The taxpayers who received notice or order from the Income Tax Department are now able to check whether it is genuine or fake. It can easily be checked through the facility provided by the Income Tax Department on its official website. In order to check the genuineness of the Income Tax Notice/Orders, attributes such as ‘Document Number’ or ‘PAN, Assessment Year, Notice Section, Month and Year of Issue’ are used by the taxpayers.

How to Check Income Tax Notice by the Govt. I-T Portal

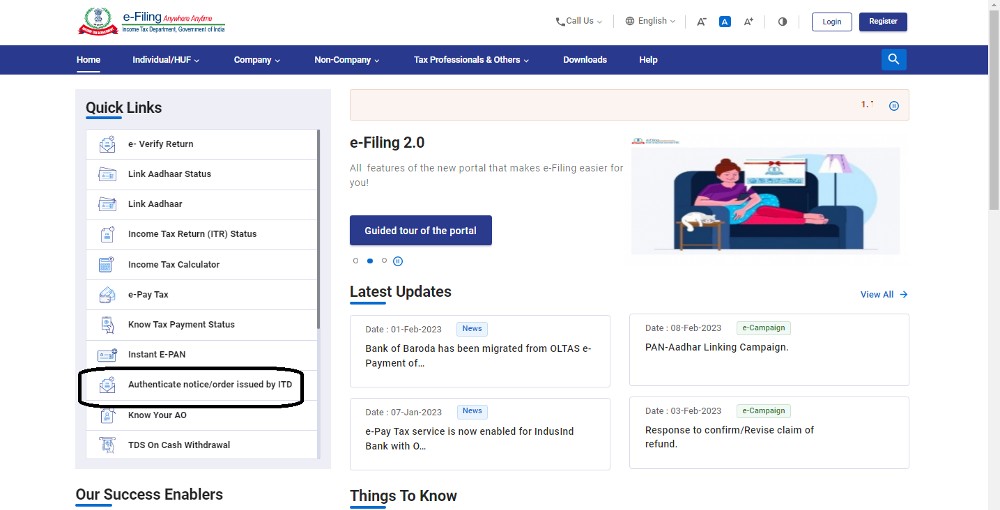

- First and foremost, go to the Department’s official website at https://www.incometax.gov.in/iec/foportal/

- Then proceed to the “Authenticate notice/order issued by ITD” tab under the ‘Quick Links’ tab, there you will get the option of ‘Notice/order issue by ITD’ underneath.

