA amount which is tax-exempt.

Don’t worry. Here’s a simple example explaining the process of calculating the tax-exemption part of HRA.

Suppose that you earn a monthly basic salary of Rs 30,000 and get a monthly HRA of Rs 10,000. That means your gross salary is Rs 40,000. Now, you are living in Jaipur in a rental apartment and paying a monthly rent of Rs 10,000, but you forgot to submit the rent documents to your employer.

Here’s how to calculate the tax-exempt part of HRA

- Basic annual salary – 30,000 x 12 = 3.6 lakh

- Total HRA received – 10,000 x 12 = 1.2 lakh

- Total rent paid in a year – 10,000 x 12 = 1.2 lakh

Excess of rent paid annually over 10% of basic annual salary = 1.2 lakh – (3.6 lakh x 10%) = 84,000

That means, 84,000 from your total HRA (1.2 lakh) will be tax-exempt, while the remaining 36,000 will be taxable.

Once you have correctly calculated your tax-exempt HRA amount, you need to furnish the same in your ITR-1 form. While filing your return, you will have to deduct the tax-exempt HRA amount from the Gross salary (‘Salary as per provision under section 17’).

Make sure to provide the correct details, including the correct tax-exempt amount of HRA, in your ITR, otherwise, the income tax department may ask you to submit documents for proof of the HRA exemption. So, keep these records available.

Is this Possible to Claim Income Tax Benefits on both Home Loans & HRA?

It is common here that salaried people live in rented property in the city they work and their families (wife, dependent children, and parents) live in other cities in a property purchased with a home loan in the name of the employee.

From time to time these employees try to get proper detail on whether they can claim a tax deduction on both their company’s HRA and tax benefits of interest on their home loan and repayment of the principal amount.

The rules of the Income Tax Act 196 enable a salaried employee to claim both these benefits on fulfilment of specific conditions subject to section 10(13A). This is applicable even if the house purchased is located in the same city where the employee works and resides in a rented property. An employee can claim both HRA and home loan tax benefits if he has let his property rent out and is living in a rented house in the same city.

Experts say that As long as one fulfils the requirements of claiming HRA deduction on the rented house and claiming tax benefit on the home loan, one can avail both the benefits.

One thing to keep in mind is that, in case you are claiming HRA tax deduction but not living in rented accommodation, then in such cases, Internal Revenue Service (IRS) may want to track you. Thus, it is advisable to claim these two benefits only in honest instances and not to avoid paying taxes.

Recommended: Rental Income in AIS Can Stop Fake Claims of HRA Exemption

If you as an employee obtains HRA as part of compensation, you are eligible to claim deduction on payment of house rent. The second condition is that you must pay the rent for the property you rented. You can’t claim an HRA deduction if someone else like your spouse or parents is paying rent for the place where you are residing. Another condition is that the rent paid should not be for your own property. You can’t claim this benefit if you are a joint owner of the said property.

To claim tax benefits on a home loan, it is necessary that you should own the property and the house is complete. You are not allowed to claim tax benefits for properties that are yet under development.

You also need to be the owner of the property and a co-borrower on the home loan taken to complete or buy the property. If it is a jointly owned property, tax benefits can be claimed on the basis of your share of the home loan services rendered by you and not on your percentage of the property.

Under Section 24(b) an employee can claim a deduction of up to INR 2 lakh in the interest of home loan payment in a financial year whereas section 80C allows an employee to take benefit of deduction up to INR 1.50 lakh on principal payment.

7 Key Provisions When You Can Claim HRA on Rent Paid

The Budget 2024 is approaching, the anticipation is much more that the finance ministry might raise certain exemption limits which shall diminish the load of tax.

One of the essential tax exemptions among all is that irrespective of who owns the house the house rent allowance (HRA) could claim. Or when the spouse owned the house, you could avail of the house rent allowance so long as the same is the portion of your salary.

In the amended tax regime the HRA exemption is not allowed. If you wish to avail of the tax exemption for the rent allowance you are required to comply with the old tax regime. Learn the major exemptions as stated below if you wish to learn more about HRA exemptions.

6 major provisions concerned with the HRA exemptions to learn

- An exemption under HRA (house rent allowance) can be claimed for rent paid to a spouse.

- Various court decisions, including the recent one in June 2023 by the Income Tax Appellate Tribunal (ITAT) in Aman Kumar Jain’s case, have determined that rent paid by an individual to their spouse is eligible for HRA, and an exemption will be granted for such payments. The tribunal emphasized that the argument against a husband paying rent to his wife lacks any legal basis supporting such a claim, as stated in the ruling.

- It is advisable for spouses to formalize their living arrangements by entering into a rent agreement, with the wife issuing rent receipts to the husband, similar to any standard landlord-tenant agreement.

- It is crucial for the wife to disclose the rental income in her tax declaration. Even if her income falls below the taxable threshold, she should still fulfill the tax filing requirement.

- Ownership of the entire house should rest with the wife, and the husband should not have any ownership stake.

- To qualify for HRA and claim tax exemption, the taxpayer must furnish the rent agreement, rent receipts, and Form 12BB to their employer.

- The rent receipt must include details such as the names of the tenant and landlord, the amount of rent paid, the landlord’s signature, and PAN information.