In a recent move, taxpayers under the Goods and Services Tax (GST) are allowed to explain the errors or discrepancies in their inward and outward supply filed in tax returns on the GST portal itself, without being worried about receiving notice from the tax authorities.

The Central Board of Indirect Taxes and Customs (CBIC) has implemented a new facility in its portal through which taxpayers can find their exact tax liability on a real basis, giving them chances to explain any discrepancy in tax returns before issuing any tax demand.

This facility will be in effect from Thursday.

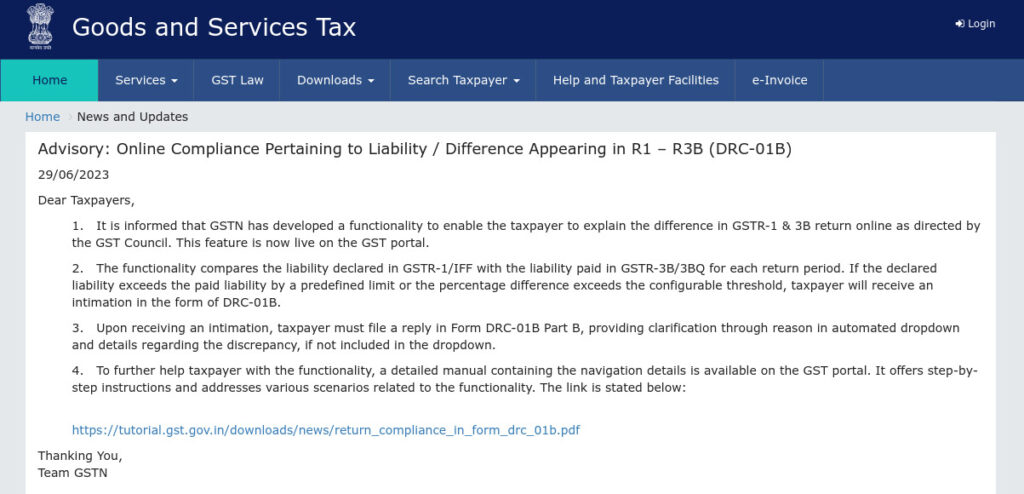

The GST network, in an advisory on Thursday, said, “It is informed that GSTN has developed a functionality to enable the taxpayer to explain the difference in GSTR-1 and 3B return online.”

The GST Council has already ordered and approved it.

For each return period, this new feature will differentiate the liability declared in the GSTR-1 form from the liability paid in GSTR-3B.

All registered taxpayers, except composition dealers, file a monthly self-declaration return called GSTR-3B under GST. This return provides a summarised overview of a business’s tax liabilities, including information about the input tax credit (ITC) claimed and output tax liabilities.

Taxpayers need to submit GSRT-1, a monthly statement of outward supplies, which includes the details of goods and services supplied through various means such as sale, transfer, barter, exchange, licence, rental, lease, or other modes.

If the declared liability exceeds the paid liability by a specified limit or the percentage difference goes beyond the set threshold, the taxpayer will be notified and can provide information about the discrepancy using the DRC-01B form.

Previously, GST officers were directed to get details of all invoices for which ITC was claimed by businesses with discrepancies between GSTR-1 and GSTR-3B. This was done before taking any recovery action for a short payment or non-payment of taxes, which increased the possibility of litigation.

Additionally, the portal has a detailed manual to assist taxpayers get familiar with the new development step-by-step.

“This being a system-driven utility, would do tax payable comparisons on a real-time basis, ensuring maximum compliance with minimum governance,” said Rajat Mohan, a partner at tax consultancy firm AMRG & Associates.

Read also: Easy GST Guide to Lookup Electronic Liability Register on Portal

Further, he added, “Defaulting taxpayers would be given an opportunity of being heard before issuing any tax demand.”