If you have already filed your income tax return (ITR) for the year and want to check the status of the same, here’s a way to do the same online.

Once the Income Tax Return has been filed successfully, a taxpayer can check their status online on the Income Tax Department’s website. It is beneficial to keep checking the status of your ITR to know whether or not it has been accepted or if there is an error reported in the filing.

The status of your account will show ‘ITR processed’ if your return is filed correctly and processed by the department. In the event of discrepancies or proposed changes by the Centralized Processing Centre (CPC), Bengaluru, the return status may differ, such as defective or transferred to the assessing officer.

If your ITR return has been in pending status for too long, you can contact the income tax department for the same.

Different ITR (Income Tax Return) Status and Their Meanings

Processed: This ITR status means that the particular return has been accepted and processed by the department, and there are no discrepancies.

Submitted and Pending for e-verification: This status means that the ITR has been submitted by the taxpayer but has not yet been e-verified, or the taxpayer has manually verified the ITR, but the department has not yet received the acknowledgement for the same.

Successfully e-verified: It indicates that the submitted ITR has also been e-verified by the taxpayer. It is yet to be processed by the department.

Read Also: Income Tax Return Filing Due Dates for Taxpayers

Defective: As it indicates, the status means that there is some problem or discrepancy in the return or it has not been filed according to the law. “If your return is found defective then you will receive a notice of defective return under section 139(9) asking you to rectify the defect within 15 days from the date of receiving the notice. If you don’t respond to a defective return then ITR shall be treated as invalid,” says a tax expert.

If a discrepancy is found in the filed return, the department will issue a notice to the taxpayer asking for clarification.

Case transferred to Assessing Officer: The status means that the particular case has been transferred by the Department’s Centralised Processing Centre to the jurisdictional assessing officer for further processing. An ITR is generally transferred to the assessing officer when it has complexities beyond the understanding and reach of the system and thus requires the intervention of the assessing officer.

In such cases, the assessing officer may contact the taxpayer and ask them to provide the necessary details in support of a claim or to correct the return process.

Step-by-Step Guide to Check Income Tax Return Status Online

You can check your income tax return filing status either by logging on to your website account or by using the acknowledgement number of the particular return.

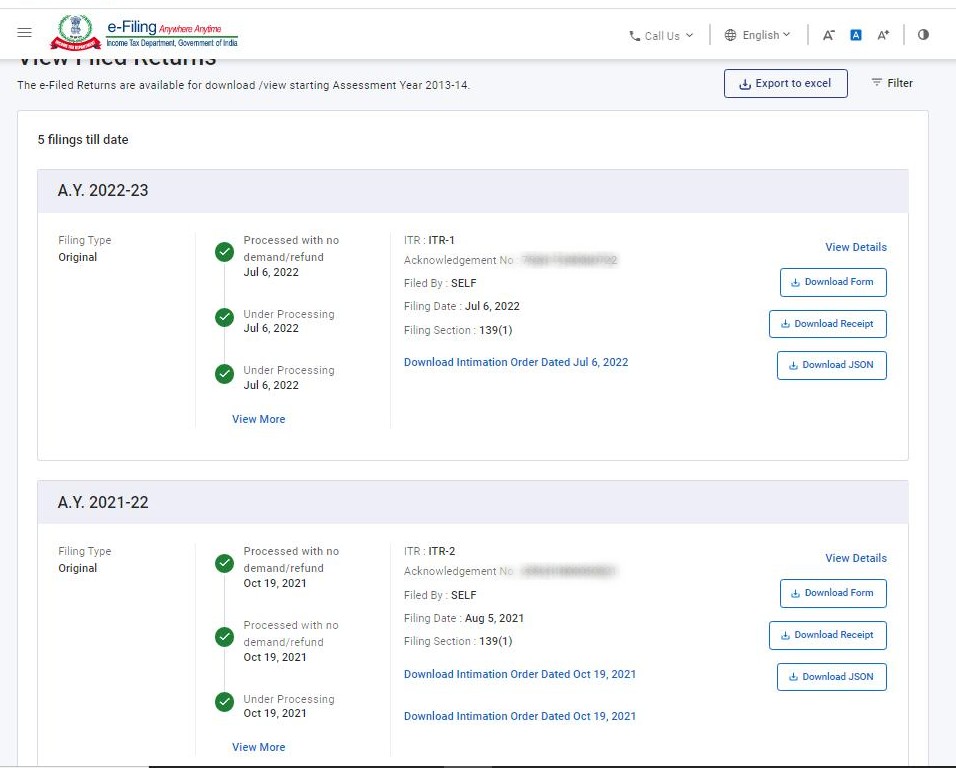

Check ITR Status on Your Income Tax Account

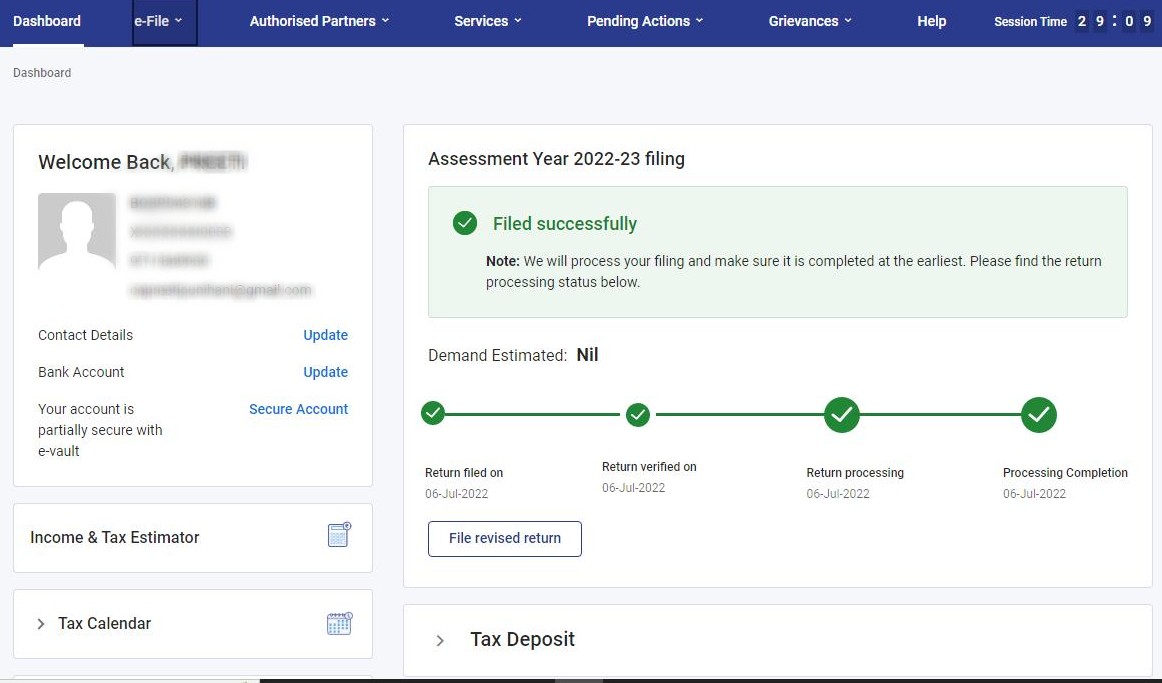

Step 1: Visit the income tax department’s e-filing website (https://www.incometax.gov.in/iec/foportal/) and log in to your ITR account using the credentials.

Step 2: On the Dashboard, click on the “e-file Income Tax Returns-View Filed Returns” option.

Step 3: The status of your selected ITR will be shown on the screen.