As time accelerates and the due date for ITR filing comes closer, here is something one must know and pay attention to. ITR will be submitted only after clearing the Income Tax Dues. The taxpayer can clear his income tax dues by approaching either the banks which allow income tax payments or online via the Income Tax portal. Out of both online is convenient for the user. Taxpayers can approach their nearest banks which allow income tax deposits and file challan 280 the statement designated by the government for Income Tax Payments. Remember, you can submit your ITR only after paying your income tax dues.

As discussed above challan 280 Income tax payment can be done in two ways:

- Offline Tax Payment

- Online Tax Payment

Challan 280 – Offline Income Tax Payment for Self-Assessment

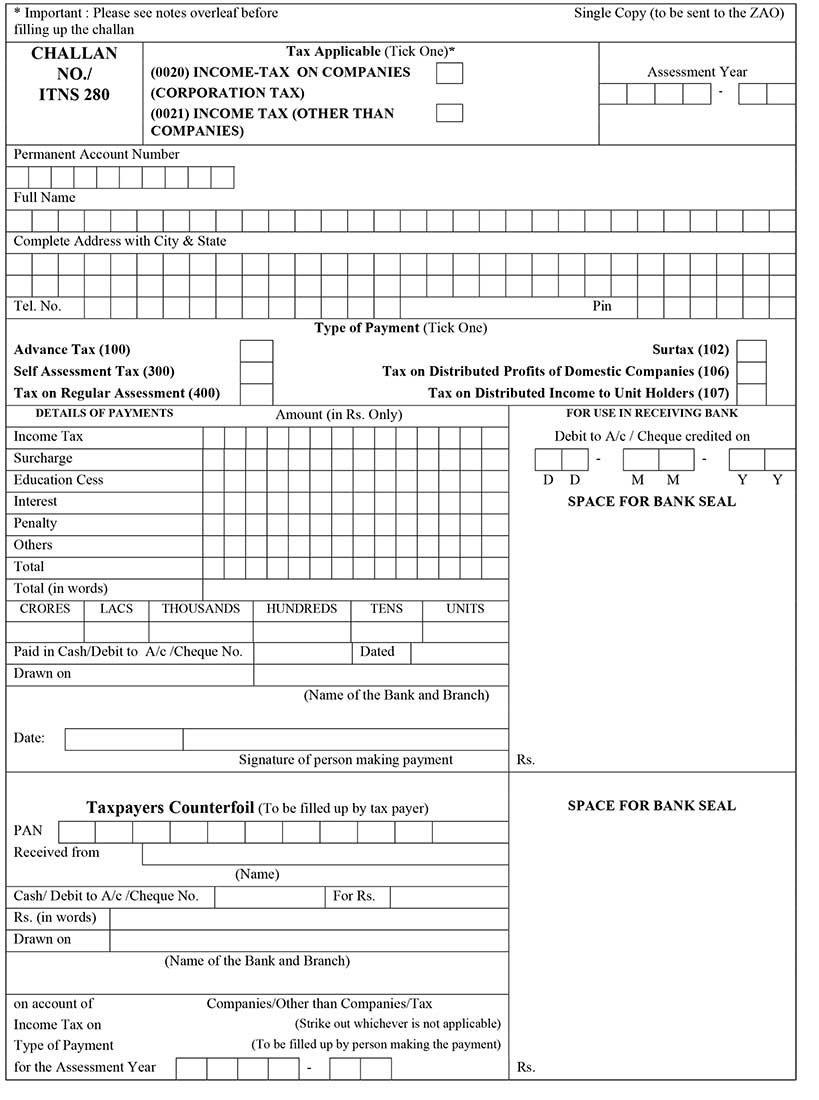

Tax payment can be made to any bank permissible for income tax collection. The taxpayer needs to download Challan 280 from the Income Tax portal. He is required to select (0021) Income (other than companies) under the heading ‘Tax Applicable’.

Let us check out the steps to file the challan 280 by Income tax e-filing Portal:

- Upon opening the Income Tax e-filing portal, one should click the Pay challans on the left-hand side

- After clicking the option, the portal will show the confirm and cancel option

- After clicking confirm option you can download ITNS 280 PDF format

Challan 280 – Online Payment of Income Tax on NSDL

For online tax payments, the taxpayer is required to log in at the I-T Department’s e-filing website and select the option ‘e-pay tax’. E-pay tax is the tax department’s approach towards facilitating quick and easy tax payments.

Upon filing an ITR form, the taxpayer automatically gets the e-pay option for paying his income tax.