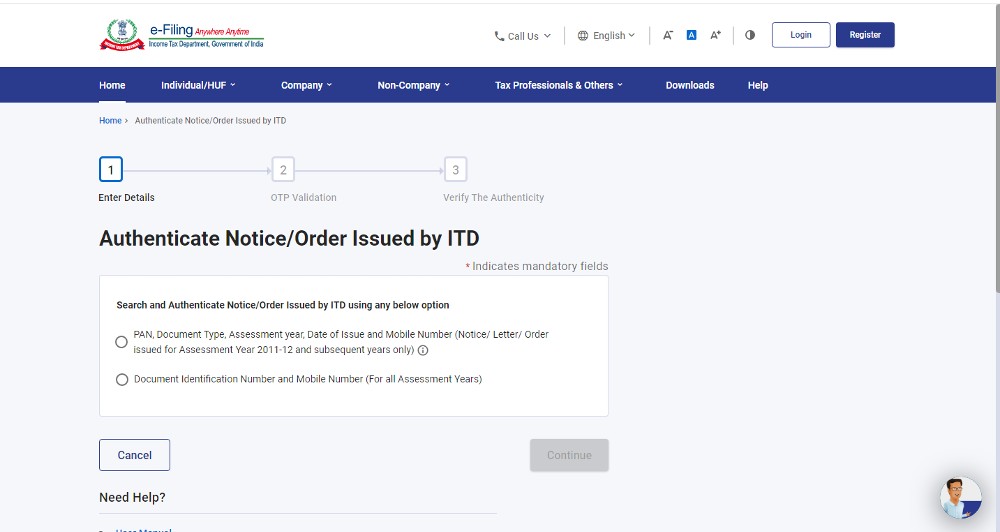

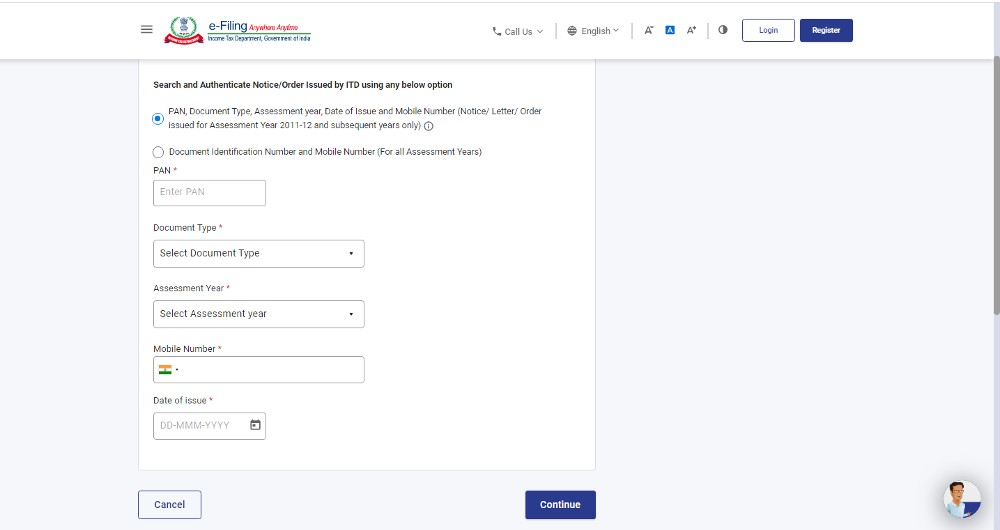

- Click on the ‘Authenticate Notice / Order Issue by ITD’ option will redirect you to a new web page on your computer screen. There you will get two options which will let you check the veracity of the notices/orders you have received. To do so, you can use either document number or PAN assessment year, notice section, month and year of issue, whichever suits your taste.

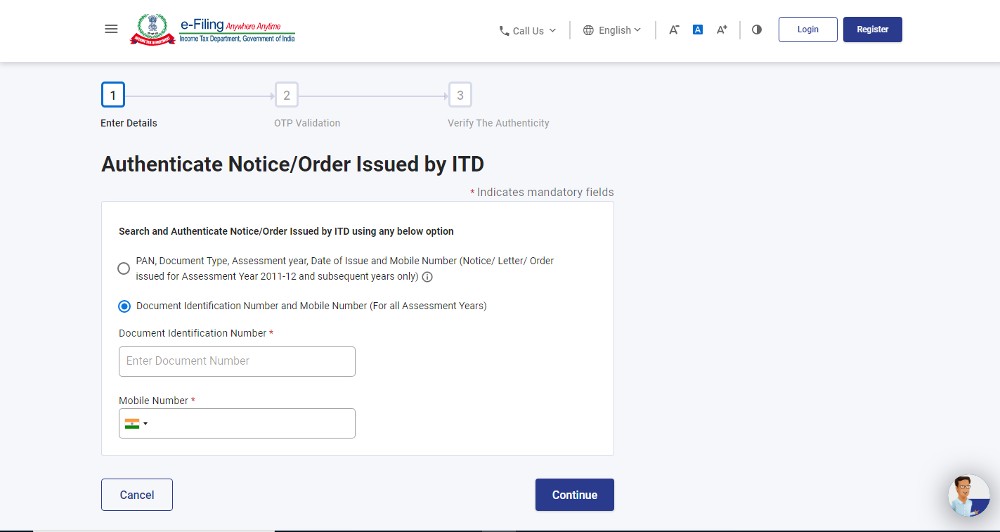

- Click on the document and there will document number option in which one has to fill in the document number.

- In case the user selects the PAN option, then they have to opt for the option after there will be certain detail requirements i.e. Permanent Account Number (PAN), Assessment year, notice section, the month of issue, and year of issue. The user needs to fill in all the required details asked as per the website.

- Click on the continue button.

Read Also: How To Revise A Defective Income Tax Return Notice?

If the issued notice/order is valid or authentic, the same document will appear on the website. Also, you will be notified with the message-Yes, the notice is valid and issued by the income tax authority. Surely, this facility will avail you in finding the veracity of the notices/ orders received from the IT Dept. According to a tax expert, “Notices from the Income Tax Department can be used to check the veracity of orders sent by the tax authorities with the tools provided by the e-filing portal.

Using this tool, the Income taxpayer can easily identify fake e-mails and fake letters sent in the name of the Income Tax Department. Any documents or notices sent to e-mail to the income taxpayer are also uploaded on the e-filing portal by the department, so their authenticity can be easily checked through this tool.”