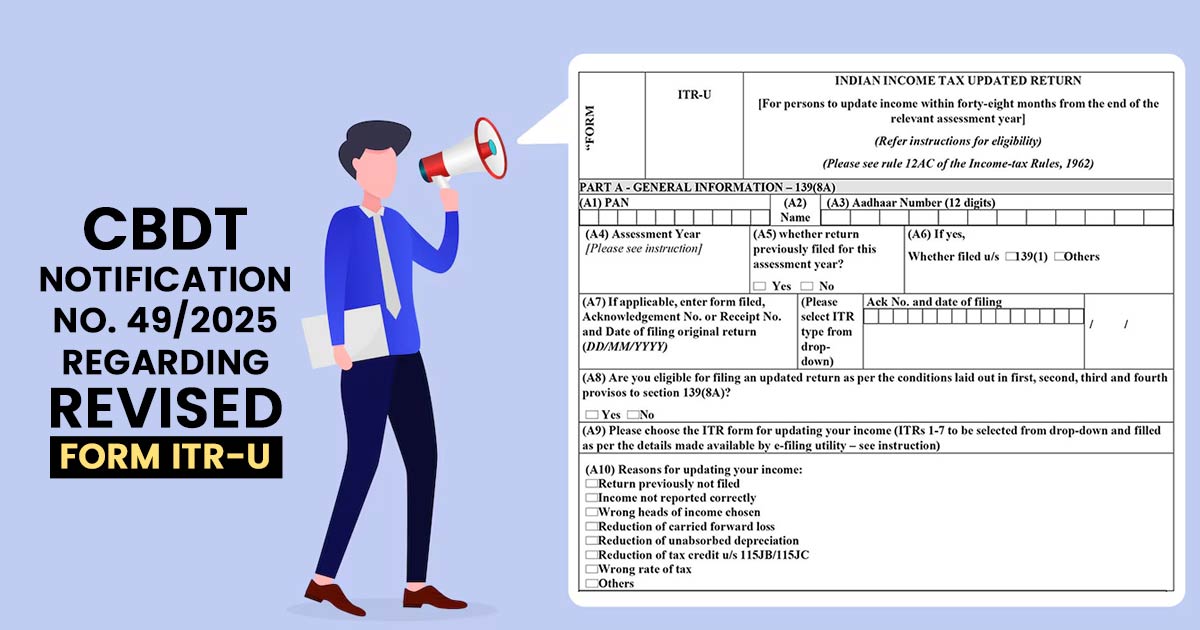

The revised Form ITR-U under Notification No. 49/2025, published in the Official Gazette, has been notified under the Central Board of Direct Taxes (CBDT). The new form replaces the earlier version of ITR-U found in Appendix II of the Income-tax Rules, 1962.

The updated Income tax return form, applicable u/s 139(8A) of the Income-tax Act, 1961, allows the taxpayers to update their income in 48 months from the end of the relevant assessment year. The proceeding shows the effort of the government to promote voluntary tax compliance and propose a structured path for taxpayers to correct earlier filed returns or file missing returns.

Key Features of the Updated ITR-U Form

Clarification of Eligibility: As per the norms cited in the first to fourth provisos of section 139(8A), the taxpayer should validate the eligibility criteria.

Increased Reporting Needs: The new form mandates detailed disclosures on:

- Additional income across heads (salary, house property, business/profession, capital gains, other sources).

- Calculation of tax payable/refundable.

- Filing timeline (categorised into four 12-month blocks within the 48-month window).

- Grounds for updating income (e.g., previously unreported income, incorrect income head, wrong tax rate, etc.).

Individual Tax Payments and Relief Disclosure: Section 89 relief, tax paid u/s 140B, and advance/self-assessment/regular taxes not claimed before should be disclosed distinctly.

Improved Verification Method: A detailed verification declaration is included in the form, which is to be signed by the taxpayer.

From the date of its publication in the Gazette, i.e., May 19, 2025, the same revision shall come into force.

Effects on Taxpayers

Now, the taxpayers can see an easier process to rectify their mistake if they missed or made an error in filing their original returns. Tax professionals and CA firms must be updated with the form and guide clients accordingly, particularly given the structured timelines and tax obligation calculations u/s 140 B.

For complete compliance, it is important to submit the revised ITR-U form precisely using the given utility on the income tax e-filing portal, complying with the guidelines and drop-down selections cited in the form.