The Calcutta High Court recently ruled that a minor delay in filing a GST appeal warranted condonation, as the petitioner presented a satisfactory explanation for the delay. Additionally, the Court instructed the authorities to re-evaluate whether the pre-deposit requirement under the CGST Act, 2017, had been calculated correctly and adhered to appropriately.

The applicant, Dhananjoy De, contested the order passed u/s 107 of the Central Goods and Services Tax Act, 2017, by the appellate authority. From an order passed u/s 74 of the same Act, the appeal has emerged.

The appeal has been dismissed by the appellate authority for two reasons: first is that it was filed 27 days after the three-month statutory period, and second, the applicant did not deposit the obligatory pre-deposit.

The applicant was represented by Sandip Chorasia, who said that the delay of 27 days resulted from severe rheumatoid arthritis, which debilitated him and prevented timely filing. The delay was well within the condonable one-month period allowed u/s 107(4) of the CGST Act, 2017.

The total demand was ₹26,31,154; only ₹21,53,505 was disputed, and the admitted portion had been paid earlier; therefore, the obligatory pre-deposit needs to be calculated on the disputed amount alone.

The bench of Justice Om Narayan Rai held that the explanation for the 27-day delay was reasonable, medically substantiated, and did not exhibit negligence or disregard statutory timelines. The court held that the delay was marginal and came under he scope of condonation given via statute.

The court for the pre-deposit said that, however, the applicant’s claims seem prima facie acceptable, the case needs a fresh estimation via the appellate authority.

Read Also: Relief for Taxpayer: Calcutta HC Allows Fresh GST Appeal After Technical Portal Delays

Therefore, the authority was asked to re-examine the computation of the disputed tax, determine the pre-deposit as per the law, and then proceed to hear the appeal on its merits after determining whether the statutory requirement had been satisfied.

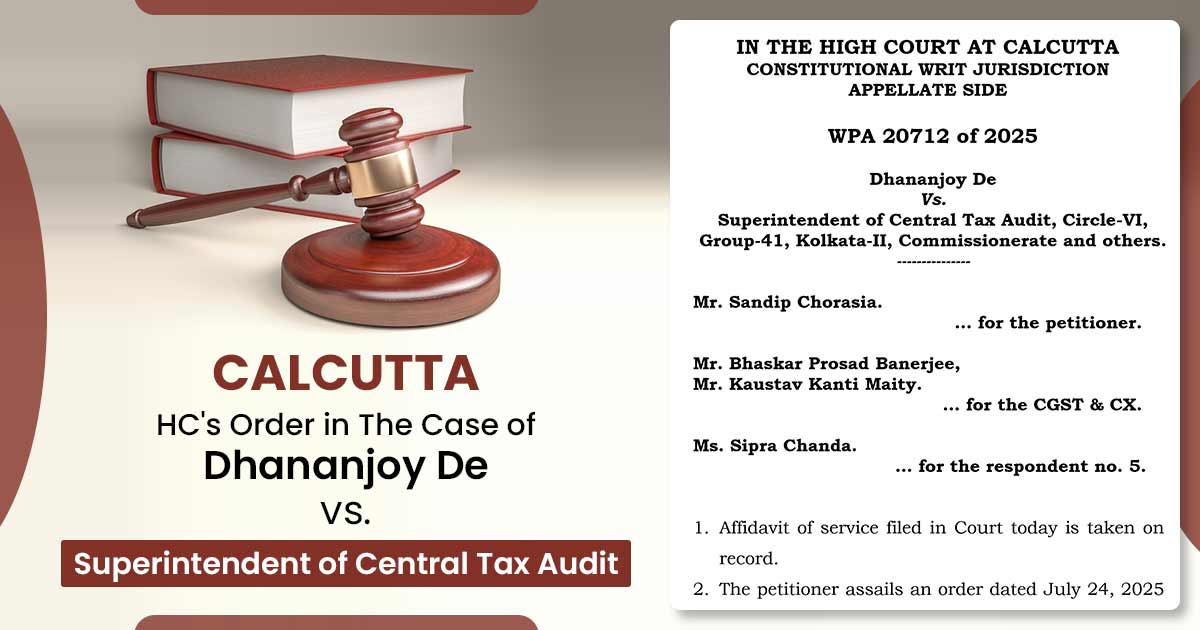

| Case Title | Dhananjoy De vs. Superintendent of Central Tax Audit |

| Case No. | WPA 20712 of 2025 |

| For the Petitioner | Mr Bhaskar Prosad Banerjee, Mr Kaustav Kanti Maity |

| For the Respondent | Ms. Sipra Chanda |

| Calcutta High Court | Read Order |