No service tax is liable to get paid on TDS paid on behalf of a foreign service provider, The Chennai Bench of Custom, Excise, and Service Tax Appellate Tribunal (CESTAT) ruled.

TDS deposited to the Income Tax Department concerning the payment completed to the foreign service provider over and above the invoice value of the services is not levied to service tax, the bench of P. Dinesha (Judicial Member) and M. Ajit Kumar (Technical Member) mentioned.

The appellant/taxpayer are service provider under intellectual property rights, scientific and technical consulting services, etc., and was releasing service tax. They agreed with M/s. Chevron Oronite Company LLC, USA, was paying royalties to the foreign company on the net sales of their products.

At the time of investigation the information furnished by the appellant for the TDS portion of the royalty payment made for the term April 2010 to September 2010 and October 2011 to March 2012, demonstrated that at the time of paying service tax on the royalty payments made to the foreign company, the appellant had not filed the service tax on the TDS portion of the royalty amount held by them.

The department believed that the TDS portion retained by them was also taxable. Show cause notices were issued on 21.12.2010 and 2.7.2012 for the recovery of the dues. After following due process of law, the original authority confirmed the demand proposed in the show cause notices, including interest, and also charged penalties.

The appellant filed appeals with the Commissioner (Appeals), who, in the order being challenged, dismissed the appeals.

Read Also: Service Tax Can’t be Paid If TDS Already Deducted from Assessee’s Account

It was argued by the taxpayer that the appellant has released the service tax on the whole consideration paid before the foreign service provider. The TDS amount has been released via the appellant separately. Under the agreement entered into with Chevron, the running royalty will be net of Indian income tax.

The appellant is needed to file the tax. Alternatively, when the royalty levied to be paid is Rs 100, the appellant has paid Rs 100 before the foreign company and the TDS of Rs 10 has been released separately to the government of India. Under section 67 on the levied amount via the service provider, the service tax is obligated to be paid. According to Rule 7 of the Service Tax (Determination of Value) Rules, the 2006 taxable service value obtained u/s 66A will be the actual consideration levied for the services furnished or to be furnished.

While permitting the petition the tribunal ruled that the TDS paid or deposited to the government exchequer via the appellant emerged at the time of legal obligation. In the normal duration, the TDS could not be ruled to be regarded for the service until mandated or considered via law as mentioned above.

The amount shall not be regarded for the taxable services obtained through them under section 67(1)(a) of the Finance Act, 1994, in the absence of the legislature itself sanctioning such a provision, mandating double taxation, in the Act.

As per the tribunal it ruled that the service tax is not levied to get paid on the TDS filed via the appellant on the behalf of the foreign service provider.

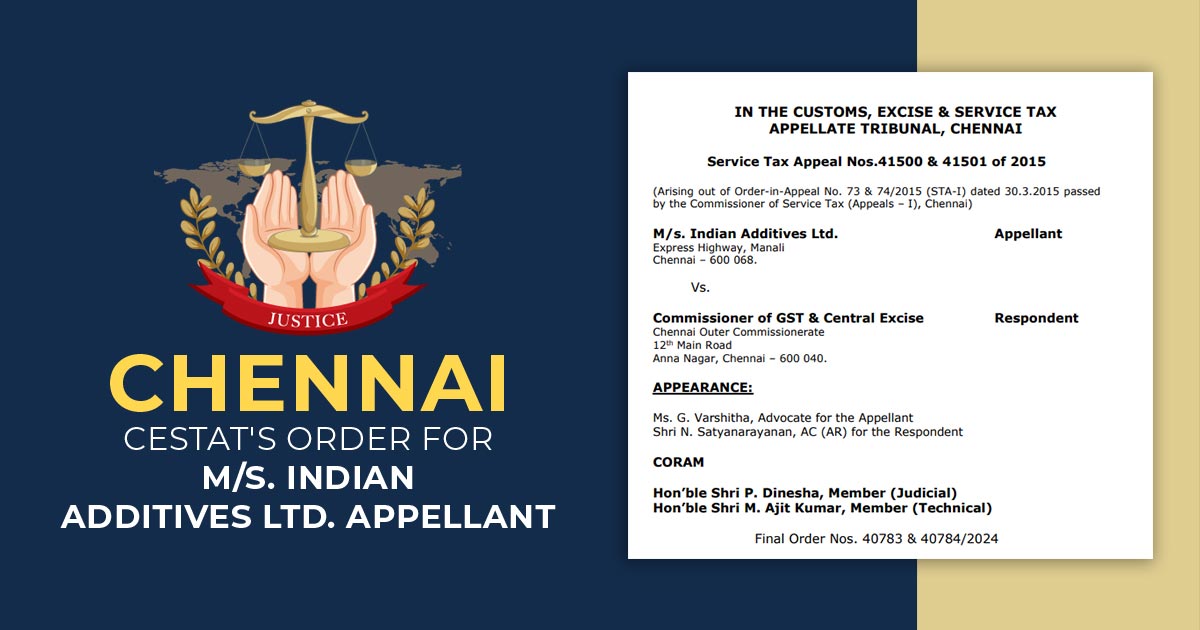

| Case Title | M/s. Indian Additives Ltd. Appellant Vs. Commissioner of GST & Central Excise |

| Citation | Final Order Nos. 40783 & 40784/2024 |

| Date | 02.07.2024 |

| Appellant | Ms. G. Varshitha, Advocate |

| For the Respondents | Shri N. Satyanarayanan, AC (AR) |

| Chennai CESTAT | Read Order |