The Madras High Court held that the Goods and Services Tax ( GST ) Department must verify the correctness of tax returns before prompting action u/s 73 of the Tamil Nadu Goods and Services Tax ( TNGST ) Act, 2017. Therefore, the court set aside the demand order.

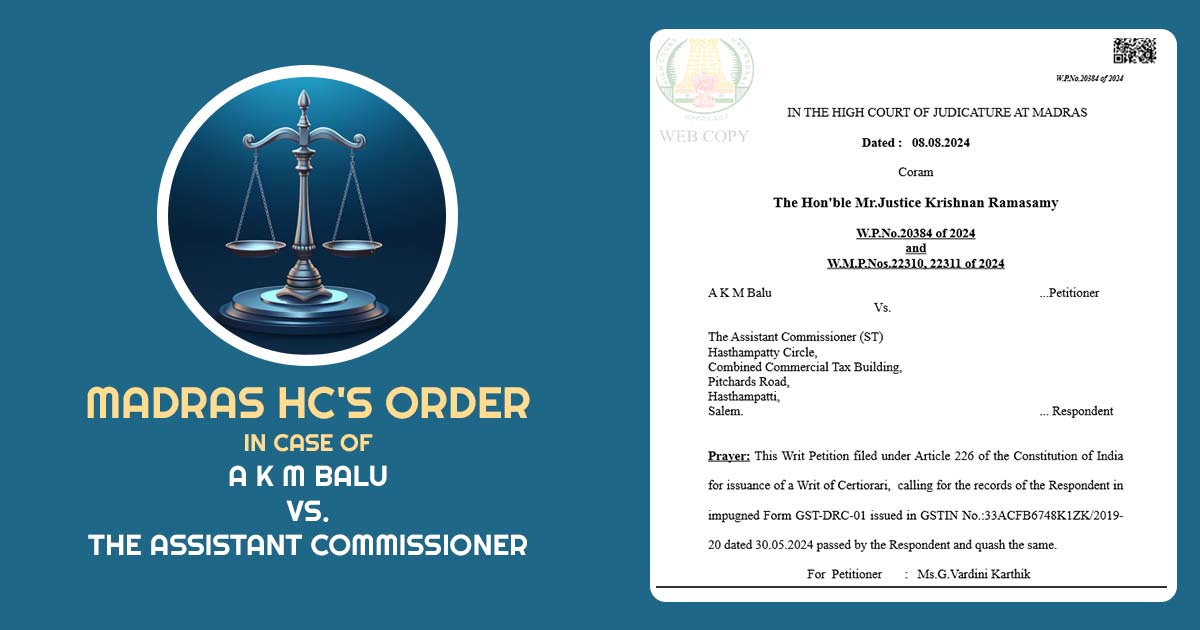

A writ petition has been filed by the taxpayer A K M Balu contesting an order on May 30, 2024, pertinent with the assessment year 2019-20.

The issued GST authorities order was contended by the applicant which followed a SCN in Form DRC-01A on May 16, 2024. The notice emphasizes the discrepancies in the annual returns furnished via the applicant in form GSTR 9 and asks for the tax payment including an interest.

The applicant was given a chance to file the objections and attend a personal hearing, which they duly did. In answer to the discrepancies mentioned in the notice, the objections were furnished, claiming that the proceedings u/s 73 cannot be initiated without a prior verification u/s 61 of the act.

Even after the detailed answer of the applicant, the GST authorities moved with the impugned order without considering or addressing the filed objections. The same has directed the applicant to file a writ petition, asking for an additional chance to show their case and take part in the proceedings of the GST department.

Read Also: Madras HC Directs Re-adjudication for Mismatch B/W GST Returns and 26AS After 10% Pre-deposit

The Additional Government Pleader for the respondent opposing that claimed that the applicant does not satisfy the prerequisite mentioned in clause (b) of sub-section (3) of Section 15 of the Act, which explained the impugned order. However, the court discovered that the GST authority’s failure to comply with the due procedure was an influential problem.

It was remarked by Justice Krishnan Ramasamy that there was no proof of irregularity related to the value of credit notes in the proceedings, the GST authorities sought action under section 73 overlooking the crucial steps u/s 61 were procedurally deficient. The court after seeing the request of the applicant for a fair chance to show their matter has decided to reject the order and remanded the case for the effective review.

Therefore, the court ordered the petitioner to submit a supplementary reply or objection along with all associated documents within 3 weeks of receiving its order.

The GST department was directed to reevaluate the issue, taking into account the petitioner’s new information, and to offer a chance for a personal hearing, ensuring that the decision was based on the case’s merits and complied with legal standards.

Following these instructions, the writ petition was disposed of, and the associated miscellaneous petitions were concluded.

| Case Title | A K M Balu vs. the Assistant Commissioner |

| Citation | W.P.No.20384 of 2024 and W.M.P.Nos.22310, 22311 of 2024 |

| Date | 08.08.2024 |

| Counsel For Petitioner | Ms.G.Vardini Karthik |

| Counsel For Respondents | Mr.C.Harsha Raj, Additional Government Pleader (T) |

| Madras High Court | Read Order |