The Income Tax Department has made a key development for the current assessment year 2025–26, enabling the revised Tax Audit Forms 3CA-3CD and 3CB-3CD on its official e-filing portal.

The same move has complied with the recent revisions to the income tax rules and aims to ensure facilitated, error-free tax audit compliance for both taxpayers and audit professionals.

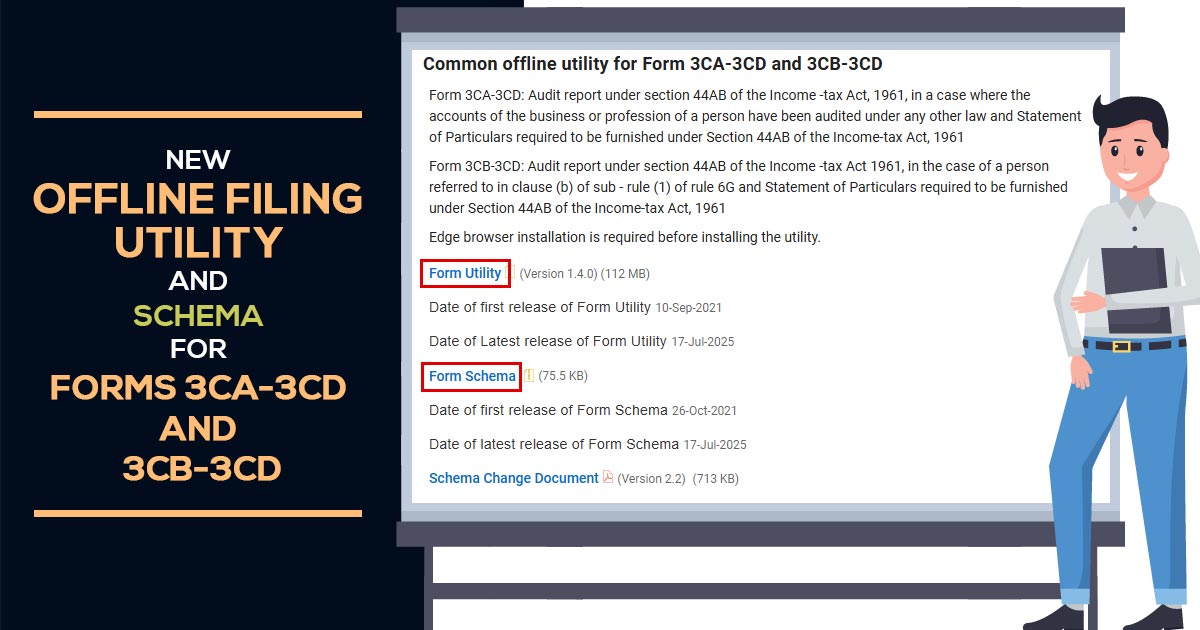

Such forms are important for the taxpayers who are mandated to obtain their accounts audited under section 44AB of the Income-tax Act, 1961. For cases where an audit is conducted under any other law, Form 3CA-3CD is used, and Form 3CB-3CD is applicable when the audit is conducted only under the Income Tax Act.

The amendment of these forms reflects the statutory updates and policy revisions made by the Central Board of Direct Taxes (CBDT) to facilitate audit reporting and the disclosure of pertinent information in a structured format.

Along with the same, the Income Tax Department has also released an updated Common Offline Utility (COU) schema for these revised forms. The same improved utility shall allow the tax professionals and Chartered Accountants to prepare and validate the audit forms offline before uploading them on the e-filing portal.

The motive of the updated schema is to lessen the technical errors and ensure effective compatibility with the amended formats.

Common Offline Utility furnishes a standardised and user-friendly interface that assists multiple form types and permits easier data import and export. The same supports offline data entry, real-time validation, and error checks, making the process of filing efficient. For the cases of bulk data management and complex audit matters, the same utility is beneficial.

Read Also: Full Guide to File Form 3CA-3CD/3CB-3CD By Gen Bal Software

All users must ensure to use the updated version of the utility and schema to prevent the discrepancies and filing the rejections, the department suggested. Professionals should read the instructions and schema modifications given in the e-filing portal to adapt to the updated compliance framework.

To enhance taxpayer convenience, strengthen digital infrastructure, and maintain a transparent and robust compliance ecosystem, the same update comes under the efforts of the Income Tax Department.

The users can access the amended forms and download the updated offline utility via the official e-filing portal.