The Chhattisgarh High Court has stated very clearly that the writ benefit cannot be extended to those indolent persons who sleep over their rights and duties without any convincing explanation and justification, and now when the due date has been ended, woke up from slumber and reached the high court trying to get relief without any bona fide base.

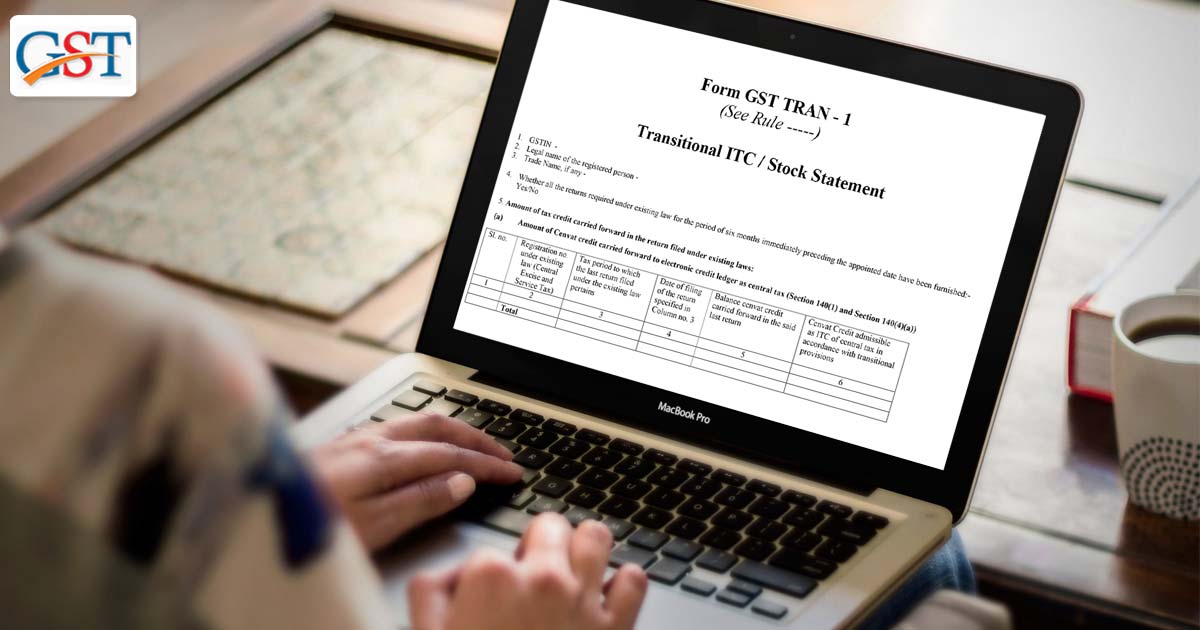

This statement comes in the Writ Petition filed by M/s Jagadamba Hardware Stores. To get the benefit of the input tax credit (ITC) under Rule 117 of the Central Goods and Service Tax (CGST)

It is a notable point that the due date was extended till 30.11.2017 and again it was further extended up to 27.12.2017.

However, the petitioner stated that, before the due date, the petitioner tried to fill TRAN-1 but due to the technical glitches and error it could not be filled online on the portal of the department. And because of the petitioner being unsuccessful in filling GST TRAN-1 online

Read Also: Easy Guide to File GST TRAN 2 Form by Step-By-Step Procedure

Justice P. Sam Koshy while rejecting this petition commented that,”. . . . there is no iota of evidence or proof produced by the petitioner to show that he has bonafide attempted to fill up TRAN-1 and was unsuccessful because of the technical glitches and errors. Moreover, the petitioner also does not seem to have approached an officer in the department showing concern about his difficulties in filling up TRAN-1 for a considerable period of time of almost 1 and 1⁄2 years. The petitioner also failed to establish having approached any of the officers in the department, nor is there any proof in his possession. There is also no document to show any correspondence made with any of the officers in the department in this regard.”