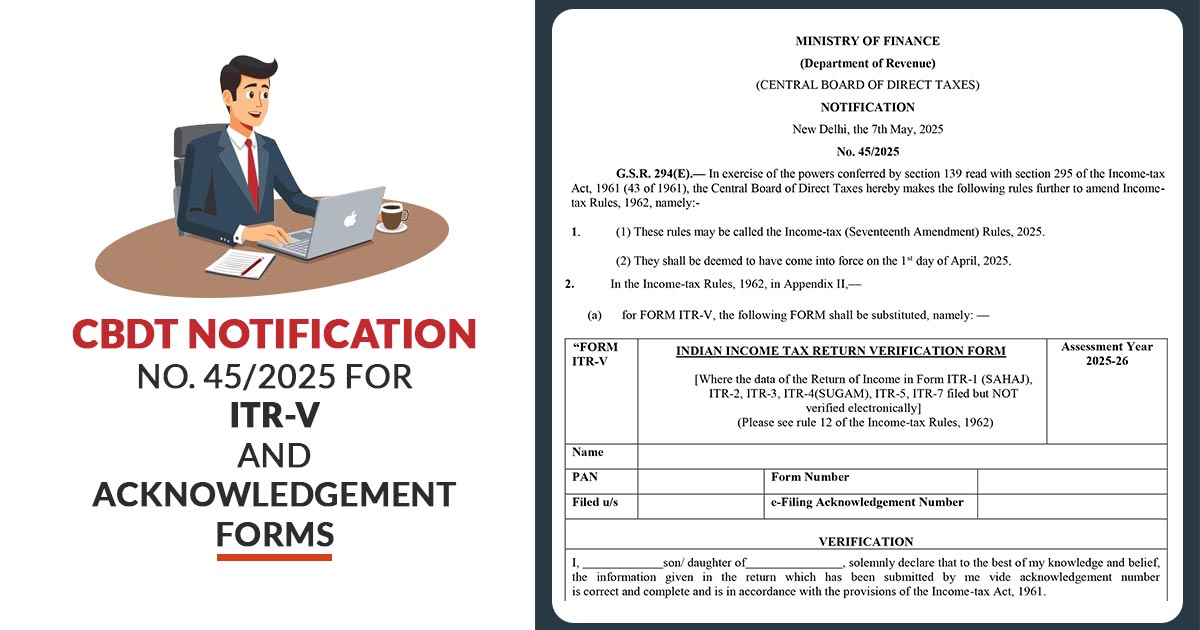

The Central Board of Direct Taxes (CBDT), which is part of the Ministry of Finance, has announced new changes to the income tax rules. This announcement, known as the Income-tax (Seventeenth Amendment) Rules, 2025, was made on May 7, 2025, through Notification No. 45/2025.

The formats of ITR-V (Verification Form) and ITR-Acknowledgement under Rule 12 of the Income-tax Rules, 1962 have been amended under the amendment revision. W.e.f 1st April 2025, such amendment comes into force and applies to the AY 2025-26.

Main Key Highlights of ITR V and Acknowledgement Forms

Here we have mentioned the key highlights of ITR V and Acknowledgement Forms for AY 2025-26:-

ITR-V Revised Form

The updated ITR-V is for the cases where the income return is filed in ITR-1 (SAHAJ), ITR-2, ITR-3, ITR-4 (SUGAM), ITR-5, or ITR-7 but has not been verified electronically. The revised form contains:

- Acknowledgement number e-filing

- A solemn verification statement

- PAN, name, and assessment year

- Compulsory digital signature or EVC/OTP-based verification

- IP address and system-generated barcode/QR code for authentication

Using Aadhaar OTP, net banking, pre-validated bank/Demat accounts, or EVC via bank ATM, taxpayers are motivated to finish e-verification. In another way, the signed ITR-V can be sent through speed post merely to the CPC, Bengaluru.

Acknowledgement Format

A new Acknowledgement format has been introduced for returns filed and verified electronically. It comprises-

- Accreted income and tax details under sections 115TD, 115TE

- E-verification method used

- Detailed tax computation: total income, MAT/AMT applicability, tax payable/refundable

- IP address and timestamp of the return filing

- Explicit instruction not to send this acknowledgement to CPC, Bengaluru

Administrative Notes

- The retrospective application of such rules has been certified not to affect any taxpayer.

- The same procedure aligns the efforts of the government to ease tax compliance and lessen paper-based interactions.

- The amended forms have the objective of improving the clarity, digital verification, and processing speed.

Closure: For AY 2025-26, the taxpayers filing the income tax returns should ensure that they use the newly reported forms and comply with the revised verification process. Return will be considered late and draw penalties under the Income Tax Act if the case is one of non-compliance or delay after the 30-day window.