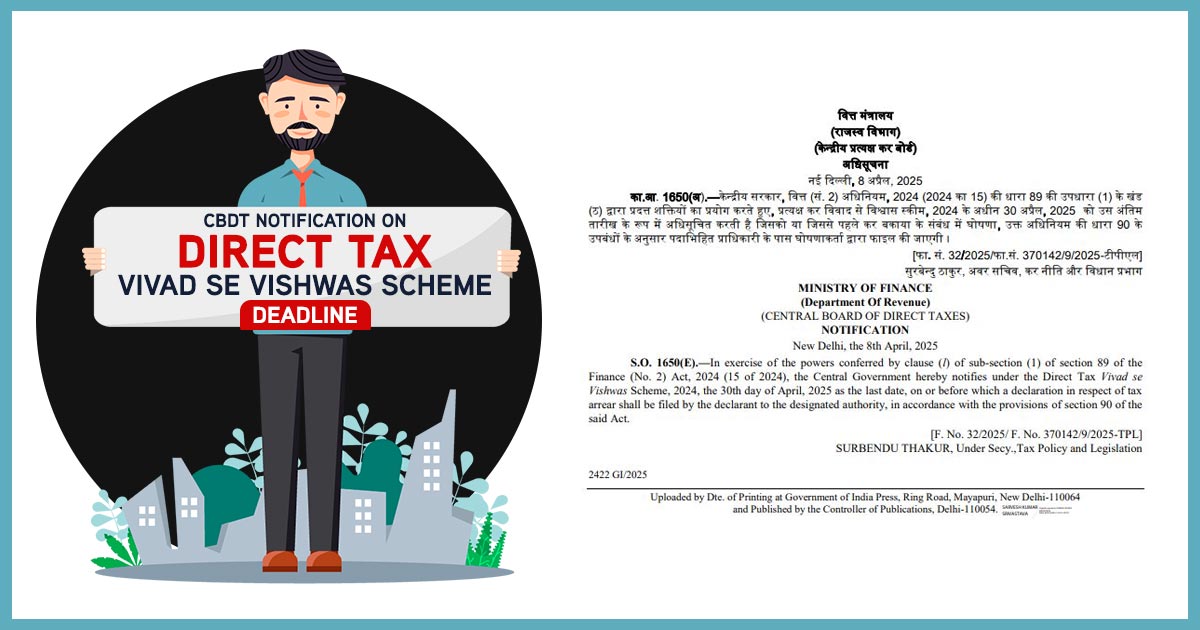

April 30 is been set as the due date by the Central Board of Direct Taxes (CBDT) for filing declarations under the Direct Tax Vivad se Vishwas Scheme (DTVSV) 2024, desired to resolve pending income-tax disputes before various appellate authorities, along with the Supreme Court and high courts, as of July 22, 2024.

The second edition of DTVSV was notified in the July budget last year and was made functional from October 1.

All the declarations are to be filed electronically via the use of Form 1, available on the income tax department’s e-filing portal, as per the notification of the CBDT.

For each dispute, a separate form is needed, it mentioned.

The first edition of the scheme was launched for the appeals due on January 31, 2020.

Read Also: A Guide to Dispute Resolution Scheme (e-DRS) with Benefits

Despite the second edition, the response has remained lacklustre. As of February 18, 40,597 eligible taxpayers have opted for the scheme, compared to 139,384 in the first edition.

Read the notification below: