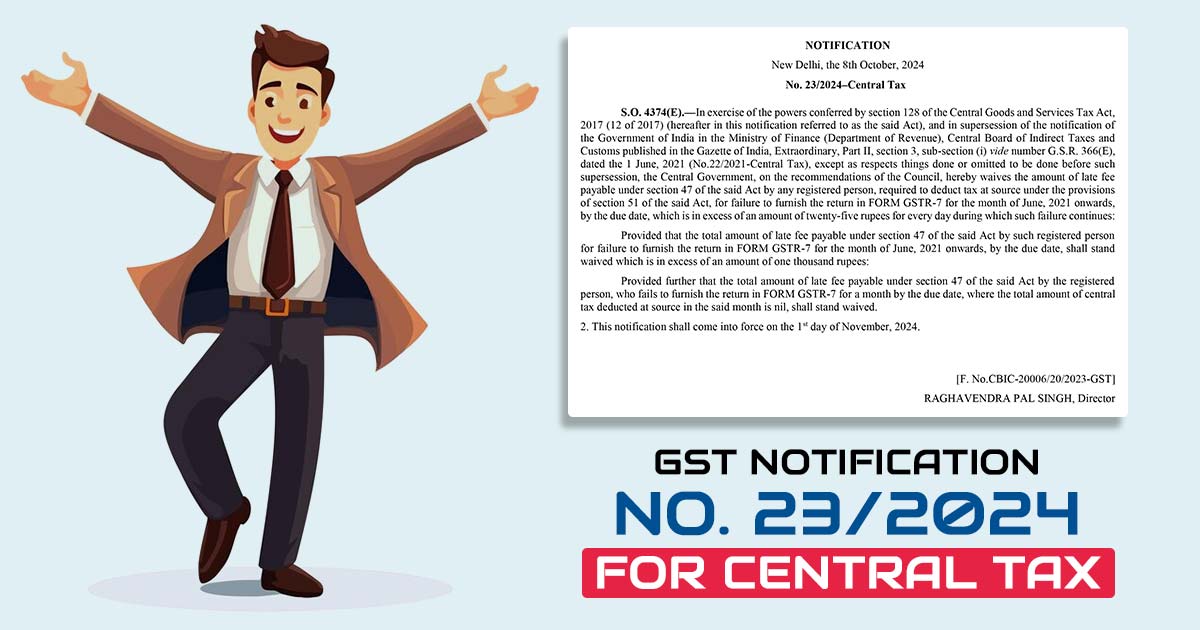

The Central Board of Indirect Taxes and Customs (CBIC) has given relief for taxpayers required to TDS under section 51 of the CGST Act, 2017, and has furnished central tax GST notification No. 23/2024, dated October 8, 2024.

The same notification exempted the late fee for the delays in filing FORM GSTR-7 from June 2021 onwards, with specific limits and conditions, and came into force from November 1, 2024.

Notification Highlights

- Late Fee Limit: The late fee is capped at ₹25 per day, as per the maximum of ₹1,000 for delays in GSTR-7 filing.

- Complete Waiver for Nil TDS: If no tax was deducted at source (TDS) in a month, the late fee is completely waived for that timeframe.

- Applicability: The same waiver is applicable before the registered individuals who are liable to deduct TDS u/s 51 of the CGST act and who have delayed filing their GSTR-7 returns from June 2021 onwards.

- Legal Basis: Under section 128 of the CGST Act, the exemption has been issued which grants the government the authority to lessen or exempt the late fee for non-compliance with tax filing due dates.

Information on Late Fee

- Rs 1000 is the limit for filing the maximum late fee, lessening the load on TDS filers who may have suffered late fees in the past.

- The total waiver guarantees that businesses won’t face penalties during months when no tax was deducted for zero TDS activity.

Effective Date

On November 1, 2024, the same notification shall come into effect given that the taxpayers with the enough time to adhere and benefit from the late fee exempted if applicable.

Effects on Businesses

The waiver is anticipated to provide significant relief to businesses that were dealing with large fines for late submission of GSTR-7. This contains public sector units, government departments, and other registered entities needed to deduct tax at source. The CBIC intends to promote prompt compliance and alleviate the financial burden on taxpayers by imposing limits on late fees and providing complete waivers in specific situations.

Reminder for Compliance

Individuals who are required to deduct TDS must file FORM GSTR-7 punctually to prevent penalties and benefit from the waiver for previous delays. It is recommended to consult with tax professionals to ensure compliance with the updated provisions.