The taxpayer has purchased agricultural land, which is outside the purpose of a capital asset; thus, the deeming provision u/s 56(2)(x) of the Income Tax Act cannot be invoked, Delhi Bench of Income Tax Appellate Tribunal (ITAT) mentioned.

The bench of Sudhir Pareek (Judicial Member) and S.Rifaur Rahman (Accountant Member) has marked that the taxpayer purchased agricultural land and paid a sum of Rs. 20,00,000 as purchase consideration.

The taxpayer has filed the pertinent information before the assessing officer. As per the record, it is clear that the taxpayer has purchased agricultural land on 23 bighas.

Section 2(14) of the Income Tax Act specifies capital assets. The definition of the capital asset contains property of any kind, movable or immovable, tangible or intangible, held by the taxpayer for any purpose.

Section 56(2)(x) of the Income Tax Act associates with the tax on property transactions. Any immovable property, which can be land and buildings or both, received without consideration (without paying anything for it) has a stamp duty value (the value adopted by the authorities for payment of stamp duty) exceeding Rs 50,000.

The income return has been filed by the taxpayer, declaring total income. Subsequently, the matter was chosen for limited investigation. For the reason of investment in immovable property, the purchase value of the property was lower compared to the value as per stamp authority. To verify it, notice u/s. 143(2) and 142(1) were issued and served on the taxpayer. The assessing officer noted that the taxpayer has purchased a property for Rs. 20,00,000, while Rs. 44,54,000 is the stamp value of the property.

To the taxpayer u/s 142(1) notices were duly issued and served to furnish the information about the land purchase including a bank statement and elaborate the difference in the purchase value and stamp value.

The taxpayer in reply furnished that the land purchased via the taxpayer is agricultural and is located outside the municipal area. The taxpayer was directed to furnish the documentary evidence of the aforesaid agricultural land.

However, the Assessing Officer (AO) did not obtain any documentary proof, and he proceeded to adopt the purchase value of Rs. 44,54,000. The difference of Rs. 24,54,000 was deemed as income via additional sources, and it was added to the total income of the taxpayer u/s 56(2)(x) of the Income Tax Act.

The taxpayer files an appeal before NFAC Delhi. The CIT (A) noticed that the taxpayer had provided a handwritten declaration on plain paper by Lekhpal. The prerequisites mentioned in Section 56(2)(x) have not been fulfilled by the taxpayer.

The taxpayer said that he had purchased the agricultural land, which does not come under the capital asset under section 2(14) of the income tax act and is an agricultural land, considering the provision of Section 56(2)(x) not applicable. The taxpayer’s transaction entered is the arm’s length price, and there is no connection with the seller.

At the time of permitting the appeal of the taxpayer, the tribunal ruled that the taxpayer had furnished the data that depicts that the taxpayer had purchased the agricultural land at Jalalabad.

As the taxpayer has purchased agricultural land, it is outside the meaning of a capital asset; hence, the deeming provision u/s 56(2)(x) cannot be invoked. The assessing officer’s addition is liable to be deleted.

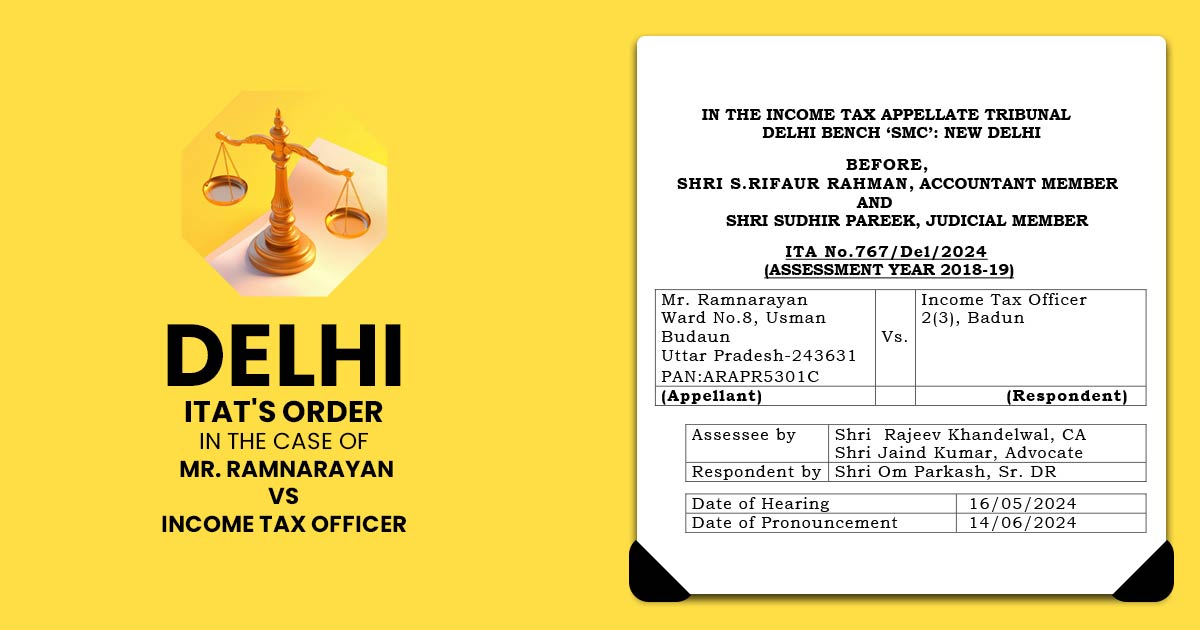

| Case Title | Mr. Ramnarayan Vs. Income Tax Officer |

| Case No. | ITA No.767/Del/2024 |

| Date | 14.06.2024 |

| Assessee by | Shri Rajeev Khandelwal, Shri Jaind Kumar |

| Respondent by | Shri Om Parkash |

| Delhi ITAT | Read Order |