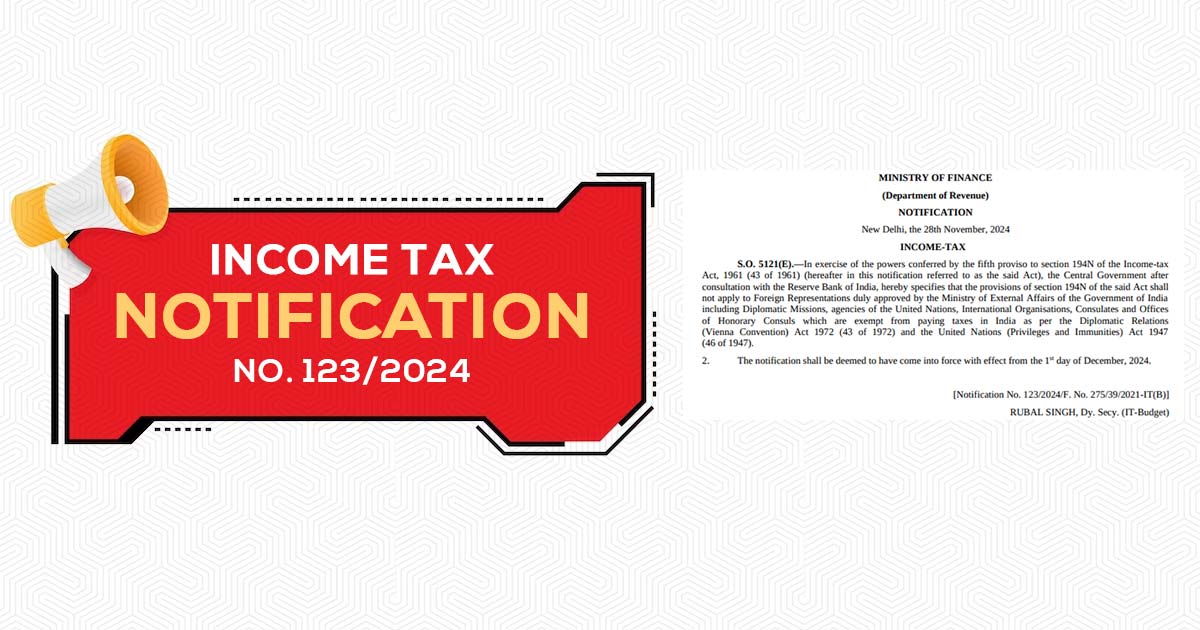

The Central Board of Direct Taxes (CBDT) in development has furnished Notification No. 123/2024, dated November 28, 2024, exempting the particular foreign representations and international organizations from the provisions of Section 194N of the Income-tax Act, 1961.

As per the exemption entities like diplomatic missions, United Nations agencies, consulates, and honorary consuls, which want tax exemptions under the Diplomatic Relations (Vienna Convention) Act, 1972, and the United Nations (Privileges and Immunities) Act, 1947, will not be within the TDS provisions u/s 194N. The very section obligates tax deduction on cash withdrawals of more than a specified limit.

In consultation with the notification issued with the Reserve Bank of India will come into force from 1st December 2024. The same move ensures that the functional provisions of waiving organizations are facilitated without the compliance load without cash withdrawal taxes.

The notification for assessees reaffirms the devotion of the government to aligning tax policies with international protocols and diplomatic obligations.

Highlights of Income Tax Notification No. 123/2024

- Applicability: Diplomatic Missions, UN Agencies, and Consulates approved via the Ministry of External Affairs

- Basis on Exemption: Vienna Convention Act, 1972, and United Nations (Privileges and Immunities) Act, 1947

- Date of Apply: December 1, 2024

Read Also: All Details About New Foreign Tax Credit Rule with Benefits

The very notification is within the measures of the Ministry of Finance to furnish clarity and ensure fairness in taxation, particularly for the entities involved in fostering international cooperation.