A show-cause notice is given by the Central goods and services tax (CGST) council in the Fiscal year 2014-15 for the difference in receipts according to the tax return and income tax return in big volume excluding going into the statutory along with furnishing the important ones as mentioned in the act about SCN and notices is given despite to the Doctors who had fought in the corona and can pay the tax.

“The notices have been issued on the basis of discrepancies in I-T and service tax even in cases where a departmental audit has already been done. Notices have been issued blanket and without any due diligence, leading to creation of unnecessary hardship for assessees. An attempt is being made by the departmental officers to create disputes and demands for reasons best known to them.”

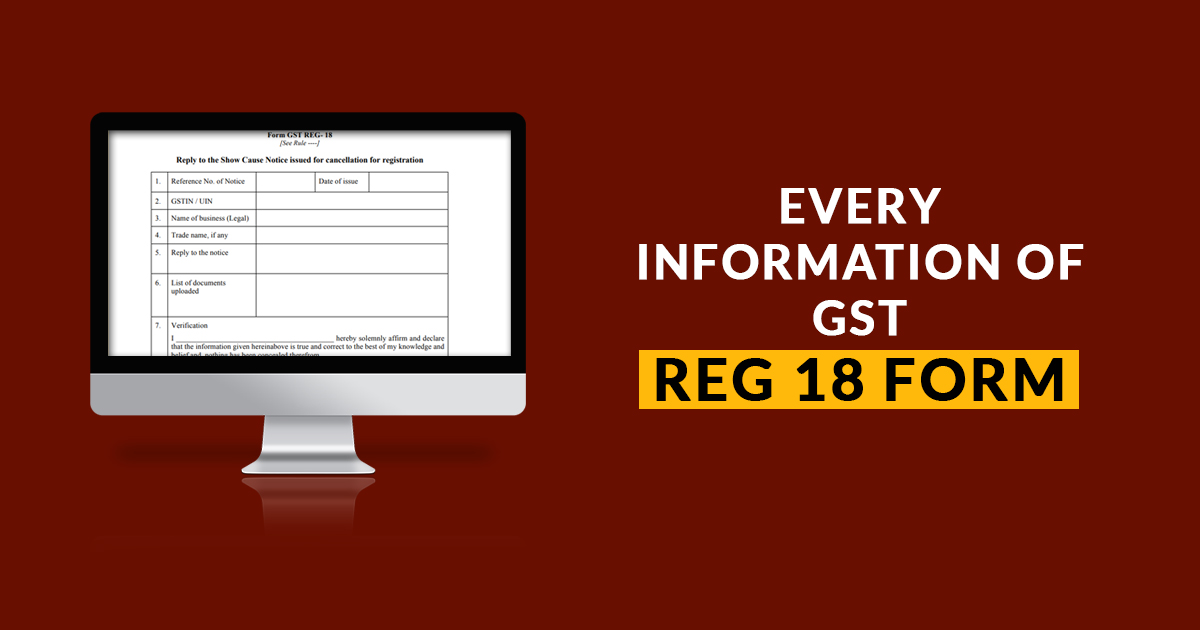

As per the written letter sent by the chartered accountant association to the Finance ministry a show cause notice (SCN)

CA associations indeed have commented on some restrictions for the duration of these notices. “The SCNs have been issued with a predetermined state of mind and in a prejudiced manner and have been issued with arbitrariness and vagueness. It is pertinent to mention here that the SCNs have been issued in an illegal manner as an extended period of limitation cannot be invoked in the cases where no facts have been suppressed from the department with an intention to evade the payment of service tax. Accordingly, the entire period covered under the issued SCNs from April 2014 to March 2015 is barred by limitation.”

“Officers cannot make roving enquiries and issue notices beyond the limitation period of one year. However, notices have been issued its bulk in defiance of the law. Without recording any reason which indicates any fraud or misstatement, notices are being issued to one and all. The extended period of five years can be availed by the service tax officer only if he is satisfied that there is fraud or wilful misstatement. However, blanket notices have been issued to all without any justification,”

Defining the causes for the mismatch amid the ITR and service tax the association stated that the variations among the Income tax return

“Enquiry up to five years can be made only if service tax has not been paid due to fraud, collusion, wilful misstatement or suppression of facts,” it says, adding, “If receipts, as per I-T are not tallying, it does not mean there is a fraud, collusion, wilful misstatement or suppression of facts. There can be a number of reasons for the mismatch like cash or mercantile basis of the system, professionals, other persons not liable to service tax and so on.”

As per the associations the prolongation time limit till 31 Dec 2020 is given so as to finish the due hearings or furnishing the petition and not doing wandering investigations along with the harassment to taxpayers.

“Sending notices, calling for information more than five years old, is uncalled for. In many cases even when replies have been sent by mail or post, notices are being sent again. This is creating a situation where the assessee has to contact the relevant officer personally or through an authorized representative, which is like making a mockery of the claims of the government for faceless resolution of issues,” they said.