In this article, SAG Infotech has added the benefits and critical challenges that taxpayers may encounter while re-filing their GSTR 3B form. This form is used for reporting monthly sales and purchases to the government.

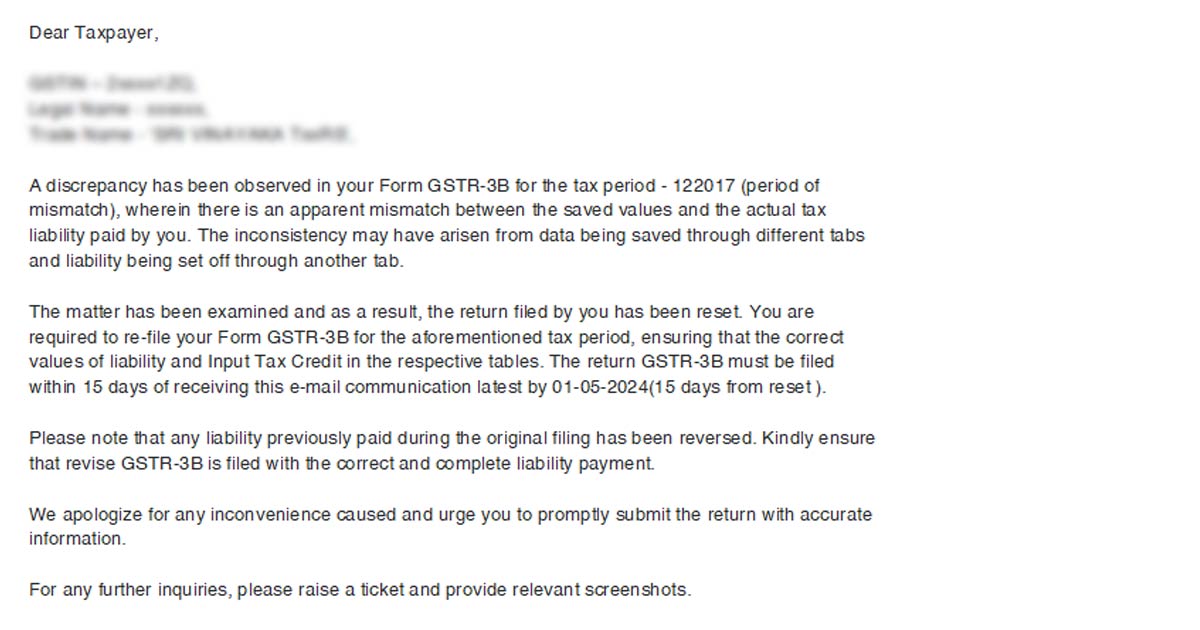

The GST department has sent an advisory to the particular taxpayers for the first opportunity provided to rectify the errors in their previously filed GSTR-3B form. The same facility was furnished as the differences revealed between the information stored in the GST system and the information that was submitted actually for the ITC claims, tax payments, etc.

The same advisory was sent through the enrolled emails to such assessees who are affected directly and such assessees might indeed see the information of the errors when they log into their GST dashboard.

The same correction utility arrives nearly 7 years post-start of the GST. GST Council along with the government for the first time in these 7 years considered such issues and difficulties and are permitting the assessees to revise their returns. Such adjustments or revisions to provide the returns were not authorized once if were filed in other terms the amended GSTR filings were not permissible.

Message to Taxpayers by GST Department

What is the Advisory of Revised GSTR 3B Re-filing?

Solely those taxpayers who have obtained the email from the department must refile their GSTR-3B forms as per the GST council. It is important for such notified businesses to validate their enrolled email addresses for certain communication from the GST department. The same email reports the need for refiling and specifies the certain month’s return that requires the correction. Businesses are needed to finish the same refill within 15 days from the date of obtaining the email.

The same is the biggest cause for why the GST Council wishes to rectify the GST filing system and ensure precise tax records. Among the assessees the same step shall develop confidence via representing an intention to solve the long-standing problems and challenges and improve the efficiency of the tax administration in India.

Key Benefits of Revised GSTR 3B Form Re-filing

Rectified tax compliance and accuracy: The same utility permits for the corrections via providing the amended GSTR returns for the precise data, assuring the proper collection of tax along with the lessened disputes. The same shall rectify the correct information to both the businesses and the government. The same feature increases the accuracy and reliability.

Improve trust: The same utility assists in developing trust among the business community in the GST departments as when an amended return furnish is provided then all the differences get eliminated and it enhances the assessees confidence for the accurate filing of the return.

Reduce GST Return Filing Errors: The amended return assists in facilitating error mitigation and assures the integrity of data to diminish errors.

Enhancing Technology: Each challenge shows a chance for technological enhancements. The current updates to the GST portal could directed to user-friendly systems and boost compliance.

What are the Major Challenges Faced by Taxpayers in GSTR 3B Form Re-filing?

Restricted limitation on correction scope: One influential hindrance that the traders suffer is the limitation on making corrections or revisions to certain taxpayers, and it is not available to every GST taxpayer.

Communication and enactment: The utility established on the email communication along with the short window provided towards compliance might not be enough for all assessees, particularly those in remote or village areas where the digital access is lower.

System issues: Issues might have taken place if a website works slowly during the implementation of the new facility systems.

Closure: In the GST department, the advisory specifies the key moment towards providing the specific assessees a grant for improving the errors in their GSTR-3B returns filed before.

The same utility has a precise database, more user-friendly systems, and encourages compliance. The blog is just for information but it is recommended to consult with a specific tax professional for particular problems and challenges.