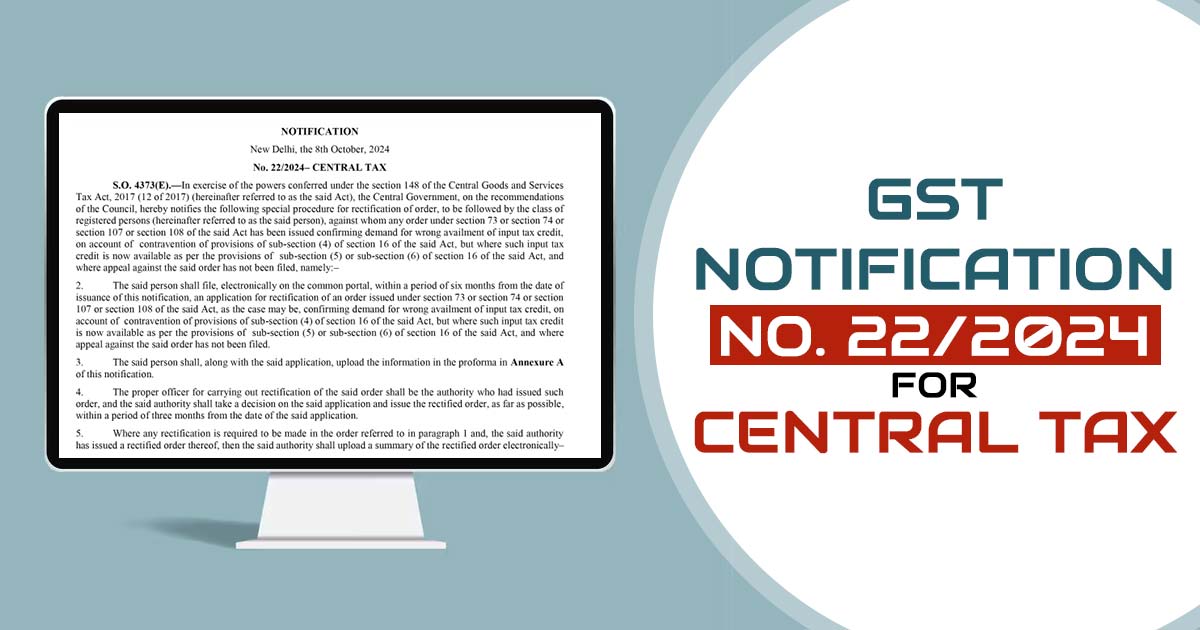

To facilitate GST compliance the Central Board of Indirect Taxes and Customs (CBIC) has issued Notification No. 22/2024-Central Tax dated October 8, 2024, to report the process of executing the newly inserted sub-sections (5) and (6) in Section 16 of the CGST Act, 2017.

The very notification furnishes a process to rectify the orders pertinent to the incorrect claim of ITC, permitting the registered assessees to correct previous errors as per the said conditions.

Notification Highlights

- Proper Officer Role- The officer liable to process the rectification request who issued the original order and should issue a rectified order within 3 months of obtaining the application.

- Rectified Orders Request Electronically- After completing the rectification the proper officer shall upload a summary of the rectified order electronically in FORM GST DRC-08 (for orders under Sections 73 and 74) or FORM GST APL-04 (for orders under Sections 107 and 108).

- Rectification Eligibility- The notification permits the registered individuals against whom an order under Sections 73, 74, 107, or 108 of the CGST Act has been furnished affirming the demand for incorrect ITC claim to apply for the rectification. The same applies to the matters in which the ITC was considered incorrectly claimed as of the breach of sub-section (4) of Section 16 but is now authorized as per the updated inserted sub-sections (5) or (6).

- Application Procedure- An electronic application is needed to be furnished by the eligible taxpayers on the GST portal within 6 months from the date of such notification. Including with the application they are required to upload the pertinent data via the proforma furnished in Annexure A of the notification.

- Rectification Only for Exact GST ITC Issues- The rectification shall apply only to the demand related to the incorrect ITC claimed erroneously as of the breaches of sub-section (4) of Section 16, now permissible under sub-section (5) or (6) of the same section.

Providing Tax Compliance and Fairness

This correction process is especially advantageous for taxpayers who have not filed an appeal against the orders affirming the improper claim of ITC. It is crucial that if the correction negatively impacts the taxpayer, the authority must adhere to the principles of natural justice to guarantee a fair procedure.

The announcement, which will take effect on October 10, 2024, aims to assist businesses by enabling them to correct previous errors concerning GST ITC claims without having to endure protracted legal processes.

This is an important opportunity to align the GST records of taxpayers and avoid penalties, especially for those who claim complex ITC. Businesses are been advised to consult with their tax advisors and take quick action in the stated 6-month window.