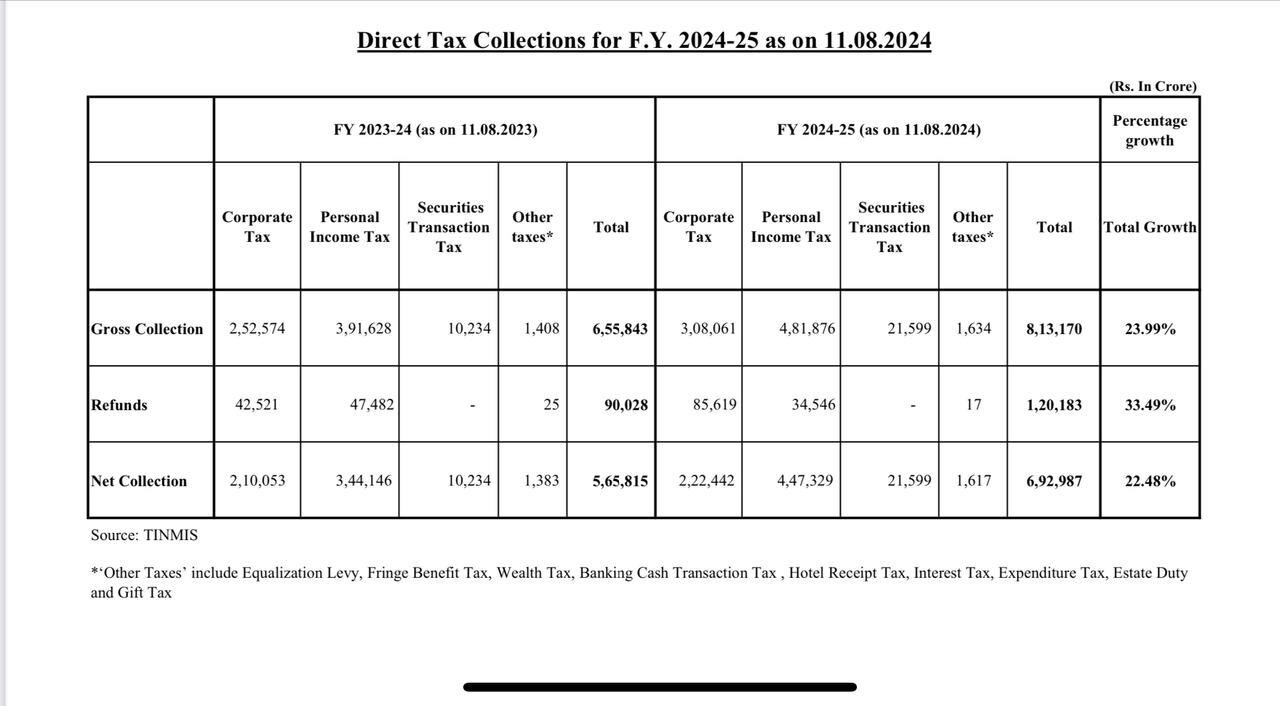

For the FY 2024-25, the gross direct tax collections of the Indian government witnessed a rise of 24% YoY to Rs 8.13 lakh crore, as per the information of the Central Board of Direct Taxes (CBDT). This straight rise arrives in comparison to Rs 6.55 lakh crore collected during the same period in the previous fiscal year.

Net direct tax collections show a positive trend depicting a 22.5% rise to Rs.6.92 lakh crore, up from Rs 5.65 lakh crore in the former year. Also, the tax refunds have been increased by 33.5% totalling Rs 1.2 lakh crore against Rs 90,028 crore in the same period last year.

The direct taxes contributing to such collections comprise the corporate tax, personal income tax, securities transaction tax, equalization levy, and various others such as fringe benefits tax, wealth tax, banking cash transaction tax, hotel receipt tax, interest tax, expenditure tax, estate duty, and gift tax.

The rise in the ITR filings this year witnessed a record. The due date to file the Income tax returns for the AY 2024-25 was July 31, 2024, and over 7.28 crore returns were filed by the deadline. It shows a 7.5% rise compared to 6.77 crore returns filed for the AY 2023-24 according to the Ministry of Finance.

The New Tax Regime has seen a significant increase in adoption this year, with 5.27 crore taxpayers, or around 72% of the total filers, choosing it. In contrast, only 28% of taxpayers decided to stick with the Old Tax Regime.

On July 31, 2024, which was the final day for salaried taxpayers and other non-tax audit cases to file their income tax returns, there was a peak in filing activity, with over 69.92 lakh ITRs being submitted in a single day. Additionally, the number of first-time ITR filers reached 58.57 lakh, which indicates a widening tax base.

Within 30 days of filing the Ministry of Finance asked the assessees to verify their unverified Income tax returns. Those who do not have filed within the due date are motivated to finish their submissions as soon as possible.