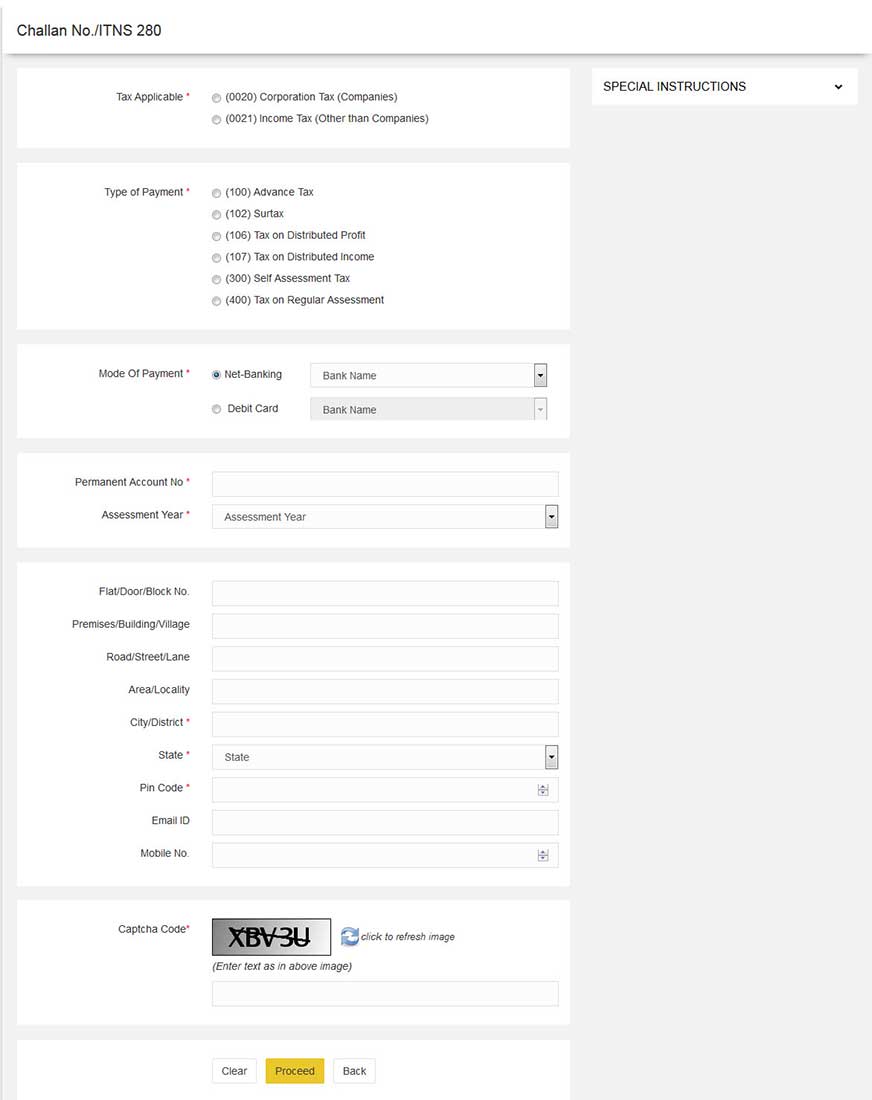

Let us check out the steps to file the challan ITNS 280 in the NSDL Portal:

- There are two options for filing challan 280 when visiting the official income tax portal i.e. e-pay tax and challan

- Upon opening the IT portal, one should click the e-pay tax tab on the left-hand side

- After clicking the option, the portal will show two options i.e. one with the NSDL portal and the other option from the e-filing on IT portal itself

- Click on NSDL and the user will be redirected to onlineservices.tin.egov-nsdl.com

- Now click on challan ITNS 280 proceed tab

- Users can select any option at their convenience and continue

The links will direct him to the government-appointed National Securities Depository Ltd. (NSDL) portal (an organization for managing securities in the dematerialized form) where you need to select Challan ITNS 280. Thereon select (0021) Income Tax (other than companies) visible under the heading Tax Applicable.

Under ‘type of payment’ select (300) Self Assessment Tax. Fill in all the required fields (like PAN and other details) and select the year for which you are paying the tax (assessment year).

Read Also: How to Revise Mistakes After Paying the Income Tax?

Tax payments can be done via debit card or any other online banking mode. Once the payment is done, the receipt will be displayed on the screen flashing the details such as tax paid, the bank branch’s BSR code, date of depositing the challan and challan serial number. You can save the challan with you in the form of a document. Once the dues are clear, file the ITR form with appropriate details, verify them and submit the form.