CBDT Circular No. 09/2024-Income Tax Dated: 17/09/2024: Enhancement of Monetary limits for filing of appeals by the Department before ITAT, High Courts, and SLPs/appeals before Supreme Court.

Introduction of CBDT Circular No. 9/2024

A series of circulars have been issued by the Central Board of Direct Taxes (CBDT) on distinct occasions that are binding on the revenue authorities. Such circulars are made to ease the income tax assessment and procedure of appeals ensuring clarity in functionality, and hence surging the confidence in taxpayers in the tax authorities.

By using the legal powers granted via Section 268A of the Income Tax Act, 1961 the CBDT has issued a Circular No. 09/2024-Income Tax Dated: 17/09/2024 wherein the monetary limits for filing an appeal for the department has been mentioned.

The analysis of Circular No. 09/2024-Income Tax Dated: 17/09/2024 is inherently not completed without reference to Circular No. 5/2024-Income Tax Dated: 15/03/2024. Therefore, one must examine the preceding circular to understand the monetary limits and the exceptions specified therein.

CBDT Circular No. 5/2024 -Old Income Tax Monetary Appeal Limits

The Circular No. 5/2024-Income Tax Dated: 15/03/2024 cites the guidelines for the departmental appeals, concentrating on fiscal limits and stressing the analysis of substantive merits for only tax effects. It quotes the exceptions for matters that have constitutional validity, unlawful orders, prosecutorial actions, and issues related to TDS/TCS.

It specifies the significance of computing tax effects towards each assessment year and obligates tax authorities to document the instances in which the pleas are not filed because of low tax effects.

In addition, the circular warns against assuming that the department has agreed to previous decisions and confirms its right to appeal in future cases. It aims to avoid potential misunderstandings by taxpayers about appeal decisions, stressing the importance of maintaining detailed judicial records and requesting monthly reports on appeals that were either not filed or were filed under specific exceptions.

Except for the exceptions mentioned in the previously stated circular, appeals or special leave petitions should not be submitted in cases where the tax effect is below the monetary limits listed below.

| Appeals/SLPs | Monetary Limits |

|---|---|

| Before Appellate Tribunal | INR 50,00,000/- |

| Before High Court | INR 1,00,00,000/- |

| Before Supreme Court | INR 2,00,00,000/- |

The circular mentioned that filing an appeal should not be based solely on the tax amount exceeding specific limits. The decision to appeal should depend on the case’s merits. Responsible officers should focus on minimizing unnecessary litigation and providing certainty to taxpayers about their Income Tax assessments when deciding whether to file an appeal.

CBDT Circular No. 09/2024- New Income Tax Monetary Appeal Limits

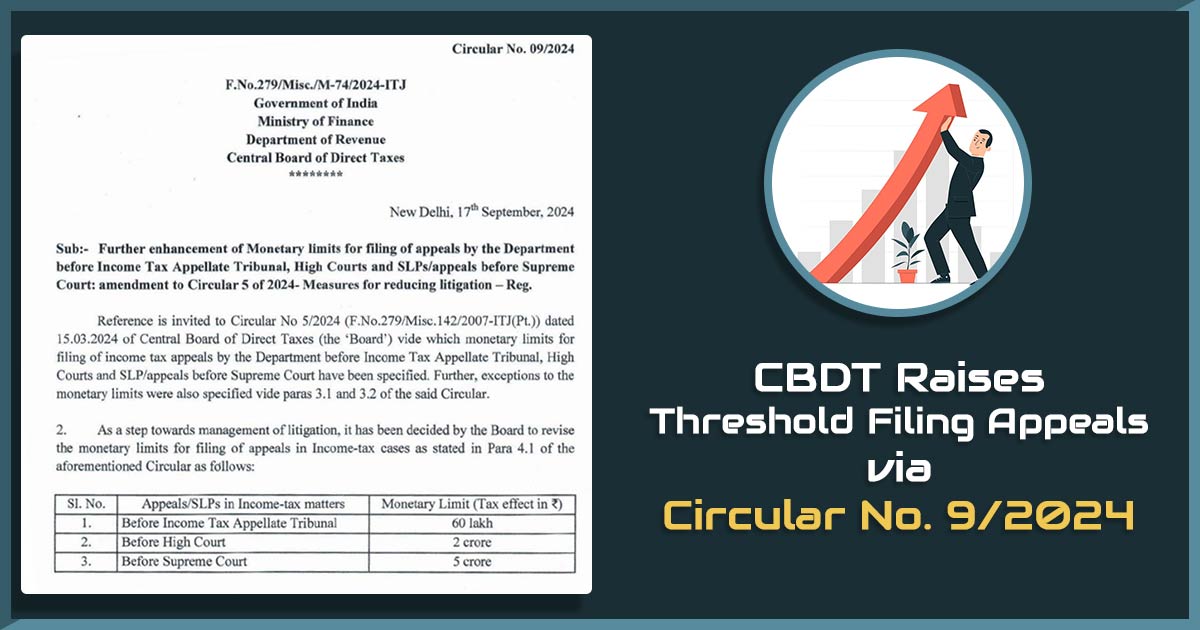

According to the above-mentioned circular, the CBDT has enhanced the monetary limits for the department for filing appeals before the Tribunal, High Courts, and Supreme Court vide Circular No. 09/2024-Income Tax Dated: 17/09/2024 w.e.f. 17.09.2024.

With effect from 17th September 2024 Circular No. 09/2024 has surged the monetary limits cited in Circular No. 5/2024, and the enhanced monetary limits are cited hereunder.

| Appeals/SLPs | Monetary Limits |

|---|---|

| Before Income Tax Appellate Tribunal | INR 60,00,000/- |

| Before High Court | INR 2,00,00,000/- |

| Before Supreme Court | INR 5,00,00,000/- |

The decision to file an appeal should not be based solely on the tax effect exceeding specified limits. It should be based on the merits of the individual case. Officers should prioritize minimizing unnecessary litigation and providing transparency for assessees concerning their Income Tax assessments when determining whether to file an appeal. This method seeks to enhance efficiency while preserving public trust in taxpayers.

The same circular would get applied to the SLPs and appeals to get filed in the Supreme Court, High Courts, and Tribunals. The same would apply to SLPs and appeals that are due before the Supreme Court, High Courts, and Tribunals, which consequently might get withdrawn.

Conclusion: The Central Board of Direct Taxes (CBDT) as per Circular No. 09/2024-Income Tax Dated: 17/09/2024 revised the fiscal limits for the income tax department surging the limits as compared to Circular No. 5/2024-Income Tax Dated: 15/03/2024. The authority of the department gets extended by this revision to file appeals to the pertinent judicial forums.

Both circulars have the purpose of lessening the load on the judiciary by reducing the litigations that are not needed and pertinent to the income tax and facilitating clarity, but the approach of the department has been increased through Circular No. 09/2024-Income Tax Dated: 17/09/2024.

The provisions of Circular No. 09/2024-Income Tax Dated: 17/09/2024 emphasize the significance of computing the matters on their merits while preserving the right of the department to file an appeal in important cases.

The same technique ensures that the resources are concentrated on matters with influential tax implications, promoting a more accountable and facilitated tax system. In conclusion, these circulars are a strategic initiative focused on lowering litigation and strengthening the reliability of the tax administration process in India.