In accordance with the most recent government regulation, all email addresses and cellphone numbers associated with PANs must be validated at the time of GST registration using an OTP. Additionally, starting with those enrolling from Gujarat, biometric-based Aadhaar authentication, as well as risk-based physical verification, have been implemented.

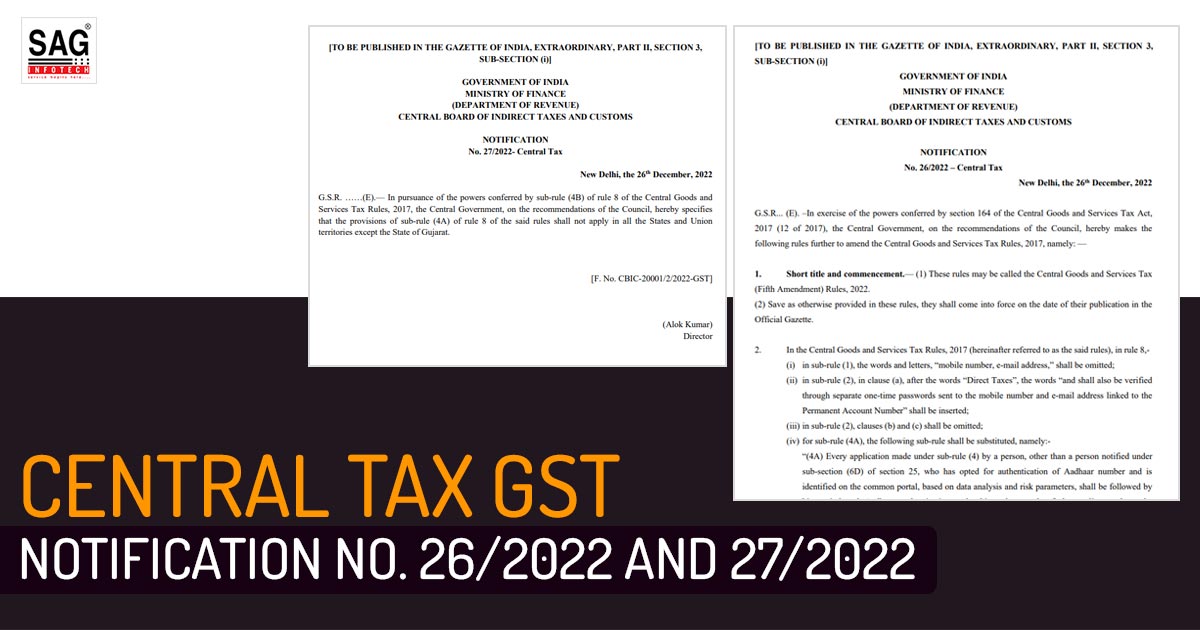

On December 26, 2022, the Central Board of Indirect Taxes and Customs (CBIC) published CGST Notifications Nos. 26/2022 and 27/2022 which made numerous changes to Rule 8 of the CGST Rules.

As long as their contact information is connected to their PAN, applicants no longer need to provide their cell number or email address for OTP verification. Due to this, when filling out Part A of the REG-01 application, the authorized person of the GST registration applicant should submit their PAN number and state or Union Territory in accordance with sub-rule (1) of Rule 8. The requirement that OTP verification is now only feasible through PAN-linked cellphone numbers and email addresses have also been added to sub-rule (2).

The applicant receives a transaction reference number or application reference number for moving on to Part B of the REG-01 application after such OTP verification with the PAN-linked contact number. Applicants who are non-resident taxable people, TDS deductors, TCS collectors, and service providers of online information and database access or retrieval (OIDAR) from outside India to online receivers not covered by GST legislation would not be affected by this change.

The aforementioned adjustment to the CGST Rules will aid in preventing any unauthorized use of the applicants’ PAN by dishonest individuals by utilizing two-factor authentication.

On the contrary, the government is adopting risk-based physical verification and biometric authentication for GST registration with a pilot program in Gujarat. To make this possible, changes to Rule 9 of the CGST Rules were enacted.

Based on an analysis of risk indicators and data metrics accessible on the GST site, there were previously no facilities for doing physical verification. With this modification, Rule 8’s sub-rule (4A) is changed to only let applicants registering from Gujarat to do so.

from 27th December 2022, i.e., the date of publishing these notifications in the Official Gazette, these changes will apply.