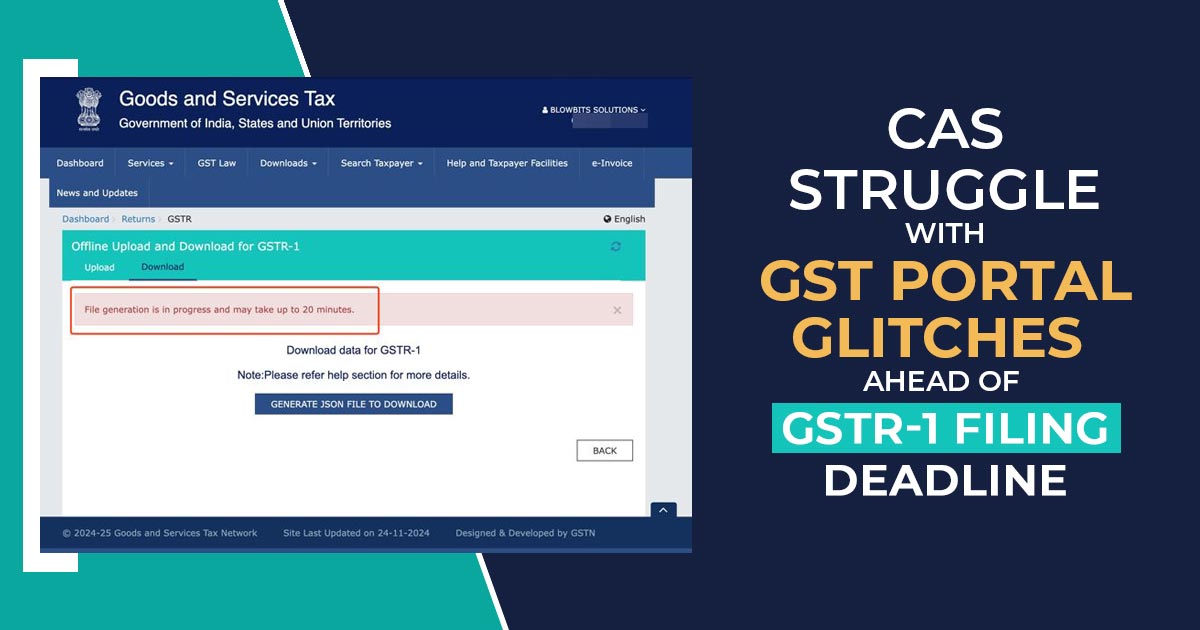

As the deadline for filing GSTR-1 is approaching January 11, 2025, the businesses and chartered accountants(CAs) are facing hurdles with the issues on the GST portal. These technical issues incur confusion and delays for the taxpayers who attempt to satisfy their compliance liabilities.

What are the problems?

The major issues are being reported via users-

- Zero Balances in Credit and Cash Ledgers: it has been discovered by various taxpayers that their credit and cash ledgers are depicting a zero balance. The same occurs despite their knowing that their funds are available in their accounts. The same errors create confusion since the businesses are not able to use their funds to complete their filings.

- Historical Data & Crore Field: The users are not able to download the historical data and access the Crore field on the GST portal due to technical problems.

- Mistakes in GSTR-1 filing: The taxpayers attempting to generate their GSTR-1 return filing summaries are witnessing the error messages. In certain matters, the information in their summaries is not completed or missing which directed them to be unable to move with the process of filing.

Such problems have raised concerns among taxpayers who are anxious towards missing the due date and facing the penalties.

About these problems, The Karnataka State Chartered Accountants Association (KSCAA) has been notified. They asked the GST Network (GSTN), the Ministry of Finance, and Infosys (the company managing the portal) to fix these problems as soon as possible, on social media.

KSCAA statement read

“We urgently request your immediate intervention to resolve the issues with filing GSTR-1 on the portal, as the deadline is fast approaching.”

“We urge you to ensure that stakeholders can file on time without facing additional compliance hurdles.”

Response of Infosys GSTN

Via the X platform (formerly Twitter), the GSTN responded by acknowledging the concerns. They confirmed that they know about the issues and are working to solve them. The statement mentioned that-

“Dear Taxpayers,

GSTN hereby acknowledges the issue being faced regarding GSTR-1 summary generation and its filing. This is to inform you that our team is working on it and the same will be fixed shortly. Thanks for your patience.”

Growing Worries of Taxpayers

The taxpayers and CAs are worried with less than a week to go before the due date. One taxpayer questioned the circumstance that the front side of the coin is if GSTR-1 is not filed within 11/01/25 the GST ITC of recipients is disallowed. The other side is because of the technical errors GSTR-1 cannot get filed via the suppliers. What to execute? In what way do we manage the situation?

Taxpayers and CA’s through the GST tech team acknowledgement can only wait and hope for a speedy resolution to the current technical problem.